After Russia started a war in Ukraine, some people (investors) got scared: they hid in other types of assets that are considered safer: bank deposits and, in some cases, government securities.

In 2022 and 2023, Romanians lent the state approximately 13 billion lei through Fidelis and approximately 18 billion lei through Tezaur.

However, if you look at the numbers, the stock has performed much better.

There are also Romanians who prefer to keep money in current accounts without generating anything.

The choices you make cost you

Like inflation, a hidden tax, opportunity costs are overlooked by many people because they are also difficult to measure, according to Adrian Angel, investment expert at OTP Asset Management.

This is the cost of our choices: how much the choices we made cost us compared to other choices we could have made.

A very good example, he says, is the behavior of Romanians with their money.

The latest data from the National Bank of Romania show that Romanians had 317 billion lei in their banks in August.

“Here we are talking only about people’s money. Very cute, isn’t it? Well, of these 317 billion lei, 49% of the money is in overnight deposits and current accounts. This money brings a profit close to zero!”,

Only 51% of Romanians’ money is placed in time deposits, and this money is placed, also according to BNR data, at average interest rates of 5-6%.

The inflation rate in September 2023 was 8.83%.

“This is an example of opportunity cost: we put money with a return below the rate of inflation, many even with zero, and it costs less and less,” explains Adrian Angel.

- “It is clear that inflation eats away at our money, we feel it every time we go shopping. And although the balance of “sleeping” money is decreasing, it remains significant. 49% of Romanians’ money is in banks!

What can money do instead of sleep?

According to Adrian Angel, this money could be used to finance new businesses, new investment projects, could be placed in Romanian companies listed on the Bucharest Stock Exchange, or simply safely invested and diversified through investment funds, and thus it could earn a profit higher than inflation.

“They would be attracted to work,” he states.

But at the moment they are producing nothing and that is the opportunity cost of our choice.

What some investors who had money in fixed income bonds lost

Another example given by the expert is the behavior of some investors in funds of fixed income instruments in 2022, who, when the corrections in this area began (after the accelerated increase in interest rates), experienced temporary corrections in these financial instruments.

“Many of them bought out during 2022, preferring the rising interest rates offered by bank deposits,” reminds Angel.

But many of them failed to take into account that these instruments they exited reach maturity, and that at maturity they receive 100% of the money, even if they trade at lower or higher prices during their lifetime.

Those who bought out and went to warehouses did not compensate for the losses

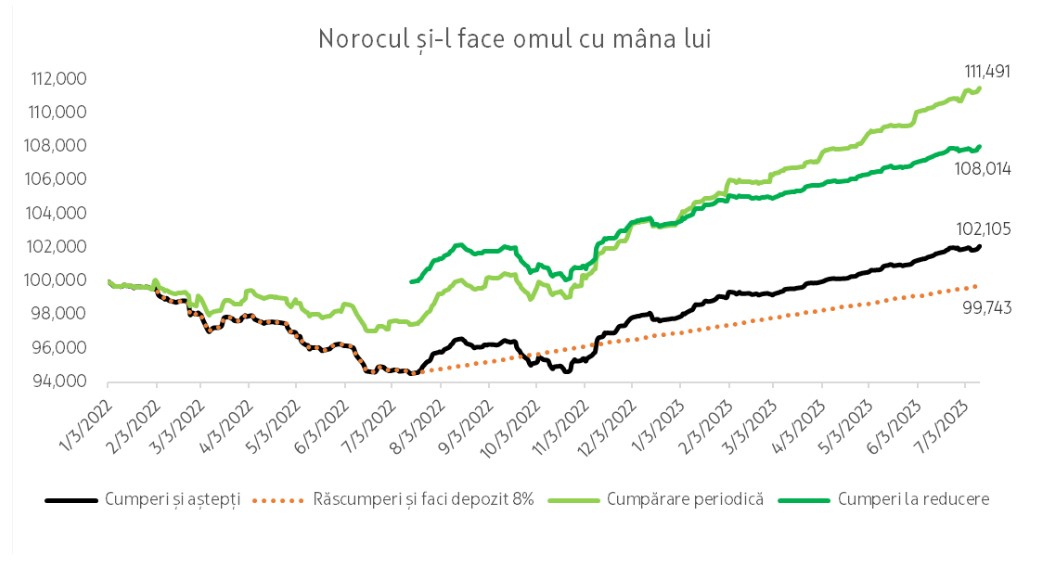

One such example can be seen below: those who bought out and made deposits have yet to recoup their losses even after a year.

“But those who waited fully recouped their losses and also made a small profit,” explains Angel.

What else the chart shows: “those who bought outright a year ago have good returns, while those who have kept their investments and bought periodically have the largest balances.”

Basically, Angel says, it’s the same investment vehicle, different behavior, different results.

“Opportunity cost is the result of our behavior, and it can be significant,” he said.

Photo source: Dreamstime.com

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.