JTI reports that the government’s intention to increase the excise duty on cigarettes will lead to a rapid growth of the black market, given that in terms of purchasing power, a pack of cigarettes costs four times more in Romania than in Luxembourg and twice as much as in Germany, Italy, Spain, Holland.

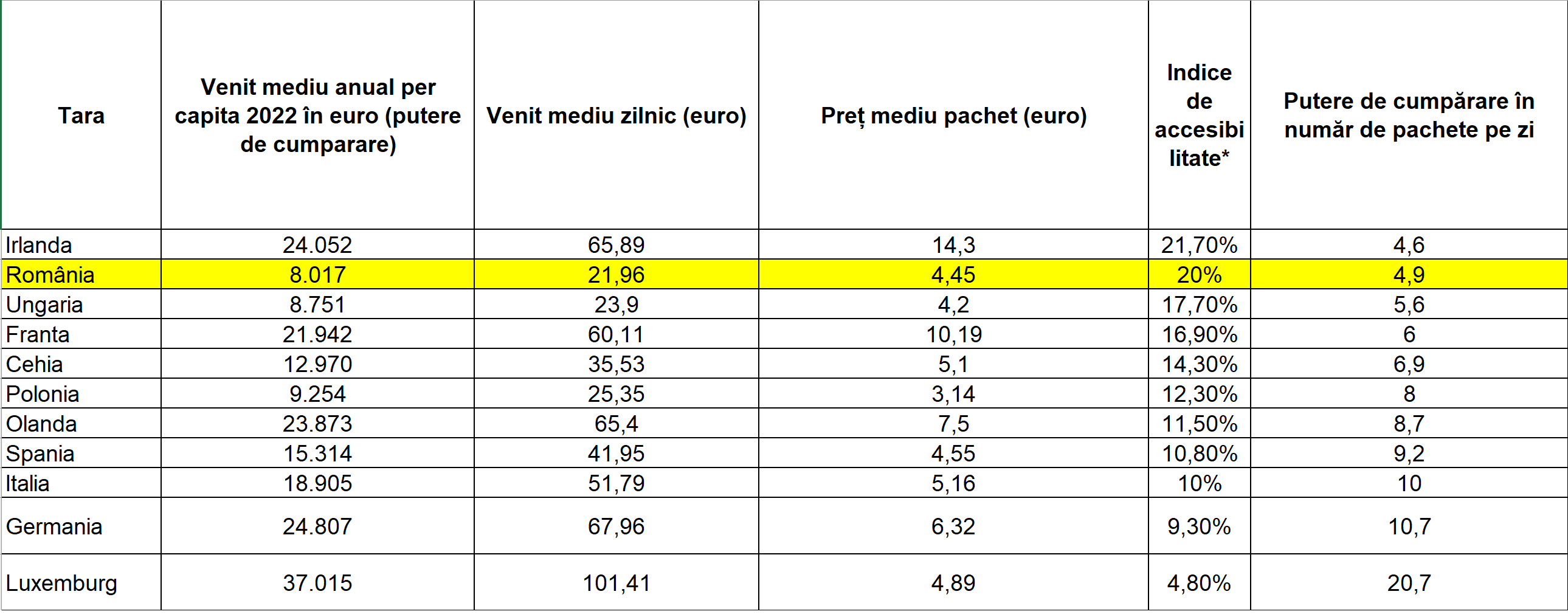

In our country, GDP per capita is 23% lower than the European average, according to the latest Eurostat data. Here, the share of the price of a pack of cigarettes in the average daily disposable income is 20%, almost as much as the share of Ireland, where cigarettes are the most expensive, and higher than France, the two countries that register the highest excise taxes on cigarettes! In Germany, this percentage is much lower than in Romania – 9.3%, Poland – 12.3%, Hungary – 17.7%. In other words, with the available daily income, you can buy almost 5 packs of cigarettes in Romania, almost 11 packs in Germany, 10 in Italy, 9 in Spain, and more than 20 in Luxembourg.

The last increase in excise duty was carried out four months ago on April 1

“We are deeply concerned about the intention to increase the excise duty on cigarettes, given that the current Coalition adopted a five-year calendar for all tobacco products last July. The calendars aimed to consolidate budget revenues and provide predictability to both this particularly important economic sector for the Romanian economy and the country’s budget,” says Gilda Lazar, JTI’s Director of Corporate Affairs and Communications.

The last increase in the excise duty was made just four months ago on April 1, according to the Calendar adopted in July 2022, which recorded the first increase last August. In one year, the excise duty on cigarettes increased by 62 lei, from 565 to 626 lei, i.e. by 11%. The new promotion will be the third in one year!

It should be noted that Romania reached the minimum level of 90 EUR/thousand. of cigarettes, provided for by EU Directive 64/2011, in 2015, three years before the deadline provided by the European regulatory act. Currently, the minimum excise duty on cigarettes in Romania is one of the highest in Central and Eastern Europe at €126.5, while it is €95 in Bulgaria, €98 in Hungary and €107 in Poland, with significant differences compared to neighboring countries. EU countries: in Serbia, the minimum excise duty is 75 euros, and in Moldova, 48 euros. Only the Czech Republic registers a higher level (140 euros) and Slovenia is slightly above the minimum excise duty level in Romania (131 euros).

When taxes increase, smokers turn to cheaper, smuggled options. The example of France is convincing

“We remind you that in January 2010, smuggling reached 36.2% after three excessive and unplanned increases in a year. Although the government’s calculations at the time predicted an increase in budget revenues, in reality there was a hole in the budget of more than a billion euros. We hope that the new government will not repeat this mistake, especially now that there is a slight decline in the black market after consecutive increases in smuggling recorded from November 2022 to March 2023,” the JTI spokesperson added.

The tobacco market is inelastic, and when taxes suddenly rise and are independent of income, smokers turn to cheaper, contraband options. And the example of France is indicative. After a sharp increase in excise taxes, the black market in Hexagon reached 32% in 2022. However, unlike France, Romania has over 2,000 km of EU external border to defend and we have a border war. The growth of organized crime poses a real threat to national security, especially in the context of the Schengen Agreement discussions. Cigarette smuggling routes can also be used for illegal trafficking of migrants or weapons. In 2010, smuggling became a priority topic of the CSAT agenda, which is now included in the country’s National Defense Strategy.

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.