If, on average, for large banks, the CA Tax implies a decrease in annual net profit by 6.8%, for medium-sized banks, this loss increases by more than 2.5 times, reaching 17%, and for small banks, the CA Tax brings an average decrease of 44% profit, almost halving its profit. Thus, due to this additional tax at the level of the banking sector, differences in the performance of medium and small banks are deepening to the detriment of them and to the benefit of large banks, according to an analysis published by the Association of Financial and Banking Analysts from Romania.

Tax on banking turnover (“CA Tax”) is set at 2% for 2024 and 2025 and 1% from 2026, applied to banking turnover, according to a special calculation formula. Patria Bank conducted an impact analysis based on the 2022 annual financial statements of Romanian banks that they published.

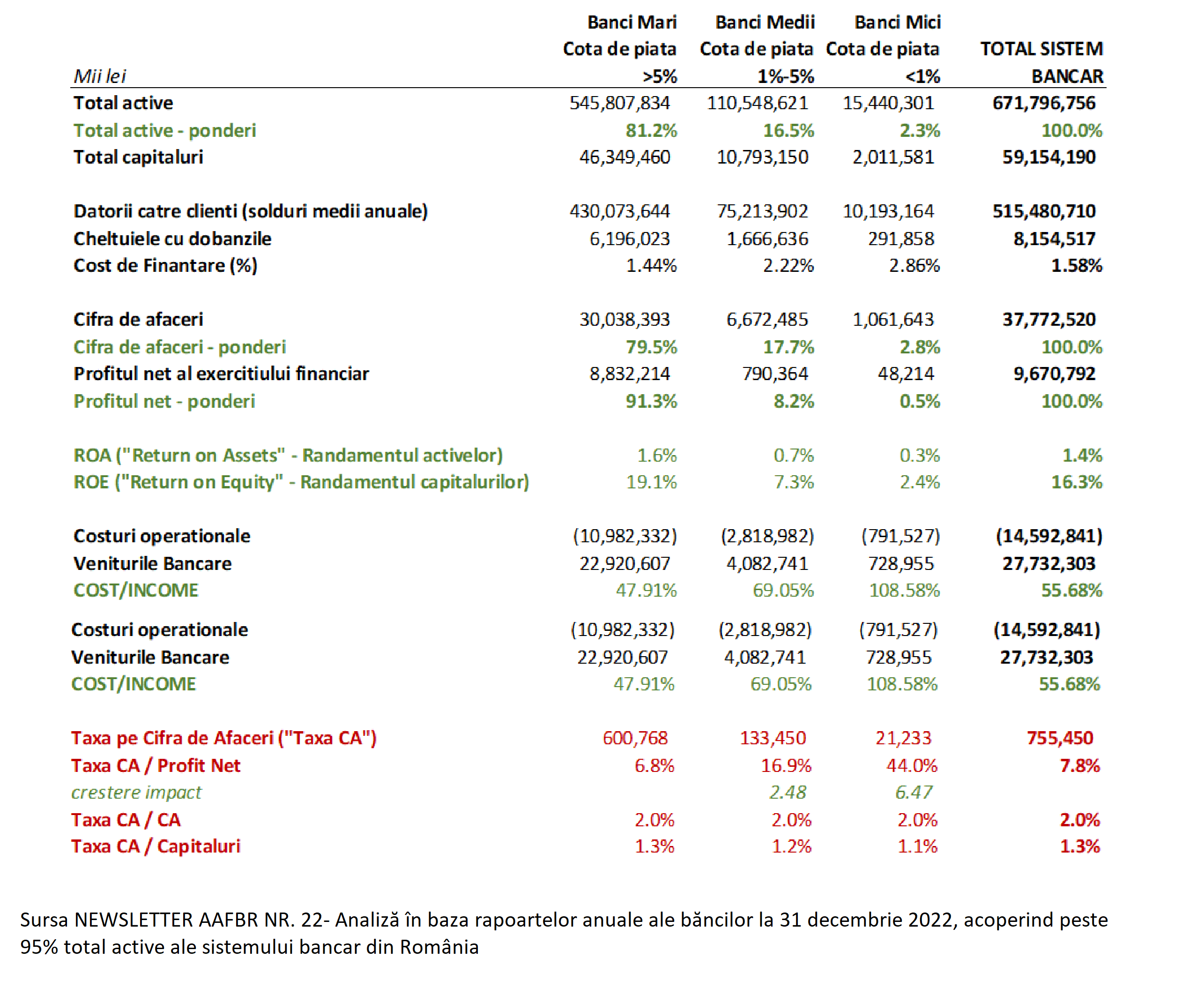

The analysis shows a significantly different impact at the level of banks depending on their size, analyzed on the basis of market share (calculated as total bank assets / total assets of the banking system), by ranges: large banks (with a market share above 5%), medium banks (with a market with a share from 1% to 5%) and small banks (with a market share below 1%).

