Minenergo is going to launch a contract-for-difference (CfD) support scheme for investments in low-carbon technologies. In this context, Rezvan Nicolescu, an energy expert and former president of the European Energy Regulatory Agency (ACER), says that the implementation of this support scheme “will be a mistake that will cross the electricity sector, an even bigger mistake than the stupid compensation scheme that has so unbalanced National budget”. In theory, the financing of the scheme will be provided by the Modernization Fund and contributions from consumers.

- Recently, the Ministry of Energy started a public discussion draft Government resolution on the approval of the general legal framework for the implementation of the support mechanism through contracts for the difference of technologies with low carbon emissions. In addition to this project, it has also published an information guide for tenderers on the operation of the scheme.

- The contracts for difference will be offered to the respective producers through a competitive bidding process conducted by Transelectrica. Energy production projects using renewable resources will be acceptable.

- CfD contracts will be signed by the Operator of Electricity and Natural Gas Markets (OPCOM). The “Tender Initiation Order” will be published in the coming weeks.

According to Rezvan Nicolescu, “you never have a large number of projects developed in market conditions, you do not start destroying them with support schemes. The role of support schemes is to stimulate projects, not to block or stop them.’

What does Rezvan Nikolescu say?

- A CfD makes sense if it is done according to the type of Dutch auction, i.e. maximum to zero or minus. If it is done with a pen, it is theft, which will give work to prosecutors.

- If the auction results in too low a price, a large part of the current projects that will not receive CfD will stop. If you get €30/MWh from CfD, who else can convince financiers of €80/MWh forecasts? Hardly anyone!

- Even posts about nuclear ambitions no longer make sense when you have a €30 CfD and a battery pack at your disposal.

- If the auction is set at a high target price (strike price) or the price is set by hand, consumers will be out of pocket for about 15-20 years. The CfD is a market intervention mechanism that will have a massive impact on the market throughout the application period.

- The very debate about CfD is delaying projects that were running at a time when Romania needs investment. Those who recently did them without CfD are the ones who cheat the most.

- CFDs can benefit from CfDs, with some investors equating investments to government securities, China’s best-in-class equipment suppliers and banks including the EBRD and EIB targeting risk-free loans.

- All others who do not fall under the above categories will lose.

Two rounds of tenders for the capacity of 5,000 MW are being held

right information note of the Ministry of Energy, will be signed in the last quarter of this year, the contracts related to the first round of the tender procedure, through which the contracts for the difference are distributed. For the first tender, the estimated date of commissioning can be no more than 36 months from the date of signing the CfD contract (December 2023).

The CfD scheme will involve two rounds of tenders, each bidding separately for the respective power generation technologies – onshore wind and solar PV – with a total capacity of 5,000MW.

Total target power:

• Installed capacity of 1,000 MW for electricity generation from onshore wind and 1,000 MW for electricity generation from solar photovoltaic sources, both as a result of the first round of auctions to be held by the end of 2023 (“CfD 2023” auction “);

• Installed capacity of 1,500 MW for electricity generation from onshore wind farms and 1,500 MW for electricity generation from solar photovoltaic sources, both as a result of the second round of tenders to be held in the first half of 2025.

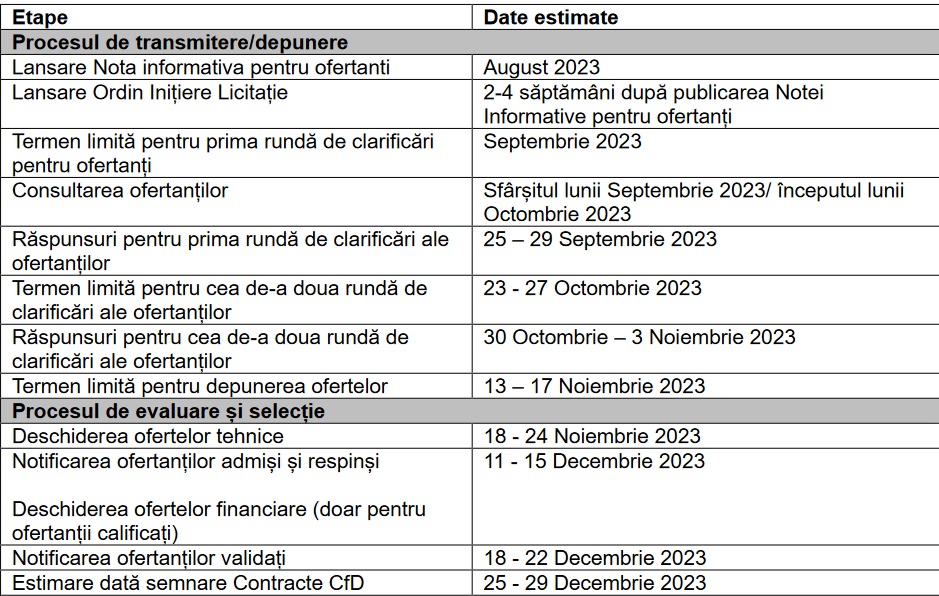

Key stages and approximate schedule for the launch of the CfD 2023 tender, including the process of submission, evaluation and selection of tenders.

The key terms of the CfD scheme, according to the information note:

• The duration of support through the CfD scheme will be a maximum of 15 years from the date of commencement of payment.

• Beneficiaries will be able to trade the generated energy according to their trading agreements. When the base price of electricity is lower than the execution price,

beneficiaries will receive a supplement for the difference. If the underlying price is higher than the strike price, the beneficiary pays the difference to the CfD counterparty.

• Proposals must specify the realization price (euro/MWh), the generating capacity to be installed and the target commissioning date.

• CfD payments will be made for each MWh of electricity produced and delivered to the National Electricity System, calculated through a special capacity meter

assigned to CfD.

• The reference prices will be a month-weighted average of the day-ahead market price (DAM). The price will be weighted for the same production technology subject to CfD support.

• Payment differences will be calculated in euros and converted to lei before payment is made in lei using the monthly average daily lei/euro exchange rates published by the National Bank of Romania.

• The strike price will be indexed annually according to the consumer price index of the Eurozone.

Financing of the CfD scheme is carried out at the expense of funds provided by the Ministry of Energy from the Modernization Fund and transferred to the CfD Liquidity Fund. OPCOM will be responsible for managing CfD payments to and from the Liquidity Fund. The Ministry of Energy is obliged to ensure that the Liquidity Fund always has sufficient resources. The liquidity fund will be supplemented by a CfD contribution that will be covered by consumers.

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.