Although RCA prices increased last year, hundreds of thousands of drivers chose to pay an average of 184 lei more to insure their car under direct settlement, which allows them to have their car repaired by their own RCA insurer sooner if it is damaged. in traffic, instead of claiming from the RCA insurer for damages to the car of the driver at fault in the accident. However, it all depends on the seriousness of the insurer where they did the RCA.

Direct settlement is an additional clause to the RCA policy that any insurer is required to offer, but which is optional for the insured to purchase.

By purchasing this item, your RCA insurer directly pays for the service that will repair your vehicle, without the need for the insurance company of the driver who injured you to intervene. The process of resolving claims should be faster and easier.

Your insurance company then applies to the insurance company of the driver who caused the accident to get their money back.

Drivers paid an average of 184 lei more to RCA than direct payment

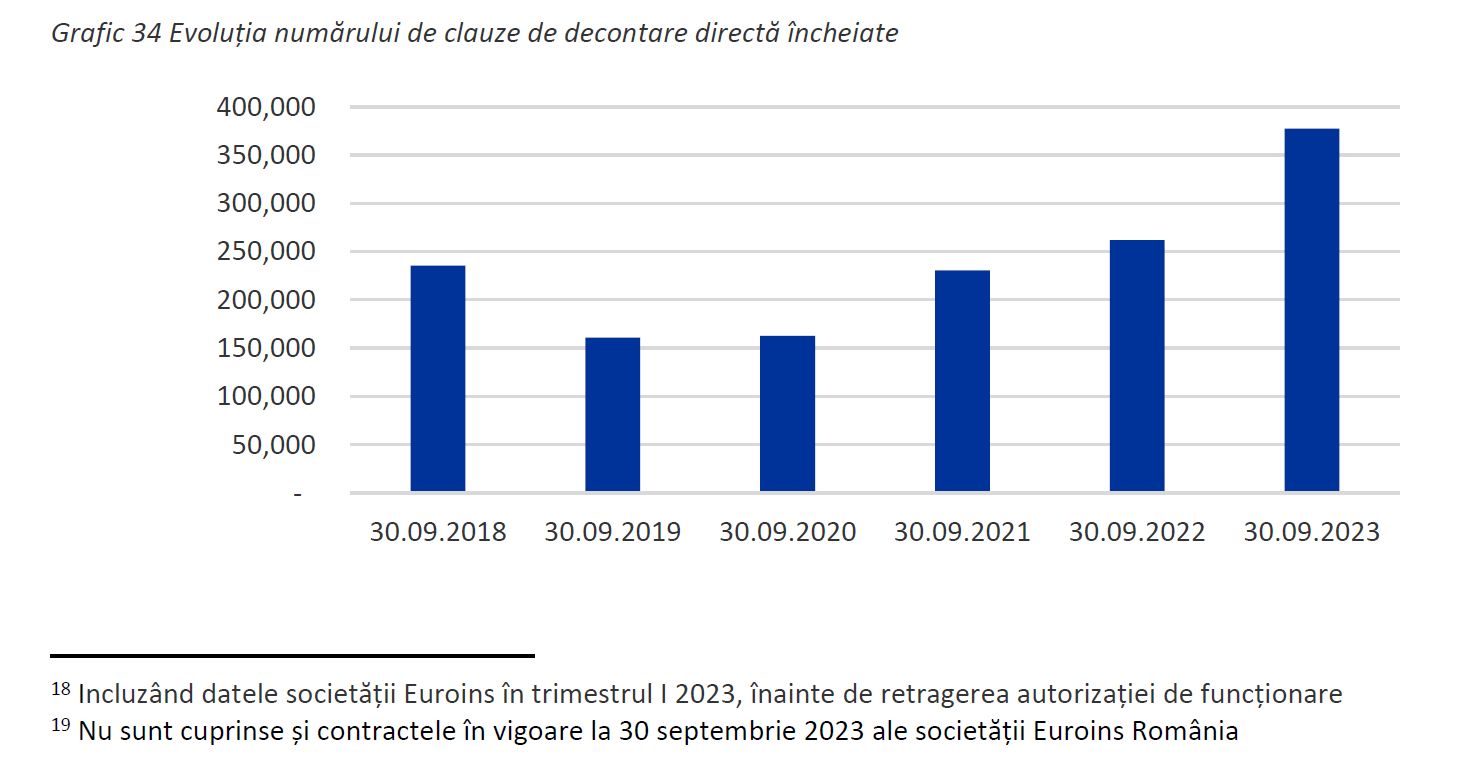

The latest ASF data shows that in the first nine months of last year, RCA insurers concluded a number of 377,502 direct settlement terms, the gross premiums signed for them amounted to 68,229,462 lei.

Thus, the first average annual value was 184 lei.

On September 30, 2023, 459,865 direct settlement conditions were in effect.

The average paid loss per case was 8,783 lei

Meanwhile, in the first nine months of 2023, RCA insurers paid 8,553 claims related to the direct settlement clause for a total of 75,117,119 lei, resulting in an average claim paid per case of 8,783 lei.

As of the end of September 2023, 3,848 claims were registered in the balance sheet of the approved claim reserve, with an estimated value of 34,701,262 lei.

Direct settlement only covers damage to the vehicle, not bodily injury, death or moral damages / Other limitations

RCA pays direct settlement for damages to your car if you are not the driver responsible for causing them.

In addition, direct settlement between RCA insurers applies cumulative performance following conditions:

- a) road accidents occur on the territory of Romania,

- b) vehicles involved in road accidents registered/registered in Romania

- c) damage was caused exclusively to vehicles,

- d) both vehicles involved in the accident have RCA insurance valid on the date of the incident

- e) damages exclude bodily injury

This means that in the event of an accident resulting in bodily injury or death in which you also claim non-pecuniary damage, you will not be able to claim these compensations from your own insurer based on the direct settlement clause, but also from the RCA insurer of the at-fault party.

As a reminder, the bodily injury and death compensation limit offered by the RCA policy currently exceeds €6.07 million, while the property damage compensation limit is over €1.22 million.

RCA prices rose in the first nine months of 2023 / Only 4 in 10 insurers benefited from RCA

According to the latest ASF data, RCA prices increased in the first nine months of last year, the first annual average value was 1,209 lei, which is 5% more than in the same period of 2022. In the same period, the average loss increased by 12% to 10,750 lei.

Despite significantly higher revenues than insurance payouts to policyholders, most insurers lost money on RCA.

Photo source: Dreamstime.com

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.