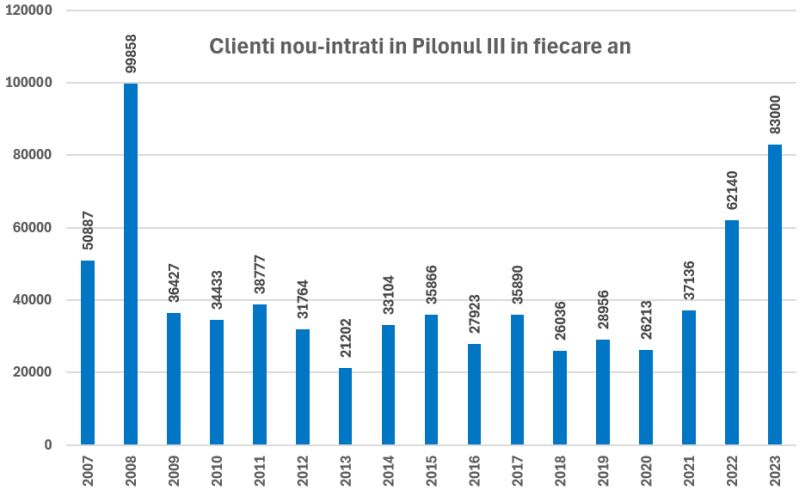

About 83,000 Romanians will start saving for retirement through voluntary private pension funds (level III) in 2023, which is a record for the number of new clients recruited in the system in one year since 2008, reflecting the high level of public confidence in private pensions, announced on Thursday APAPR (the association that represents administrators of private pension funds).

Thus, at the end of 2023, the total number of Tier III participants reached 710,000, on behalf of which 10 additional pension funds manage net assets of 4.74 billion lei (953 million euros), which is 31% more than in 2022. and represents an all-time high for the system.

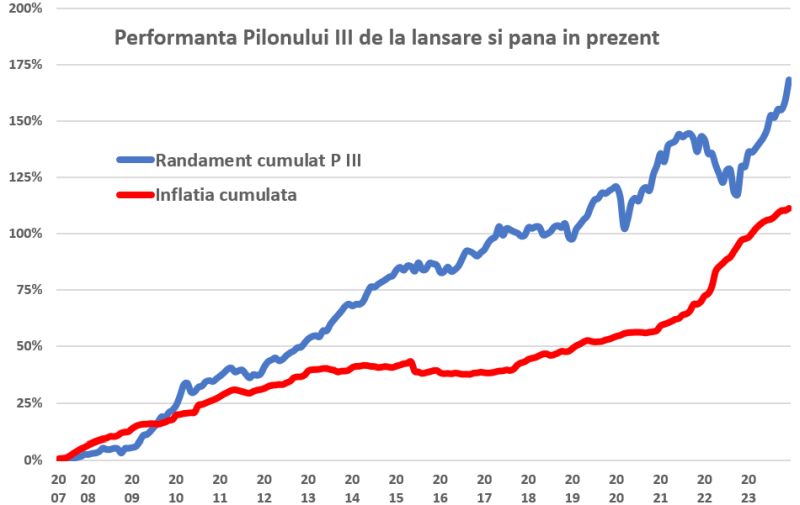

Tier III pension funds recorded a weighted average return of 16.8% in 2023, around 10 percentage points above inflation, consolidating their very good long-term performance.

During the period of existence (2007-2023), voluntary pension funds received an average annual return of 6.13% compared to an average annual inflation rate of 4.61%, according to APAPR calculations.

In monetary terms, Level III generated a profit of 1.25 billion lei (€251 million) for participants, net of all commissions, in addition to the contributions received from administration.

Romanians with voluntary private pensions can receive their money after age 60. What payments were made last year

Also, voluntary pension funds have already made payments for a total amount of approx. 635 million lei (128 million euros) for almost 80,000 beneficiaries in the period 2007-2023, of which 115 million lei (23 million euros) in 2023 alone.

- Pillar III members can withdraw their accumulated money at any time after reaching the age of 60, and they can continue to contribute even after that age.

- The money saved on Level III can be withdrawn in a lump sum or in equal monthly installments for a maximum of 5 years.

- In the unfortunate event of the participant’s death, the funds accumulated in Pillar III pass to the heirs by law or by will.

Starting from January 1, 2024, the fiscal regime of payments to beneficiaries has improved (as in the second level of mandatory private pensions), in the sense that the basis for calculating the 10% income tax rate is no longer the entire accumulated amount (as until now) , but only income received by investing optional pension funds, in addition to listed contributions.

Level III contributions are deductible up to €400 per year for both individuals and employers

All Romanians registering occupational income can contribute to Level III of the optional pension (employees and self-employed persons are treated as employees), as well as employers who can offer additional Level III contributions on behalf of employees as part benefits package, additional salary.

Level III contributions are currently deductible up to €400 per year for both individuals and employers.

The maximum amount of franchises can be doubled – a bill in parliament

Unfortunately, APAPR said, the deductible limit has not been raised since 2009, making the system less attractive and discouraging additional retirement savings.

In this context, APAPR welcomes the submission to the legislature of a parliamentary initiative aimed at doubling this deduction ceiling and automatically renewing it in line with increases in the economy’s minimum wage.

The passage of this bill is likely to encourage both individuals and companies to contribute up to the third level for additional income after retirement, while reducing pressure on the public pension system.

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.