The wealth of the population (measured by “net wealth”) increased in the middle of last year by more than 10%, according to the data of the National Bank published the other day. That’s right, inflation in 2022 was also high, so we looked at another metric that better captures the wealth effect: net worth/GDP over the last 10 years. With this new indicator, the data will never look the same again.

According to the OECD, by dividing net wealth by nominal GDP, we “normalize” the time series with inflation and economic growth. According to the OECD, this gives us much more stable indicators over time and a better measure of family well-being.

What the last 10 years of welfare/GDP data show: we’ve actually decreased, not increased

The recent macroeconomic history of Romania is characterized by fluctuations in the well-being of Romanian families. The “peak” was in 2007, when real estate (which contributes a lot of wealth to the population) was at its peak, after which the adjustments made by the last financial crisis reset things in terms of net worth.

Over the past 10 years, the welfare of Romanians in relation to GDP has decreased from 2.48 to 2.27.

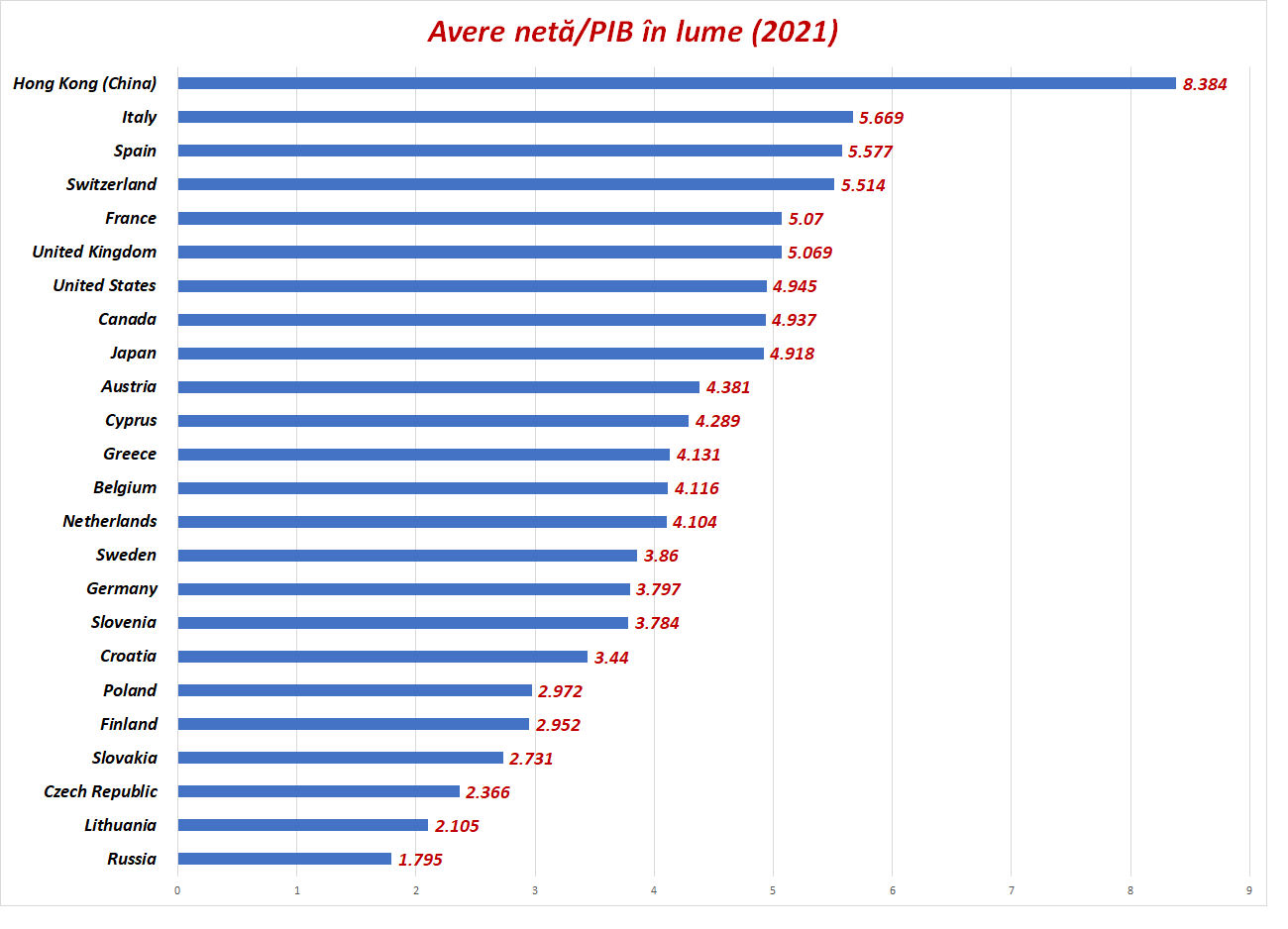

For comparison, in the US the same ratio (net worth/GDP) in 2021 was 4.9. In China – 4.4 (however with reservations about the data provided by the Chinese authorities), in Germany – 3.7.

