If you have income from video chat, you must file a single return for 2023 and pay taxes. May 25 is a few days away.

In Romania, approximately 400,000 people use video chat, if we look at the recent statements of ANAF chairman Lucian Heiuš. No one knows how many there are, a common figure he saw on the Internet.

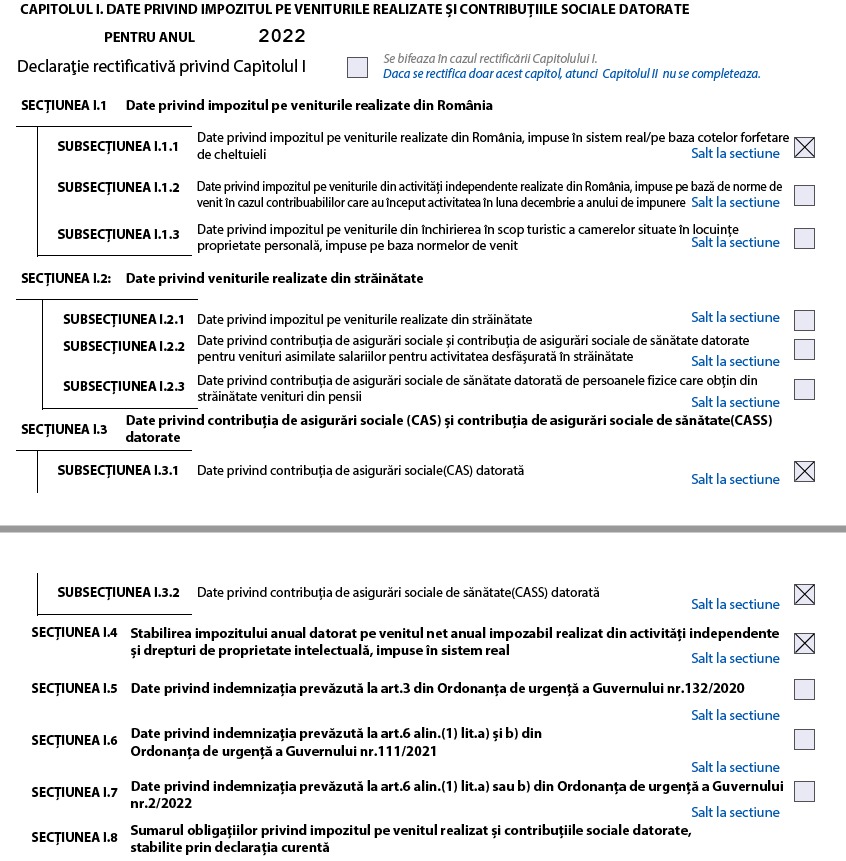

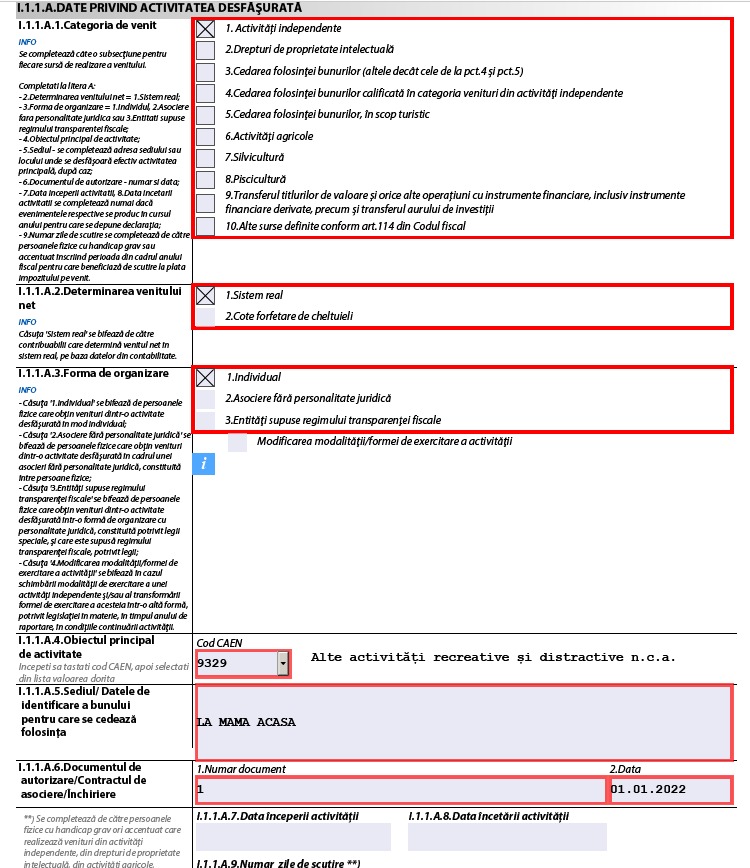

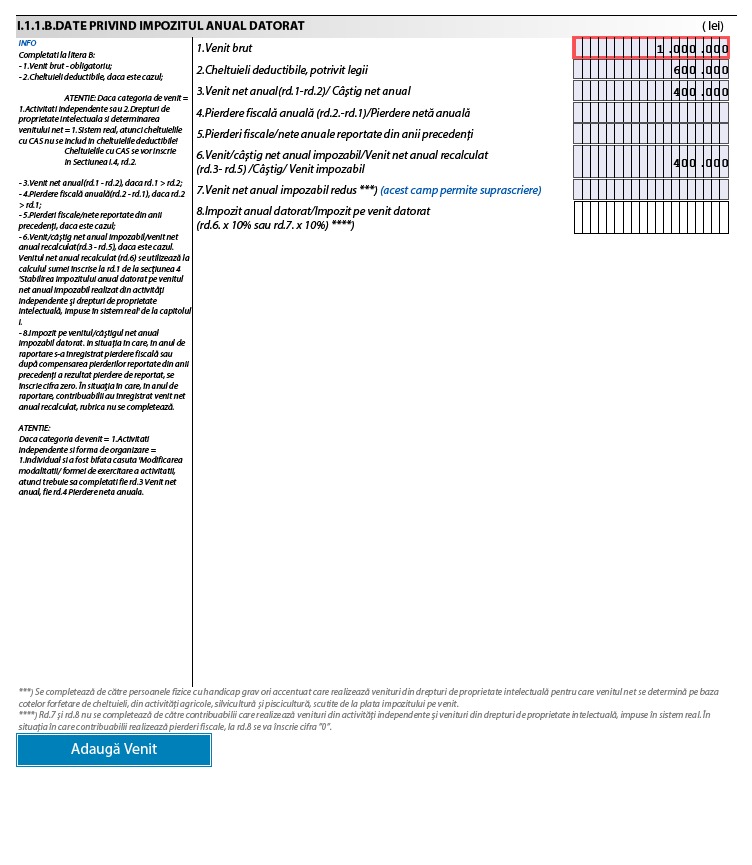

