The economy is doing better than before the recession, but in the short term, risks are high and we could see a slowdown in economic growth. Maybe even a quarter or two with a decrease compared to the previous quarter, Ionuc Dumitru, Raiffeisen Bank’s chief economist, said on Wednesday at the Romanian Banking Forum organized by Finmedia.

In his opinion, this year inflation may reach 17%, and next year it may remain at a double-digit level.

What else did Ionuts Dumitru say on Wednesday:

- The sector that suffers the most is the manufacturing industry, which still needs to recover before the pandemic. The automotive industry is the one that has fallen the most

In the second quarter of 2022, real GDP increased by 1.8% compared to the first quarter of 2022 and by 5.1% compared to the second quarter of 2021. Annual growth in real GDP significantly exceeded our expectations (3.7%) and expectations of other economic analysts (2.7% in a Bloomberg survey).

- Real GDP growth in the second quarter was supported by an increase in population consumption, investment and exports. Industry and services were the main sectors of activity that supported GDP growth in the 2nd quarter.

- Household consumption continued to grow in the II quarter of 2022 (+2.2% compared to the I quarter of 2022), having a positive contribution to the quarterly dynamics of real GDP in this period. In the 2nd quarter of 2022, there was an increase in both the purchase of goods and the consumption of services.

- The number of people employed in the economy continues to grow, and the unemployment rate remains at a low level.

- Net nominal wage growth (base wages and incentives) increased rapidly in the private sector (+15.0% in August 2022 compared to August 2021), but rose modestly in the public sector (+5.1% in August 2022) compared to August). 2021). At the economy level, however, real wages are falling.

- Investments in the economy had an upward trend in the first half of the year after falling in the second half of 2021. Investment growth in the 2nd quarter of 2022 (+1.8% compared to the 1st quarter) was mainly supported by an increase in investments in construction works (residential and non-residential).

- Lockdowns in global production and distribution chains have had a negative impact on Romanian industry and exports over the past two years, with the negative impact being more severe compared to the events recorded in the countries of the region.

- Industrial sector output and merchandise exports recorded improvements in October. 2021 – January 2022, but later fell again.

- Exports of vehicles and vehicle components are important for Romania (22.3% of total merchandise exports in 2019 before the outbreak of the pandemic) and have been severely affected by existing blockages in global production and distribution chains.

- In the 3rd quarter, growth for most components of GDP should have slowed, but real GDP excluding agriculture should remain on an upward trend.

- However, crop production was down a lot this year, which likely contributed to the contraction in real GDP in Q3 compared to Q2.

- We expect economic activity to moderate in Q4 2022 and Q1 2023 (we do not rule out a contraction in real GDP excluding agriculture).

- We revised our economic growth forecast for 2023 to 2.3% from 3.0%.

- The state budget deficit in the first half of the year was low (4.8% of GDP). The reduced level was supported by the rapid growth of state revenues against the background of a significant increase in energy prices (additional taxes, royalties, dividends), and settlements with electricity and natural gas suppliers were extremely insignificant.

- The state budget deficit increased in the third quarter (6.2% of GDP) thanks to the acceleration of settlements with energy suppliers and the addition of social assistance to the population, but it increased in the third quarter

- In 2022, against the background of sustained economic growth and rapid growth in prices and wages, government revenues had a steady upward trend.

- At the same time, the rise in energy prices brought significant additional revenues to the state this year.

- Increases in government spending this year were limited by modest increases in public sector wages and pensions. Pressure to increase government spending increased in the third quarter as the government began paying energy subsidies and providing social transfers to the poor.

- Romania ranks second in the EU in terms of the share of tax revenues in GDP (after Ireland, which has a special tax regime). We are also the country with the highest share of public sector wage costs and social transfers in budget revenues.

