Not only in RCA, but also in the Voluntary Car Insurance (CASCO) market, there is a high degree of concentration, with Omniasig, Groupama and Allianz-Țiriac controlling 75% of revenues from this industry, which grew to 1.6 billion lei in the first half of this year , the latest figures from the Financial Conduct Authority (ASF) show.

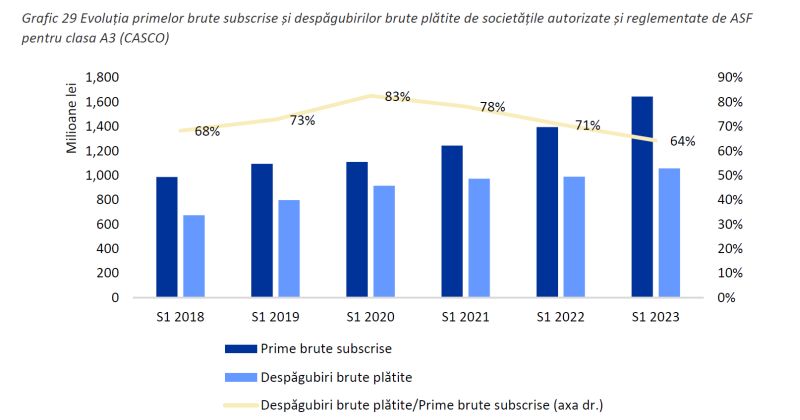

Damage compensation under CASCO – 64% of the total income

Revenues from gross premiums signed by fortune tellers authorized by ASF to sell optional car insurance (CASCO – class A3) amounted to approximately 1.6 billion lei in the first six months of this year, which is 18% more than in the same period last year. government data show.

On the other hand, gross compensations paid for the analyzed period amounted to 1.1 billion lei, which is 7% more than for the same period last year.

As a share of gross premiums, gross claims paid were 64%.

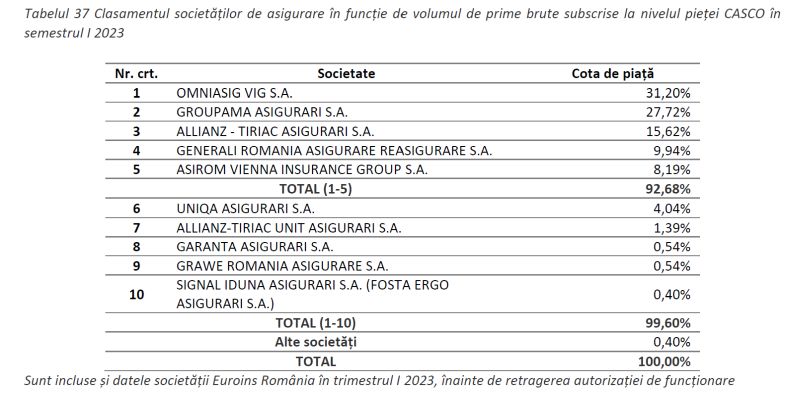

Which insurers earn the most from CASCO

In the statistical report, ASF notes that there is a high degree of concentration in the voluntary car insurance market (CASCO), and not only in the RCA market.

Thus, Omniasig (31.2%), Groupama (27.7%) and Allianz-Țiriac (15.6%) control 75% of revenues from this industry.

Generali (9.94%) and Asirom VIG (8.74%) followed by a margin.

Omniasig VIG announced on Monday that in the first half of this year, it reported a gross premium income of more than 1.1 billion lei, which is about 5% more than in the same period last year, and the total amount of paid claims increased to more than 560 million lei. , the insurer said on Monday.

The biggest revenues came from car insurance, CASCO and RCA, where gross premiums exceeded 770 million lei. The amount of compensations paid under the two lines in the first half of the year cumulatively increased compared to the previous year, the total amount was almost 500 million lei.

