Homeowners in Romania are required by law to insure their homes against the three risks of natural disasters – earthquakes, floods and landslides – but only 1.85 million homes were insured at the end of last month, equivalent to just 20% of Romania’s housing stock. Romania. For 13 years, no mayor has given any fine to citizens so as not to upset his electorate.

Mandatory home insurance against natural disasters (PAD) costs €20 per year for houses made of modern materials and €10 per year for houses made of adobe and other less durable materials, for which in the event of a disaster you can receive a maximum of €20,000 and 10 000 euros respectively, depending on the annual premium paid.

More than 1.84 million, or almost 20% of the more than 9.1 million houses in Romania, were insured with a compulsory PAD policy at the end of 2022, slightly more than the 1.81 million houses compulsorily insured at the end 2021, according to data from the Pool of Natural Disaster Insurance (PAID).

75% of all mandatory types of home insurance are covered by cities

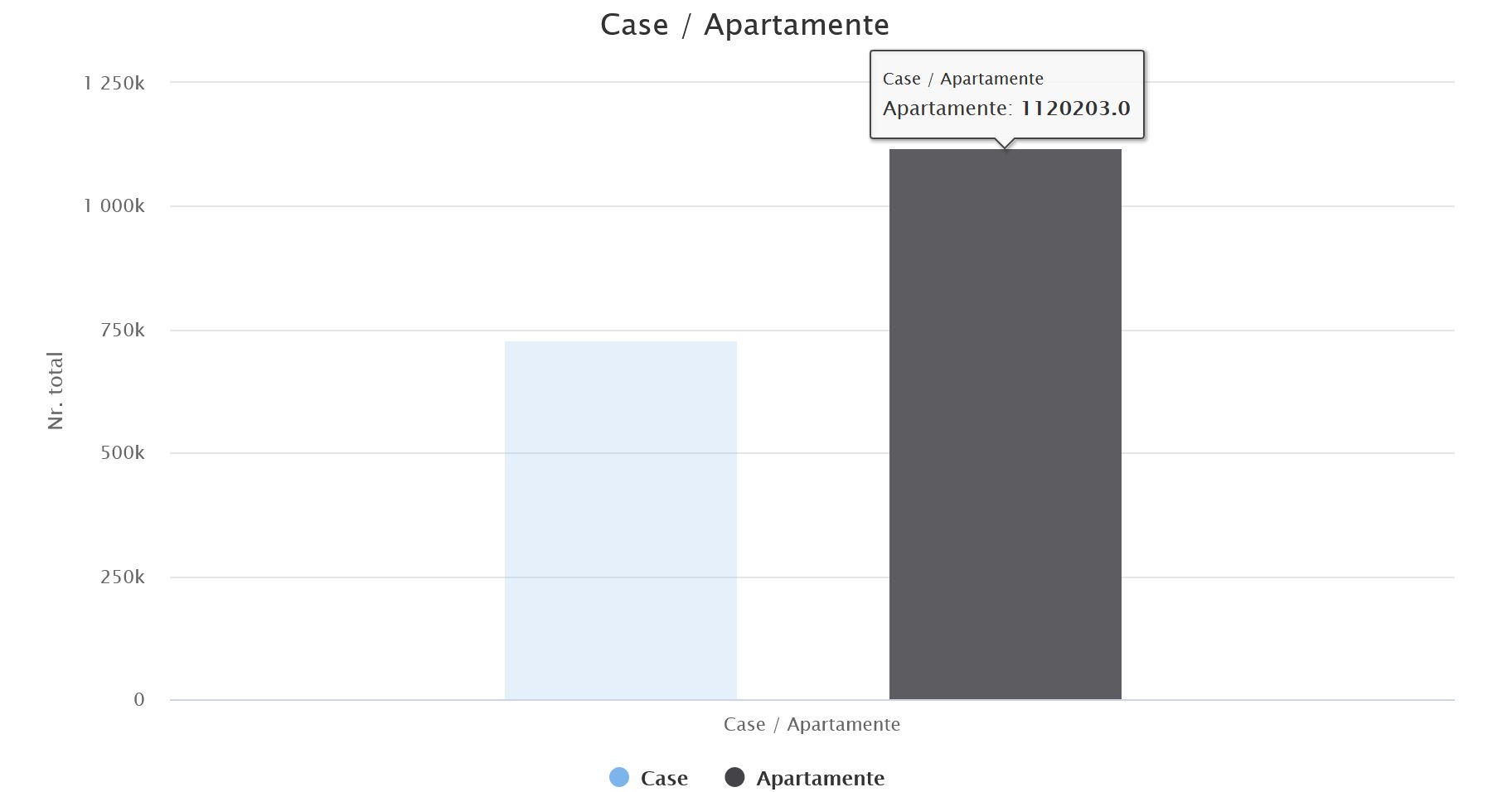

At the end of January of this year, the number of houses that are required to be insured against earthquakes, floods and landslides increased slightly to 1.85 million insured houses, of which 75% were in cities, more than 1.1 million are apartmentslose PAID data.

- This is evidenced by these figures many mandatory types of home insurance are actually concluded on the basis of bank loans taken out for housingwhere mandatory insurance is related to optional insurance of the purchased home.

In addition, the latest data from the Financial Supervisory Authority (ASF) showed that after the first nine months of 2022 more than 1.6 million homes were also insured through optional insurance.

Top mandatory home insurance by region

The most mandatory types of home insurance are concluded in Transylvania (22%), Bucharest (20.3%) and Muntenia (18.5%), on the opposite pole are Maramures (3.1%), Bukovina (3.4%) and Dobruja (4.4%).

