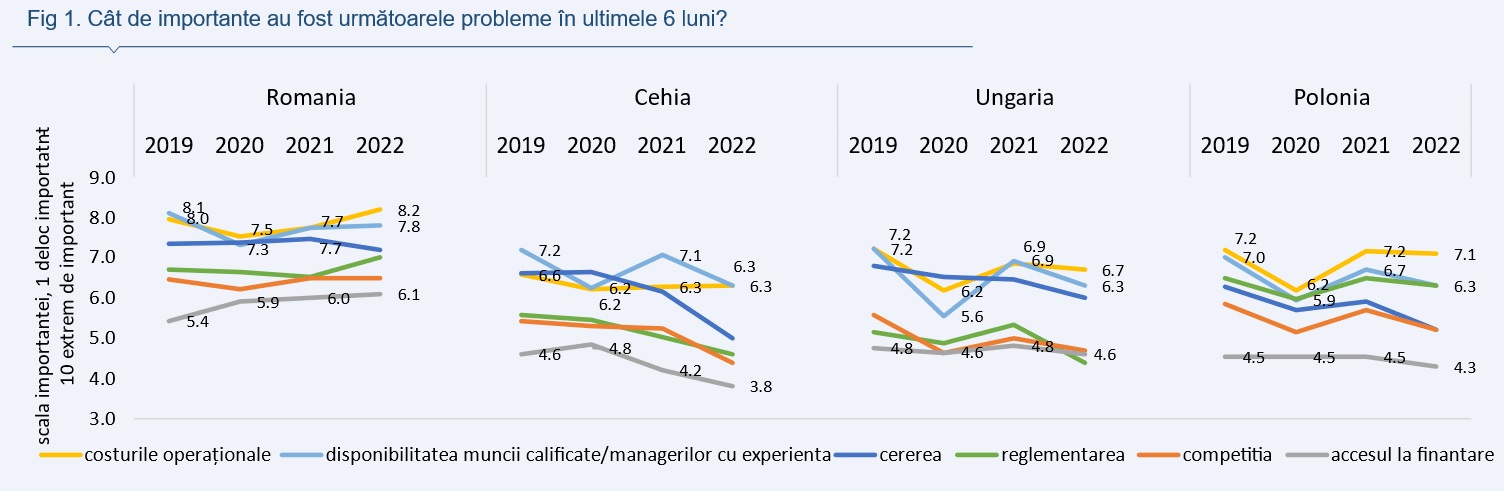

According to an analysis by Alpha Bank Chief Economist Ella Callai, in 2022 operating costs will become the most important issue for SMEs in Romania, surpassing difficulties in the availability of skilled labor, demand, regulation, competition and access to finance.

In Romania, Hungary and Poland, the issue of operating costs became more important than the issue of finding skilled labor, while in the Czech Republic both issues were rated as equally important. It should be noted that in Romania all problems are assessed as more important than in other countries of the region (Fig. 1). Access to finance, as in other countries, is considered to be the least important issue in 2022 as well.

The European Commission monitors SMEs’ access to finance through the SAFE survey (Survey on Access to Finance for Enterprises), which is carried out in partnership with the European Central Bank between September and October each year. Below we present some of the responses received from the last four surveys.

The most relevant sources of financing for SMEs are credit lines/overdraft/card overdraft in Romania and the Czech Republic, leasing in Poland and grants in Hungary (Fig. 2). In Romania, all sources of financing except factoring, securities and issued shares have become relevant for more SMEs in 2022. In the Czech Republic, internal sources of financing and commercial credit have become more relevant, in Hungary grants and credit lines have replaced leasing, and in Poland leasing and credit lines are the most important sources of financing.

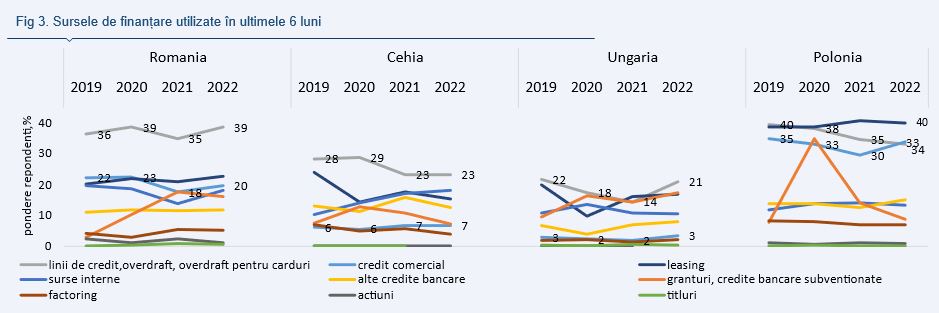

In the 2-3 quarters of 2022, the most used sources of financing remained the credit line/overdraft/card overdraft in Romania, the Czech Republic and Hungary and leasing in Poland (Fig. 3). 39% of companies in Romania, 23% of companies in the Czech Republic, 21% of companies in Hungary and 40% of companies in Poland resorted to these sources of financing.

