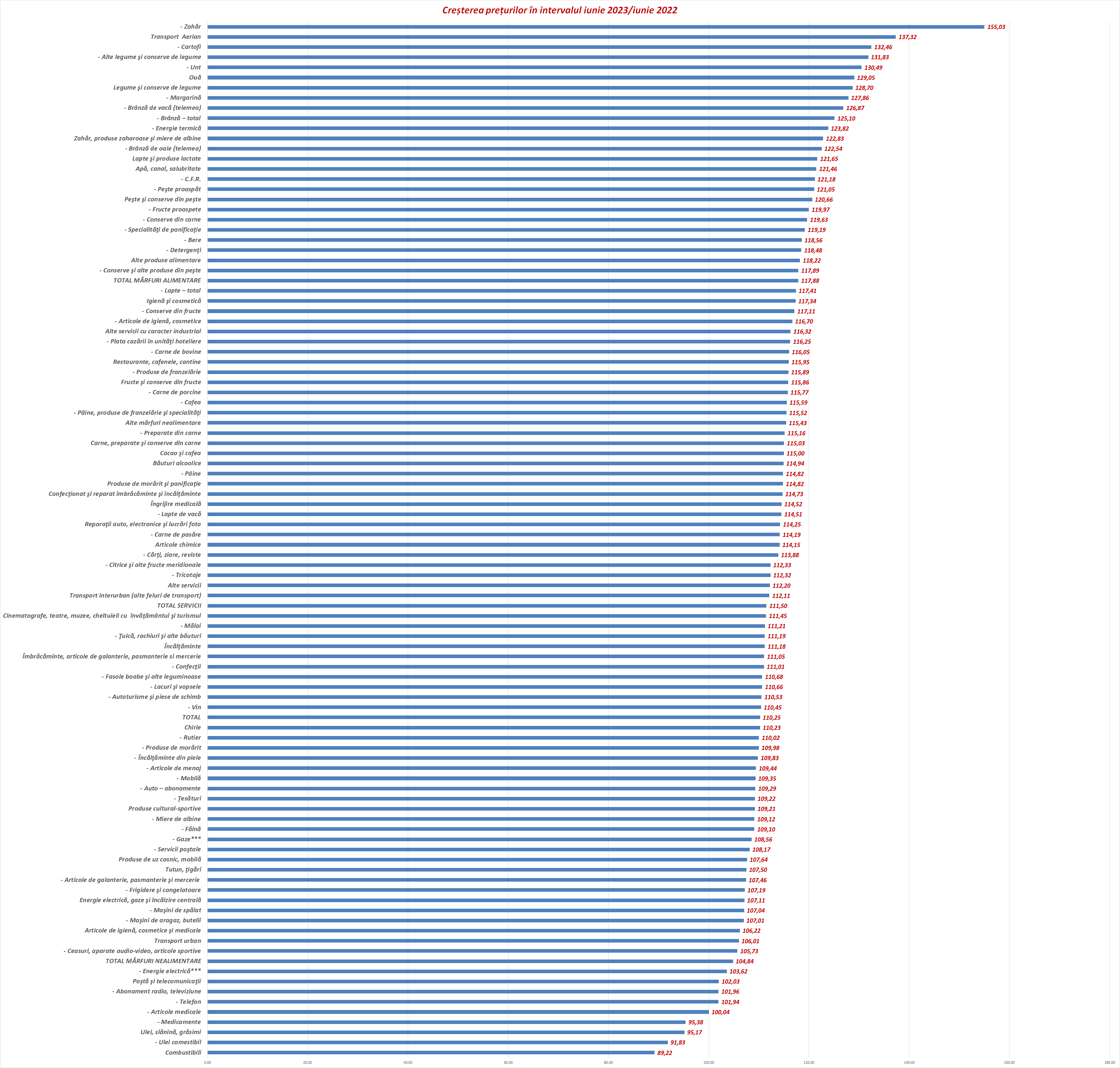

Inflation eased only marginally to 10.3% in June (from 10.6% in May), and food remains at the top of price increases. Food prices rose by 18%, according to data sent on Thursday by statistics. Among food products, sugar, potatoes, butter and eggs rose in price the most in June. Only oil has become cheaper.

A noticeable impact, in the sense of an increase in the level of inflation, continued to come from the gradual transfer to consumer prices of increased costs for materials and wages, from an increase in the rate of profit and from an increase in the prices of some imported consumer goods, the Central Bank reported this in the inflation report published last month.

There is a growing consensus among experts, from academics to strategists and central bankers, that the current persistent inflation stems more from corporate greed or their ability to simply raise prices. This is how the term greedflation (from greed) or “scuzflation” was born.

