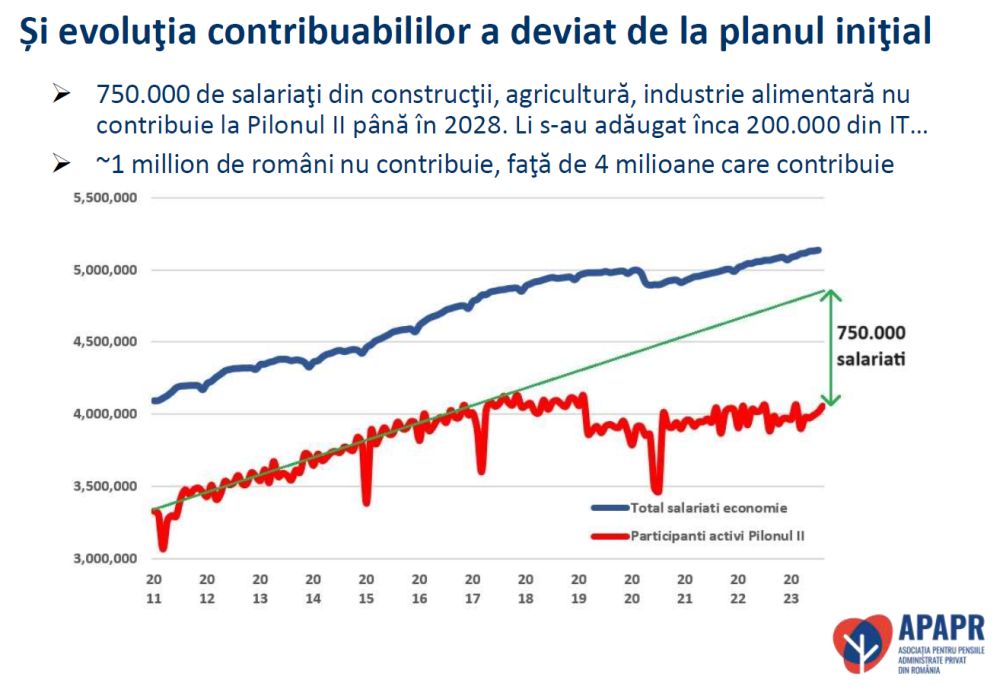

“After exempting IT professionals from Tier II contributions, we will cover approximately 1 million Romanians who will no longer contribute to this system for a certain period of time, which will certainly not be to their advantage,” he told the Krecun Council on Tuesday , president of APAPR.

750,000 construction, agriculture and food industry workers will not pay Tier II contributions until 2028, and under the Çolak government’s tax law (296/2023), another 200,000 IT workers will be automatically exempt from Tier II contributions.

If they do want to transfer money to a private pension, IT professionals should make a request to their employer.

“After exempting IT professionals from Tier II contributions, we will reach approximately 1 million Romanians who will no longer contribute to Tier 2 for a certain period of time, which will certainly not benefit them. It’s a very short-term advantage, but in retirement they’ll suffer because they’ll have less money in their retirement account.” said Radu Krachun, president of APAPR (Association of Pension Fund Administrators) on Tuesday.

