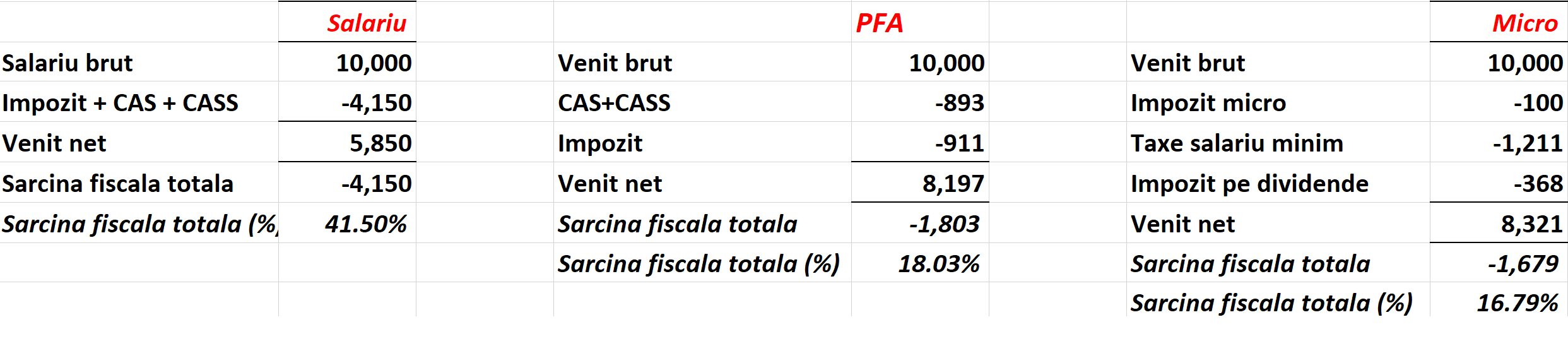

Let’s consider a gross monthly income of 10,000 lei (equivalent to 2,000 euros), which I think a middle-class Romanian should earn. In the table below, we see the differences in tax costs, according to the new rules, in three options: salary, PFA and micro-enterprise, writes Gabriel Sincu on my personal blog.

I emphasize that we are talking about 100% legal forms of activity, and not about disguised salaries that tax officials tolerate or cannot collect.

As can easily be seen, the total tax burden remains more than 2 times higher for employees compared to a micro-enterprise entrepreneur and 1.6 times higher for those working under the PFA system. It should also be noted that as gross income increases, differences in tax expenditures increase.

You tell me that entrepreneurs take risks, that workers are protected by the Labor Code, that they can benefit from unemployment, that unions can fight for them. I reserve the right to take these arguments with a grain of salt, as the British say, we know very well that when things are not going well, employers will not hesitate to send workers home… We are talking about workers here, not the beneficiaries of the benefits I am talking about mentioned above. Also, let’s not forget that for both micro and PFA, there is an option to deduct expenses that are considered business related, resulting in a lower tax burden.

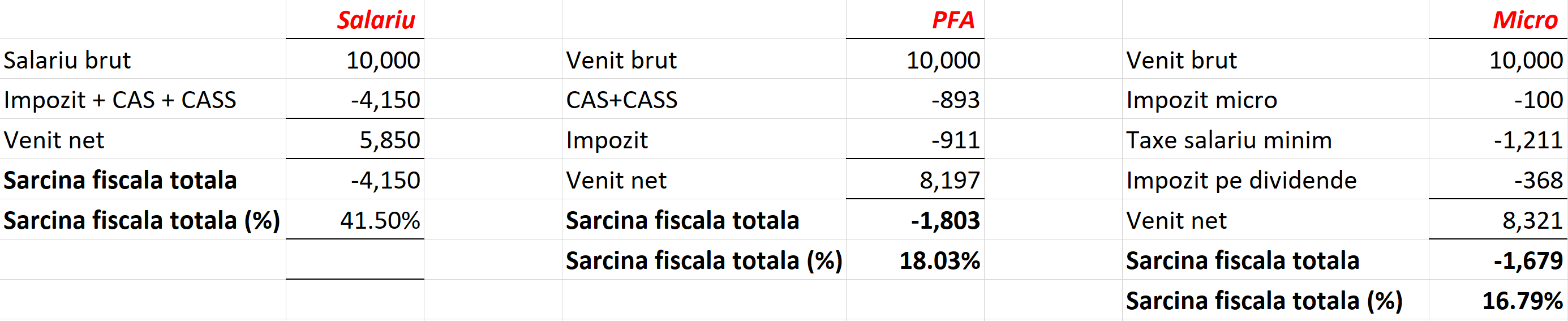

For comparison, we redid the calculations taking into account current fiscal rules:

So we are talking about an increase in fiscal expenditure (at this level of income) of 8% of gross income for PFA and 2.2% for micro. Interest that decreases as income increases or increases if income decreases. Will new taxes really kill entrepreneurs?

Going a little to the extreme, I redid the calculations with the new rules, for the new maximum ceiling for micro, 500,000 euros per year, that is, about 208,000 lei/month, and the table looks like this:

Thus, the tax burden remains at 41.5% for the employee, decreasing asymptotically to 10% in the case of the other two forms of activity.

Thus, fiscal spending increases by 2.93% on micro, while it remains relatively constant on PFA. I ask again: are we killing entrepreneurship? I dare say no.

However, few people talk about the real problem: fiscal justice, which can be achieved by introducing two measures: a single rate and limiting social contributions to a decent level (fiscal colleagues talk about the equivalent of 2-3 average salaries per month). Of course, in combination with real help for entrepreneurs, for example: exemption from taxation of reinvested income, simplification of bureaucracy and true digitalization of tax administration, facilitation of payments for those who find themselves in a difficult situation, etc.

Unfortunately, this is only a dream in a country where taxation is changing at the call of the evening along with the polishing of boots that trample social dialogue. The burden will continue to be borne by those unfortunate enough to be on the wrong side of taxation, and those who claim to participate will continue to complain.

Comment on Gabriel Sinku’s blog

Source: Hot News RU

Robert is an experienced journalist who has been covering the automobile industry for over a decade. He has a deep understanding of the latest technologies and trends in the industry and is known for his thorough and in-depth reporting.