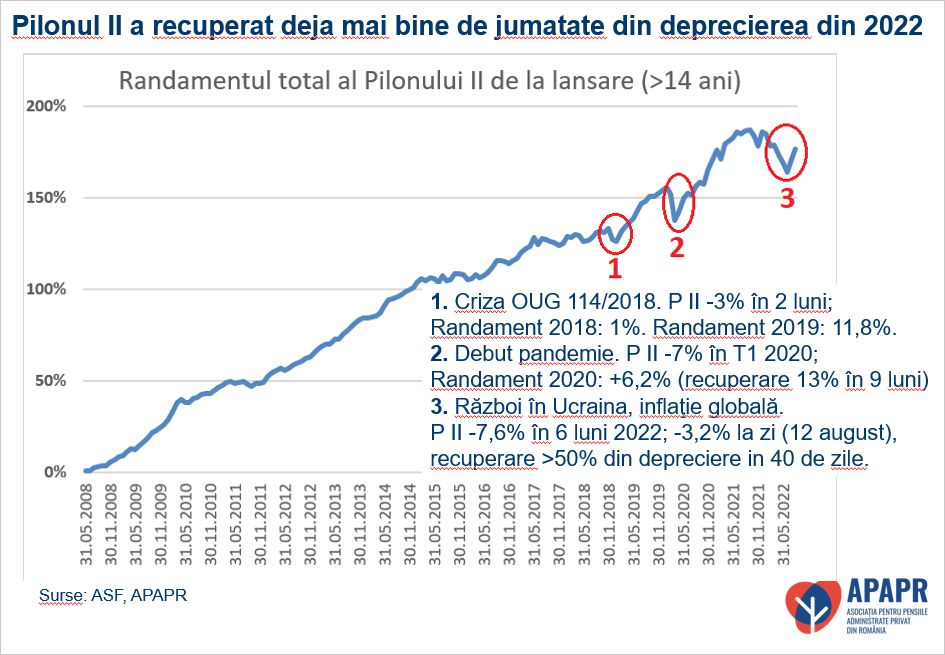

The value of the sums accumulated in the second tier of mandatory private pensions has recovered in less than two months from more than half of its fall in 2022 amid improved quotes for government securities, in which pension funds invest about two-thirds of their administered sums, according to calculations presented in on Wednesday by the Association of Private Pensions from Romania (APAPR).

Thus, on August 12, 2022, the average return of Pillar II in 2022 showed a minus of only 3.2%, compared to -7.6% at the end of the first semester.

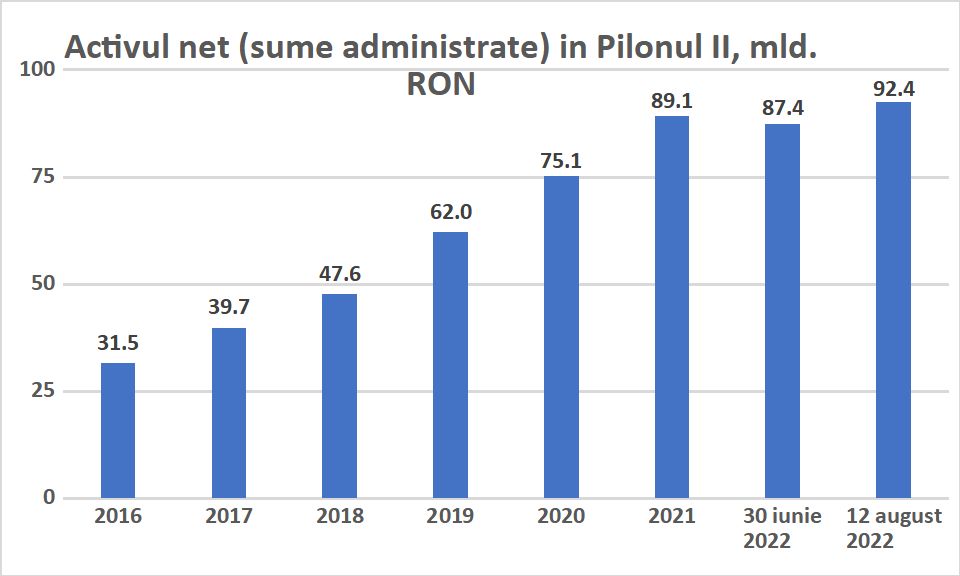

Assets under management of Pillar II reached 92.4 billion lei, an all-time record for the system, a significant increase of 5 billion lei compared to mid-2022. Compared to mid-August 2021, Pillar II assets are now almost 7 billion lei higher (+ 8%).