- VIEW APAPR’S PRESENTATION ON PRIVATE PENSIONS HERE

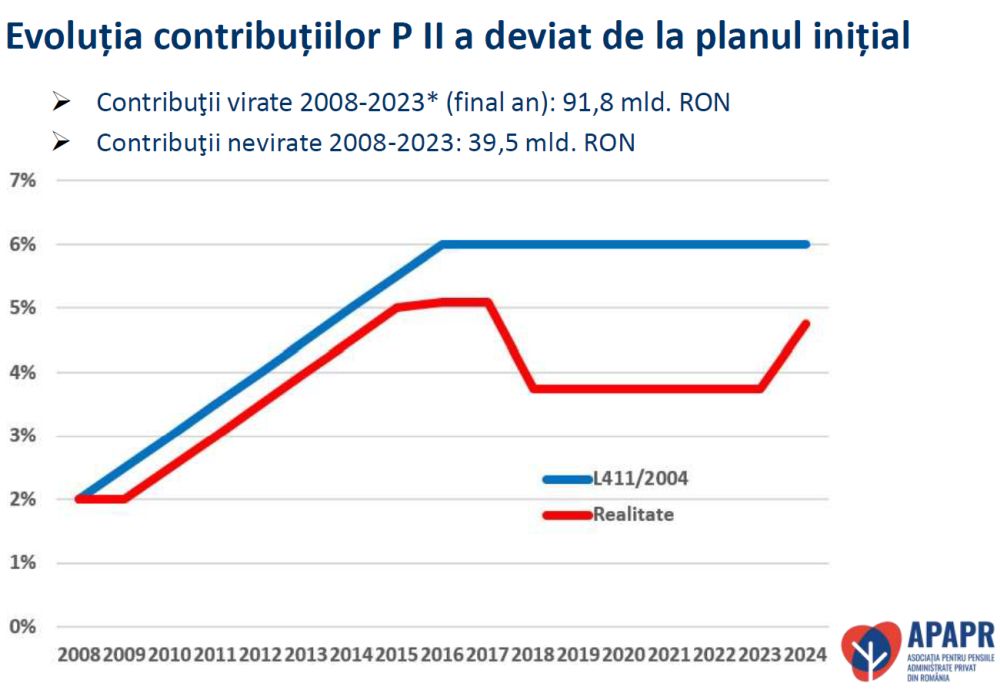

He emphasized that over 15 years of private pension provision, the evolution of contributions was not as originally planned.

“There was a spike, followed by a major correction, and now we’re in somewhat of a recovery process. I hope with all my heart that from the beginning of next year we will see this increase from 3.75% to 4.75%, which was legalized by the government and which is part of the commitments made by Romania in the PNRR”, said Radu Kracun.

The value of the account should have been 36% higher

<>br The APAPR official also calculated how much money Romanians would have had in their accounts if the original plan of contributions, which were to be transferred to the second level of pensions, had been followed.

Hypothetically, a Romanian with an average salary who continuously contributed to Level II between 2008 and 2023 would have an average of 36,000 lei in his account today. If the original contribution calendar had been followed, the accumulated amount would have been 49,000 lei.

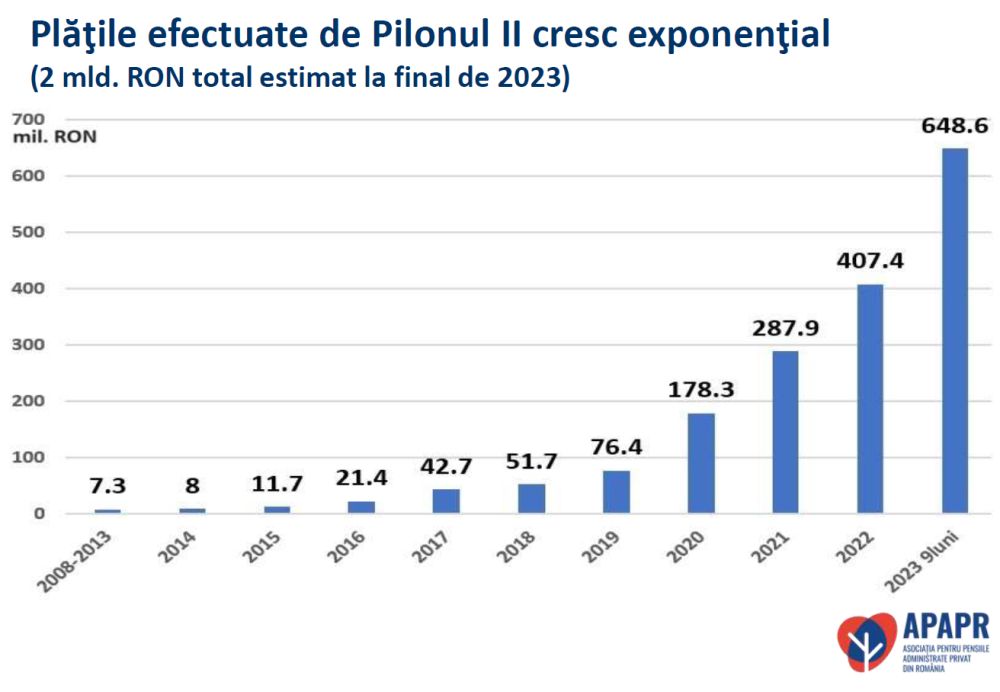

Payments from Level II this year may reach 2 billion lei / In 7-8 years the decree generation will retire

However, as of September 2023, Pension Tier II has covered more than 8.1 million members over 15 years, of which only 4.1 million members are active.

“We have 1.7 billion lei of payments in Level II, with a good chance that we will reach the threshold of 2 billion payments this year. From year to year, payments grew exponentially.

In about 7-8 years the baby boomer generation will retire and this will be an important moment in this evolution with a significant increase in those eligible for a non-state pension. It is even more important to have a law on the payment of pensions,” Krachun told Radu.

Tier II pensions reached assets of 117.1 billion lei in September 2023, and net investment income (net of commissions) was 30.3 billion lei.

