If you’re looking to get a 20-30 year home loan, it’s good to know that fixed interest rates have both advantages and disadvantages compared to variable ones.

A fixed interest rate is usually chosen by people who want to be certain about the rates they will pay. They want to know that no matter what happens and what inflation is, they will return the same amount to the bank.

When interest rates tend to rise (as they did until recently), customers who borrowed from banks tend to prefer a fixed interest rate to a variable one. On the other hand, if interest rates are trending down, a fixed interest rate will be a little confusing because it will likely be higher than the rate on a variable rate loan.

“Fixed interest has a risk component. In particular, risk cost, margin and product cost. The cost of a product takes into account all the elements that make up that product: from consulting to technology, there is an area where all the costs associated with the respective product are stored in the cost of the product,” Dana Dima, executive deputy, explained to HotNews. President of Retail and Private Banking, member of the BCR Executive Committee.

We try to reduce the cost of production, the effort we put into the paper, with advice, so that this cost is reflected in the final price of the product. As for the margin, sometimes we work with it at very low levels, close to zero, because we believed that a real estate loan is taken for 20-30 years and plays a significant role in a person’s life, says the vice president of BCR. .

Advantages and disadvantages of a fixed interest rate

Key advantages:

Certainty of the amount to be repaid: the borrower always knows how high his current and future rates are because they are fixed.

It provides protection against a sudden increase in the key interest rates of the NBR, which affects the variable interest rates of commercial banks. We will remind you that last year the Belarusian People’s Republic raised interest rates several times, and interest rates on loans in lei with a variable interest rate steadily increased.

The main disadvantages of fixed interest:

Potentially higher repayment amounts: If interest rates fall, a variable interest rate is generally lower than a fixed interest rate.

A fixed interest rate protects you from the negative impact of rising interest rates, but you are also protected from the positive impact of falling interest rates

A practical example with Mr. Ionescu

Mr. Ionescu goes to the bank to get a loan of 225,000 lei (€45,000). The banker offers him 3 options: a fixed interest rate for the entire loan period, a variable interest rate for the entire loan period, and a combination of the two (fixed for the first 5 years, then variable)

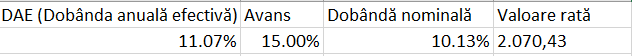

In the case of a loan with a fixed interest, its rate will be 2070 lei:

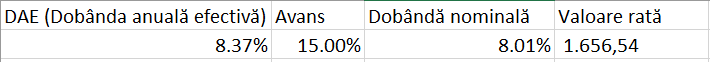

The option offered by the banker to Mr. Ionescu in the case of variable interest is as follows:

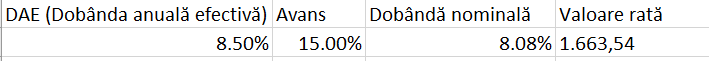

And if the bank’s offer of a loan with a fixed interest for the first 5 years was accepted, and then the interest became variable, the first installments would be as in the table below:

DAE Advance Value rate Interest

Unlike developed European countries, in Romania there are no real estate loans with fixed interest rates for 25-30 years, with one exception. That’s right, people aren’t even flocking to access it because of the obviously higher interest rate.

Bankers say it is difficult to have fixed interest rates on loans with such high maturities because of the complexity of managing interest rate risk. Interest rate risk is the probability that interest rates will change, which is exactly what we see in all markets today.

“The ability of banks to offer mortgage loans with a fixed interest throughout the entire lending period (as, for example, in the USA) is related to the ability to manage the interest rate risk at the appropriate repayment terms. Given the degree of development of the instruments available in the Romanian financial markets, local banks tend to offer fixed interest rates only for a limited period of time. In developed financial markets, some of the main tools and conditions that allow us to manage interest rate risks over the long and very long term are:

- Availability of a very liquid government bond market in the relevant currency (maximum maturity of government bonds in lei in Romania: 14 years, there are only two issues over 10 years)

- Availability of a liquid market for interest rate swap contracts with medium and long maturities (does not exist in Romania)

- An active securitization market through which banks can create instruments that make mortgage loan portfolios available for sale (does not exist in Romania)

- An active corporate bond market, through which banks can finance themselves, in turn, with fixed-rate instruments (early stage in Romania, but with maturities of less than 10 years in any case)’.

– a commercial banker told HotNews.

“In the bank’s ALM (Asset and Liability Management n.red) model, it is assumed, for example, that part of the current accounts and time deposits are stable. Therefore, an econometric analysis is carried out and those stable components are considered long-term resources (for 10 or even 20 years). So you have long-term “synthetic” liabilities. Baska is a component of equity that is modeled for a long period of time,” explained HotNews how a 30-year fixed-rate loan could be created, even if it is more expensive.

How will house prices develop? Dana Dima, BCR: A few cities are overpriced and there will be a slight reduction

As for the time required to buy a 2-room house (55 sq m), without taking into account living expenses or savings and without financial support from banks, the highest level of the indicator is recorded in Cluj County, where it takes approximately 11 years to buy a house.

These are the conclusions in the section of the stability report published by the National Bank, which shows the position of Romania in the real estate market compared to neighboring countries.

It takes about 12 years in Vienna, almost 18 years in Prague and about 15 years in Budapest and Warsaw to buy a 55 square meter house without a mortgage, BNR data also shows.

On the other hand, in counties such as Giurgiu, the indicator does not exceed the value of six years.

“We all survived 2009-2010. We may see a slight downturn in the housing market, but not immediately and not suddenly. It will probably be a smooth curve. And it will depend on how many developers and how much new housing will be on the market.

Some cities have inflated house prices, that’s for sure, but compared to the last financial crisis (2009-2010), customers are now much less vulnerable for several reasons: loans are now mostly in lei (thus eliminating the exchange rate), and now we also have unemployment insurance for 6 months or a year, and if a customer loses their job, then within 6 months or 12 months we actually pay them a premium. Which is of great importance to the client, and 10-12 years ago such a product did not exist,” said Dana Dima, vice president of BCR.

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.