According to data sent on Wednesday by the National Institute of Statistics, price growth in January was 15.1% less than in December. But this does not mean that prices are falling, just that they will grow more slowly.

Inflation is everyone’s problem, unlike crisis or unemployment, which affect only a few. Wages, although growing at a high rate (over 13%), do not keep up with the accelerated growth of prices and increase the feeling of financial discomfort. When you go to the grocery store, you spend more money on the same products than you did last month, and it feels like money is slipping through your fingers.

However, the economy is not in bad shape at all, not like it was during the financial crisis. The INS just announced that GDP will grow by almost 5% in 2022.

But we all feel the state of the economy as bad because of this inflation.

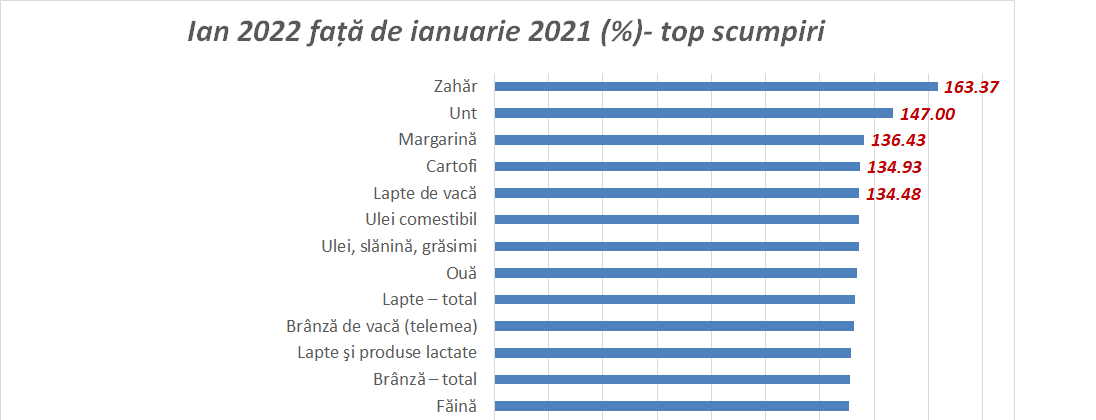

According to the INS, the prices of sugar, butter, margarine, potatoes and milk increased the most – that is, the main products that are present in large quantities in the diet of most of us.

The National Bank does everything it can (it is true, there have been rare cases when inflation fell within the limits of the NDB’s target), but the support of another “wing” on which the economy flies is also needed – fiscal policy.

Rising prices affect some people more than others. Hardest hit are retirees or minimum wage families who have less room in their budgets to cover higher prices. Even those who earn an average salary suffer. Inflation “steals” at least one salary from their 12 monthly salaries.

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.