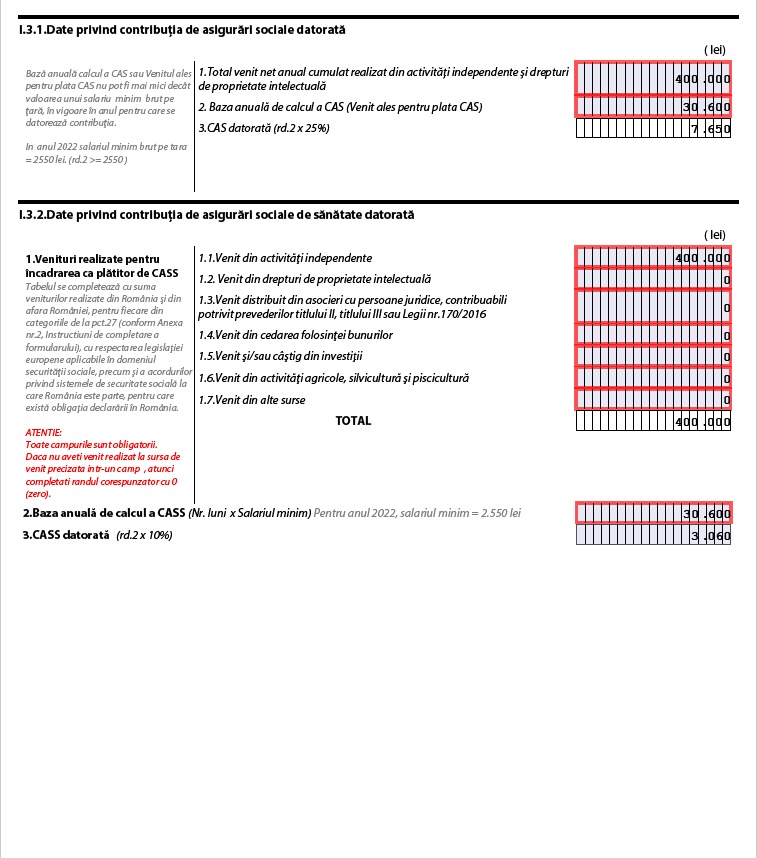

HotNews.ro asked Mr Cornel Grama, Tax Consultant, show us two examples of filling out the Unified Declaration (form 212).

Video chat can be divided into two categories:

1. Independent activity in a real system

2. Income from intellectual property rights

*Cornell Grama invested a large amount in these examples, although there are rare cases with such figures. You can see the reason at the end.

