According to a study by Visa and consulting firm Kearney, Romania loses approximately 80 billion lei in tax revenue annually due to the shadow economy, which is characterized in particular by undeclared work. “A 5% increase in digital payments for five consecutive years would increase GDP by approximately 7 billion lei and increase tax collection by approximately 1.9 billion lei,” the study says.

Romania is on the 3rd place in the top European countries regarding the shadow economy

The informal or shadow economy is characterized by underestimation of income and undeclared work, which leads to distortion of market competition, reduction of social insurance contributions and loss of tax collection.

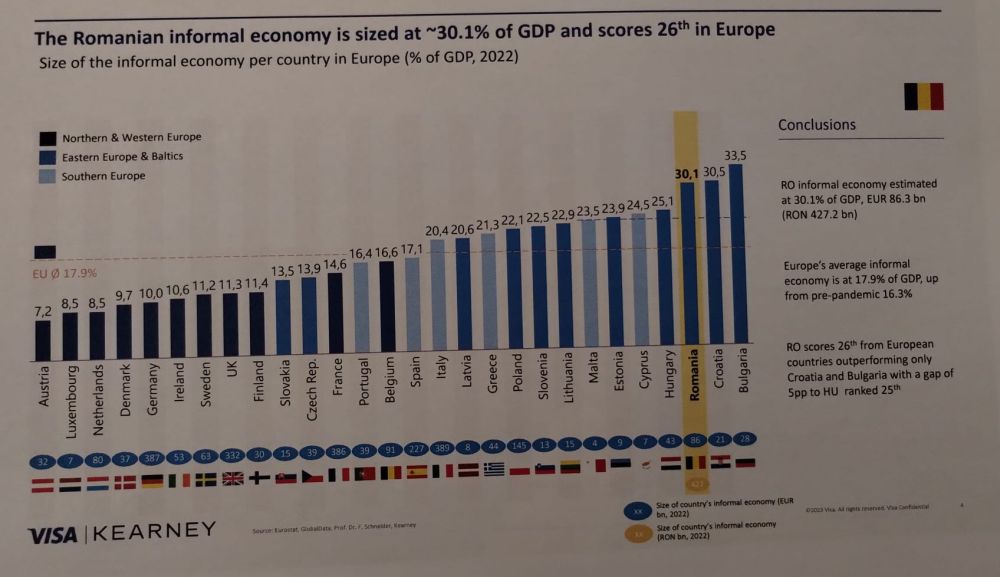

Romania’s shadow economy is estimated at 30.1% of GDP in 2022, i.e. 86.3 billion euros, and ranks 3rd in Europe, behind only Croatia and Bulgaria.

The sectors with the highest penetration of the informal economy in Romania are construction (47%), industry (37%), trade, transport, accommodation and food (35%), and agriculture and fishing (30%).

In Romania, around 67% of transactions are carried out in cash, which is in stark contrast to other countries such as the UK (12%), which is one of the least cash-dependent economies in Europe.

What could be improved thanks to the digitalization of the state

The government can further encourage the growth of digital payments by improving digital payment infrastructure and incentivizing digital transactions.

Regarding acceptance, the future digitalization strategy in Romania may include the introduction of mandatory acceptance of digital payments.

To further encourage digital payments, the government could introduce tax refund or cashback programs for digital payments. For example, in Greece, where tax refunds for digital payments were part of a comprehensive digital payments strategy, digital payments per capita doubled between 2017 and 2021.

In addition to digitizing payments, the government can reduce the informal economy by implementing AI data mining techniques to improve overall tax collection.

Photo source: Laupri / Dreamstime.com

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.