The government wants to delay for 2 years the increase in contribution to non-state pension funds (Pilar II) from 3.75% to 4.75% of the 25% share of CAS only from 1 January 2026, according to the draft emergency order. This comes after the government boasted in March 2022 that it had achieved a major milestone in the PNRR by passing an emergency resolution to increase the Tier II contribution to 4.75% from 1 January 2024.

The new draft emergency decree, a document published by the National Youth and Sports Union, provides for an amendment to Law 411/2004 on private management funds to increase the contribution to Tier II starting January 1, 2026.

How the government boasted that it respects the PNRR by increasing the contribution to Tier II from 1 January 2024

The changes proposed by the Çolaku government come after the same government approved an Emergency Decree on March 16, 2022, which provided for a one percentage point increase starting January 1, 2024, in contributions to private pension funds (Tier II).

The Ministry of Labor, then headed by Marius Budai (PSD), boasted of achieving a major milestone in the PNRR by increasing this contribution.

- “The reform of the pension system, proposed in the National Recovery and Stability Plan, is aimed at developing legislation aimed at ensuring the medium- and long-term stability and predictability of the state pension system, respectively, the stability of the second level of pensions.

- Through the normative act adopted today, compliance with the calendar established by the PNRR (component C8, R6, stage 213) is ensured, while contributions to the II level of pensions comply with the provisions of the Fiscal Budgetary Strategy.”, This is stated in the press release of the Ministry of Labor from this date.

Contributions to private pension funds are part of the social insurance contributions belonging to the state pension system and are deducted from the gross monthly income, which is the basis for calculating social insurance contributions.

Currently, 3.75% of the 25% share of CAS is transferred to the accounts of more than 8.1 million Romanians, to the II level of pension insurance.

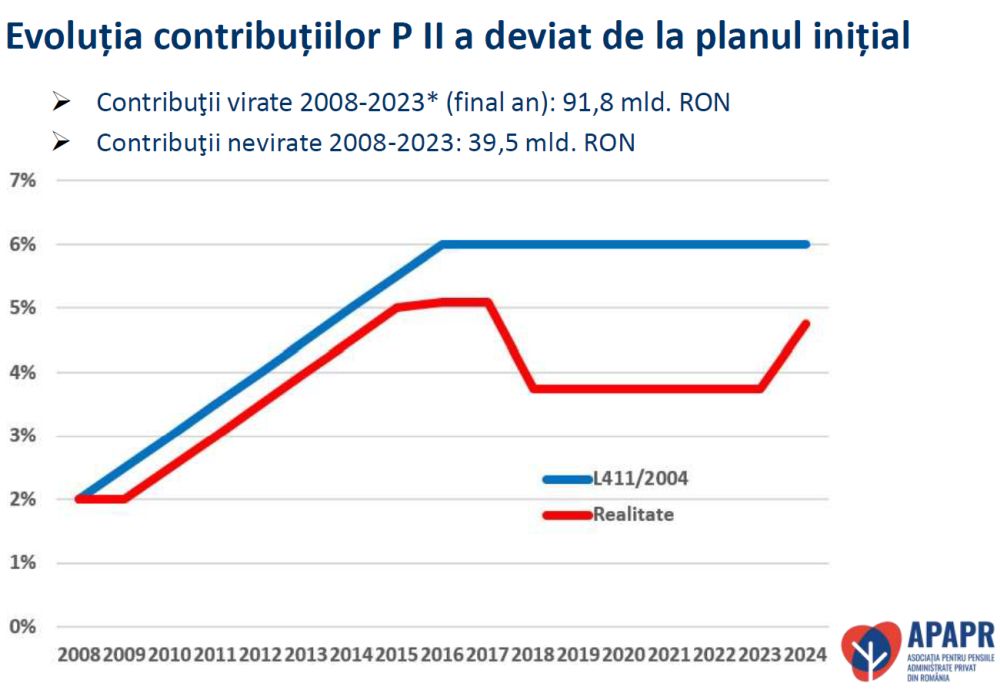

Romanians would have an average of 36% more in their Tier II accounts if the contribution increase calendar were followed

Last month, during an event organized by the BNR on the topic of 15 years of Level II in Romania, pension fund administrators warned that the evolution of contributions does not correspond to the original plan, due to which Level II participants have less money in their accounts.