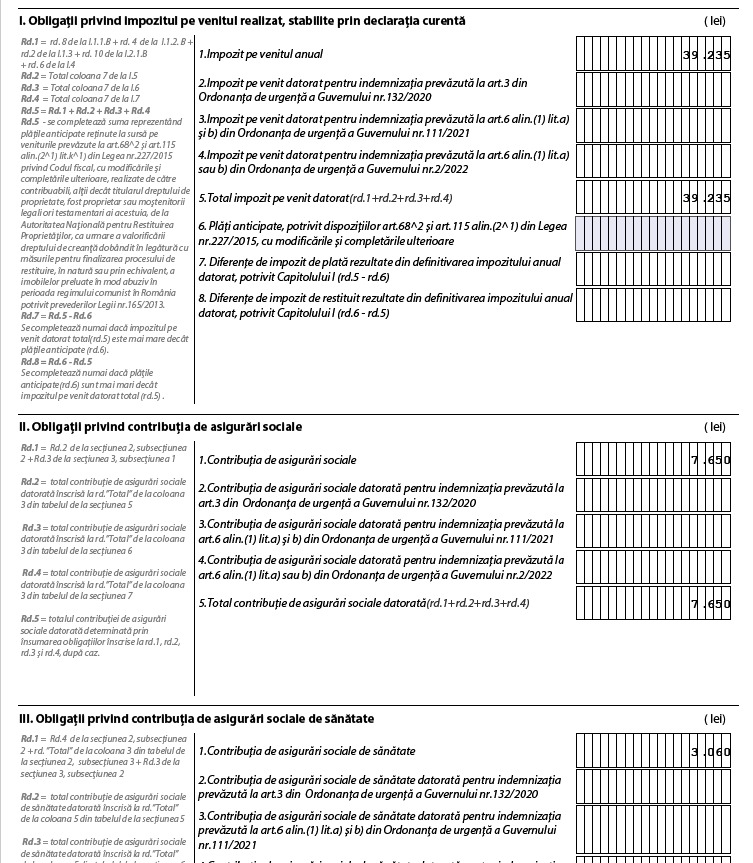

How to fill out a single declaration in case of independent activity in the real system

As I said above, a person can classify an activity in a video chat as an independent activity in a real system.

Net profit is calculated as the difference between receipts and payments (10% tax). For payments, it is necessary to have supporting documents in case of ANAF control.

