If you belong to the more than 8.1 million Romanians who pay contributions to the second level of pension, but you do not know which pension fund you belong to, you can find out online in a few seconds on the website of the Financial Supervisory Authority (ASF). after entering name, first name and CNP.

More than 400,000 Romanians accessed the program last year, authorities said, double the number from the previous year.

- “In more than seven years of use (2016 – 2023), almost 1.1 million people have accessed this program, which has provided consumers of the private managed pension system – Pillar II with a digitized, transparent, secure solution for the processing of personal data. data that is fast and extremely easy to use even by those with minimal internet knowledge.”, emphasizes the ASF.

If in 2020 almost 52,500 Romanians used the application, then in 2023 their number reached almost 500,000 unique users.

Depending on the development regions of Romania, it was found that the Southern region recorded the highest number of unique requests registered in the application Find out which pension fund you belong to! (17.32% of the total number of unique requests registered in 2023), and at the opposite pole – the Western region – 9.04%.

Changes to the II level of pensions from January 1, 2024

Contributions to private pension funds are part of the social insurance contributions belonging to the state pension system and are deducted from the gross monthly income, which is the basis for calculating social insurance contributions.

From January 1, 2024, the contribution to level II pensions increased by one percentage point from 3.75% to 4.75% of gross monthly income. This means that of the 25% withholding of gross wages for social security contributions, 4.75% will be diverted to the II pension level.

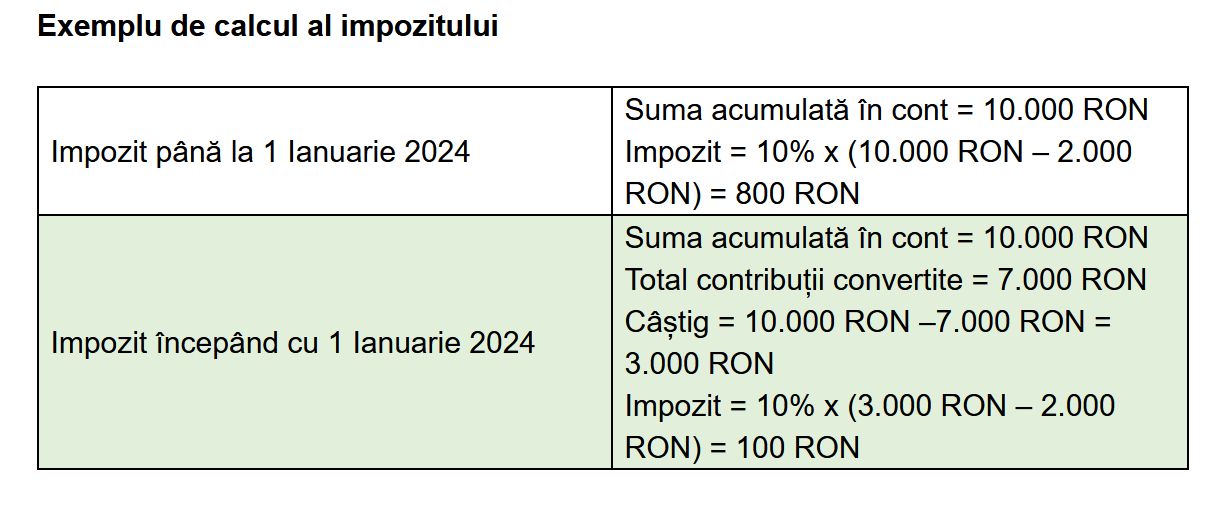

The level II pension taxation regime has also been changed: if until the end of 2023 the tax base was the entire amount accumulated in a private pension account, then from January 1, 2024 the tax base applies only to the net income received as a result of the investment of contributions from which the the most tax-free limit is 2,000 lei.

- Read also: DOCUMENT From January 1, 2024, the contribution to the II level of pensions will increase to 4.75%. Impact on the social security budget

Photo source: Dreamstime.com

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.