John Bostan of Bymer came back angry from the market; he spent almost 200 lei on bitter greens, a loaf of bread, eggs and meat. With the same money last year at this time, he came with two full nets from the bazaar

The INS released its “family inflation” numbers on Wednesday: how much family incomes and expenses have risen and where most of our money is going. Data refer to autumn 2023, when average inflation was 18.8%

Short:

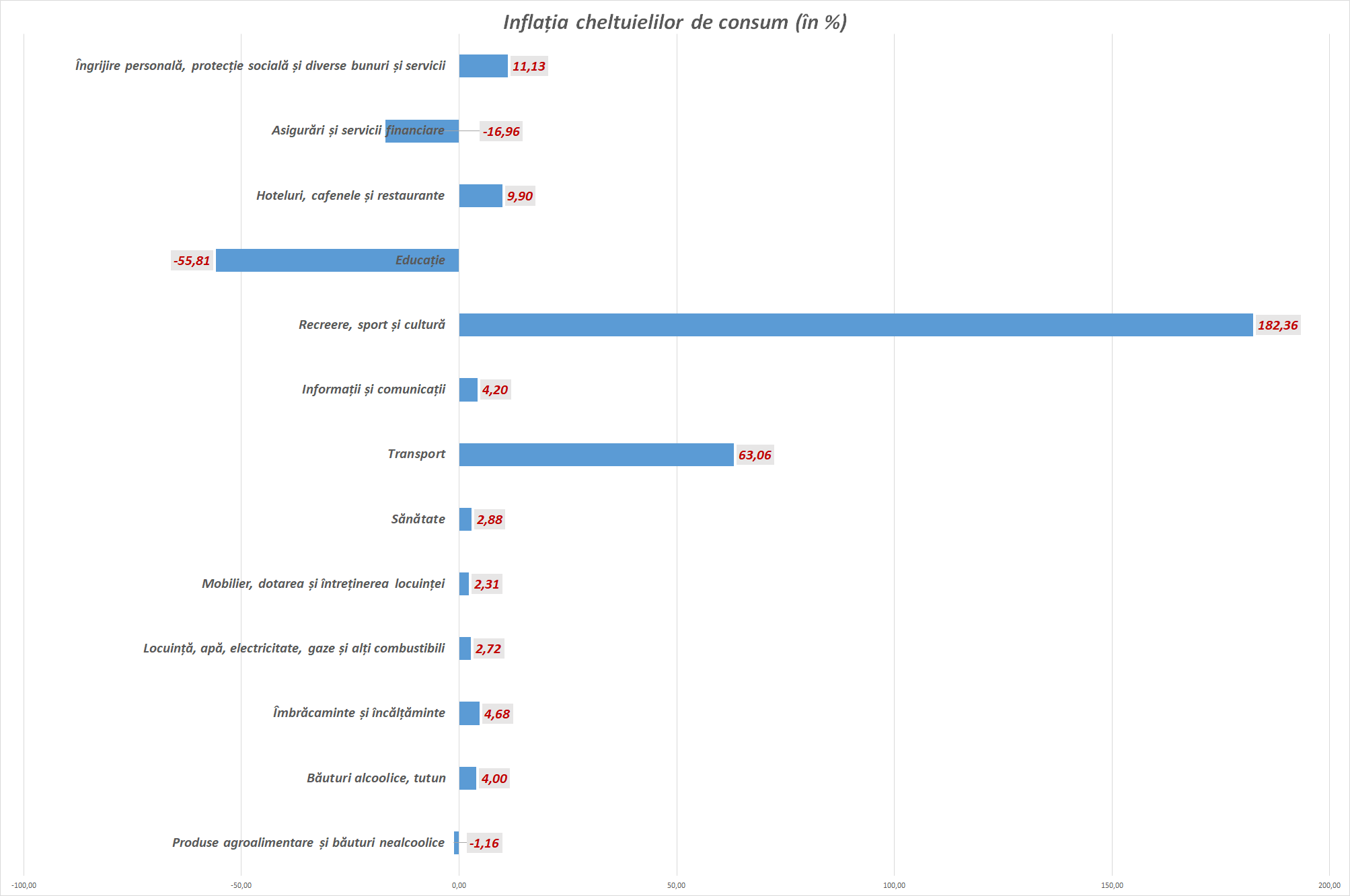

- To cope with the rising cost of living, Romanians are cutting 55% on education, 16% on insurance and buying less (or cheaper) food, with food costs falling by 1%, according to statistics.

- Monthly spending increased by 10.6%/household, while spending grew at a slower rate of 9.5%.

- The average monthly income in the fall of 2023 was 7,301 lei per household, an increase of 9.5% compared to the fall of 2022.

- Total average monthly expenses were 6,432 lei per household in the third quarter of 2023, which is 10.6% higher

