The year 2023 has reached the peak of the impact of the consumer crisis, which has led to a change in retail to a new reality – a fragmented basket, smaller and more frequently replenished, responsive to price dynamics, but with carefully selected and varied content, according to a RetailZoom analysis sent on Thursday HotNews.ro

At the end of 2023, retail sales settled on a positive consumption trend, while customer brand loyalty began to decline as consumers alternated between product types and store concepts.

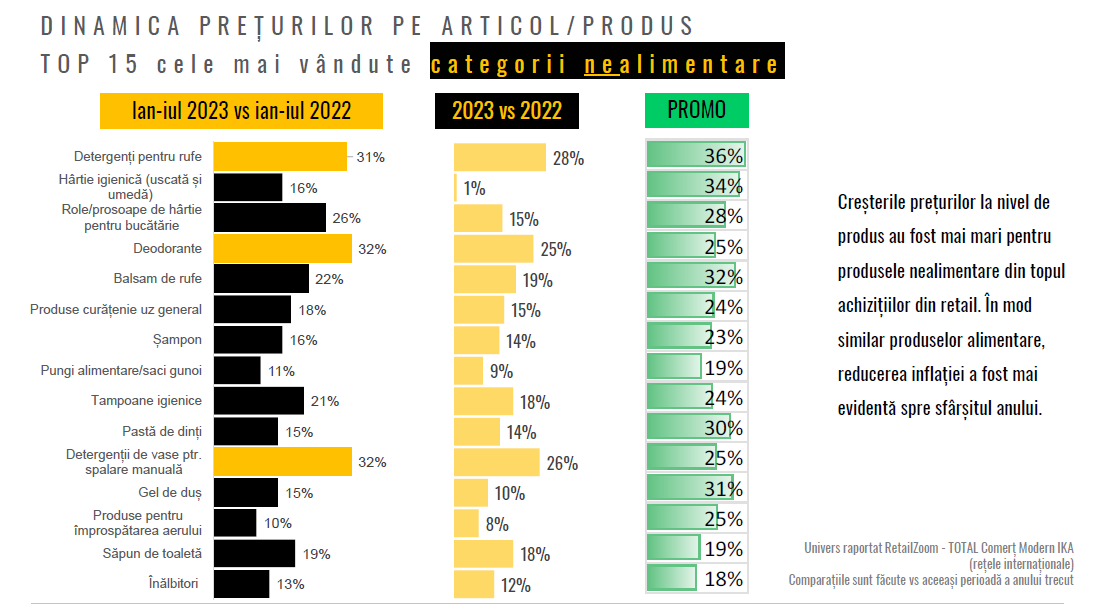

Below, see the price dynamics of the TOP-15 best-selling non-food products (Click on the picture to enlarge it)

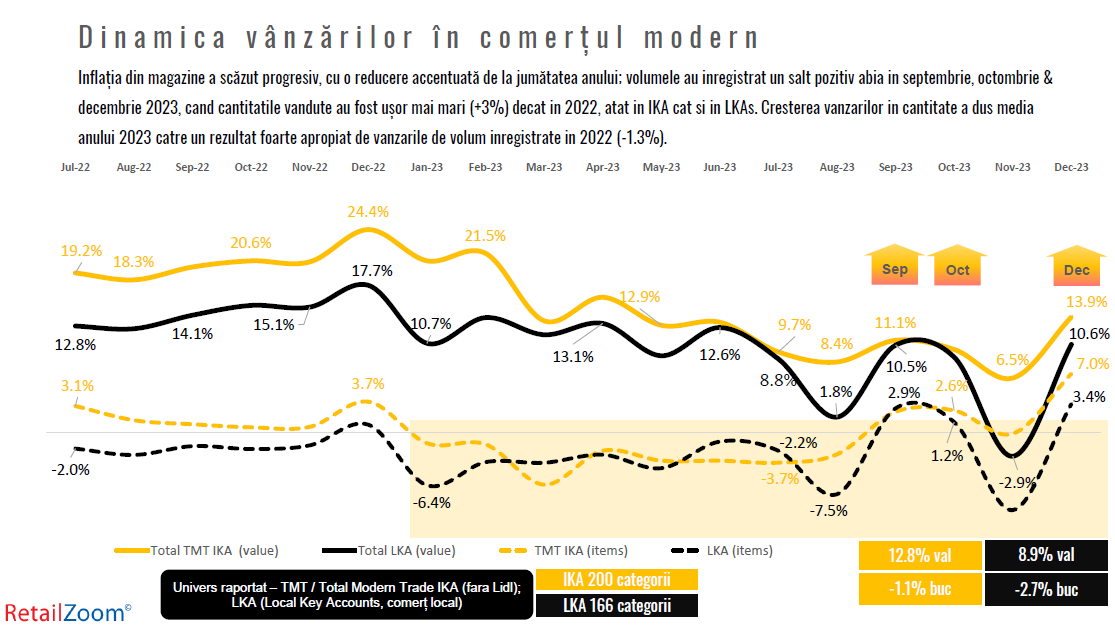

Starting mid-year, 2023 brought waves of change and increased sales against a backdrop of lower inflation.

