High social security contributions are preventing low-wage workers from entering formal employment in a country with a large shadow economy and widespread tax evasion, while tax breaks for IT, construction and agricultural workers are further narrowing the income tax base, according to the latest OECD Economic Survey of Romania report . The organization recommends that the Government cancel tax benefits and plan a gradual transition to progressive taxation of wages.

Romania should collect more tax revenue and do it more efficiently than in the past, the Organization for Economic Co-operation and Development (OECD) claims in the latest economic study of our country’s economy.

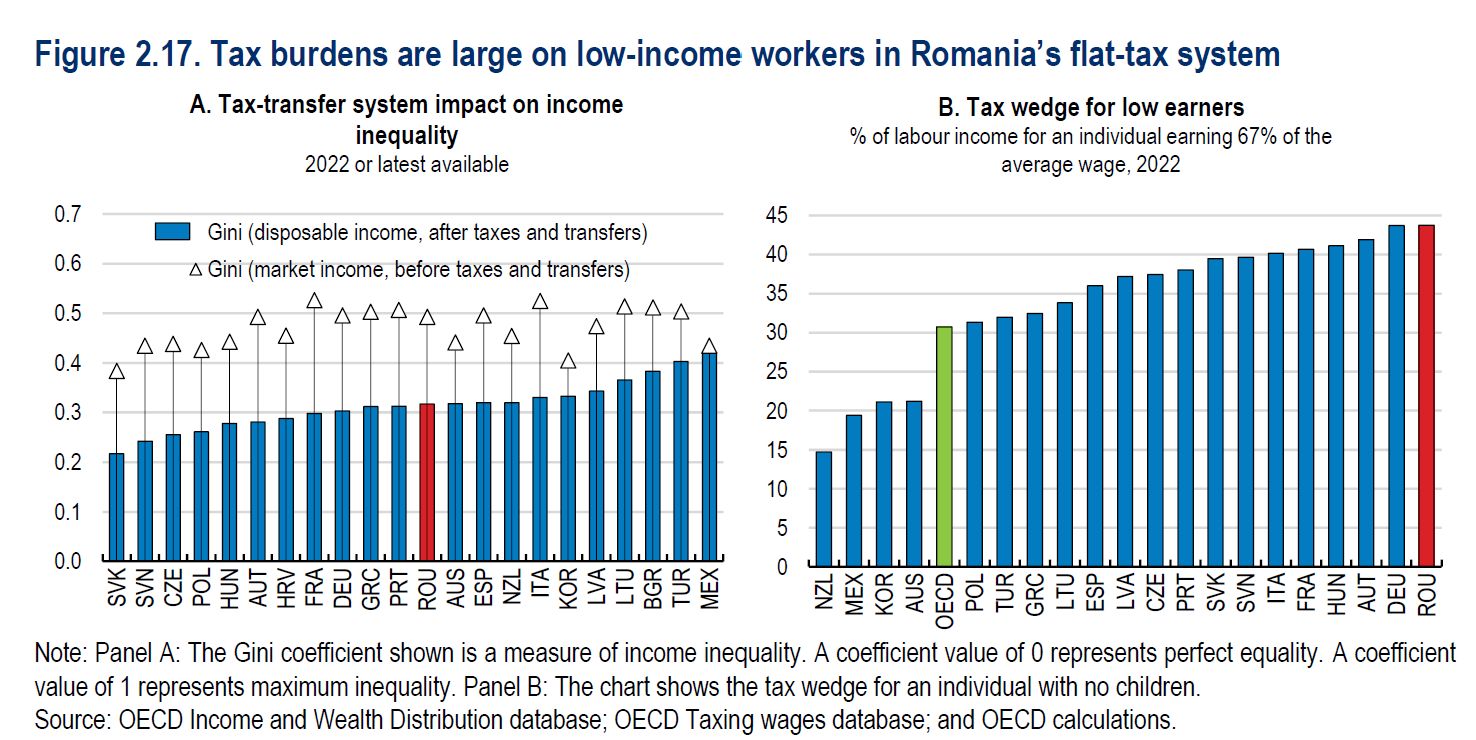

Tax revenues are too low to finance current government spending, and income taxes are distortive, putting many workers out of business and preventing those on low incomes from being employed, the organization says.

Romania applies a reduced tax rate of 10% to wage income, but employee contributions to health insurance (10%) and pensions (25%) are higher than in most OECD countries, significantly reducing the net income of skilled workers.

- “Reforms should be aimed at reducing the tax burden on the incomes of low-wage workers over time. The introduction of the Earned Income Tax Credit (EITC) could contribute to a greater commitment of low-skilled workers to the formal labor market. (..) Romania should start planning a gradual transition to progressive payroll taxation, which would complement transfer reforms aimed at reducing income inequality,” the OECD study says.

OECD experts say it will be possible to widen the income tax base to compensate for future tax cuts on low wages.

- “The main priority should be the elimination of sectoral distorted tax benefits. Workers in construction (10% of the employed workforce), IT (3%) and agriculture (11%) are exempt from personal income tax and part of mandatory social contributions (contribution to the II level of pensions is optional)”, Research OECD states.

OECD experts also write that, according to the estimates of the Ministry of Finance, in 2023, due to such tax benefits, revenues in the amount of 9.2 billion lei (2% of tax revenues) were lost.

On the other hand, OECD experts believe that “removing these distortive tax benefits could cause some workers and companies to return to the informal economy, especially in construction and agriculture”, but modernization of tax administration could reduce such risks in the future.

Scenarios of the World Bank regarding the introduction of a progressive tax in Romania

Last year, the Ministry of Finance launched an analysis on the introduction of a progressive tax, using the advice of the World Bank.

The World Bank presented in a report last summer several scenarios for the introduction of a progressive tax.

- Scenario 1: keep current rates, abolish personal income tax relief and increase the level of the basic benefit (personal deduction). Tax neutral impact as the increase in deduction is offset by the elimination of benefits.

- Scenario 2: Increase income tax from 10% to 13% and introduce a refundable tax credit for low incomes.

- Scenario 3: Abolition of CAS deduction, introduction of three progressive rates of personal income tax from work (6% for incomes up to 80,000 RON/year; 12% for incomes from 80,001 RON/year to 189,000 RON/year; 18% for incomes over 189,000 RON/year) and the introduction of a refundable tax credit for incomes with reduced wages.

- Scenario 4: Abolition of CASS, abolition of CAS deduction and introduction of three progressive rates of personal income tax from work (10% for incomes up to 42,000 RON/year; 20% for incomes from 42,001 RON/year and 100,000 RON/year ; 25% for incomes over 100,000 RON/year).

Read also: The Ministry of Finance has an analysis of the introduction of a progressive tax / State Secretary: We will provide a technical justification

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.