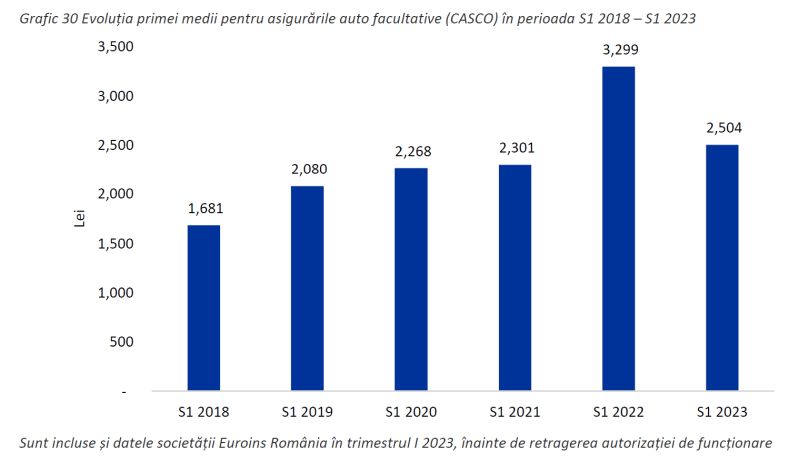

The average price of CASCO insurance decreased to 2,504 lei, while the average amount of compensation increased

The average premium for voluntary car insurance (CASCO), calculated as the value of gross premiums signed by companies authorized and regulated by the ASF, in relation to the number of contracts concluded in the reporting period, was 2,504 lei in the first half of 2023. , which is significantly lower than the level recorded for the same period of the previous year (3,299 lei).

“The average premium in the case of optional insurance differs from that registered in the compulsory vehicle owners’ civil liability insurance (RCA) segment, taking into account the risks covered, as well as the difference between the sums insured, respectively, the different compensation limits between the two products.

There are also significant differences in the volumes registered for the two categories of insurance.

If the number of contracts concluded for optional insurance was about 657 thousand, the number of contracts concluded for RCA by companies authorized and regulated by ASF was much higher, more than 3.7 million, respectively about 3.4 million expressed in annual risk units ( annually) in the first half of 2023 (without taking into account the number of contracts concluded by branches).” explains ASF.

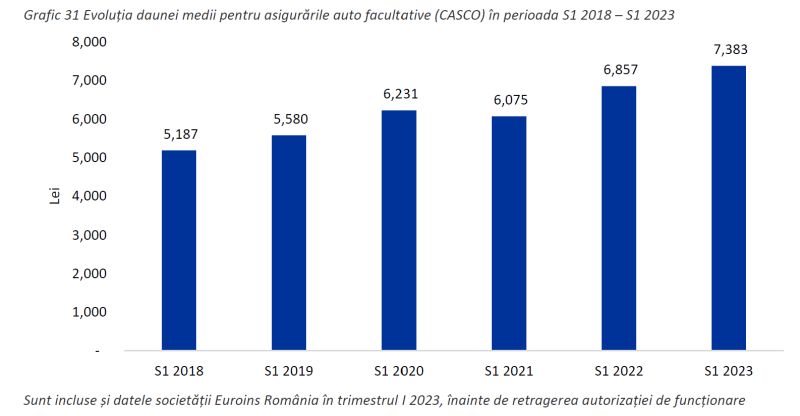

Regarding the average CASCO claim size, an indicator calculated as the ratio between gross compensations paid and the number of liquidated or partially paid claims in the reporting period, it was 7,383 lei in the first half of 2023, an increase of 8% compared to the same period last year.

The two insurers have more than 45% of RCA’s revenues, despite the bankruptcy of Euroins

The degree of concentration in the RCA market remained high even after the first half of this year, with Groupama and Allianz-Țiriac amassing 45.6% of revenue, while Euroins, which was left without a license in March, had 14.1%. %, according to ASF data. In the entire market as a whole, on June 30, 2023, the first average RCA was 1,190 lei, which is 3% more compared to the same semester last year.

- Read more: Two insurers own more than 45% of RCA revenues despite Euroins bankruptcy / Prices up 3% on average in first six months

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.