After two major bankruptcies in 2 years and an apology in Parliament that City Insurance or Euroins withheld claims from it or failed to provide it with financial data in time to calculate its solvency and risks ceded to reinsurance, ASF management is now trying to demand as much data as possible from brokers and insurers on RCA car insurance contracts.

Brokers are required to report daily which RCA contracts they have sold

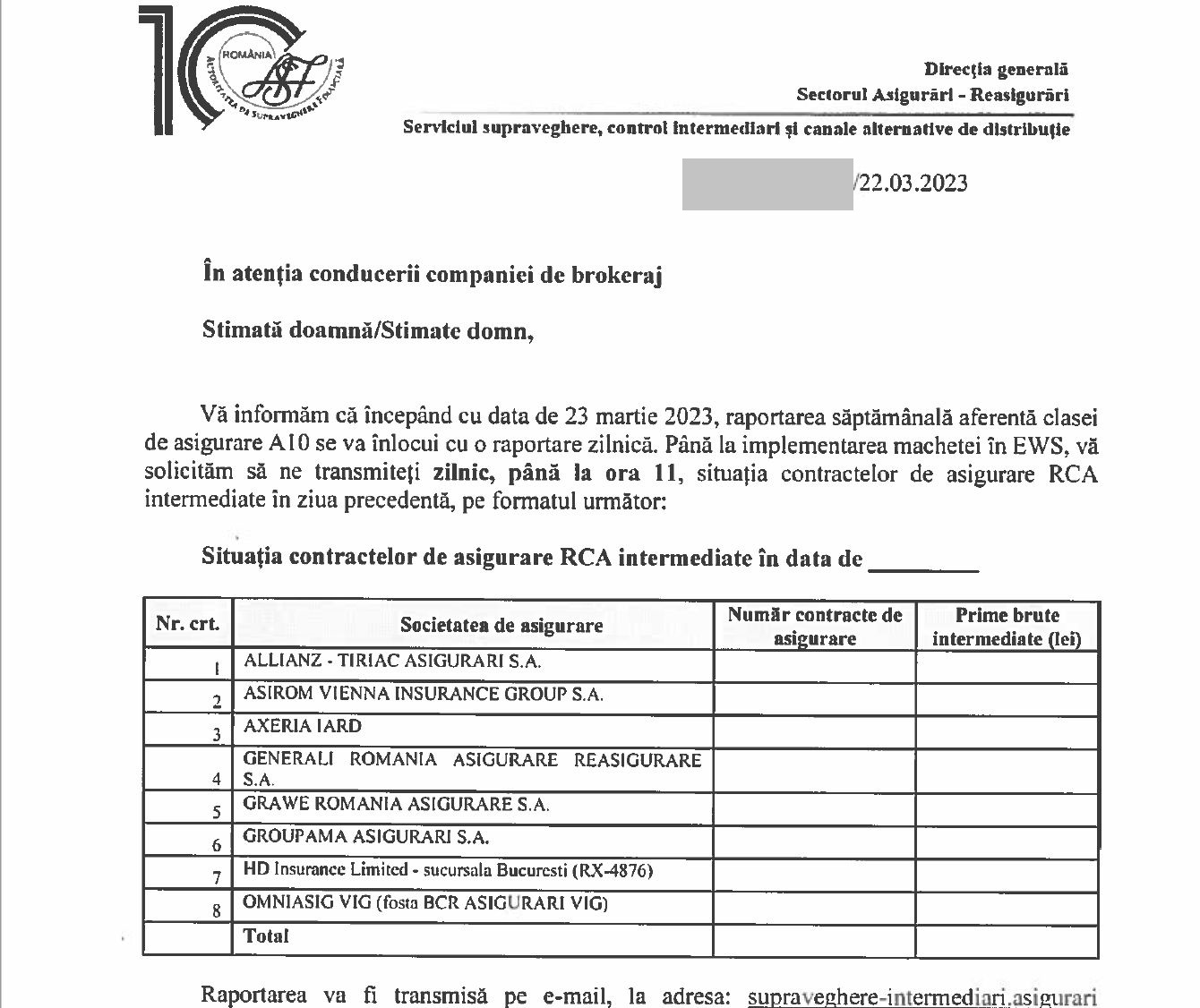

In an appeal signed on March 22, 2023, the director general of the insurance department of the Financial Supervision Authority (ASF), Valentin Ionescu, asks insurance brokers, starting from March 23, 2023, to report to the authorities on the situation with the contracts concluded the day before, every day by 11:00 a.m.

According to an address obtained by HotNews.ro, this reporting used to be weekly.

New solvency and reinsurance data required from insurers

In another rule published on Tuesday 28 March in the Official Gazette, the ASF establishes new reporting obligations for third-country insurers with branches in Romania, such as Hellasor Akseria.

- SEE HERE THE RULE PUBLISHED TODAY IN THE OFFICIAL RESULT

The rule was issued on March 14, 2023, 3 days before the ASF decided to withdraw the authorization and file for bankruptcy of Euroins, the RCA leader with almost 2.8 million customers.

The law published in the Official Gazette amends the norm 26/2021 and imposes many new reports for such insurers operating in the Romanian market, some of which relate to reinsurance agreements and the assessment of own funds that can cover technical reserves, SCR (optional solvency capital) and MCR (minimum solvency capital requirements) in a situation of financial difficulties have immediate application.