In 2022, compared to 2021, SMEs used more internal sources, trade credit and leasing in Romania, credit lines and grants in Hungary, internal sources in the Czech Republic, trade credit in Poland. Commercial credit is the third most common source of financing in Romania, used by 20% and 18% of SMEs in 2022 and 2021, respectively. In Poland, commercial credit became widespread in 2022 and became the second most common source of financing, used by 34% of SMEs. In the Czech Republic and Hungary, this source of financing is used little (only 7% and 3% of companies, respectively).

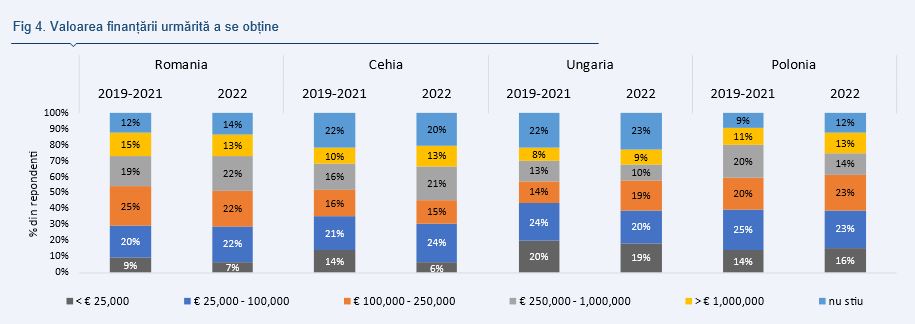

In 2022, as in previous years, in Romania, the majority of small and medium-sized enterprises (66%) wanted the amount of external financing from EUR 25,000 to EUR 1 million, while companies were equally distributed between intermediate tranches of EUR 25,000 – EUR 100,000 . euros, 100 – 250 thousand euros. thousand euros and 250 thousand -1 million euros (Fig. 4). These volumes were desired to a lesser extent in other countries: 49% of firms in Hungary and 60% of firms in the Czech Republic and Poland. In Romania and the Czech Republic, in contrast to Hungary and Poland, relatively few companies are willing to receive small financing (up to €25,000): 7% of companies in Romania and 6% of companies in the Czech Republic compared to 19% of companies in Hungary and 16% in Poland.

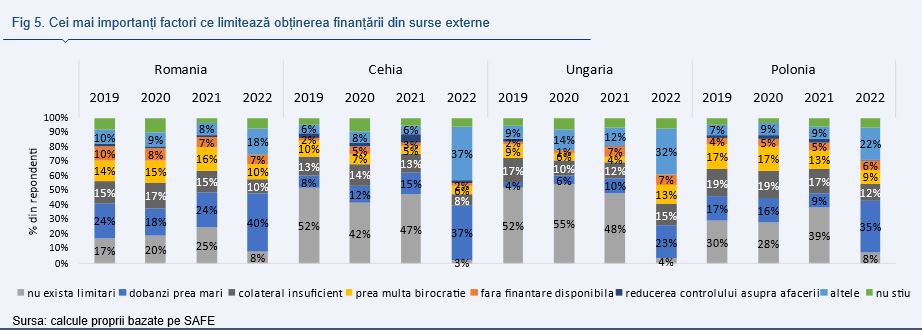

The share of companies without restrictions on obtaining financing from external sources doubled in Romania and Poland compared to Hungary and the Czech Republic, although the share of these companies fell sharply in 2022 in all countries. For the majority of companies in Romania (40%), the Czech Republic (37%), Poland (35%), and Hungary (23%), the main obstacle to obtaining financing from external sources was the cost of financing (Fig. 5). . However, exclusion from financing did not worsen, the share of companies without available financing remained at the level of the previous year and only in Romania it was below the pre-pandemic level.

Source: Hot News

Lori Barajas is an accomplished journalist, known for her insightful and thought-provoking writing on economy. She currently works as a writer at 247 news reel. With a passion for understanding the economy, Lori’s writing delves deep into the financial issues that matter most, providing readers with a unique perspective on current events.