Last year, more than 240 claims were made against insured and earthquake-damaged homes, of which only 119 were paid out, while 27 people were denied compensation, including because the plaster hadn’t arrived. before the earthquake, according to official data provided by HotNews.ro.

Insurance companies and PAID, the insurance company that manages the system of mandatory insurance against 3 natural disasters: earthquakes, floods and landslides (PAD insurance), have already received more than 150 reports of damagefor homes damaged by this week’s earthquakes in Gorge County.

- According to the law, insurance companies cannot provide optional insurance for a home that does not have mandatory PAD insurance. While damage assessment is carried out by insurance company inspectors, compensation is paid by PAID.

Under these conditions, HotNews.ro requested data from PAID on the damage files opened as a result of last year’s earthquakes and how they were resolved.

Last year, 244 claim cases were opened. Top payments by districts and settlements

Official figures show that 244 damage cases were opened after the earthquakes last year. The most (187 files) after the earthquake that occurred on November 3, 2022.

Out of a total of 244 cases opened in connection with the earthquake, compensations in the amount of approximately 600,000 lei were paid in 119 cases.

- “The difference between the number of open files and the number of paid files does not mean the files are rejected, but they are files that are still in different stages,” Cosmin Tudor, Director of PAID Development, told HotNews.ro.

The most popular payments by district: Buzeu, Prahova and Vrancha

Buzeu (21 files), Bucharest municipality (18 files) and Prahova (with 17 files) dominate the county ranking in terms of the number of paid files:

Buzeu (133,321 lei), followed by Prahova (77,487 lei) and Vranca (75,508 lei) is the leader in the ranking of poviats in terms of amounts paid as compensation.

The most popular payments by region: Bucharest, Buzeu, Tirgu-Giu

Bucharest (18 files), Focşani (6 files) and Buzău (5 files) dominate the top settlements in terms of the number of paid files.

Bucharest (47,568 lei) dominates the ranking of settlements in terms of amounts paid as compensation, followed by Buzeu (33,278 lei) and Tirgu Giu (24,532 lei).

27 files were refused payment: the plaster fell, but not from the earthquake – the main reason

