A 1% sales tax, an additional 2% bank tax and an oil and gas tax (0.5%) could lead to either inflation or unemployment.

Alexandra Smedoiu, a partner in the Fiscal Services Department of Deloitte Romania, reminds that if the fiscal package is published by the President, the threshold of 50 million euros, which will be taken into account for the 1% tax, will be on December 31, 2023, and the application will be from January 1, 2024.

How many companies will be affected

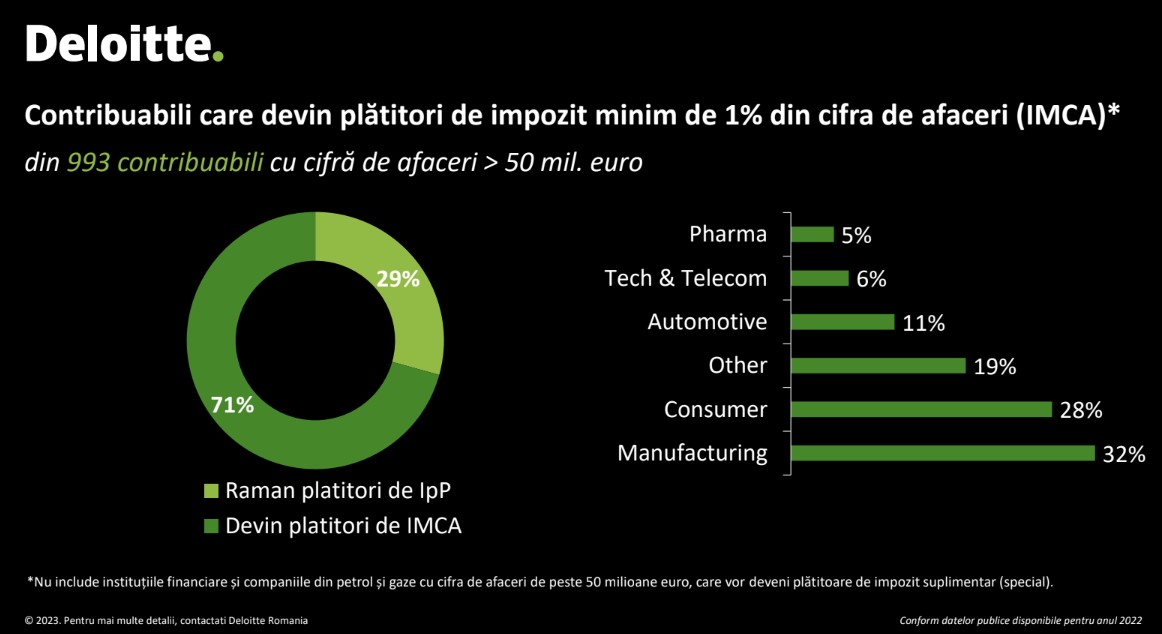

“This measure will apply to companies with a turnover of more than 50 million euros, about 1,000 companies, according to our estimates, that is, a third of large taxpayers, Romanian and multinational companies,” Smedou said.

To this measure, she said, an additional income tax is added in the case of financial institutions (2% of basic income in the first two years, 1% thereafter), as well as companies in the oil and gas industry with a larger turnover. EUR 50 million (0.5% of turnover).

According to data provided by companies for 2022 and estimates for 2023 from companies subject to the minimum tax, 70% will be subject to turnover tax and only 30% will remain subject to income tax.

What areas will the sales tax hit?