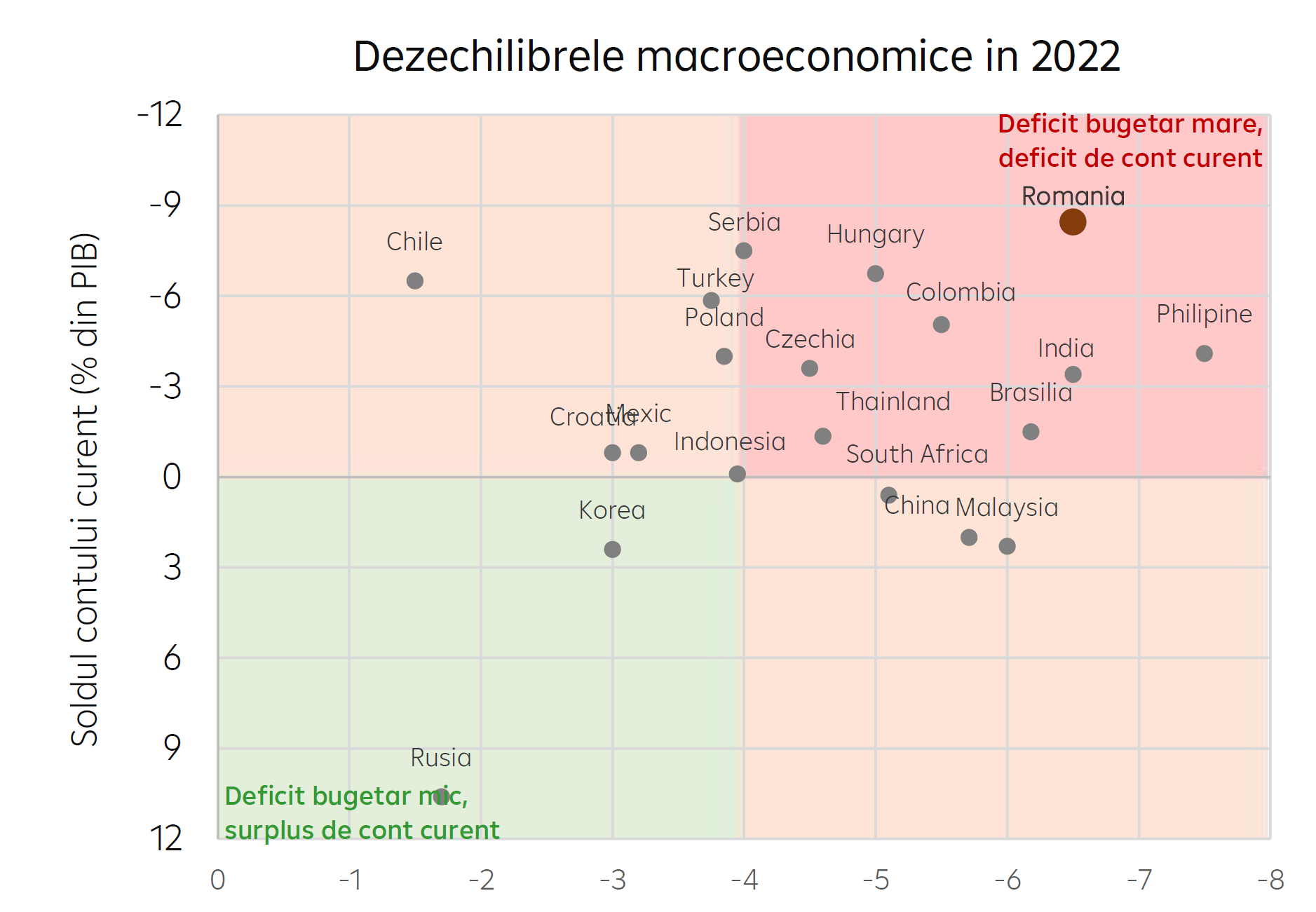

Romania registers the largest external imbalances in the region.

- CEE countries registered a widening current account deficit starting in 2021 due to existing blockages in global production chains and a sharp rise in commodity prices.

- Romania registers a very large permanent deficit at the level of foreign trade in goods and services. Similarly, Romania’s current account deficit is high from a regional perspective.

- The high government deficit that has materialized since 2020 was largely financed by the issuance of Eurobonds, which led to an increase in external government debt.

- More than 50% of Romania’s gross public debt is financed by non-resident investors, and most of the external debt is in foreign currency

- Romania’s public budget and current account deficits from 2022 are among the largest expected in emerging economies.

Source: Hot News RO

Anna White is a journalist at 247 News Reel, where she writes on world news and current events. She is known for her insightful analysis and compelling storytelling. Anna’s articles have been widely read and shared, earning her a reputation as a talented and respected journalist. She delivers in-depth and accurate understanding of the world’s most pressing issues.