Starting from January 1, 2024, the contribution transferred to Level II pensions increases from 3.75% to 4.75% of the gross monthly income as part of Romania’s obligations to the EU through the PNRR, thus the level of the average monthly contribution for this according to the Association pension fund administrators (APAPR), it will probably exceed 350 lei compared to 270 lei last year.

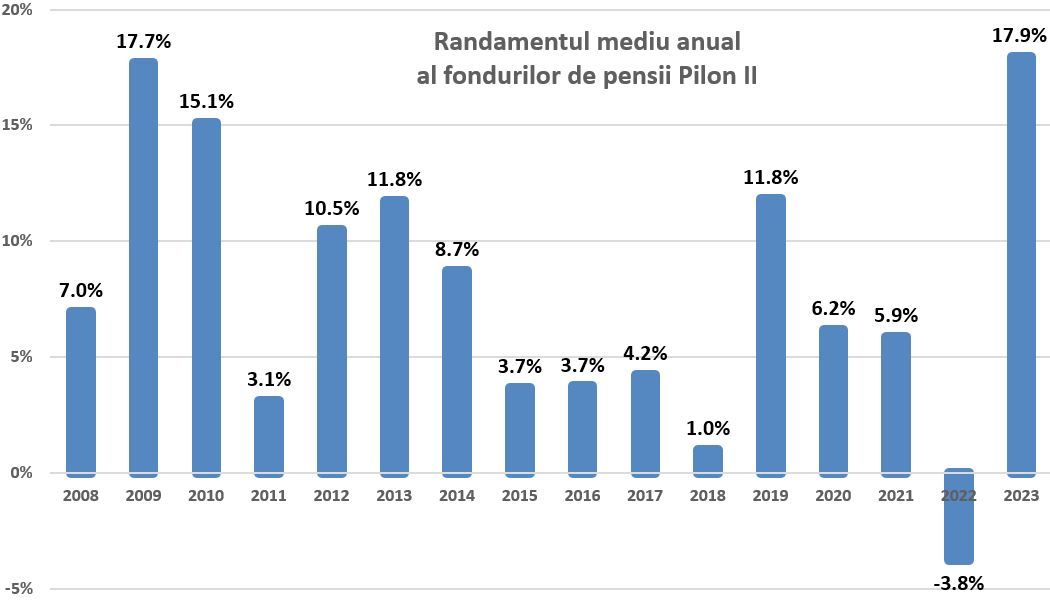

According to calculations, 7 compulsory private pension funds (level II) recorded a weighted average return of 17.94% last year, which is the best annual performance in the entire history of the system and more than 10 percentage points above the inflation rate estimated for the previous year . APPROX.

At the same time, the net assets under management of Pillar II reached 126.7 billion lei (25.5 billion euros), a record for the system, increasing by 31.4% compared to the end of 2022.

8.1 million Romanians are enrolled in the second level of private pensions, i.e. the majority of the country’s active population, half of whom (more than 4 million) contribute regularly, month after month. Pillar II money is the second most valuable financial asset of the population after bank deposits.

The very good performance recorded by private pension systems in 2023 is due to both the recovery in government bond prices and the increase in stock market quotations.

Last year, the value of government securities recovered from a fall in 2022 on the back of lower inflation and interest rates, and indices of the Bucharest Stock Exchange, where Tier II pension funds are the largest institutional investors, recorded a steady increase of more than 30%.

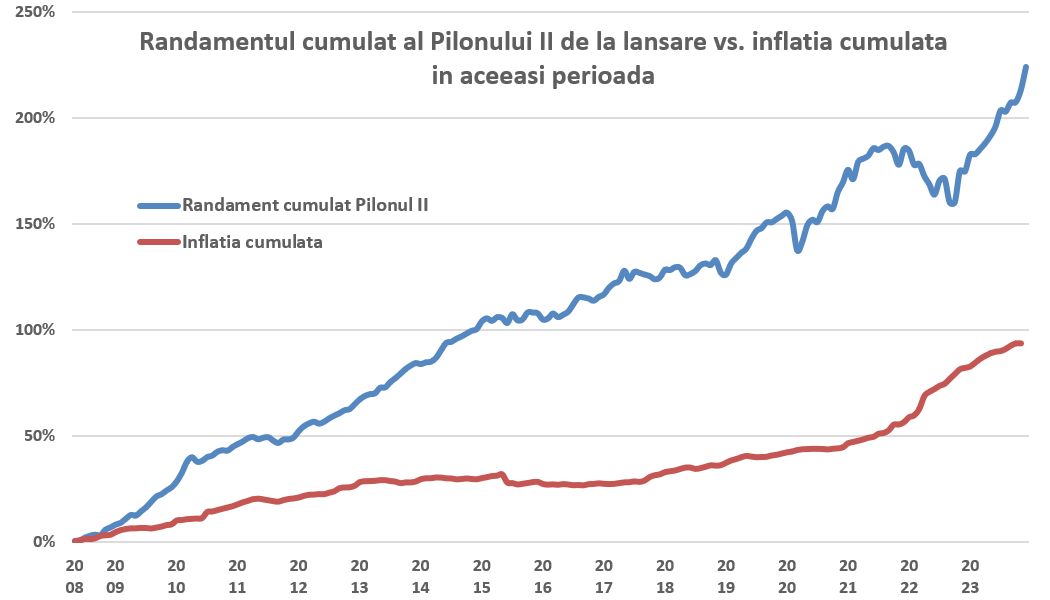

During its lifetime (2008-2023), Tier II recorded an average annual return of 7.82% against an average annual inflation rate of 4.35%.

In monetary terms, mandatory private pension funds made a total profit, net of all fees charged, of 36.9 billion lei (7.4 billion euros), in addition to contributions received during administration, exclusively for the benefit of depositors.

- “The 2023 yield once again confirms the medium- to long-term profit formula offered by private pension funds.

- Even if negative changes can occur in the short term, as was the case in 2022, the further recovery of the markets means that the long-term positive trend will continue.

- It is an invitation to calmness and confidence at times when markets temporarily fail to deliver expected returns.” said Radu Krachun, president of APAPR.

From January 1, 2024, two important changes have been made to the second level of pensions

In addition to the very good results of Level II, 2024 also starts with other good news for the 8.1 million Romanians registered in mandatory private pension funds, APAPR says.

Starting from January 1, 2024, the contribution transferred to Tier II increases from 3.75% to 4.75% of the gross monthly income as part of Romania’s obligations to the European Union through the PNRR.

Thus, compared to the average monthly contribution of 270 lei in 2023, the level of the average monthly contribution in 2024 is likely to exceed 350 lei.

At the same time, from January 1, 2024, the taxation regime of payments by non-state pension funds to beneficiaries (participants and heirs) has been improved.

If until the end of 2023, the tax base was the entire amount paid by non-state pension funds to beneficiaries, then from January 1, 2024, the tax base will be reduced only by the profit obtained from investing pension funds.

Photo source: Dreamstime.com

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.