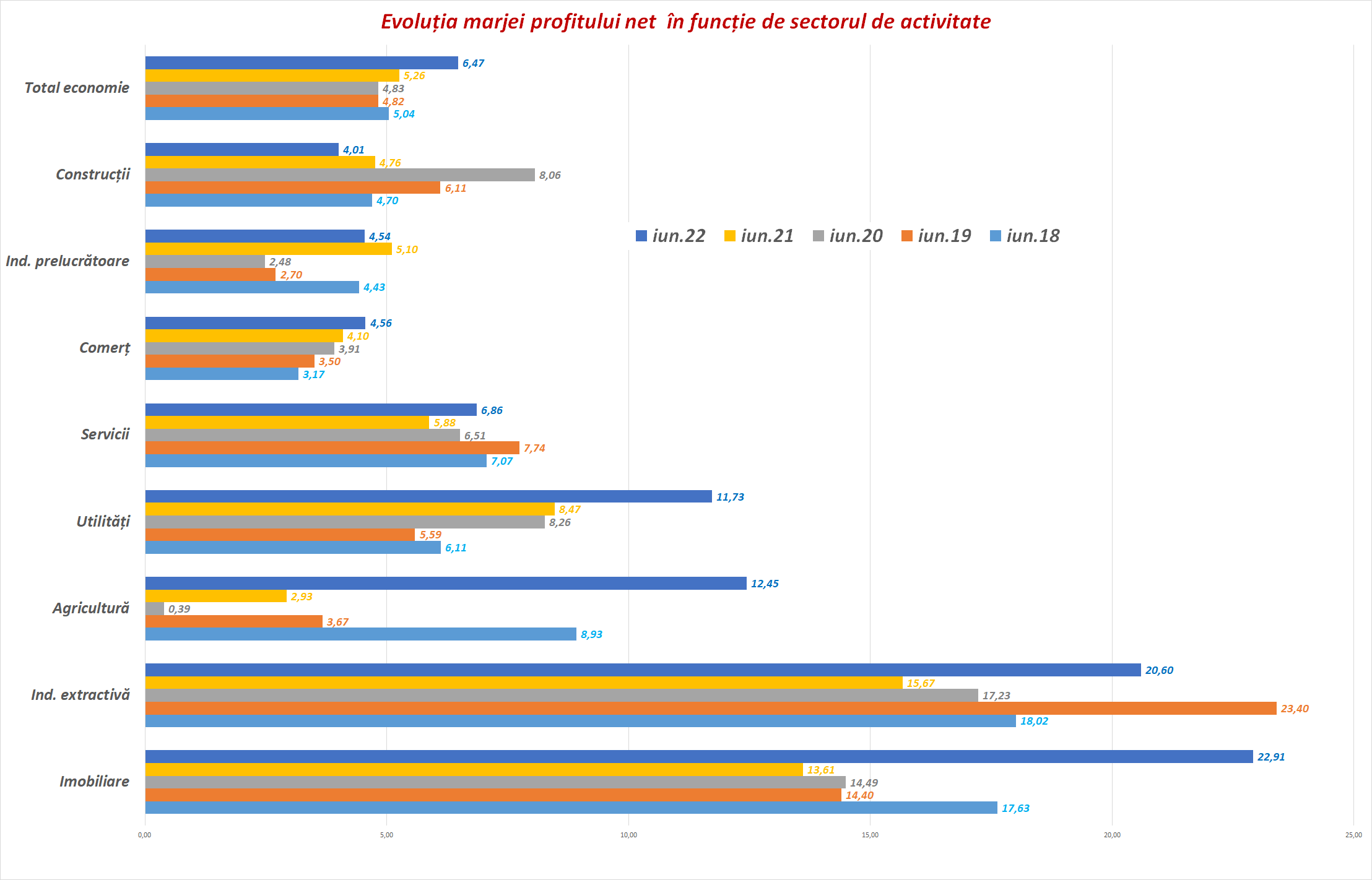

According to the BNR, the profitability of agricultural production was very high (see Financial Stability Report, June 2023)

Immediately after the pandemic, when inflation seemed to be rampant, everyone was still talking about its “transitional” nature. That prices have risen due to supply disruptions, and once those supply chains are restored, prices will calm down. But it wasn’t like that at all.

A significant recovery in consumption after months of isolation and rising energy prices due to the war in Ukraine were the main ingredients of this inflationary cocktail, which led to increased production costs for companies, which they were then forced to pass on to their customers.

A study by economists Isabelle Werner and Evan Wasner of the University of Massachusetts, published in March, helps to understand the mechanism. Initially, the rise in prices is associated with the difficulties of ensuring the necessary goods on the shelves (supply shocks, as economists call them), associated with bottlenecks. This leads to extraordinary profits for some companies (for example, carriers, fuel distributors).

Then, “to protect their rate of return, the downstream sectors spread these price increases and increase inflationary pressures. All because of the greed to get financial benefit from the deficit.

“The workers are reacting and also demanding higher wages, which is normal given the high profits of the companies they work for and the rising prices in the stores they sometimes supply themselves.” In other words, the risk of a price-wage inflationary spiral is real.

At a time when social cohesion is breaking down, having a higher rate of return during a crisis can only fuel unrest.

As for analysts, we increasingly agree with this theory, with Albert Edwards, global strategist at Societe Generale in London, saying that “something seems to be broken in capitalism.” He points the finger at companies that he says have taken advantage of the pandemic and the war in Ukraine to make a profit. “At a time when social cohesion is already breaking down, I think those companies that generate higher-than-normal profit margins during a crisis can only fuel unrest,” he warns.

In addition to inflation created “on the ground”, Romania imports inflation from countries with which we have a large trade deficit and where prices are higher than in Romania

“Look at the deficit we have with Germany or Hungary! You will see how much inflation we import from there,” INS Tudorel President Andriy pointed out.

In Germany, food prices started to rise again (inflation rose to 6.3% in June), and Romania annually imports goods worth more than 5 billion euros from the Germans. Likewise, inflation in Hungary has exceeded 21%, and imports from it are approaching 2 billion euros per year.

Romania also exports inflation to countries such as the United Kingdom (with which we have a positive trade balance, and “Romanian” inflation is higher than the British one), the Republic of Moldova, the USA or France. However, the list is longer and includes Morocco, Japan, Norway, Gibraltar and other countries with which we have a positive trade balance and where inflation is lower than ours.

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.