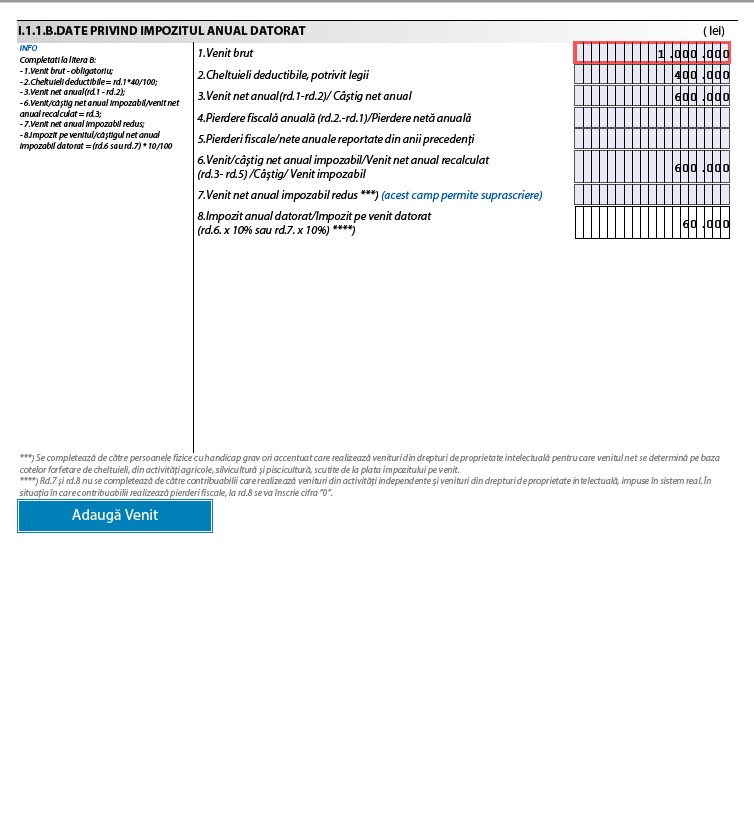

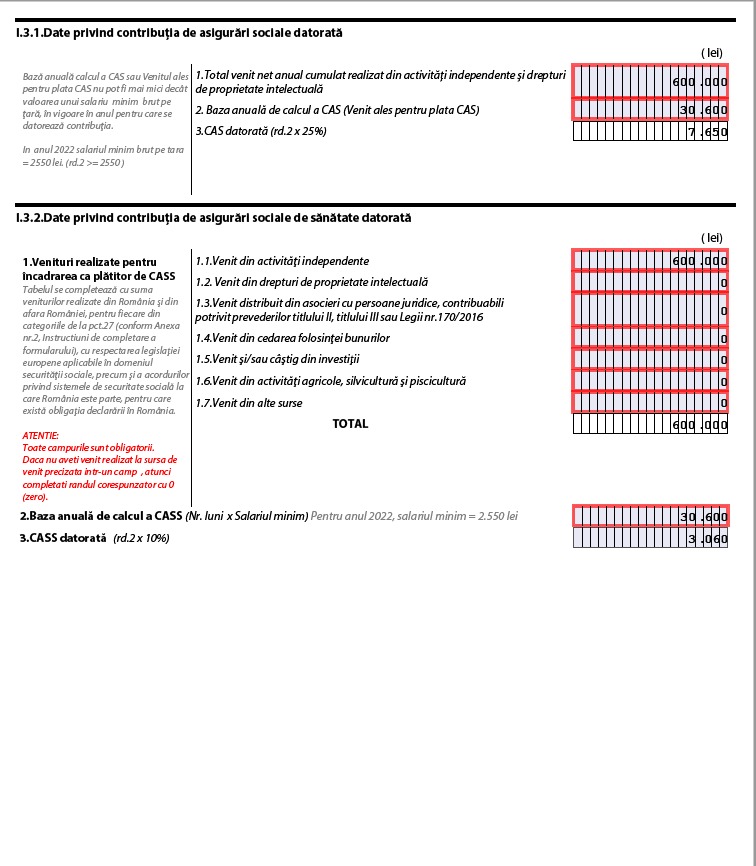

If the net income exceeds the maximum amount of 12 salaries (30,600 lei for 2022), it is also necessary to pay CAS 25% of the maximum amount and 10% CASS of the maximum amount, i.e. 7,650 lei, respectively 3,060 lei.

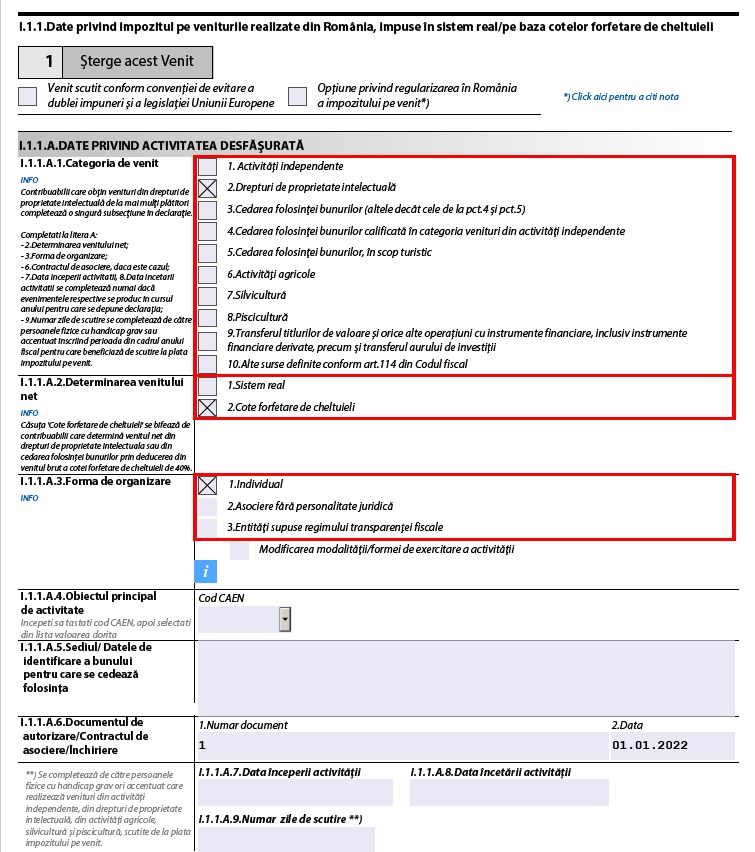

How to fill out a single declaration, if the activity is classified as income from intellectual property rights

If you decide to convert your video chat activity to income from intellectual property (copyright), the advantage is that you will have a fixed cost of 40%, for which you do not need to have supporting documents.

Net profit is gross income -40%. Gross income – i.e. 60% of gross income. Tax 10%

CAS and CASS are the same as in the above case in the real system.

CAREFULLY: If the maximum amount of 300,000 lei is exceeded, you must register for VAT purposes in any of the above cases.

Read also: VIDEO How to fill out the unified declaration 2023 / 14 typical filling situations

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.