More precisely, this is the graph of net wealth compared to GDP in 2021. Romania is higher than Lithuania or Russia, but if we look at other European countries, it is good to know your place.

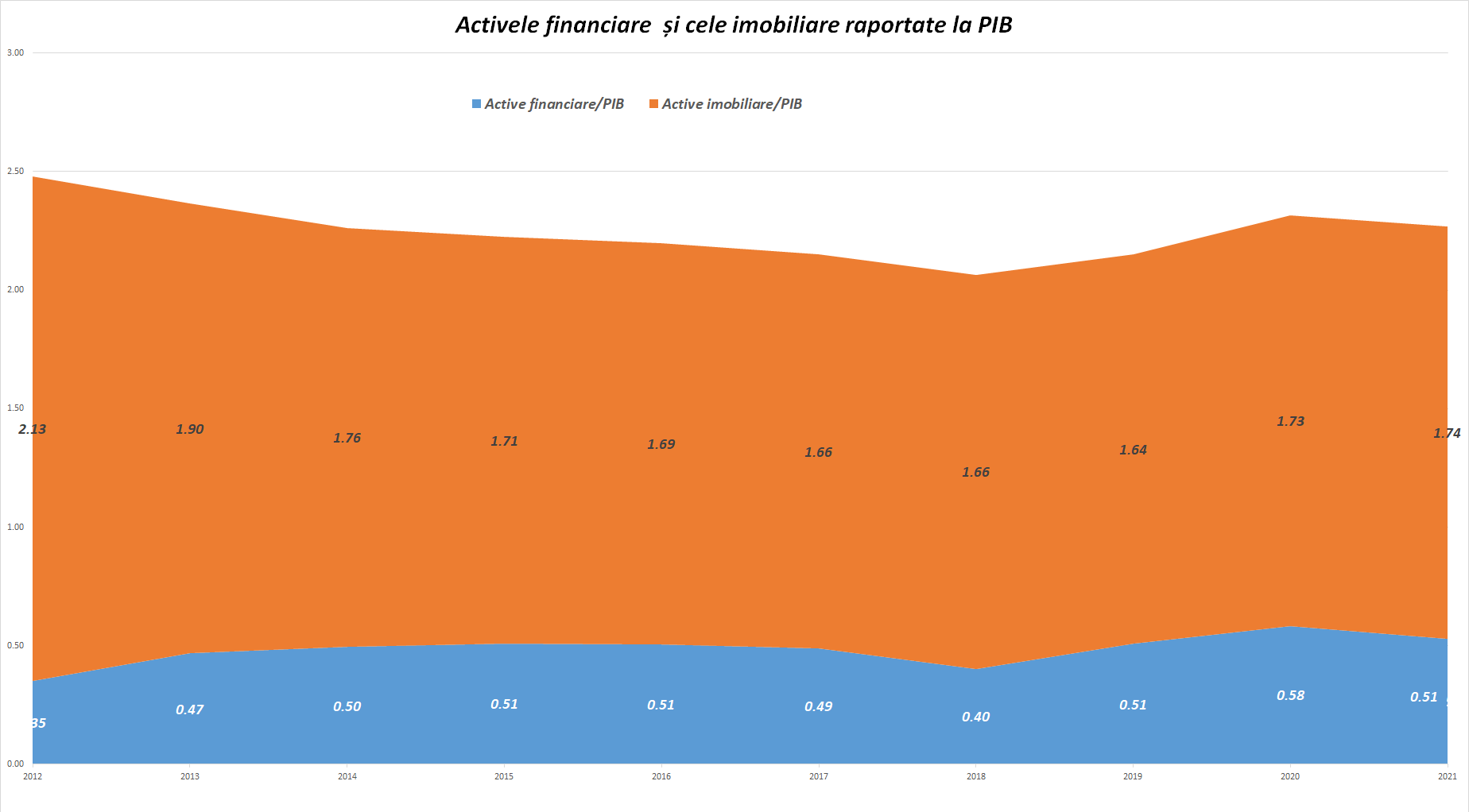

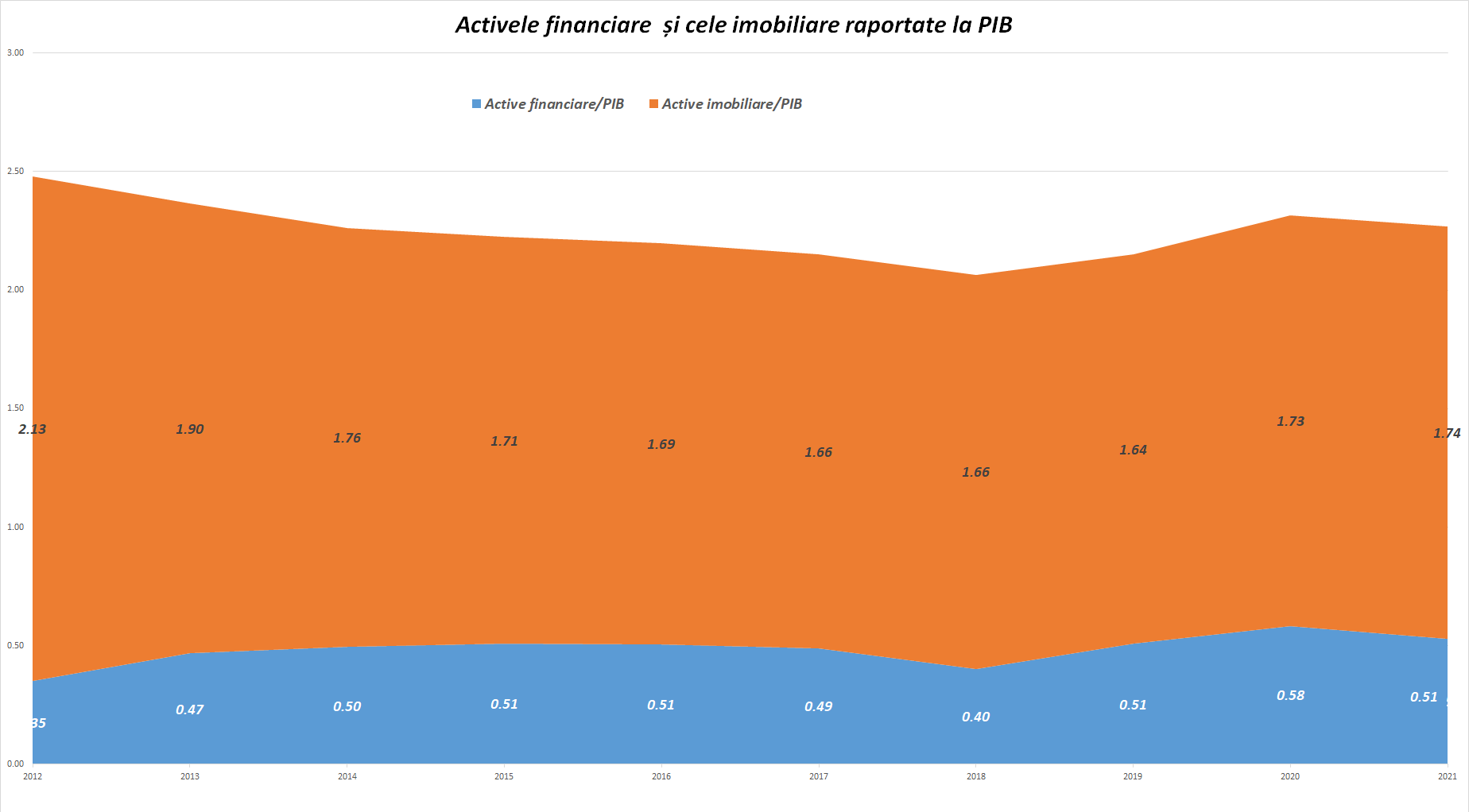

It is also worth looking at the components of net wealth: financial wealth (assets – liabilities) and the wealth provided by the houses/apartments we own.

Over the last 10 years, we have grown in financial assets (relative to GDP) but decreased in real estate (again, relative to the growth of the economy as a whole). The schedule is below.

What else does the BNR Report on Stability show?

In the structure, real estate assets make up three quarters of the total net wealth of the population, according to the BNR. In June 2022, they registered an annual growth of 11%, mainly due to rising property prices (+8.5% in June 2022 compared to June 2021).

Savings of the population grew at a faster pace, financial assets in the first half of 2022 increased by 7% in annual terms compared to 3% in December 2021. Deposits occupy the largest share of financial assets (almost a third of the total amount), indicating that there is an intensification of currency redistribution from overnight deposits to time deposits in lei

At the same time, it is important that the growth rate of demand deposits is significantly decreasing compared to the evolution recorded at the end of 2021, when the annual growth rate was at the level of 30%. This evolution can be explained by: (i) the acceleration of the annual growth of term deposits of the population, (ii) the increase in the inflow of investments in government securities of the sector37 and (iii) the general decrease in the purchase of power by the population marked by the increase in prices for food products and in the energy sector, the report also states Central Bank on stability.

Source: Hot News

Ashley Bailey is a talented author and journalist known for her writing on trending topics. Currently working at 247 news reel, she brings readers fresh perspectives on current issues. With her well-researched and thought-provoking articles, she captures the zeitgeist and stays ahead of the latest trends. Ashley’s writing is a must-read for anyone interested in staying up-to-date with the latest developments.