Thus, in Art. 1, paragraph 6, 8, it is necessary to enter new information to be sent to the ASF:

- “contact persons of the insurer’s auditors in a third country;

- a description with an appropriate level of detail, depending on the complexity, of draft reinsurance agreements and other methods of risk minimization;

- risk description for the first five reinsurers;

- projects of outsourcing and subcontracting contracts covering the activities of the branch;

- a description of the risk profile, risk appetite and risk tolerance limits adopted for the entire activity of the third country insurer and the branch;

- estimates of own funds that can cover technical reserves, SCR and MCR in situations of financial difficulties or in the event that the activities carried out deviate significantly from the initial business plan;

- a description of the business-wide and industry-wide investment strategy, including the reasons why the third-country insurer adopts that strategy;

- if the third-country insurer is part of a group, the SCR value of the group and own funds covering this value;” shown in the norm of ASF.

It will be recalled that on March 17, the FSA revoked the permission to operate Euroins, accusing the RCA leader of insufficient funds to cover the minimum solvency capital requirements.

- “As of June 30, 2022, the company does not have the appropriate funds to cover the EES, this situation remains as of September 30, 2022. Funds in the amount of 2.19 billion lei are needed to restore the Solvency Capital Requirement (SCR), and funds in the amount of 1.75 billion lei are needed to cover the MCR. The decision to withdraw the authorization was made in conditions where the situation of Euroins Romania does not make the application of the settlement procedure reliable,” the ASF decision reads.

What reporting obligations has the ASF imposed on all RCA insurers at the end of December 2022

Another measure taken by the ASF only at the end of December 2022 was the obligation for all RCA insurers to submit electronically to the AIDA compulsory motor insurance database new information on approved claims reserves, payment history or compensation for refusal of payment or legal proceedings , and ASF received real-time access to all this information.

As a result of the changes, the FSA wanted to know at any time what payments an insurer is making, whether they are partial or full, whether it has built up statutory loss reserves when it has paid or refused compensation, whether there are recourse claims or litigation in respect of a particular claims from the insured.

How the heads of ASF complained to the Council about the lack of information in the bankruptcies of “Euroins” and “City Insurance”

All these regulations seem extremely overdue, given that there have been financial problems and complaints of delayed claims payments since 2020 against City Insurance and Euroins, RCA’s biggest players, which the ASF claimed until they filed for bankruptcy were solvent.

At a soft Senate hearing on the Euroins bankruptcy on March 20, 2023, ASF management blamed the lack of legal leverage and real-time information from two insurers that went bankrupt in just 2 years.

Valentyn Ionescu, director of the insurance department at ASFclaimed that due to solvency problems at the end of December 2021, the authority decided to implement a recovery plan for Euroins and that it had problems obtaining timely data from this insurer.

- “The audited financial statements for 2021 were not sent on time. Instead of April 30, 2022, they were sent in August, that is, more than 3 months late. So in August 2022 we had data that we were able to analyze for 2021.

- For this violation, the general director was fined 125,000 lei.

- As soon as they released the data in September, we saw that there were changes in the company’s reserves, a big decrease in IBNR (reserve estimate) of almost 400 million (in euros) and some changes in the insurance contracts that worried us.” , – said Valentyn Ionescu.

Similar complaints came from him Christian Rosu, Vice President of ASF responsible for insurance, asked why he had not decided earlier to put the Insurance Guaranty Fund (FGA) at the head of Euroins.

- “The option in which the FSA was supposed to cooperate with the company’s management does not work. We had this decision before in February 2020 when the FGA was appointed to replace the executive and for 2 months they did not receive any documents or information. All operations and transactions were conducted through Bulgaria,” said Christian Roche.

ASF’s vice-president also complained about problems with the reinsurance contract that Euroins came up with at the last minute to transfer most of the risks to RCA.

- “This contract was signed on February 9. We learned about this contract on February 17 from the press. I requested and received on February 21st.

- Moreover, in certain articles of the reinsurance contract, it turned out that in a situation where the balances are positive day by day, the positive balance is transferred abroad, and the negative balance will also be fed by them from abroad. So it was a deliberate fraud.

- Their only catch was that in February 2023 they brought us a reinsurance agreement with a midget re-insurer where they moved all the assets and all the reserves overseas, so they were the basis under that agreement.

- In the case of Euroins, from 2021, all legal steps provided for by the Solvency 2 Law and Law 237 to restore solvency indicators have been applied. We gave a solution to the deficit of the SCZ, they had enough time to restore it,” said the vice-president of the ASF.

Similar explanations were given by to ASF President Nick Mark.

- “These companies were sitting with files (claims) under the table that they did not register. These companies did not record their court cases and we had to investigate all these things.

- As a measure, together with BAAR, we have implemented an IT system where all insurance companies can enter all their data from policy issuance, provisioning to claim files and payments to see real-time tracking. This is the main solution, that we will be able to have information in real time.

- Senator, the reason is that most of these companies have committed fraud. Our utility exists and exists because we discovered it,” Niku Marku said.

Read more: VIDEO Scandal in the Council, where the management of ASF gave an explanation about the bankruptcy of Euroins: “City Insurance and Euroins were a forest mother for the population”

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.