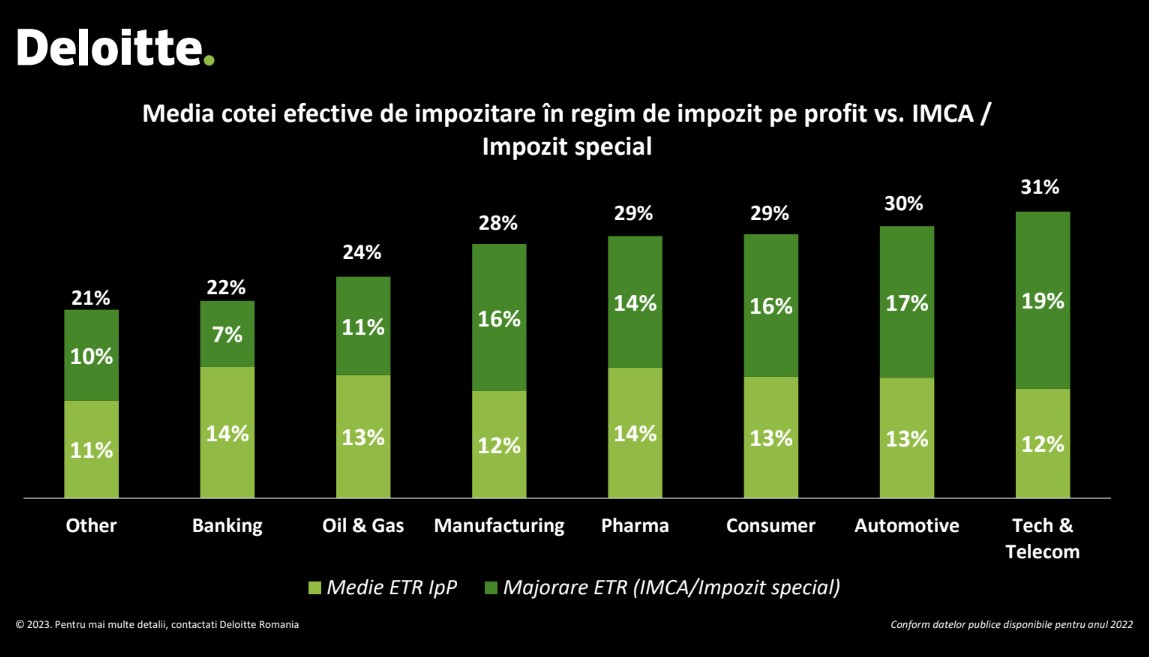

So for them, as well as taxpayers who will owe additional taxes, Smedoyu says, the effective tax rate is likely to rise from 2024.

“The most affected will be technology and telecommunications companies, for which the total tax will increase to 31%, the automotive industry (up to 30%), retail trade (up to 29%), pharmaceuticals (up to 29%) and manufacturing. (up to 28%),” she explains.

Calculations are based on income tax reported by companies for the previous year and estimated turnover.

A representative of Deloitte notes that turnover tax also applies to companies in the same categories that have fiscal losses, approximately 100 of the specified amount.

Next year, these measures can bring about 6.5 billion lei to the budget.

In her opinion, the increase in costs will hit in two ways:

1. Transition to the prices of goods and services, which will lead to inflation.

2. They will be internalized by companies and thus economic growth will slow down or there will be a reduction in economic activity leading to unemployment.

“All companies make these calculations to see how and who can bear these costs,” Oleksandra Smedoyu also noted.

What the Cholak government’s tax package provides for large companies

Large companies (with a turnover of more than 50 million euros) will pay a tax of 1% of the turnover, while the income tax (16%) will be lower.

In practice, a formula is introduced from which various things are deducted, such as investments or excise taxes.

Exceptions are companies that exclusively engage in the distribution/supply/transportation of electricity and natural gas and are regulated/licensed by the National Energy Regulatory Authority.

Banks will pay an additional 2% turnover tax

An additional tax is introduced for banks (in addition to income tax) in the amount of:

2% for the period from January 1, 2024 to December 31, 2025 inclusive;

1% starting from January 1, 2026.

Additional tax for companies in the oil and gas sector

An additional tax of 0.5% is also introduced for oil and gas companies with a turnover of more than EUR 50 million.

Practically, in addition to the income tax, this new tax should also be applied.

See also: What taxes will increase if the president enacts the law passed by the Cholaku government: from taxation of micro-enterprises and large companies to VAT and excise duty on sugary drinks

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.