Following the increase in the contribution rate from 3.75% to 4.75% for the second level of pensions, the Financial Supervisory Authority (ASF) estimates that approximately 16 billion lei will be transferred to this system this year. To boost asset value, the ASF wants to allow administrators to invest more than 70% of assets in government securities over a 5-year period, according to the draft rule.

- “The administrator may decide that, within five years from the date of entry into force of this rule, to invest in government securities issued by the Ministry of Public Finance of Romania, member states of the European Union or members of the European Union. Economic zone, in a percentage ratio of more than 70% of the total value of assets of a non-state pension fund,” says the draft rule submitted for discussion by the ASF.

The draft regulation will apply to administrators of private pension funds (level II) and administrators of optional pension funds (level III).

Initially, the ASF allowed in 2020 to exceed 70% for investments in government securities, the limit change was temporary for 1 year. The event continued in the following years.

The rule, approved last year, provides that administrators can invest more than 70% of the value of assets within 4 years and is valid until April 2024.

2 out of 7 Tier II funds invested more than 70% of their assets in government bonds last year

Last year, administrators notified the Financial Supervisory Authority of their intention to apply the provisions of the Norm to 5 funds out of 17 non-state pension funds.

- “In the case of privately managed pension funds (level II), 2 funds out of 7 apply the provisions of the rule, and in the case of non-mandatory pension funds, 3 funds out of 10 apply the provisions of the rule,” the ASF argues.

ASF: This measure is useful even if used by a single administrator

The authority says that “in order to determine the real possibility of investments that can be made by private pension funds in 2024, it has also carried out a simulation of the contributions related to 2024, taking into account the increase in the contribution rate from 3.75% to 4.75% , starting with contributions related to January 2024, which will be transferred to private pension funds starting in March 2024.

- “I noted that during 2024, total contributions of approximately 16 billion lei are forecast. Thus, the implementation of this tool proves to be useful in the environment where it is used by even a single administrator,” states ASF.

Data from the ASF, which HotNews.ro consulted, show that last year the value of contributions transferred to the second level of pensions exceeded 12.8 billion lei.

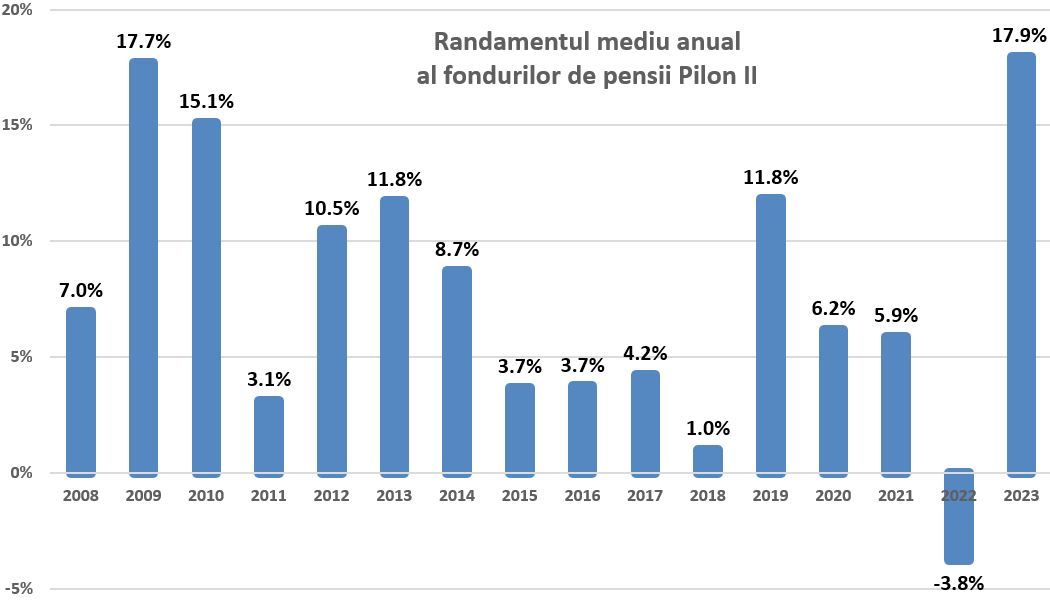

Recovery in government bond prices contributed to record Tier II yields in 2023

According to calculations, 7 mandatory private pension funds (level II) recorded a weighted average return of 17.94% last year, which is the best annual performance in the entire history of the system and more than 10 percentage points above the inflation rate of the previous year. Association of Pension Fund Administrators (APAPR).

Net assets managed by Pillar II reached 126.7 billion lei (25.5 billion euros), a record for the system, increasing by 31.4% compared to the end of 2022.

8.1 million Romanians are enrolled in the second level of private pensions, i.e. the majority of the country’s active population, half of whom (more than 4 million) contribute regularly, month after month. Pillar II money is the second most valuable financial asset of the population after bank deposits.

- “The very good results recorded by non-state pensions in 2023 are due in equal measure to the recovery of government bond prices and the appreciation of stock market quotations.

- Last year, the value of government securities recovered from a fall in 2022 amid lower inflation and interest rates, and the indexes of the Bucharest Stock Exchange, where Tier II pension funds are the largest institutional investors, registered a steady increase of more than 30%, “APAPR reports.

Level II – assets of 128.7 billion lei in January 2024. 66% of this money is invested in government bonds

According to the latest data from the ASF, at the end of January 2024, the value of assets of private pension funds reached the level of approximately 128.73 billion lei, an increase of 28.5% compared to the same date of the previous year.

Approximately 85 billion lei, which is equivalent to 66% of the total value of Tier II pension assets, is invested in government securities.

Investments of private pension funds were realized in percentage

93% in Romanian assets, most of which are denominated in lei. A large part

Romanian instruments are represented by government securities or shares listed on

BVB.

The average monthly contribution was 277 lei in Level II and 170 lei in Level III

Collected contributions in January 2024 amounted to 1.13 billion

lei, while the average contribution was 277 lei.

In pension level III, the value of assets of optional pension funds at the end of January 2024 was 4.82 billion lei, with an annual growth of 28% compared to the same period last year.

Most of the investments were made at the local level (96%), most of them were denominated in lei (90%).

The value of contributions transferred in January amounted to 57.7 million lei

the average contribution was 170 lei.

Photo credit: Robert Kneschke / Dreamstime.com

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.