Depending on the size of the bank, the impact of CA Tax can be significant

Thus, while the value of the tax related to capital is relatively close for the three categories of banks, the value of the same tax related to the annual net profit varies significantly between 5% and 60%, which can seriously harm profitability and activities of some banks; and this impact can affect the level of financial intermediation in the economy, which is already low.

For large banks, the tax cuts 6.8% of net profit, for medium-sized banks the loss increases by more than 2.5 times, and for small banks it cuts profits in half.

Thus, due to this additional tax at the level of the banking sector, the differences in the activities of medium and small banks deepen to their detriment and to the benefit of large banks, creating conditions for a further negative impact on their desire to develop lending activities, thus negatively affecting a number of segments of the economic clientele , operating in various market niches.

The impact analysis, based on the banks’ annual financial statements for 2022 as published, was conducted at the aggregate level of financial information for three size categories analyzed on the basis of market share: large banks, medium-sized banks and small banks.

The table below provides an analysis of financial indicators and the impact of the new turnover tax on banks operating in Romania (figures represent cumulative values for each size category, respectively, for the entire banking system):

Some conclusions from the X-ray analysis of the banking system

1. Large banks with a market share of more than 5% (top 7 banks) report significantly improved results compared to the other two categories and the system average, as shown below:

- They account for 80% of the banking system’s total assets and about 80% of total turnover, but report more than 91% of the bank’s total profits;

- The profitability of assets and capital of banks of this category is more than twice as compared to other categories;

- The cost/income ratio is one of the main elements of differentiation to improve the profitability of this segment: from 48% in this category, the ratio rises to 70% for medium-sized banks and goes to superunitary in the echelon of small banks. banks (109%); it is well known that a significant part of these indicators is due to the increase in the efficiency of large banks, as well as a smaller share of fixed costs (meaning mainly regulatory ones) in total costs;

2. Considering the turnover of the banking system in 2022, the estimated turnover tax (“CA Tax”) amounts to 755 million lei.

Depending on the size of the bank, the impact of CA Tax can be significant. Thus, while in terms of percentage of capital the impact is relatively close for the three categories of banks, in terms of percentage of annual net profit it ranges from 5% to 60%, potentially harming the profitability and productivity of some banks. If on average for large banks CA Tax leads to a reduction in annual net profit by 6.8%, for medium-sized banks this loss increases more than 2.5 times, reaching 17%, and for small banks CA Tax brings an average of 44% slashed profits, nearly halving profits.

This surcharge widens the performance gap between medium and small banks against and in favor of large banks

However, we believe that the most important impact is on the business model of medium and small banks, which will have more strategic opportunities to neutralize the impact of the CA tax on profitability and efficiency in order to continue to provide competitive products and services to markets where large banks also operate :

- Decrease in credit activity, a decision that, however, will have a negative impact especially on potential clientele, most often clients from certain market niches (micro-companies, small agricultural farms, etc.); in general, medium-sized and small banks address market niches that are less attractive to large universal banks, meeting the needs of financial products and services for customers who are excluded or partially excluded from these services; in terms of limiting the credit capacity of medium and small banks, we believe that including these segments of small and medium business entities that work in various sectors (agriculture, trade, services), will suffer from the limitation of access to loans;

- Reduction of interest on depositsgiven that the cost of funding for small/medium-sized banks is almost double that of large banks, a reduction in these interest rates will have a negative impact on customers (their savings will be less rewarded), but will also create risks for banking, loss of sources of funding for lending activities ;

- Increase in credit marginbut with limited capabilities and creates a negative impact on customers, as well as risks for credit activity, loss of potential for attracting new customers and increasing the balance;

- Reduction of operating costsbut with limited opportunities, given the competition for resources and the state of the labor market, as well as inflationary pressure on the cost of goods and services, as well as the constant increase in the complexity of the regulatory framework at the European and local levels, which entails an increase in costs.

All the elements presented in the above analysis are arguments in favor of differentiated tax legislation in CA depending on the size of banks in order to encourage a healthy competitive environment and further stimulate the lending activities of banks in order to support economic growth and implicitly increase the level of financial intermediation (calculated as the ratio of total loans/total GDP) at the national level, which is in any case the lowest in the European Union at the end of 2022: 25.8% in Romania compared to 42.8%-55.6% in Poland, Bulgaria, the Czech Republic and 88 .8% in the European Union.

In its current form, the CA Tax unduly penalizes small banks, to the greatest extent, and medium-sized banks, to a certain extent, compared to large banks, affecting access to banking products of some important customer segments for Romania, such as, for example, micro-enterprises. Therefore, we believe that a modified approach in the sense of eliminating or significantly reducing the corporate tax for small banks with a market share of less than 1% of total assets will be useful to significantly reduce the negative impact that the 2% level will have on financial intermediation in Romania and the level of credit activity during the application period.

Article published in AAFBR Bulletin #22. Author: Daniela ILIESKU, member of CA Patria Bank

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.