According to an analysis by Alpha Bank Chief Economist Ella Callai, with the exception of Romania, the inflation differential increased sharply until the 1st quarter of 2023, after which it steadily declined.

In Romania, the inflation gap compared to the euro area has had a tortuous trajectory with no signs of abating.

In the countries of the region, by default, there is an additional margin of inflation compared to the euro area, since the medium-term target inflation of the central banks of these countries, with the exception of the Czech Republic, is higher than the European one. Goodbye to the Central Bank’s 2% target.

The medium-term inflation target range is 3%±1% in Hungary and 2.5%±1% in Poland and Romania. The Czech Central Bank has the same objectives as the European Central Bank. After 2022, other factors, both external and internal, caused the spread of inflation in the euro area to widen.

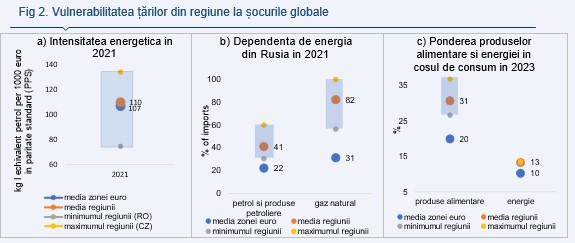

The region is vulnerable to recent adverse external shocks – the energy crisis, the disruption of global supply chains, the imbalance between supply and demand following the Covid 19 pandemic. Some countries, but not Romania, have large energy resources. -consumer sectors, which determine the energy intensity of production significantly above the average level of the Eurozone. Romania has the lowest energy intensity of production compared to the countries of the region (Fig. 2a).

The region’s dependence on energy imports from Russia before the start of the war exceeded the eurozone average: of the region’s total imports of oil, petroleum products, and natural gas, 41% and 82% came from Russia, compared to 22% and 31% in the eurozone. (Fig. 2b).

Romania’s energy dependence on Russia was lower than the regional average (33% for oil and petroleum products and 78% for natural gas). The share of energy sources and food products in the consumer basket in the region (Fig. 2c) is higher than the average indicator of the Eurozone (13% and 31% versus 10% and 20%).

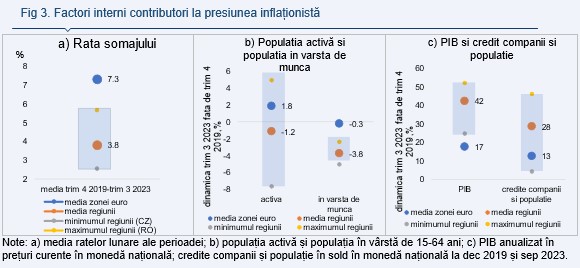

And the dynamics of core inflation excluding energy and food products in the countries of the region is faster than in the Eurozone (Fig. 1b). Thus, in December 2023, the differential reached 2.1 pp in the Czech Republic, 2.5 pp in Poland, 5.7 pp in Hungary, and 7 pp in Romania, which indicates preservation of internal inflationary pressure, that is, about the tendency to transfer the growth of production costs to final prices. . On the one hand, the pressure on labor cost growth in the region is higher than in the Eurozone. Between Q4 2019 and Q3 2023, the labor market in the region remains tight, the unemployment rate is lower than the euro area average (3.8% vs. 7.3%, Figure 3.a), and labor resources are shrinking. In the region, both the number of the active population and the population of working age decreased by 1.2% and 3.8% (Fig. 3b).

In the Eurozone, the number of the active population increased by 1.8%, while the number of the working population remained almost unchanged. On the other hand, a longer period of more accelerated inflation in the region compared to the euro area determined in these countries a temporary decrease in the real value of outstanding debts and the perception of the cost of financing as relatively low. It is possible that these factors contributed to credit growth faster than in the euro area (28% vs. 13%, Figure 3c) and with a greater potential to support domestic demand than in the euro area.

Romania’s energy intensity advantage and energy dependence on Russia before the start of the war was lower compared to countries in the region, and the energy subsidy policy contributed to a narrowing of the inflation gap with the euro area average after 2022 and until August 2023. However, the dynamics of core inflation differed across countries region (Fig. 1b). The difference to the average core inflation in the Eurozone is growing and accelerating from August 2023, unlike other countries in the region, where it is constantly decreasing (from July 2022 in the Czech Republic, from November 2022 in Poland and from April 2023 in Hungary). The reason was drug prices (Figure 4), which increased sharply in August 2023, when the price correction from the National Catalog of Authorized Prices for Medicines (CaNaMed) took effect.

Central banks in the region cautiously started a cycle of monetary policy easing, justifying this decision by the dynamics of core inflation. This should still be expected in Romania.

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.