“There was a spike, followed by a major correction, and now we’re in somewhat of a recovery process. I hope with all my heart that from the beginning of next year we will see this increase from 3.75% to 4.75%, which was legalized by the Government and which is part of the commitments made by Romania in the PNRR”. Krachun told Radu at that time.

- VIEW APAPR’S PRESENTATION ON PRIVATE PENSIONS HERE

The value of the account should have been 36% higher

The APAPR representative also calculated how much money Romanians would have in their accounts if the original plan of contributions, which were to be transferred to the second level of pensions, had been followed.

Hypothetically, a Romanian with an average salary who continuously contributed to Level II between 2008 and 2023 would have an average of 36,000 lei in his account today. If the original contribution calendar had been followed, the accumulated amount would have amounted to 49,000 lei.

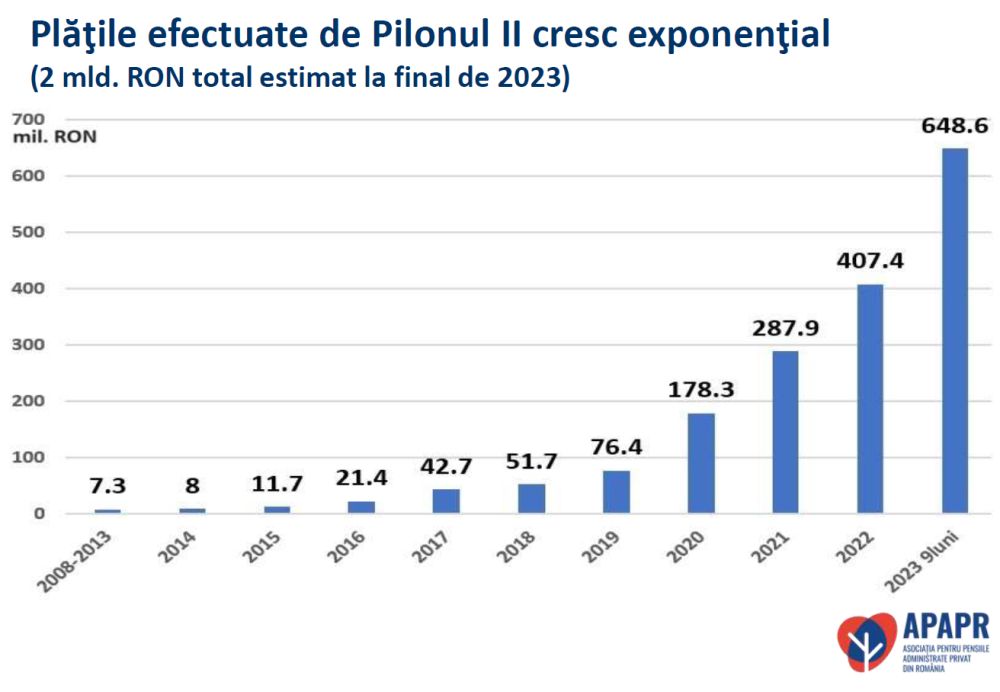

Payments from Level II this year may reach 2 billion lei / In 7-8 years, the decree generation will retire

However, as of September 2023, Pension Tier II has covered more than 8.1 million members over 15 years, of which only 4.1 million members are active.

- “We have 1.7 billion lei of payments in Level II, with a good chance that we will reach the threshold of 2 billion payments this year. From year to year, payments grew exponentially.

- In about 7-8 years, the maternity generation will retire, and this will be an important moment in this evolution with a significant increase in those eligible for a non-state pension. It is all the more important to have a law on the payment of pensions,” Krachun told the Radu.

Tier II pensions reached assets of 117.1 billion lei in September 2023, and net investment income (net of commissions) was 30.3 billion lei.

Photo source: Dreamstime.com

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.