The National Consumer Price Index (NCPI) is a measure of national inflation. It differs from the CPI only in that it has a different weight. Indeed, the IPCN weighting is based on the final consumption expenditure of residents of the national territory, while the HIPC takes into account the expenditure of both residents and non-residents.

What did the Luxembourg authorities do to stop the rise in prices

Last year, inflation in Luxembourg exceeded 9%. In Luxembourg, however, there is a law on the automatic indexation of salaries (public and private) and pensions according to the level of inflation, the government’s intention is to preserve the purchasing power of the population.

First introduced for some categories of workers in the 1920s, the choice was gradually extended to more categories of workers, and its application became universal in 1975. Since then, the system has remained in place and has become the cornerstone of market work. Similar systems existed in many European countries, particularly in the 1980s, but have since been either abolished or reformed.

Automatic indexation applies to wages in both the private and public sectors, with the exception of employees posted to Luxembourg. Many social benefits are also automatically indexed to inflation, especially family benefits (allocations familiales).

Such indexation has been consistently applied during periods of uncertainty or economic downturn

Until 2005, contributions were paid in the month following the month in which inflation exceeded the established threshold.

In addition, the structure of the consumer basket is different for Luxembourgers. The share of food consumption is 3 times lower than in Romania, and the share of meat is even 4 times lower.

That’s right, they calculate how much the price of car tires or city parking lots, flowers or pets has risen. See their weight in the shopping cart here.

Other factors that contributed to the decrease in inflation in Luxembourg

Temporary reduction in the VAT rate: In September 2022, the Luxembourg government introduced temporary measures to combat inflation, including a reduction in value added tax (VAT) rates on goods and services. This measure was aimed at easing price pressure and supporting consumer spending.

Factors such as high labor productivity, labor supply, and economic growth can help keep inflation rates lower.

The country’s strong economic performance and prudent fiscal policy can help keep inflation levels low.

In October 2022, the governor of the Banque centrale du Luxembourg appeared on radio in an interview and announced that interest rate increases would be used to reduce lending and fight inflation.

In June 2023, the national consumer price index calculated by STATEC increased by 0.3% compared to the previous month. STATEC explains this increase in the prices of petroleum products and the increase in the prices of some tourist services. Prices without petroleum products increased by 0.2%.

At gas stations, drivers had to pay 1.8% more for a full tank of gasoline and 2.7% more for a full tank of diesel.

In addition to oil products, tourism services contributed to inflation in June 2023. With the beginning of the summer season and the approach of the school holidays, prices for service packages and air tickets increased by 7.7%.

Food prices continued the upward trend that began in October 2021, increasing by another 0.2% for the month. Fresh fish (+3.2%), olive oil (+4.1%) and potatoes (+1.8%) saw the biggest month-on-month growth in Luxembourg, according to statistics. Prices for fresh vegetables are falling, their statistical office also reports.

Plants and flowers fell in price by 3.7%, men’s clothing by 0.4%, and in the services sector, children’s and hotel rooms fell in price.

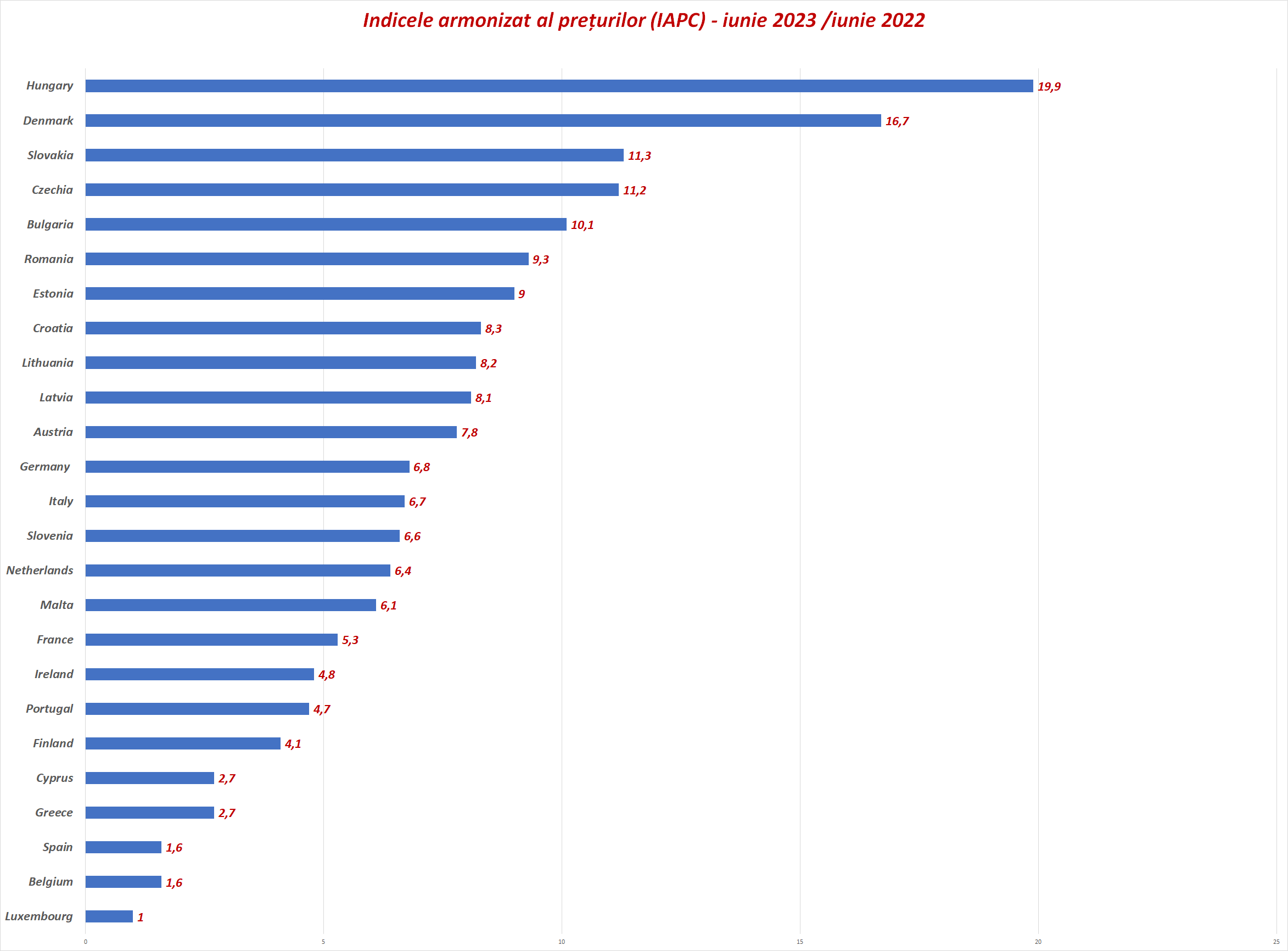

Below is the European inflation chart (calculated based on HICP)

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.