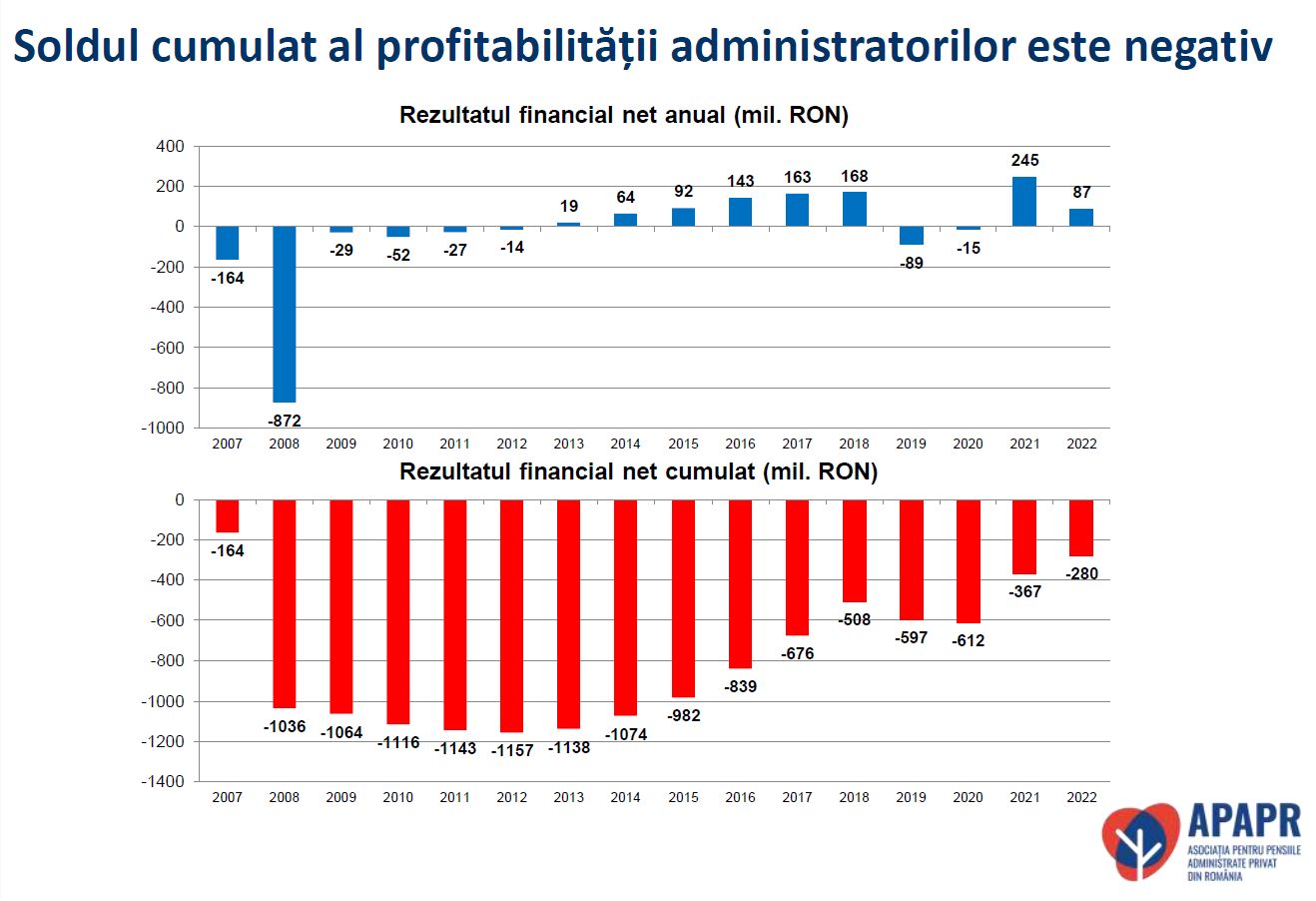

The cumulative profitability balance of Pillar II administrators is negative

In terms of the profitability of Tier II pension administrators, APAPR data shows that while some administrators have managed to turn a profit over time, on an aggregate level the industry is in the red.

After 5 years, Pillar II assets will reach 50 billion euros

According to him, ]further[torii 5 ani activele din Pilonul II de pensii se vor dubla.

„În doar 5 ani activele fondurilor de pensii se vor dubla și cât s-a acumulat în 15 ani se va acumula în 5 ani. Este vorba de o creștere normală accelerată a activelor – 50 miliarde de euro în 5 ani . Întrebarea este cum ii vom pune la treaba?”, a precizat acesta.

According to him, the development priorities of Pillar II should be:

- an increase in the contribution (to 4.75% in 2024), then 6% in the medium term;

- return to mandatory contributions for almost 1 million Romanians (construction, agriculture, food industry, IT): PNRR milestone in Q1 2025

- Diversification of the investment horizon

- Law on payment of pensions

- Legislative predictability and stability

- Financial stability for managers of pension funds

Photo source: Dreamstime.com

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.