Hidroelectrica is a state-owned company that generates a lot of money, thanks in large part to the government’s policy of regulating electricity prices in favor of the producer. But, despite the record profits it receives year after year in the billions of lei, the company is not developing, the level of investment is much lower than planned. Last year, the degree of implementation of the investment program was only 45%, of which only 30% was for development, the company’s document says.

“We are betting on infrastructure that was created 30, 40, 50 or 70 years ago”

“I asked them to draw up their investment plan and I got assurances that even in the conditions of 100% dividends they will stick to the investment plan and I follow them every week,” the minister said at the end of the Cabinet meeting on Thursday. energy expert Sebastián Burduya asked HotNews.ro why the company’s entire profit, amounting to 6.3 billion lei, goes to shareholders in the form of dividends, leaving nothing for investments. We will remind you that the Board of Directors of the company decided that 100% of the company’s profit for 2023 will be transformed into dividends.

The minister says that “it is important to send a signal to investors and pay these dividends”, in the context of which the company went public last year.

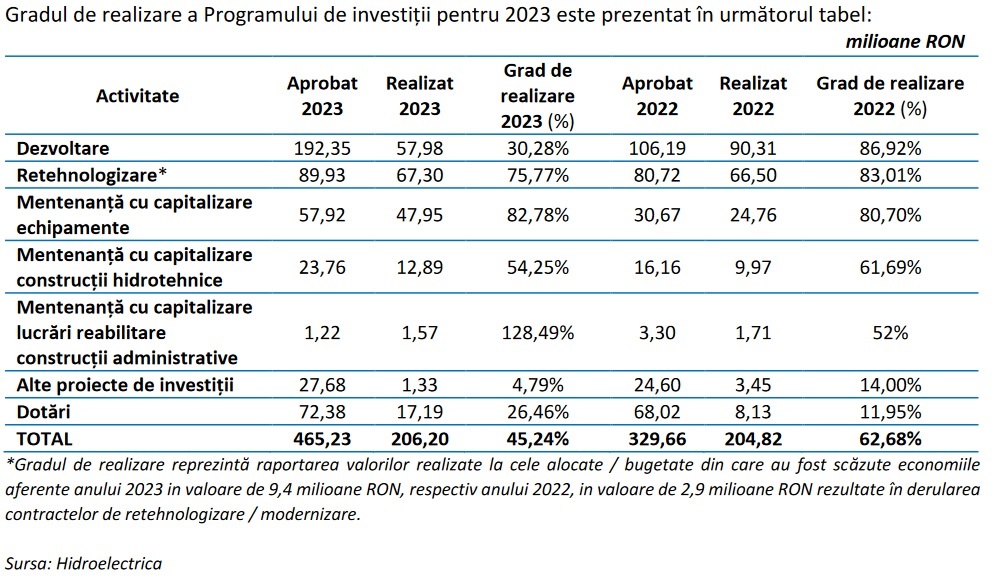

“But they have investment goals,” Burduya added. But the company’s report shows that Hidroelectrica met only 45% of its “investment target” last year. A year ago, it was slightly better, with an investment realization rate of 62%.

Investments are very low, even if the infrastructure on which the company is based is very old, even the minister admitted this. “I have always encouraged companies in the ministry’s portfolio to invest, especially Hidroelectrica, where, as you well know, we rely on infrastructure that was created 30, 40, 50 or 70 years ago, as is the case in Vidraru, almost 70 years,” – said the minister.

How Hidroelectrica turned into a company that pumps billions of lei into the budget, working on infrastructure 70 years ago

