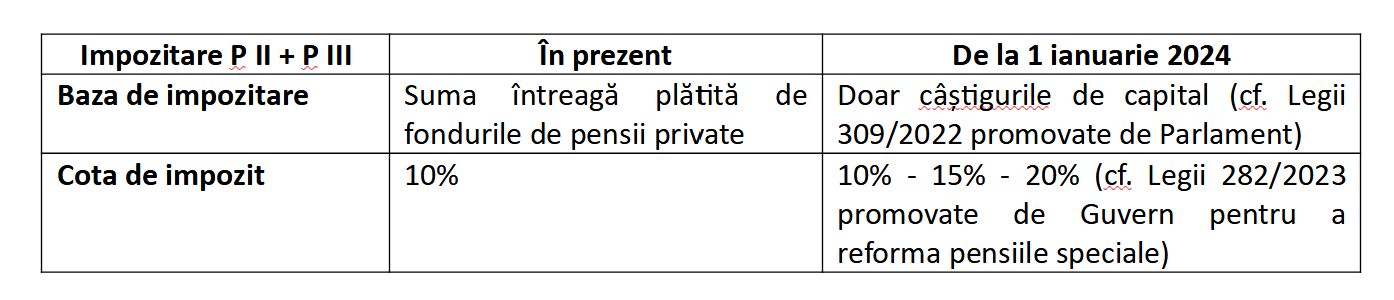

The Association of Administrators of Private Pension Funds (APAPR) publicly warned on Monday about a legislative ambiguity in the Fiscal Code, which creates conditions for the progressive taxation of capital gains from private pension funds (mandatory level II and optional III), mistakenly absorbed with an unaccrued part retirement pensions (commonly known as “special pensions”) from January 1, 2024.

- “Thus, instead of taxing payments from non-state pension funds at the usual rate of 10% (as now and as with pensions paid from the state system), from January 1, 2024, the tax regime risks turning into a progressive one. 15% or 20% applied to capital gains is the most unfavorable of all savings/investment products in Romania,” the association warns.

More specifically, the APAPR warns of legislative changes made to Articles 100 and 101 of the Fiscal Code by Law 309/2022 and, accordingly, by the recent Law 282/2023 on the reform of long-term pensions, due to which capital gains from private pension funds may be erroneous. equated to the non-contributory portion, resulting in progressive taxation similar to retirement pensions.

- “The application of these provisions would mean an unfair punishment for the participants of private pension funds and the beneficiaries of the benefits, therefore APAPR has started procedures in an institutional dialogue with the Financial Supervisory Authority (ASF) and the Ministry of Public Finance (MFP) to clarify as much as possible the relevance of this legislative ambiguity.

- APAPR requests, including publicly, to amend the Fiscal Code (Art. 100 and Art. 101) by decree of the extraordinary government to correctly reflect the difference between the contribution principle governing private pensions par excellence and the non-contribution principle of special pensions. In essence, APAPR is asking to keep the current tax rate of 10% instead of applying rates of 15% or 20%,” the Association of Pension Fund Administrators notes.

What losses risk participants of the II and III levels of pensions

The stake of this necessary legislative clarification is the annual payments of billions of lei to hundreds of thousands of Romanians, with the level of payments made by private pension funds growing exponentially.

To date, all pension funds (Level II and Level III) have made payments totaling more than 2.36 billion lei to almost 210,000 beneficiaries.

Level II payments alone are estimated to reach 1 billion lei in 2023, almost as much as the 1.1 billion lei paid out over the 15 years from 2008 to 2022, and the exponential growth rate is estimated to continue in the following years .

Photo source: Dreamstime.com

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.