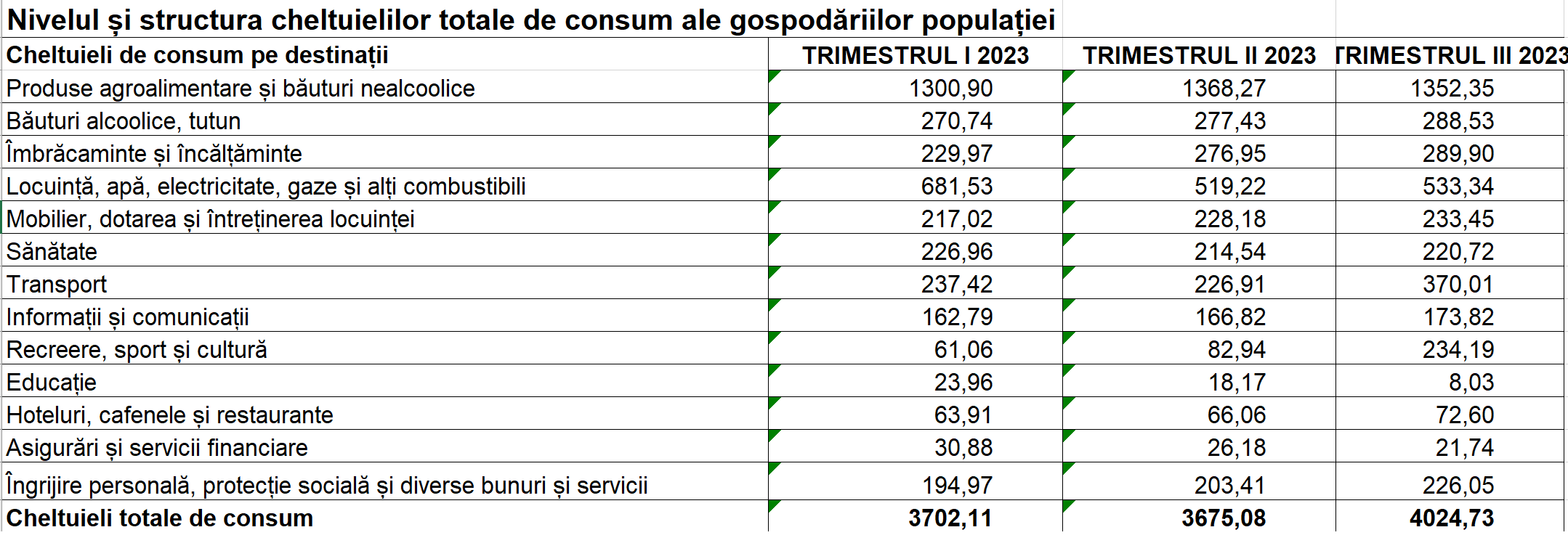

In the third quarter of 2023, the main areas of family spending were: consume (4,025 lei per month) and transfers to the state and private administration and to social insurance budgets in the form of taxes, contributions, fees (2054 lei per household)

If we look at households made up of salaried workers, farmers, the unemployed or pensioners, their costs have increased at different rates.

Food costs for the unemployed were more than 20%.

They felt inflation the most: spending on non-food goods increased by 50%, and on services – by almost 40%. As an impact, farmers experienced the second most intense inflationary shock, followed by wage earners. In the latter, almost 20% more services were taken from the card, almost 24% more non-food goods.

The INS also calculated how much our consumer spending has increased and what our money is being spent on.

In lei, consumer spending looks like this:

A statistician asked people how much money they needed to live on. He got some answers that might surprise you

In Romania, every 5th family has arrears to pay bills – it’s maintenance/rent, utilities, bank fees, etc. Most of the arrears are for electricity and maintenance bills (about three-quarters of the arrears). The INS asked the Romanians what salary they would need to have to cover the costs.

Regarding the ability to pay some bills on time (house maintenance, loan repayments, utility bills, etc.), it was found that 18.5% of households indicated that there was at least one situation where they could not pay some bills on time. , the situation is mainly caused by an unsatisfactory financial situation.

Among the payments for which arrears were registered during 2022, payments for electricity (75.0%) and housing maintenance (68.1%) were most often observed. Overdue rent amounted to 14.6% of houses, according to a statistical study.

The first contradictory result: women would accept less money

According to statistics, there are about 7.5 million families in Romania. About 5.2 million are headed by men and 2.3 million are headed by women, the INS data also shows.

About 3,000 male-headed families claim that the minimum net income should be at least 4,000 lei to cover all expenses. In the case of women, a little more than 800 families would qualify for this level. In July, the average net salary was more than 4,500 lei.

For example, in the US, during a similar survey, Americans said that in order to feel financially comfortable, they need an average salary of about $233,000 per year, which is three times the average income of American households (about $71,000 per year). . ).

One-person families would accept less

Obviously, the larger the family, the greater the needs. When you have 4-5-6 children, it is clear that more resources are needed. Otherwise, the needs in all other categories are the same: more than 4,000 lei.

According to the INS study, in our country only 15% of families claim that they could cover current expenses with a net monthly income of less than 2,001 lei. A little higher (18%) is the percentage of those who need an income of 3,000 lei, the same percentage of families that could get by on 3-4,000 lei per month.

Half of the families surveyed by Statistica say that the net monthly income needed to cover current monthly expenses should be more than 4,000 lei.

Overall, the statisticians who conducted the survey noted, there is an increasing trend in the share of households that believe they need a growing net monthly cash income to cope with expenses.

The assessment of families living outside the city is significantly different.

Thus, if in rural areas more than 20% of families believe that they can cover current household expenses with a monthly net income of less than 2,001 lei, then in cities only 9.7% of families believe that the necessary monthly net income is less than 2,001 lei per covering current costs.

In the case of urban families, almost 60% say they will need more than 4,000 lei per month for current monthly household expenses, compared to 39% of families living in rural areas.

Low incomes, below 2,001 lei, are considered necessary to cover the current expenses of the family, mainly those formed by a single person aged 65 and over (35.5%).

High incomes, more than 4,000 lei net monthly, are considered necessary by more than half of two-person families. The share of households with 3 or more people who consider incomes of more than 4,000 lei net per month to cover current expenses is about 70%.

In addition, high incomes, more than 4,000 lei net monthly, are also considered necessary by more than 75% of households with two adults and 3 or more dependent children, as well as 68.1% of households consisting of two parents and 2 dependent children.

By region, the majority of families who would not accept less than 4,000 lei net are families from Moldova, which is also one of the poorest and most underdeveloped regions of the country.

Families from Bucharest, Ardeal and Muntenia are almost equal (560 families each), and in Oltenia only 265 families would like high salaries.

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.