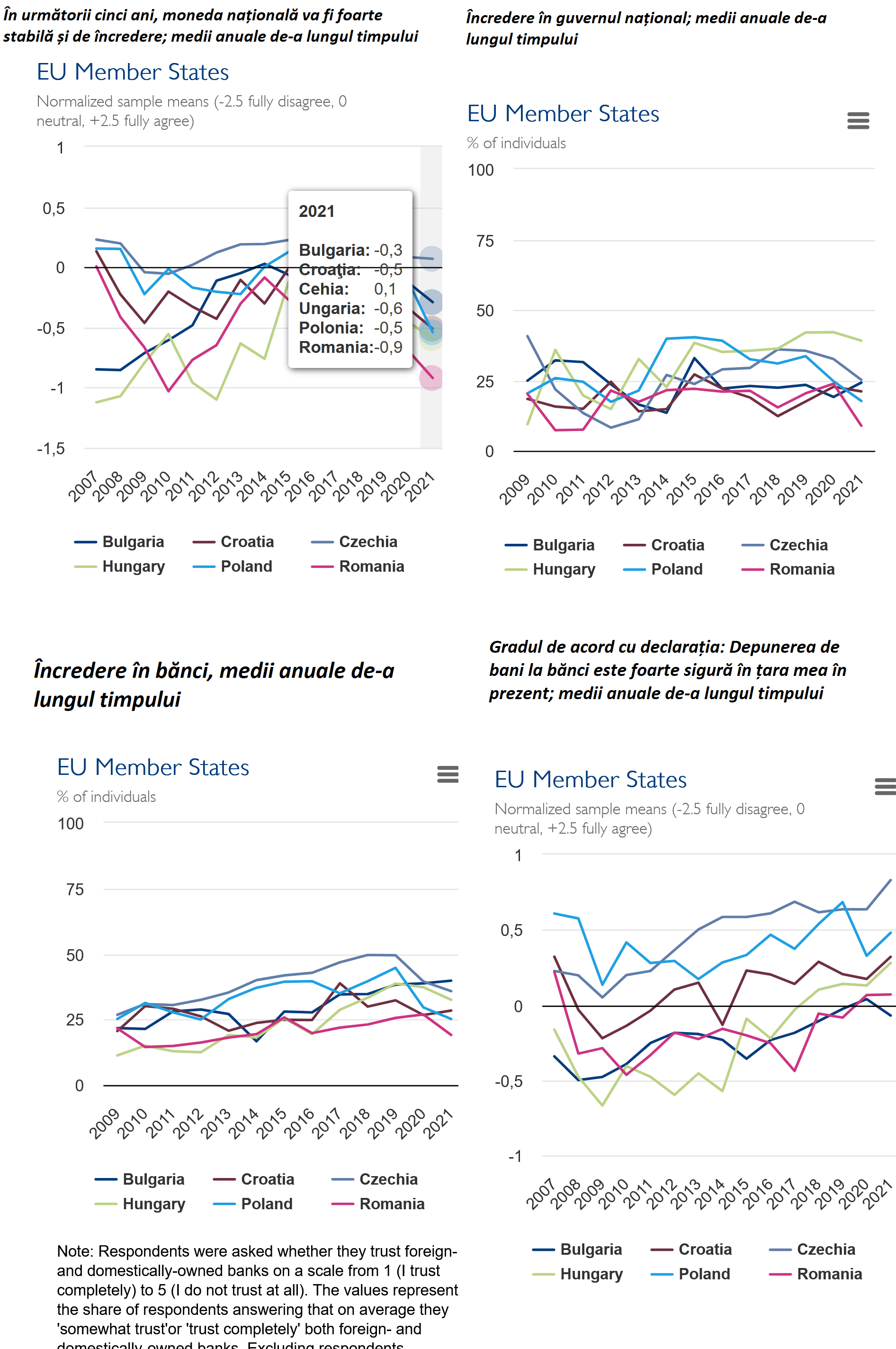

Romania is the worst in terms of trust in the national currency of the 10 countries in the region surveyed in a survey conducted by the Austrian National Bank (OeNB), consulted by HotNews. We also have the least trust in the government, as well as local banks.

As for the security of bank deposits, the Bulgarians are inferior to us in terms of trust. Although there is no doubt that bank deposits in Romania are not safe, the opinion created against the unstable level of financial knowledge of the respondents, our country is in the last places in terms of financial education, also shows the survey conducted by the National Bank of Austria.

