On Monday, the National Institute of Statistics published unemployment data (according to the methodology of the International Labor Office) for August. We have nearly 450,000 unemployed, which equates to an unemployment rate of 5.4%, down 0.1 percentage point from July 2023.

The unemployment rate represents the share of the unemployed among the active population.

The unemployment rate among men was slightly higher (by 1.0 percentage points) than among women. And youth unemployment remains very high – more than 20%

Why this is good news and bad news at the same time

Economic theory says that the rate of inflation usually rises as unemployment falls. I say usually because there are periods (stagflation) when inflation and unemployment also increase. But the rule is that the relationship between the two indicators should be inverse.

When one of the two indicators increases, the second one decreases. And the NBR and the Government are taking measures so that the economy does not overheat or, on the contrary, does not slow down significantly.

In Romania, the BNR and the Government are pressing the time pedal. When the Government raises wages and pensions, whether the economy allows it or not, or when it overtaxes industries that will incorporate the taxes into prices and the public will pay the costs, the danger of rising inflation becomes more consistent. I mean exactly what Iserescu does not want.

On Thursday (October 5), BNR will hold a Central Bank meeting on monetary policy, and economists interviewed by HotNews say Iserescu is likely to leave the key interest rate unchanged, although he is confused by the fiscal package launched by the government. .

Returning to the unemployment reported by the INS on Monday, low unemployment generally corresponds to higher inflation, while high unemployment corresponds to lower inflation or even deflation.

The explanation is that when you have low unemployment (that is, when you have more people working), it means that more consumers have disposable income to buy goods. Therefore, the demand for goods/services increases and this is transmitted to mothers. And in periods of high unemployment, buyers become more careful with their money and buy fewer goods, which extinguishes the “fire” under the price pot.

Who suffers most from unemployment?

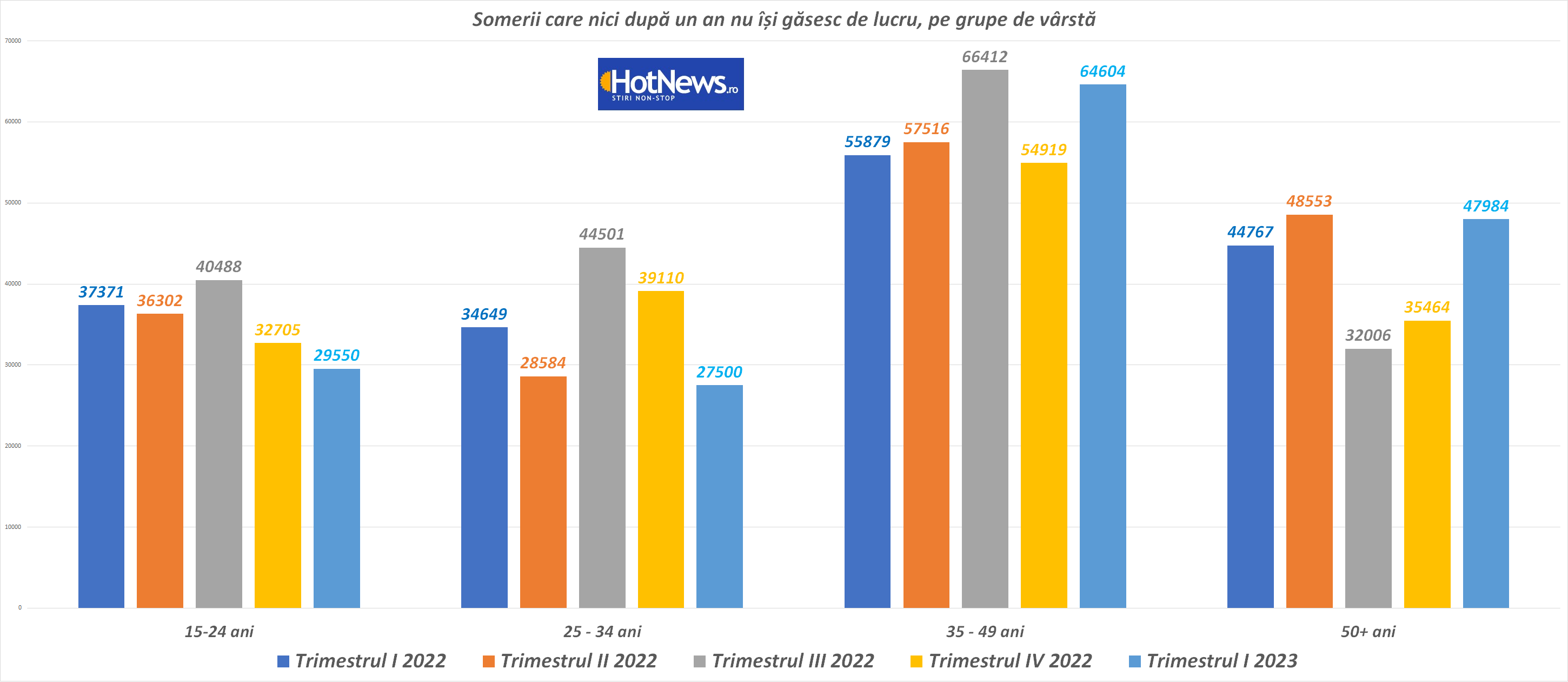

When we look at the unemployed, it is interesting to see who are those who cannot find a job even after a year of searching. In other words, let’s look at long-term unemployment. Who are these unemployed?

Who are the long-term unemployed?

1. The majority is in the age group of 35-49 years. Third. They are followed by those who are over 50 years old, but their number has increased the most (in terms of growth rate) since the beginning of the year. :

2. They are quite well educated. A third have a higher education, but despite the saying “there is a book, there is a job!”, they cannot find a job.

3. They are more likely to be black or Asian. This surprised me a lot. Among the unemployed, Asians were the most likely to remain out of work for a year or more, followed by black workers. In both groups, two out of five unemployed people have been out of work for more than a year.

4. They are spread.. everywhere (yes, they are more in poorer areas – those “poverty pockets” – districts where companies are mostly closed and where it is difficult to find a job)

Finally, there is the emotional side of long-term unemployment. Losing a job is accompanied by great social and economic stress. And searching for a year without finding it becomes even more stressful.

A Pew survey of the long-term unemployed last year found that nearly half of the long-term unemployed say their absence from work has caused family stress, and 40 percent of the long-term unemployed said they are less likely to be reached out to by friends. often

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.