Food prices rose by 5.82% in December and services by more than 11%, according to data sent by Statistics on Friday, bringing the inflation rate to 6.61%. “Inflating is like toothpaste: once it’s out of the tube, it can’t be put back in; so it’s better not to push too hard,” warned Karl Otto Pöhl, president of the Bundesbank, in 1980. We remind you that a decrease in inflation does not mean a decrease in prices, but only a slowdown in the rate of their growth.

The Covid pandemic was followed by the invasion of Ukraine, leaving central bankers around the world to manage crisis after crisis. In our country, inflation came out of the pipe in 2022, and now Iserescu and his team are trying to bring it back into the pipe. The bad thing is that at the other end of the pipe is the Government, which moves the pipe (through the fiscal measures it takes) making it difficult for the National Bank.

Why inflation arose seems quite clear.

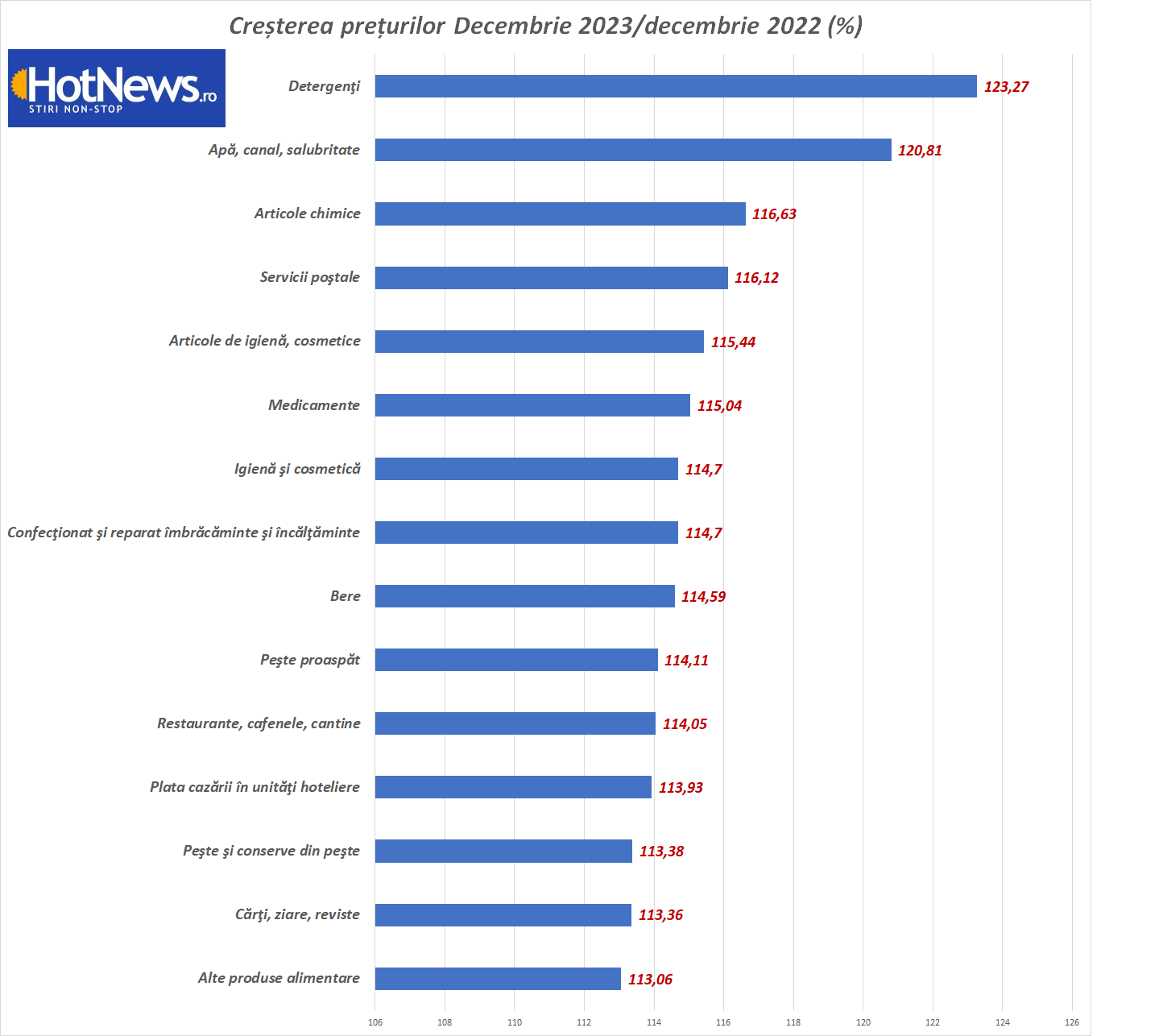

Below are the biggest December price increases:

The crisis with the Covid-19 pandemic was followed by the invasion of Ukraine by Putin’s Russia. This led to an increase in prices for many types of raw materials (oil, gas, wheat). The drop in Ukrainian exports reduced the supply in the markets and pushed prices up.

Sanctions against Russia have forced many countries to reorganize supplies, a complex and expensive process that requires time and investment.

Moreover, China, which is called the “workshop of the world”, has been forced to close several factories as part of the zero-covid policy. Thus, we have increasing demand and decreasing supply. The result: rising prices.

