The Ministry of Defense wants to provide the RCA with more than 2,800 vehicles (minibuses, SUVs and city cars, motorcycles, trailers, etc.) from several countries. Because it will cost a lot of money, it requires insurers not to come up with different prices according to criteria such as the driver’s location, age, gender or religion.

The Ministry of Defense, through Military Unit 02574, is looking to enter into a 12-month framework agreement to procure RCA insurance for more than 2,800 vehicles registered in its fleet from several countries in the country, according to a tender notice published on Thursday in the Government Electronic Procurement System (SEAP). .

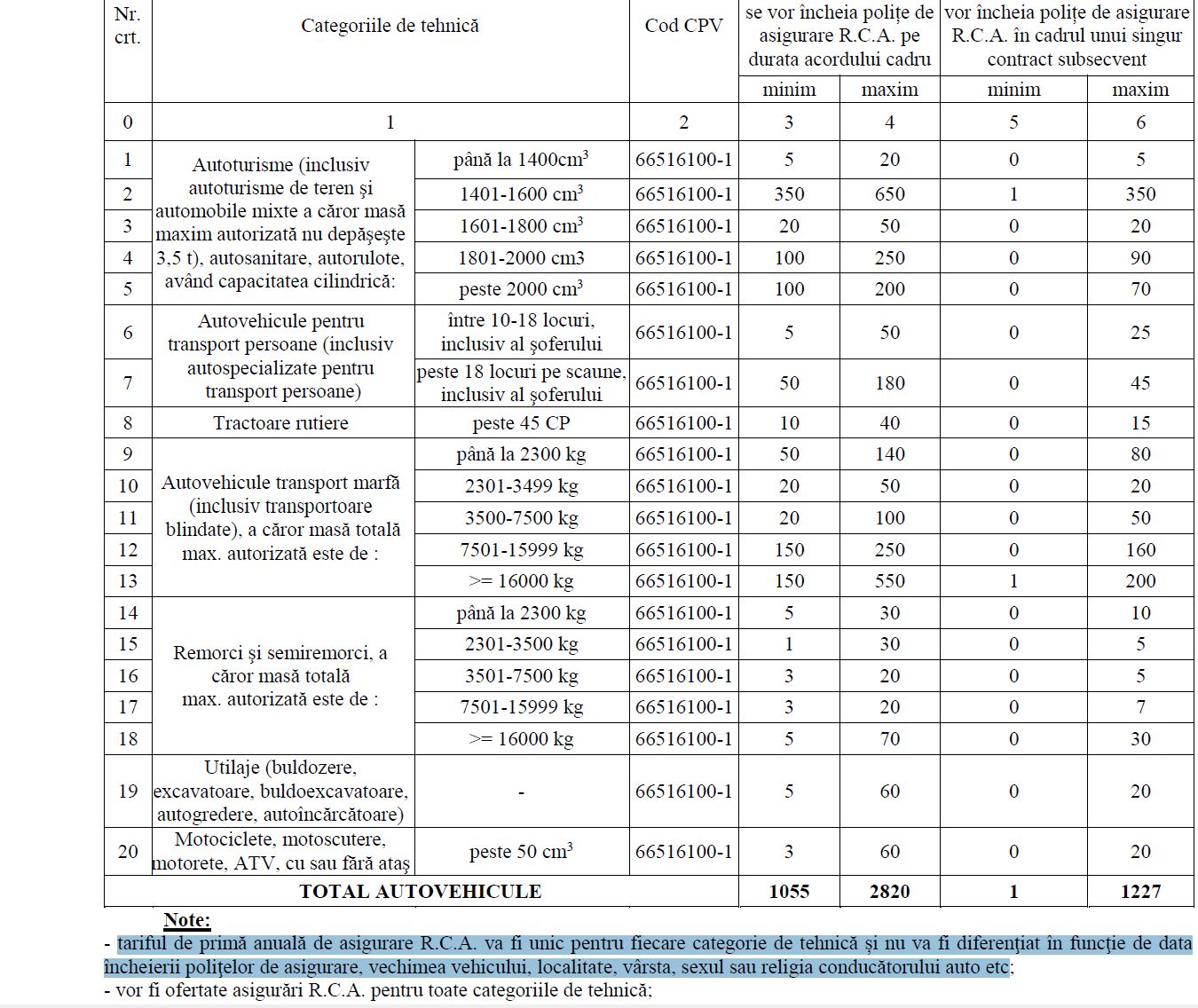

Since we are talking about many cars whose RCA insurance is valued at more than 13.7 million lei (excluding VAT), MApN sets the price conditions:

- “RCA’s annual insurance premium rate will be unique for each equipment category and will not vary based on policy date, vehicle age, city, age, gender or religion. driver, etc.;”, it is shown in the specifications.

In other words, MApN asks insurers not to set RCA prices that differ based on criteria such as the age of the vehicle, location, age, gender or religion of the driver, etc.

- “During the conclusion of insurance policies, depending on the history of each vehicle and the period for which it is subject to insurance, discounts/increases allowed under the bonus-malus system will be applied,” the specification also states.

We remind you that the RCA market is liberalized in the EU, and insurers are free to introduce dozens of segmentation criteria when setting RCA prices, if these criteria are approved by an independent actuary. Insurers are no longer required to report these criteria to the Financial Supervisory Authority (ASF).

However, RCA prices are unlikely to be gender and religion specific. Sources from the insurance market told HotNews.ro that these two segmentation criteria do not exist.

RCA price differentiation by gender in RCA prices has been banned in the EU since December 2012 after the European Court of Justice ruled that this criterion of differentiation was incompatible with the fundamental principle of equal treatment of women and men within the European Union (EU).

- HotNews.ro has asked the ASF for further clarification on the segmentation criteria (including gender or religion) used by insurers in Romania to set RCA prices, and we will return with answers as soon as we receive them.

Why RCA prices in Bucharest are much higher than in other cities

On the other hand, when forming the RCA price, the town where the car is registered must be taken into account. For cars in Bucharest, insurers in some cases practice double RCA prices compared to what such insurance would cost for a similar car but registered elsewhere.

This was also confirmed by representatives of ASF, who in April this year were summoned to provide explanations to the government regarding the limitation of RCA tariffs in the context of the bankruptcy of Euroins.

Valentin Ionescu, General Manager of ASF Insurance, explained why drivers from Bucharest and other big cities have higher prices in RCA and why it is difficult to have lower prices in RCA in general.

According to him, in large cities, the burden on the tariff calculated by insurance companies is somewhat higher due to the risks and the frequency of losses, which is higher.

- “Usually to have the most reasonable rate, you need as many companies to sell that insurance, as much spread as possible. When there are only a few companies selling RCA, it’s hard to expect a lower rate, given that Romania’s accident rate is much higher than the European average.

- Damage is a very important element in RCA pricing. Over the past 3 years, the average amount of losses has increased from 7,000 lei to 9,500 lei.

- In Bucharest, 7 out of 100 cars get into accidents compared to some regions of the country where the frequency is lower, somewhere around 4%. All these elements must be taken into account when calculating the price of RCA. he declared.

He also noted that there is also a structural problem: RCA is a mandatory product sold by private companies.

- “There are some private companies that have had losses in recent years. One of the largest companies in the Uniqa market left the RCA market due to accumulated losses of hundreds of millions over the past 7-8 years. As you know, after City Insurance exited, Uniqa applied to withdraw from RCA insurance and we may also have such situations.”, Valentin Ionescu also stated.

Read more: ‘I don’t want to comment, it seems a bit biased’: ASF boss’ response when asked about honorable retirement and performance bonuses after City and Euroins bankruptcies

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.