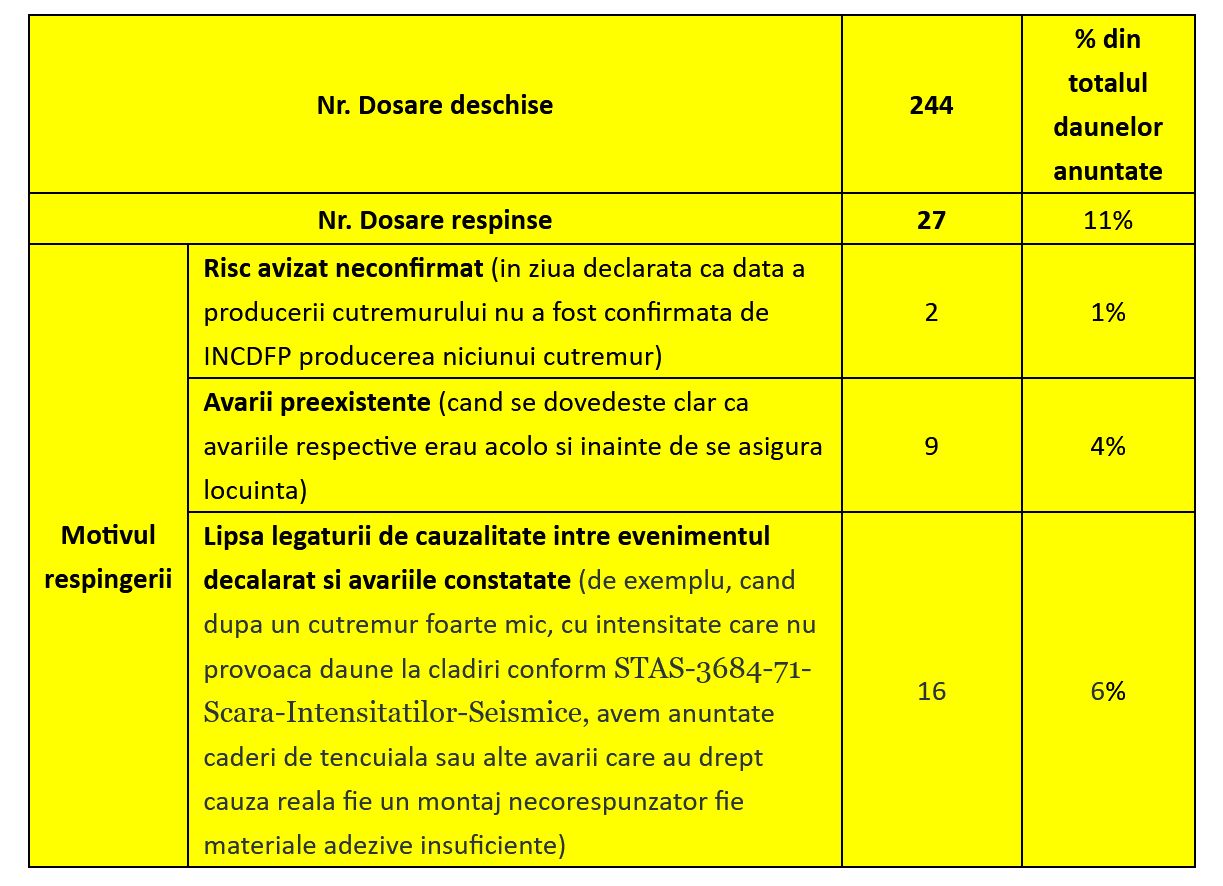

Out of a total of 244 cases opened last year for damage to buildings caused by earthquakes, 27 cases were denied (11%).

The majority of documents (16) were rejected on the grounds that there was no causal link between the earthquake and the damage found:

- “For example, when after a very small earthquake with an intensity that does not cause damage to buildings according to STAS-3684-71-Scara-Intensitéat-Seismice, we have reports of falling plaster or other damage that is the real cause or incorrect assembly or insufficient the amount of adhesive materials,” is stated in the PAID specifications.

9 cases were refused payment on the grounds that the losses occurred earlier: “when it is clearly proven that the corresponding losses occurred even before the registration of the house.”

“Clear evidence” in this case means either the fact that the insured admits that there was previous damage due to the earthquake, or, if there is a misunderstanding between the insured and the insurance company, through an out-of-court or forensic technical examination (if the proceedings are in court).

Another reason for the rejection of 2 damage files last year was the fact that the approved risk was not officially confirmed (on the day announced as the date of the earthquake, no earthquake was confirmed by the INFP).

No fine for 13 years: even municipalities do not insure their public housing

Homeowners in Romania (individuals, legal entities and public authorities) are required by law to insure their homes against the three risks of natural disasters – earthquakes, floods and landslides.

In practice, during the 13 years of application of the law 260/2008 on mandatory housing insurance, mayors were not fined in order not to lose their electorate.

In addition,about 50,000 social or service buildings belonging to the state are not insured by city halls of large cities against earthquakes, floods and landslides, despite legal obligations and sanctions.

PAD insurance costs €10/year or €20/year, depending on the materials the house is built with, and you can receive a maximum of €10,000 or €20,000 in the event of a disaster, depending on the amount of the insurance premium. paid.

In order to additionally insure your home against other risks, such as fire or flooding by your neighbors, you need to take out optional insurance. By law, insurance companies cannot voluntarily insure a home that does not have mandatory PAD insurance.

The latest figures from PAID (Pool de Asigurare Optoriva Desastrelor), a private insurance company that issues compulsory PAD home insurance policies and pays disaster compensation, show that at the end of January of this year, there were 1,850 active .373 PADs. policies, which is 19.30% of the national housing stock.

75% of houses insured by PAD are located in cities.

Read more also:

- Romanians would be even less likely to insure their homes if they did not have loans. Some consider it a disguised tax – What does the ASF correspond to?

- “Traps” in mandatory home insurance: why some people are denied compensation

- Only two out of ten houses in Romania are insured against earthquakes: why Romanians do not insure their houses, even though it is required by law

Photo source: Dreamstime.com

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.