The dynamics of consumption in the last half of the year recorded a positive jump in quantitative sales since September itself – especially for convenience stores and supermarkets, both in international and local chains.

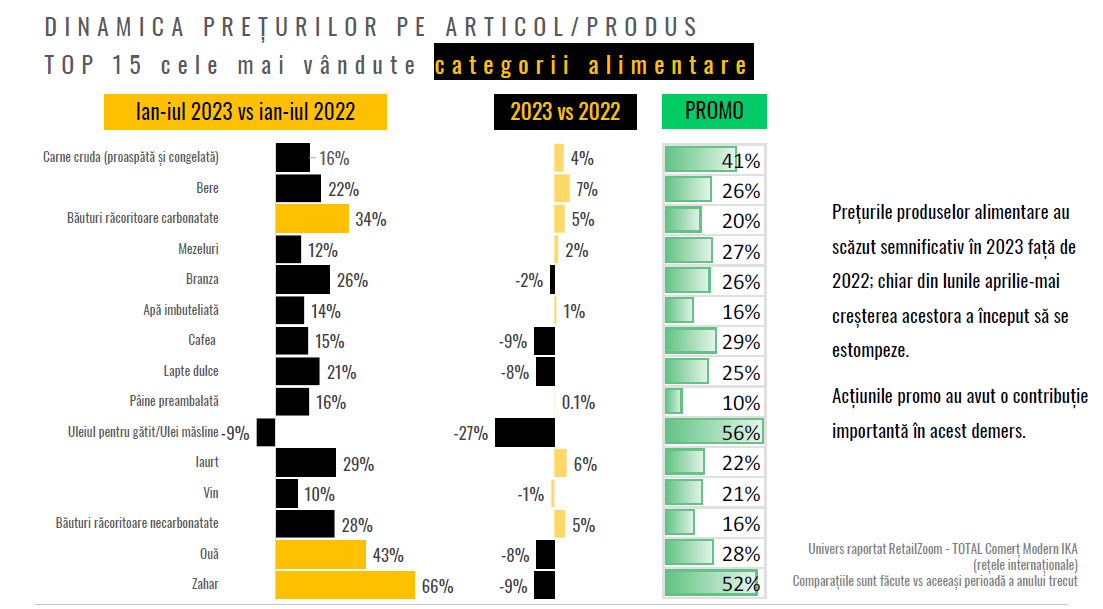

Below, see the price dynamics of the TOP-15 best-selling food products (Click on the picture to enlarge it)

Only November had a slightly different trajectory, volumes in large-format stores and local chains slightly decreased.