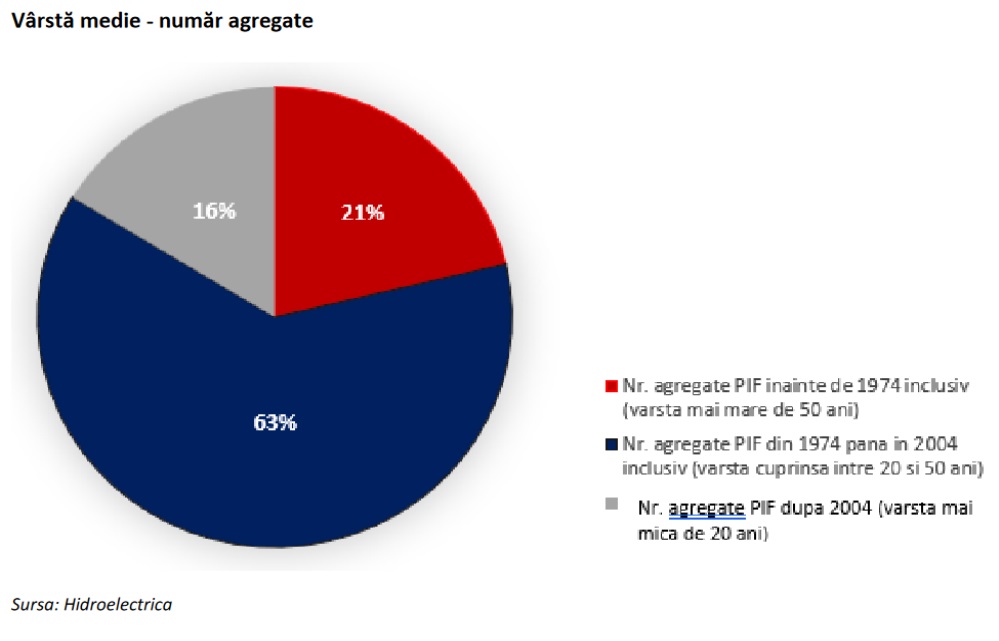

The company’s report shows how old the hydropower infrastructure is.

Currently, Hidroelectrica has 418 hydro units in operation, 21% of which are over 50 years old, and 63% were commissioned between 1974 and 2004. Only 16% were commissioned or renovated after 2004.

The capacity installed in new or renovated hydro units in the last 20 years is only 23%, that is, not even a quarter. About 64% of the installed capacity is between 20 and 50 years old, and 13% was installed before 1974.

Despite the age of the objects, too few funds are spent on investments. Last year, when Hidroelectrica made a profit of 6.3 million lei, on revenues of 12.1 billion lei, only 206 million lei were spent on investments, most of which were on maintenance.

As for development, only 58 million lei were spent last year, which is 30% of the plan. 67 million lei were used for the reconstruction.

The management of Hidroelectrica is also considering the possibility of distributing extraordinary dividends

In addition to the 6.3 billion lei profit, Hidroelectrica shareholders could receive extraordinary dividends. More specifically, the company’s management considers “the distribution, at its discretion, of extraordinary dividends from the retained earnings of the Company, if it is suitable for use and if the investment plans of the Company have provided funding.”

Otherwise, the strategic direction followed by the company’s management is to “focus on shareholder value through operational efficiency and investments to maximize profits, while striving for a dividend policy with a distribution rate of at least 90% of profits.”

How could Hidroelectrica take over a business worth billions of lei without investment money.

Regarding investments, the company’s management talks about “Diversification of the production portfolio and increase of the supply portfolio.”

According to HotNews.ro sources, Hidroelectrica together with Romgaz will analyze the possibility of purchasing electricity and gas supplies from E.ON. But it would be a huge operation that would require a lot of money. E.ON Energie registered a turnover of 13.7 billion lei in 2022 and has a portfolio of more than 3 million customers. Unlike Hidroelectrica, Romgaz executives proposed to turn into dividends only 20% of the 2.8 billion lei profit obtained last year, precisely in order to have money for the development of the company.

But not only this will be a very expensive business. For example, the Vidraru hydroelectric power station, which the minister also spoke about, needs reconstruction, the works are put up for auction at the end of February, the contract value is more than 200 million euros. This is already the sixth attempt to conclude a contract. Hydroelectricity failed to attract a developer due to the low price. Last year’s auction offered a price of 150 million euros including VAT. The Vydrarus hydroelectric power station was put into operation in 1966.

In addition, a year ago Hidroelectria approved an association with Abu Dhabi Future Energy Company PJSC Masdar to develop photovoltaic projects based on floating panels and offshore wind projects – stationary and floating.

Regulated price in favor of Hidroelektrica

The policy of regulating energy prices in recent years has brought huge profits to producers. Thus, at the height of the energy crisis, such a manufacturer as “Hydroelectricity” managed to obtain record profits, which were later transformed into dividends. Last year, net profit increased by 42%, from 4.4 billion lei to 6.3 billion lei. A year ago, at the height of the energy crisis, growth was 45%.

Basically, the regulated price set by the state was in favor of the producers. Producers and the state will benefit from a higher regulated price. The largest producers Hidroelectrica, Nuclearelectrica, CE Oltenia are state-owned companies. The higher their profit, the more money comes to the budget through dividends.

The government has approved a reduction in the price at which producers can sell electricity from 450 lei/MWh to 400 lei/MWh, believing that this no longer corresponds to reality in markets where there is a clear downward trend. But even the new regulated price of 400 lei (80 EUR)/MWh is not in line with the market, being above the average levels that fall below 70 EUR/MWh, with the expectation that in the next period the average values will even be 50 EUR/MWh .

Source: Hot News

Ashley Bailey is a talented author and journalist known for her writing on trending topics. Currently working at 247 news reel, she brings readers fresh perspectives on current issues. With her well-researched and thought-provoking articles, she captures the zeitgeist and stays ahead of the latest trends. Ashley’s writing is a must-read for anyone interested in staying up-to-date with the latest developments.