European Parliament elections are rather elections in which populist parties tend to get more votes than in other types of elections – parliamentary or presidential. And I think that will happen this time as well, said Dan Buksa, Unicredit’s Chief Economist in Central and Eastern Europe. Buca attended the Euromoney conference in Vienna on Tuesday and spoke at a press conference together with Teodora Petkova, global head of Central and Eastern Europe, about how they see the economy of Romania and the region in 2024.

We believe that populists and nationalists will not have much success in the parliamentary and presidential elections in Romania. The biggest risk in Romania in 2024 is fiscal policy (italics added) Because of the very large mass deficits in the past, I think this will remain a focus, Dan Buxa also said

2024 is a year of decisive decisions. Most countries in this part of Europe will go to the polls to elect their representatives in the European Parliament, local parliamentarians, mayors and local councilors. And usually, when there are elections, governments don’t think about savings at all. That is, they seek to guide and loosen the belt; this also happened during the covid period when they were very generous with saving savings.

Then the war in Ukraine began, and they had to provide support, especially in energy. And now the same governments are heading for the first post-Covid and Ukraine election cycle.

“We analyzed why Central and Eastern Europe moved to the right. And one of the reasons is migration”

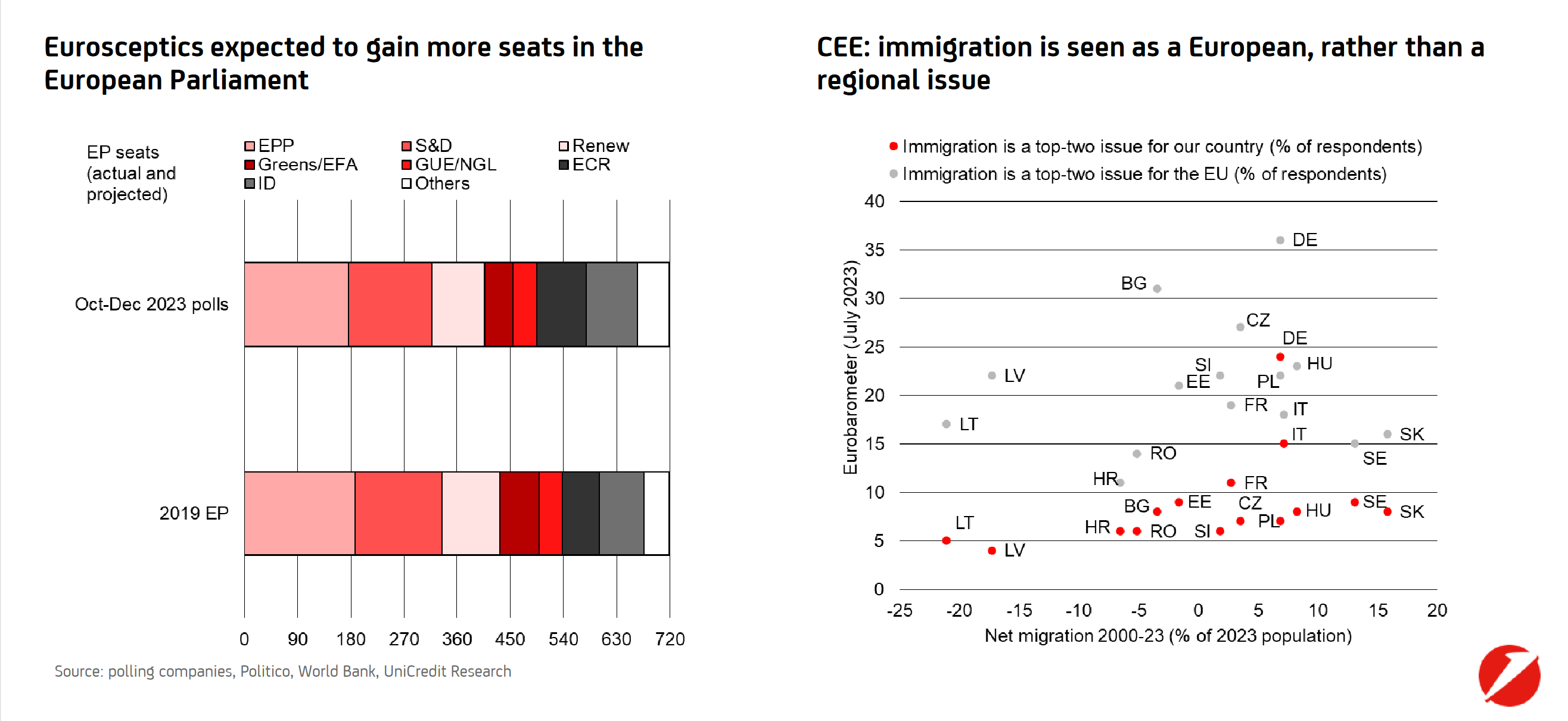

If you look at the opinion polls for the European Parliament, you will see that Eurosceptics expect to win somewhere between 15 and 20% of the seats. In our region, interest rates rise to 20-25%

“We analyzed why Central and Eastern Europe moved to the right. And one of the reasons is migration. But what is very interesting, when people are asked if they are worried about immigrants in their country, between 5 and 10% say yes. When asked if they were worried about immigration in Europe, 3 times as many people said they were. Therefore, for Central and Eastern Europe, immigration is not a national problem, it is more of a European problem. What is good and bad. This is good because we started to feel European, much more than 10 years ago. This is bad, because it can usually lead to our slightly distorted choices,” Bucha believes