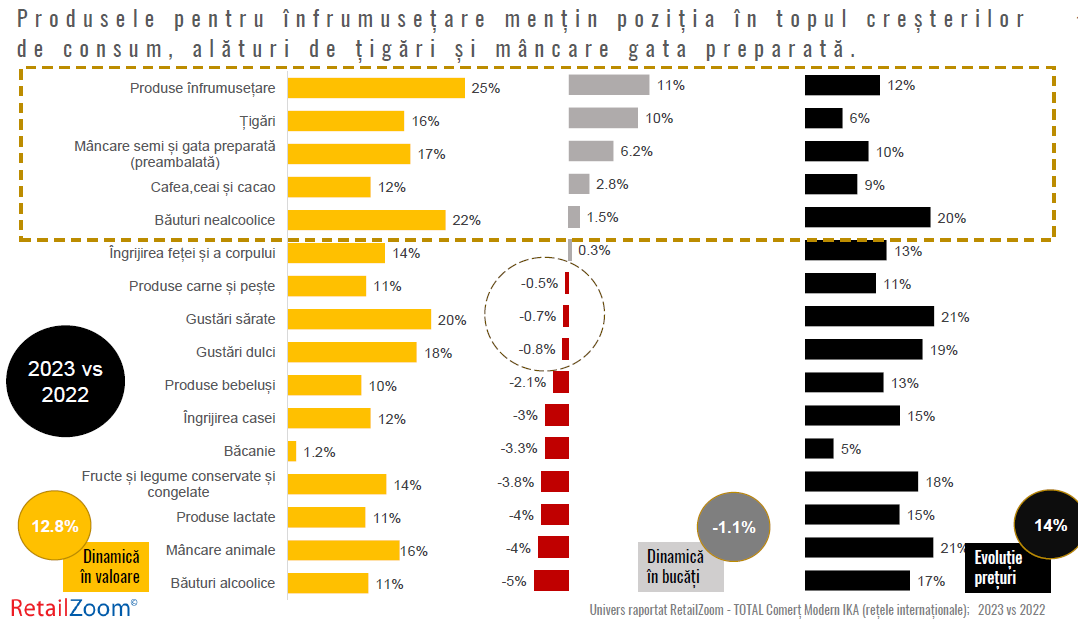

In general, the consumption reflected by sales recorded in modern trade registered an evolution of 12.3% in value and -1.3% in sold quantities in 2023 – clearly, the general trend is to restore the previous rhythms of sales evolution.

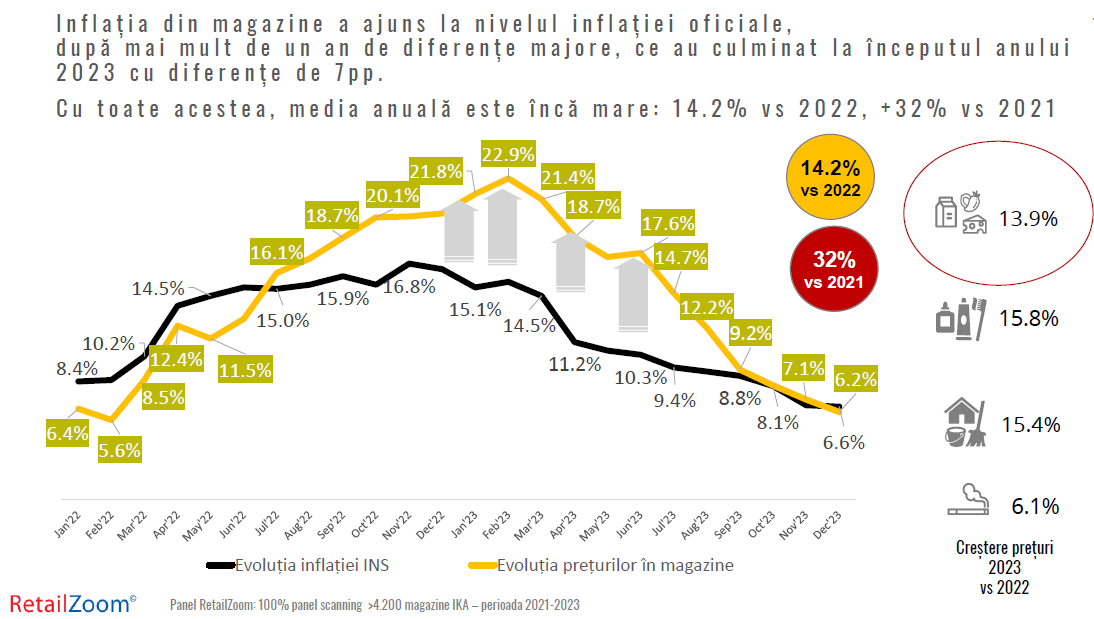

Inflation on the shelf has fallen significantly since August 2023, reaching a level similar to official inflation in December – the first time in more than 14 months that it has alarmingly exceeded it. The maximum increase in inflation in stores of modern trade was observed in January-February 2023 (23% compared to the same period last year), but the largest difference with official inflation was recorded in April 2023 (+7.5 percentage points against official inflation) )

MECHANISMS OF ADAPTATION TO INFLATION

Even in conditions of low inflation, the buyer remains vigilant, takes care of the family budget, continues to alternate adaptation mechanisms in order to maintain or balance the quality of life.

Incomes have not grown at the same rate as inflation or price dynamics, and the divergence between their evolution will not be highlighted any time soon.

Even if shelf inflation eased significantly by the end of the year, reaching the same level as national inflation, prices as a whole had an annual average increase of +14% compared to the previous year or 32% compared to 2021.