As I said, since February 2022 we have seen a terrible war between Russia and Ukraine. The problem is that both countries are large exporters of raw materials. Ukraine’s inability to produce and sanctions against Russia reduce supply, pushing prices up again. Governments have to reorganize the supply of raw materials, which sometimes involves finding more complex and expensive solutions than before the war. Europe’s energy dependence on Russia has come under a lot of pressure, especially when compared to the United States, which had it much easier. This difference translates into an advantage of the dollar in the market. In other words, the dollar rose against the euro because investors saw it as less risky. This is although, if there was a recession, it would obviously hit both continents.

Finally, in order to maintain a certain economic stability, a large number of states have implemented support programs, the consequence of which is an increase in the state deficit. For example, if we take not only the case of Romania, in March 2022 the United States announced a massive stimulus package from the Biden administration. This government spending stimulates demand and increases inflationary pressure. In addition, they affect state budgets and increase debt. In France, public debt increased in 2022 after the first quarter by 88.8 billion euros and now stands at 114.5% of GDP, according to the INSEE report.

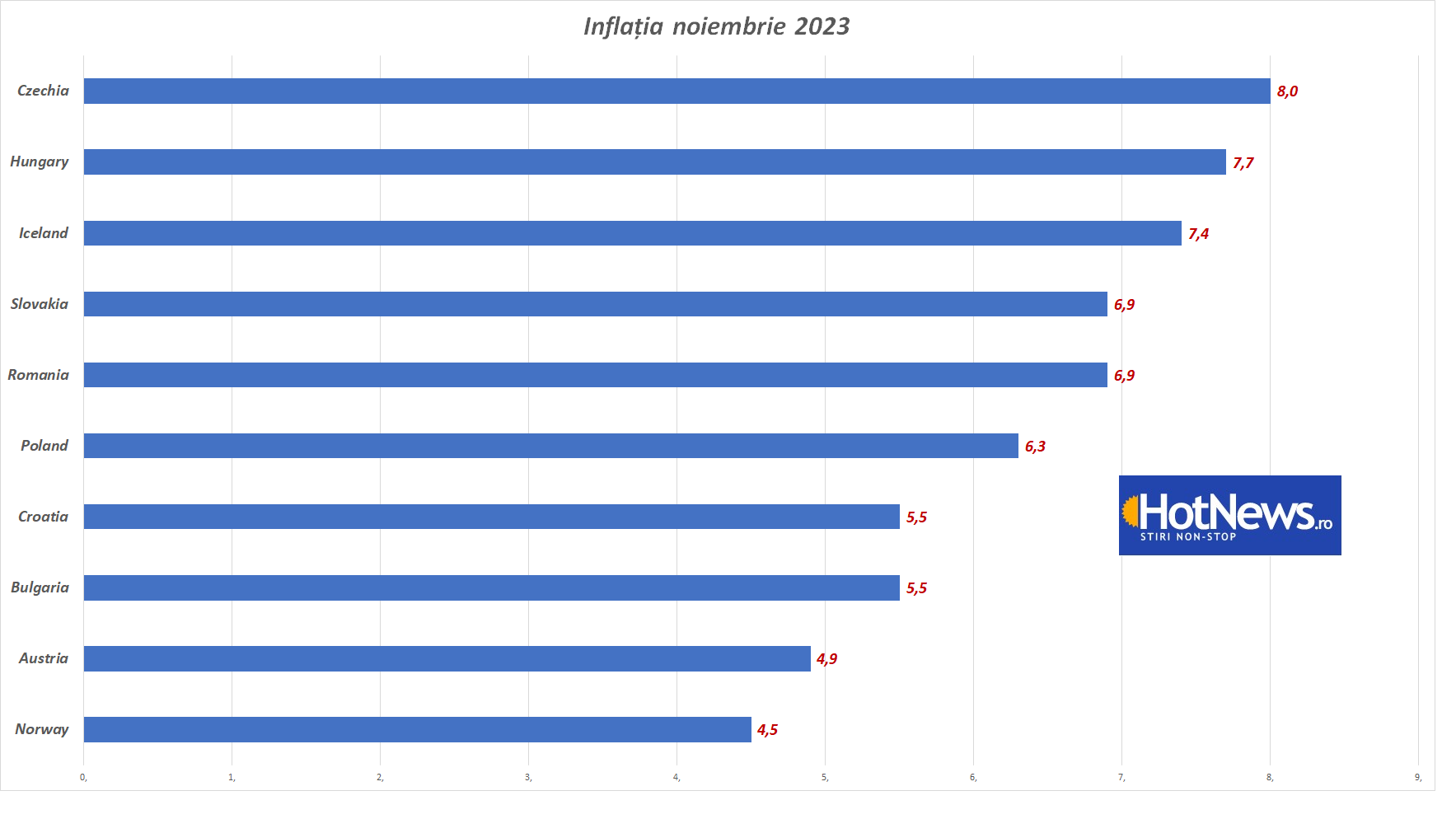

In November 2023, Romania had the 6th highest inflation rate in Europe.

To put the toothpaste back in the tube, the BNR raised the monetary policy interest rate to 7% and today (Friday) there will be a new meeting of the Board of Directors, where it is very likely that this level of interest will be supported by key interest.

According to a report by Erste Bank, the head of the NBR ruled out discussing interest rate cuts until inflation falls “significantly” and the process of deflation becomes truly irreversible.

At the same time, Iserescu suggested that discussions about lowering rates could begin as soon as inflation falls below the key rate, that is, sometime in the second quarter of the year.

Despite inflation falling below the key rate in November, economists say we will see another inflation boost in the first quarter as a result of the government’s fiscal measures.

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.