The degree of concentration in the RCA market remained high even after the first half of this year, with Groupama and Allianz-Țiriac amassing 45.6% of revenue, while Euroins, which was left without a license in March, had 14.1%. %, according to ASF data. In the entire market as a whole, on June 30, 2023, the first average RCA was 1,190 lei, which is 3% more than in the same semester last year.

- “The degree of concentration remained high for the first leading insurers in the first half of 2023, so that the first 3 insurance companies (excluding Euroins, which entered bankruptcy proceedings) accumulated approximately 60% of RCA’s insurance portfolio in Romania.

- However, there is a decrease in the degree of concentration compared to previous periods, taking into account the dynamics of subscriptions of branches present in the local market, which had a cumulative share of 13.1% in the first half of 2023.” this is shown in the latter a report published by the Financial Conduct Authority (ASF).

RCA’s best insurers for the first half of 2023

On June 30, 2023, there were six insurers authorized by the ASF for RCA insurance activities operating on the insurance market: Allianz-Ţiriac, Asirom VIG, Generali, Grawe, Groupama and Omniasig VIG.

On the RCA market in Romania, there are two branches operating by right of foundation: Axeria IARD and Hellas Direct.

The Axeria Iard branch started operations in the RCA market during the fourth quarter of 2021 and recorded a volume of gross premiums written for RCA of approximately 339 million lei in the first six months of 2023, representing 7.3% of total premiums written. for this segment.

In addition, Hellas Direct entered Romania’s RCA segment on a Right of Establishment (FoE) basis in late 2022, accumulating over 267 million lei in gross written premiums (5.8% of the RCA market) in the first half of 2023.

RCA’s revenues increased by 3% to 4.6 billion lei

The total value of insurance premiums written for RCA insurance by companies authorized and regulated by the ASF was approximately 4 billion lei in the first half of 2023, the remainder to the total amount of class A10 represents the carrier’s insurance for goods transported as a carrier and RCA insurances taken out on the territory other EU member states on the basis of the right to provide services free of charge.

Compared to the same period last year, the value of gross premiums written by companies authorized and regulated by the ASF decreased by approximately 6%. The volume of gross premiums written by companies authorized and regulated by the ASF decreased in the context of the expansion of the activities of the two branches practicing RCA insurance in the territory of Romania.

Thus, if we also include the activity carried out by branches, the volume of gross premiums signed in the first half of 2023 amounted to 4.6 billion lei, an increase of approximately 3% compared to the volume of subscriptions related to the first 6 months of 2022 ( 4.5 billion lei, including branches), reports ASF.

RCA’s average premium rose 3% in the first six months of 2023

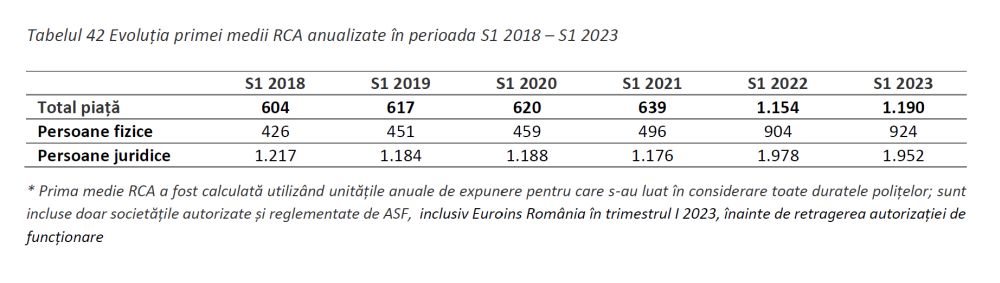

In the entire market as a whole, on June 30, 2023, the first annual average RCA was about 1,190 lei, which is 3% more compared to the first half of 2022, respectively 86% compared to the first half of 2021.

In the case of individuals, the first average RCA was 924 lei in the first half of this year, compared to 904 lei for the same period in 2022.

In the case of legal entities, the first average RCA was 1,952 lei, slightly down from 1,978 lei in the same quarter last year.

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.