The evolution of the last 2 months shows a strong and rapid increase in the value of assets against the background of the return of quotations of Romanian government securities, in which pension funds invest approximately two-thirds of their managed sums. Between June 2021 and June 2022, Romanian government securities experienced a cumulative depreciation of 16%, followed by a 7% recovery year to date (source: I29114RO index, calculated by Bloomberg).

In general, APAPR notes, during the entire period of operation of Level II, that is, for more than 14 years of operation (May 20, 2008 – August 12, 2022), mandatory non-state pension funds have shown very good results, even taking into account the temporary depreciation from this year:

- 7.8 million Romanians contribute to 7 second-level pension funds

- gross contributions transferred to the system = 74.4 billion lei

- already made payments by funds = approx. 900 million lei

- current managed net assets = 92.4 billion lei (historic record)

- net profit received for Romanians = 18.9 billion lei (excluding all fees collected)

- that is, an average annual return of 7.4% over 14 years.

According to APAPR, the latest Pillar II results show several key findings:

- 1) The decline in Tier II in 2022 was not caused by a poor investment strategy or stock market fluctuations, but by record inflation that led to the depreciation of government securities. Inflation has affected the world’s major economies this year, being a global phenomenon;

- 2) In the vast majority of cases, this year’s declines were caused by previous significant Tier II profits, not by participant contributions (money transferred into the system). The proof is the significant profit of 18.9 billion lei, net of all administrative fees, made by level II over the gross contributions transferred into the system, even taking into account this year’s results;

- 3) Volatility is normal and Tier II’s overall daily performance remains excellent, with an average annual gain of 7.4% per year over 14 years even with the 2022 drawdown. Tier II is a savings and investment system linked to the real economy and the development of financial markets, the evolution of which it accurately reflects;

- 4) Although there have been several episodes of volatility in the past similar to the one we are experiencing now, the upward trend in asset values has persisted since the recovery.

Reduction of the II level of pensions: how much money Romanians who retired received in the first 5 months, and what guarantees the law provides

More than 7,200 Romanians applied for Tier II pensions in the first 5 months of this year, a period when the value of their assets fell sharply amid the war in Ukraine and record inflation. Did they collect less than they contributed? What does the ASF data say and what guarantees are there in the law regarding the amounts owed?

According to ASF data requested by HotNews.ro, between January 1, 2022 and May 31, 2022, 7,201 participants requested the payment of assets after fulfilling the retirement conditions, of which 4,843 requested a lump sum payment and 2,358 requested installments.

The total amount paid out of the pension funds to participants who requested payment of assets as a result of the fulfillment of retirement conditions was 137.05 million lei, of which 89.99 million lei was paid as a one-time payment, and 47.05 million lei. lei was paid in installments.”

ASF: No Tier II participant can receive less than the legally guaranteed value

Since during the first 5 months of the current year, level II pension provision recorded a decrease in the value of assets by almost 6%, it is possible that some participants have less funds in their accounts than they contributed.

If such a participant reaches the end of the deposit period and wants to immediately withdraw the accumulated amount, how much will he receive?

- “Administrators are obliged, if the value of the participant’s personal property is lower than the value guaranteed by the provisions of Art. 135 para. (2) of Law 411/2004, administrators must increase the value of the participant’s personal asset to the level of the guaranteed value.

- In accordance with Article 135 para. (2) of Law 411/2004, the total amount payable for the private pension cannot be lower than the value of the contributions paid, reduced by fines and court costs,” says the ASF.

What are the legal guarantees that he will receive the appropriate sums?

“According to the provisions of Art. 138 para. (1) of Law No. 411/2004, pension fund administrators must constantly maintain a volume of technical reserves corresponding to the financial obligations arising from the prospectuses of managed private pension schemes, respectively to cover the risks associated with the mandatory minimum investment guarantee or, if applicable, the risks associated with guarantee supplements accepted by the administrator through the pension scheme prospectus.

The technical reserve is an appropriate volume of assets that corresponds to the financial obligations arising from the investment portfolio, which covers biometric and investment risks.

Thus, no participant who requires payment of an asset, as a result of fulfilling the conditions of retirement, can receive less than the guaranteed value, respectively, the value of the contributions paid by the participant during the entire active period, reduced by penalties and court costs.” – also ASF representatives clarified for HotNews.ro.

- Read more: Reduction of the II level of pensions: how much money Romanians who retired received in the first 5 months, and what guarantees the law provides

Source: Hot News RO

Anna White is a journalist at 247 News Reel, where she writes on world news and current events. She is known for her insightful analysis and compelling storytelling. Anna’s articles have been widely read and shared, earning her a reputation as a talented and respected journalist. She delivers in-depth and accurate understanding of the world’s most pressing issues.