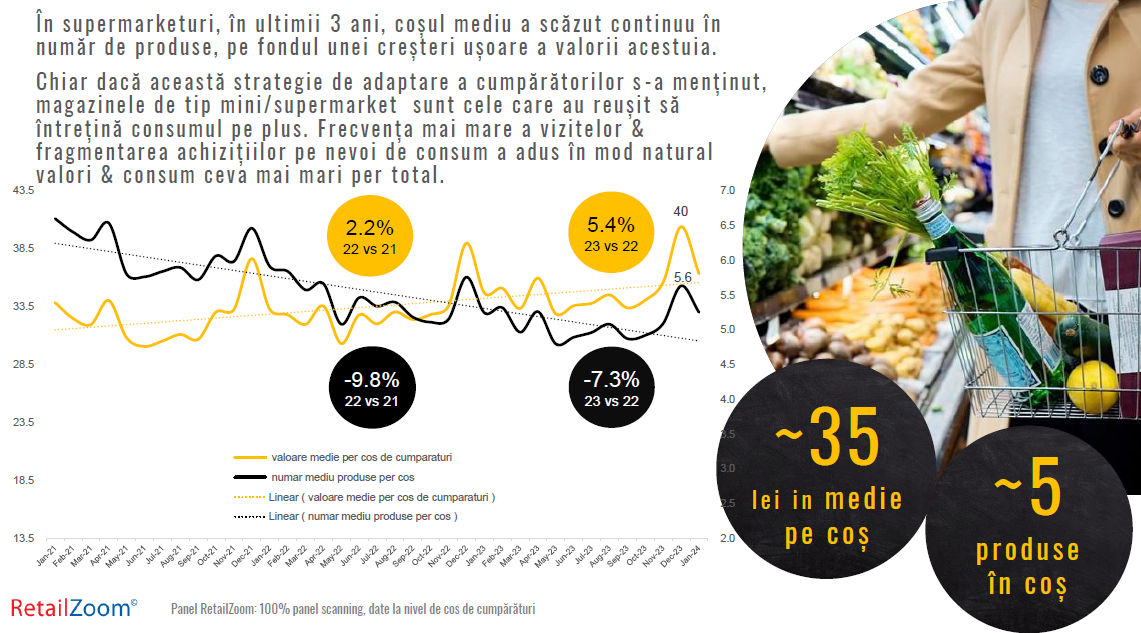

The supermarket shopping basket has increased in price very little – below the average inflation rate (+5.4%), in a general context where people are controlling or maintaining their spending without making major sacrifices in their consumption choices.

The overall trade-off was split between cheaper products and their quantity (smaller volumes purchased for the same products) – the mini/supermarket basket reached an average of 5 products/shopping basket, compared to an average of 7 products/shopping basket 3 years ago.

With all these changes between the frequency of store visits and fewer products purchased, convenience stores/supermarkets are the ones that managed to increase consumption in 2023. Increasing the frequency of visits to neighboring stores for smaller, alternative purchases or with differentiated goals per visit actually results in higher total sales, which defines a positive bottom line in this type of store

Own brands have maintained their value share (18.1%) and volume (19%) of total sales in modern trade, thus showing that they have not found a comfortable level of growth in times of permacrisis. In general, own brands in 2023 compared to 2022 increased only in value – by 9.2% and decreased in quantity by –1.7%.

Even if in total the average prices of own brands are -10-15% lower than manufacturers’ prices, they are not always perceived as an alternative offered by a chain of stores, but as a national brand that is not only for the retailer they shop at.

This is explained by the fact that there are many private brands, unknown or unrecognized by customers as goods that are specific only to the chain of stores where they are represented.

With the number of new products in today’s trade increasing significantly in 2023 compared to 2022 (by 10%), shoppers can find a variety of new products on the shelves, among which own brands are just as much an alternative as any other. .

70% of private label sales come from 25 (14%) categories that sell this type of product (quantity and value). ) compared to 2022. Own brands for babies, dairy products, personal care products and cosmetics, but also for alcoholic beverages, increased significantly compared to the previous year.

In recent years, it has been increasingly argued that the current inflation is more likely to be caused by corporate greed or the ability of their firms to simply raise prices. This is how the term greedflation was born (from greed – greed). Invited to the show, Bohdan Chiritsoyu, the head of the Competition Council, admitted that “there is an opinion that some companies are using this unstable climate for unjustified price increases.”

One of the minutes of the meetings of the Board of Directors of the BNR talks about “the gradual transfer to prices of increased material and salary costs and the restoration or increase of some profit rates, in the context of the stability of consumer demand.” A team of economists from the BNR carefully reviewed the financial data of companies and analyzed whether and in which areas we experienced “voracious inflation”. A high proportion of companies that increased their profit share at that time were found in agriculture and the energy sector, as well as in HoReCa, an economic sector that was recovering from a severe reduction in activity in the previous year.

- Read also: Have firms used inflation to increase their profits? / BNR: Construction and the food industry are among the few types of activity in which the share of profit has increased

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.