What compensation was paid last year and this year

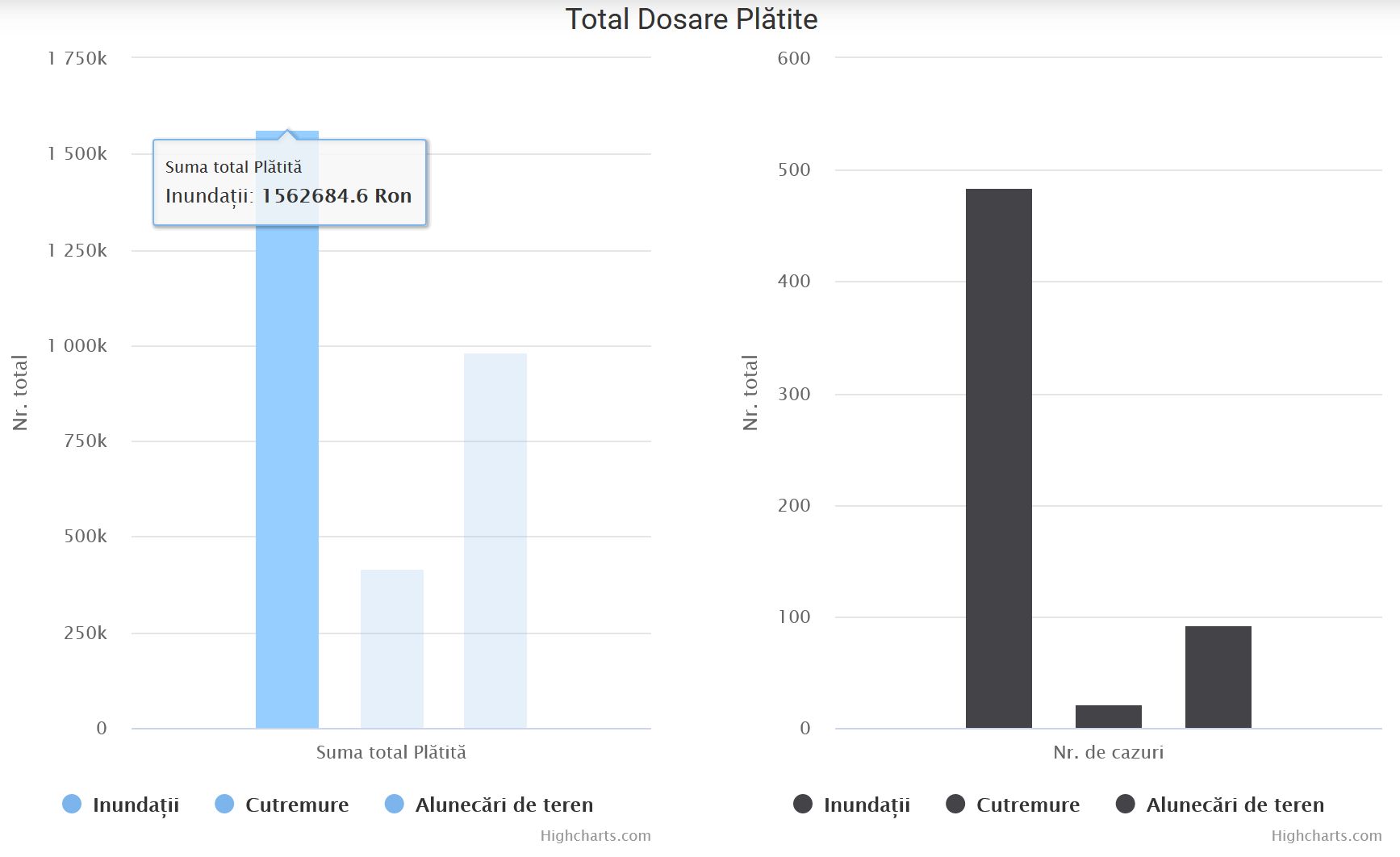

This year, more than 234,000 lei were paid in compensation for disasters caused by earthquakes, in the case of 3 cases of earthquakes and more than 34,000 lei for 21 cases of floods.

However, last year the most compensation was paid for floods – more than 1.56 million lei in 484 cases of flooding.

Landslides came in second place – more than 980,000 lei in 93 cases, and more than 417,000 lei were paid for damage to buildings caused by earthquakes in 22 cases.

Why do you need optional home insurance and what is the cost?

Compulsory house insurance in case of an earthquake in the cities would not be enough, considering that the prices of apartments are well above the 20,000 euros that you can get from this insurance.

In addition, PAD insurance does not cover the value of the property in the house, so those who wish to insure their home must also take out optional insurance.

“The cost of such insurance is generally about 0.1-0.2% of the insurance value. For a house in Bucharest, for example, worth 100,000 euros, additional insurance costs between 100 and 150 euros per year, which is about 10 euros per month. We note that these costs refer to a policy that also covers household goods, within a certain limit, an object that does not exist in the case of a mandatory policy.” – reports Studiifinanciare.ro.

No penalty for 13 years after fulfilling the home insurance obligation

Home insurance against earthquakes, floods and landslides became mandatory in the summer of 2010.

According to the law on compulsory home insurance (Law 260/2008), owners who do not insure their homes risk fine from 100 to 500 leiand detection of violations and application of sanctions is carried out by mayors and persons authorized to do so.

In practice, it has been almost 13 years since then no mayor fined citizens for the lack of this confidence, especially in order not to upset his electorate, as the president of the Association of Municipalities of Romania has repeatedly emphasized.

Due to the lack of fines, Romanians who live in areas with little risk of earthquakes, floods or landslides do not shell out money for home insurance.

Photo source: Dreamstime.com

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.