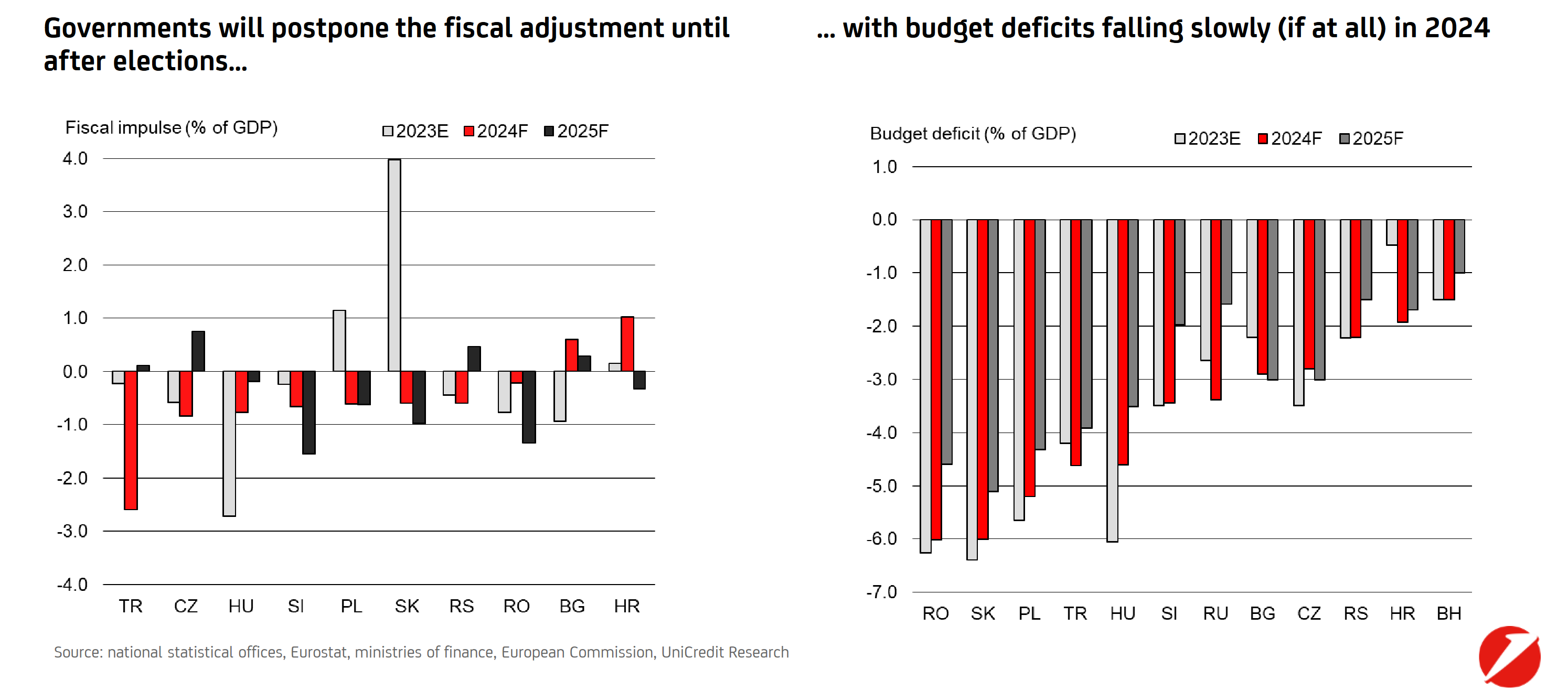

In countries where the budget deficit was very high last year, it will remain high in 2024

In countries where the budget deficit was very high last year, such as Romania, Slovakia, Poland, Turkey, Hungary, it will remain high in 2024. And if we expect an adjustment of the budget deficit, it will happen a little later. There are countries in a good position, where the budget deficit is already lower than 3% of GDP: Bosnia and Herzegovina, Croatia, Serbia, and this year also Bulgaria and the Czech Republic.

This means that the budget deficit can be reduced, but we don’t expect others to do so very quickly. In fact, in discussions with the European Commission, which is announcing a fiscal adjustment, they always say that if we do it too soon, there is a risk that the populists will win the elections, so it is better to wait. And that’s what he will do!

For us, this means higher consumption in 2024 than last year. And if we look at GDP growth last year, we will see that in four countries – Poland, Hungary, the Czech Republic and Slovakia – private consumption actually failed. One reason was very high inflation, another reason was very high interest rates (preventing people from taking out loans), Bucha explains.

We expect consumption to recover in 2024 thanks to wage growth above inflation, gradually lower interest rates and elections, ie governments that ensure the electorate is happy to go to the polls.

As consumption drives economic growth, we see stronger growth this year. We see growth in Central and Eastern Europe of around 3%, compared to the Eurozone, where growth is estimated at 0.5%.

We are seeing a return on investment. There are some FDI projects that are finally starting after being announced four or five years ago and interrupted due to the pandemic. We also expect governments to get more money from the EU, money for investment. What we do not see contributing to the economic growth of the region is external demand.

What about companies? The good news about companies is that they are well capitalized and have plenty of cash. Most of the excess savings were accumulated in 2020. Of course, in 2022 and 2023, many of them have given up spending, but they still have money to invest.

On Inflation and Interest Rates: When Governments Remove Support Measures, Budget Deficits Will Reduce, But Inflation Will Be Higher

We expect both to decrease, but not linearly because there are very large budget deficits. How will we reduce this budget deficit in the future? By raising taxes, canceling measures implemented as a result of COVID or the war in Ukraine, such as energy subsidies, reducing VAT on more goods or services, price caps imposed by the government.

When governments withdraw these support measures, the budget deficit will be smaller, but inflation will be higher.

And we do not expect most central banks to miss their targets in 2024 and 2025. What does this mean for monetary policy? We expect interest rates to fall this year, but less than the market currently expects. And we don’t see them going back to the near-zero level where they were four or five years ago.

The good news is that for lending, falling interest rates are helping lending recover. So, we see a recovery in lending starting in 2024 and recovering in 2025.

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.