The profile of those who take out a mortgage loan, as a rule, is a person who either lived with rent before buying a new home, or lived with parents. According to a loan broker survey, when a person buys a home, they want the rate they have to pay the bank to be similar to the rent they paid when they were a tenant.

- 90% of customers who apply for mortgage loans are renters or live with extended family.

- 80% of those buying a home with a home loan want their monthly bank payment to be equal to the rent they paid when they were tenants.

- Lending experts recommend taking out a mortgage loan for a purchase before the age of 40.

- After 40 years, it is more difficult to get long-term loans.

“It’s simple math. If I’m a 65-year-old man and have lived in a rental all my life, when I retire, the pension is usually lower than the salary I had when I was working, and it will be harder for me to pay the rent. If I had bought a home with a mortgage during my professional career, by the time I retired, I would have owned a home and I would have almost finished making payments on it. The older people are and the later they think about getting a mortgage loan, the less likely they are to get one. Since the loan amount is large, the repayment period is shorter for those over 50 years of age. That is, if a person is now 55 years old, then the loan is granted for only ten years, so he must pay it off until he reaches 65 years old. The stake in this case is high,” warns Valentin Angel, CEO of AVBS Credit.

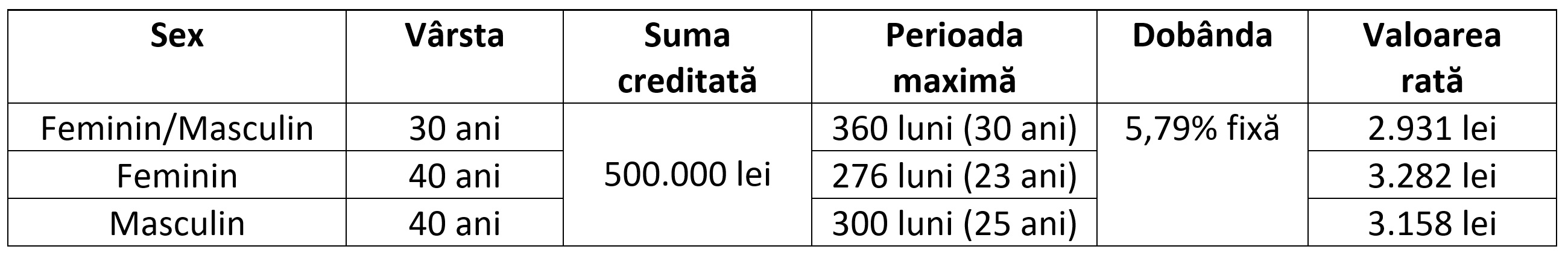

To better understand the benefits of getting a mortgage loan at a younger age compared to a mortgage loan at an age, say, just ten years older, we’ve included a 30-year-old versus 40-year-old mortgage study in the table below.

How to increase the chances of getting the loan of your dreams

The result of consideration of a mortgage loan application largely depends on the size of the initial payment, solvency and credit rating. These are the factors that the bank pays attention to when you apply for a loan.

Two things to look for when buying a new home

Don’t stretch your budget to the limit

You are usually allowed to borrow two and a half times your income (40% debt ratio). If your net monthly salary is 4,000 lei, or 48,000 lei per year, the bank will give you less than 20,000 lei of credit. Two people with 4,000 lei each month will be able to get a loan for 40,000 lei. But this does not mean reaching for the maximum amount that can be obtained, because in life (especially if the loan is taken for 25-30 years) many troubles can happen that will lead to a decrease in income.

The higher the value of the home you buy, the more money you have to pay back to the bank. Also, if you borrow for a longer term, the rate may be lower, but the total amount returned to the bank will be higher.

Improve your credit score

A good credit score shows lenders that you’ve managed your money responsibly in the past, so you’re less likely to run out of money.

You can improve your credit score by having a good relationship with the products the bank offers you – from deposits, access to more investment products and more.

If you have had loans before and you registered delays or resorted to a payment moratorium (suspension of payments), this will not be well received by the banks.

The risk to lenders is lower if borrowers have a high deposit value and can charge a higher interest rate the higher the collateral.

It’s good to know that smaller bank deposits mean more risk to the bank if your equity goes negative if house prices fall. (Negative equity is when the value of your home ends up being less than your mortgage balance).

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.