If before the pandemic you went to the supermarket and bought 100 lei of products, today you will have to take out another 40 lei from your pocket for the same basket.

We took into account March 2020, when the president signed a decree imposing a state of emergency.

According to the INS, between February 2020 and March 2023, food inflation was about 40%. If we delve into the “guts” of the detailed data at the local level, we can see that in Ploiesti the price of potatoes has doubled compared to the month before the pandemic, in Baia Mare beans are 121% more expensive, in Slatin milk is 141% more expensive (also sheep’s cheese costs 113% more), and the price of eggs has almost tripled in Ploiesti since the pandemic so far.

Of course, inflation depends on what and how much each person consumes. (a .pdf file with data from the chart above can be downloaded here)

How much more is a hundred lei worth: the salary increase does not cover the increase in prices

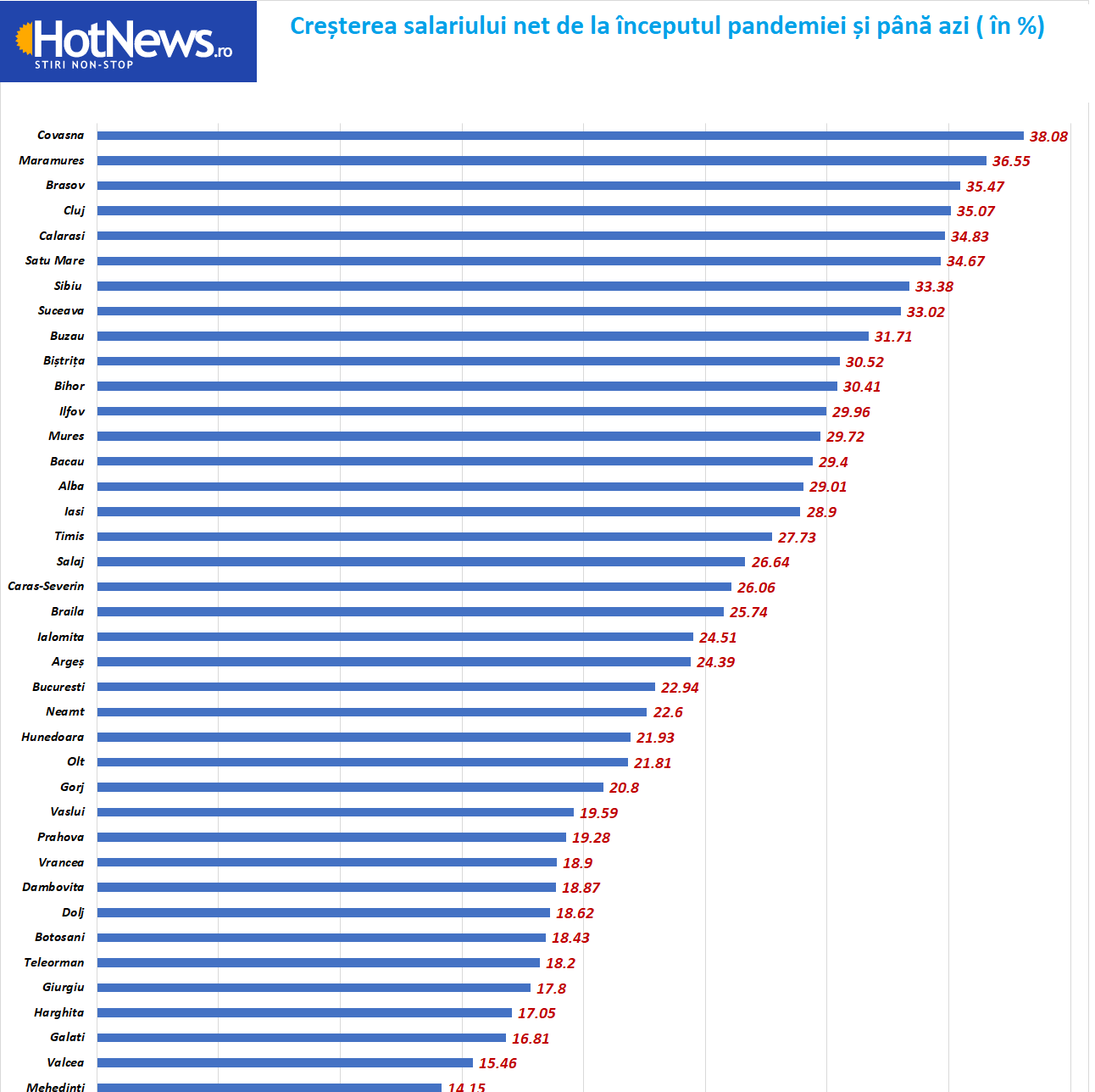

Growth in net wages lagged behind growth in food prices, according to statistics reviewed by HotNews. The highest growth rates were in Covasna (38%) and Maramures (36.5%), counties where wages were already among the lowest. But even despite this, when products rose in price by an average of 40%, the dynamics of wages was lower, or, in other words, purchasing power decreased.

How much is one hundred lei still worth: every 6 and a half months of work, the salary is “stolen” by inflation

The average net salary in Romania was 4,270 lei in February 2023, and inflation in the same month was 15.5%, according to official data. This means that 661 lei every month was money “eaten” by inflation. Or, in other words, every 6.5 months the salary is absorbed by inflation

But we don’t have to say it, you can feel it on your skin. Before the Russian invasion, a liter of milk cost an average of 3.50 lei. A few months later, the same package of milk cost almost 5 lei. The price of bread also increased – from 1.5 lei a slice went up to 2.6 lei. To extend the time when you go to the market with 100 lei in your pocket, you buy less food than before the pandemic. Much less.

And people react to rising prices by reducing consumption, replacing usual products with cheaper ones, or giving up some types of leisure.

“I was and am a big fan of beaches in Greece. This year, I will also go there for vacation, but instead of 10 nights, we will stay only for 7, and I chose an inexpensive accommodation,” says Yosyp Barna, a client whom I met at the headquarters of the travel agency.

Those who have lived through high inflation in the past may have some advice that will work for you

In the early 1980s, Linda was a teacher and mother of three girls in Cape Cod, Massachusetts. High prices for baby items and food made her thrifty because her family didn’t have enough money to cushion the impact of rising prices.

Instead of taking her girls to the movies or ordering them pizza for dinner, Linda taught them to be thrifty from an early age.

Instead of going to the movies or ordering pizza for dinner (which the girls would have loved), Linda taught them to be thrifty from a young age. He took them picking strawberries and taught them how to preserve the berries as well as other fruits and vegetables. See details here.

She made baby girl dolls out of whatever materials she had around the house, avoiding buying them at the store where they became very expensive. Mrs. Gadkowski also took her children to local thrift stores to not only buy clothes to dress the dolls in, but also to fit them.

The Japanese advise to avoid inflation by getting married

It has long been often said that “one person cannot afford one thing, but two can.” And looking at the data of the Bureau of Statistics, those related to the survey of family budgets, they look like this:

Total consumption expenditure of one-person households: 155,048 yen

Total consumer spending for households with two or more people: ¥279,024

Even if there are two or more people, these costs are not doubled, but 1.8 times. This is a simple calculation that shows us that living as a couple actually saves costs, writes the Japanese press.

Read also: Forget inflation! Welcome to the Age of Greed and Scoozflation!

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.