The survey is a very good source of information on foreign currency deposits and loans of individuals across the region, allowing comparisons not only between countries, but also between socio-demographic groups.

The OeNB regularly surveys private individuals in the CESEE: The OeNB Euro Survey collects unique information on cash (euro), savings behavior and debt, and analyzes respondents’ opinions, expectations and economic experience.

The OeNB Euro Survey is currently being conducted in the following ten countries:

- 6 EU countries: Bulgaria, Czech Republic, Croatia, Hungary, Poland, Romania

- 4 non-EU countries: Albania, Bosnia and Herzegovina, North Macedonia, Serbia

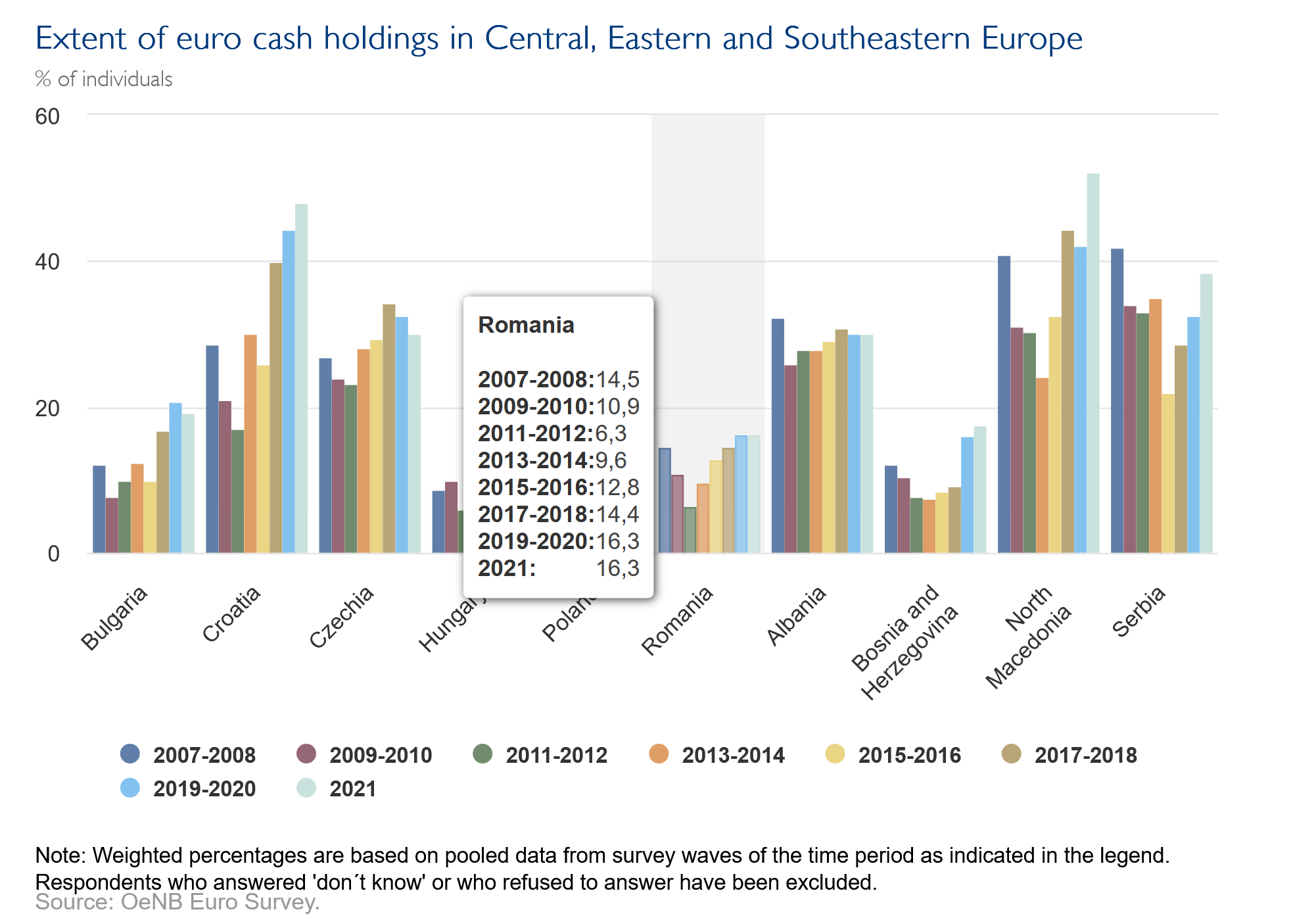

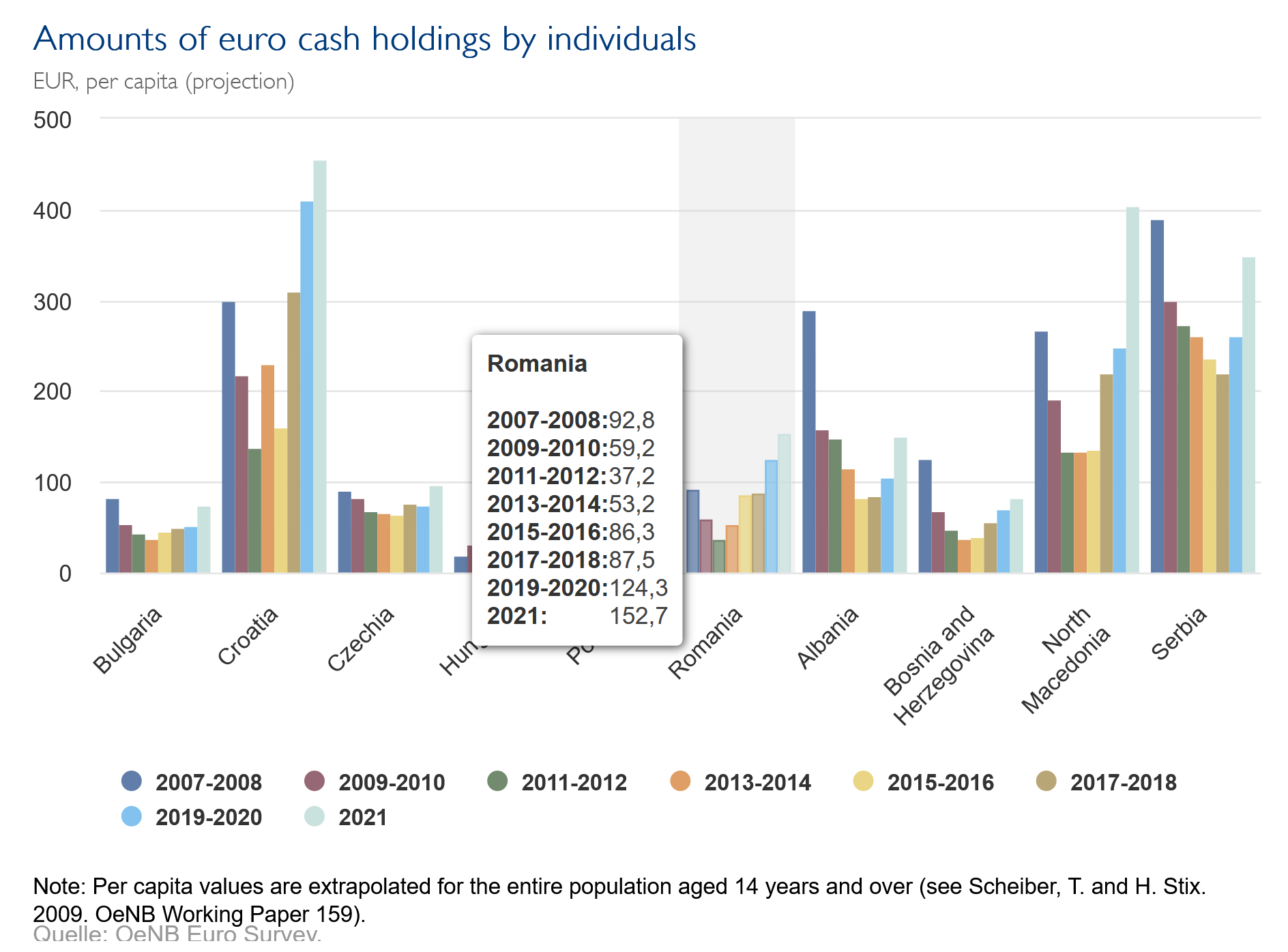

Cash holdings in euros (Euroization of assets)

One aspect of asset euroization is the use of cash foreign currency as a safe deposit or secondary means of payment. A study by the National Bank of Austria provides unique direct evidence of foreign currency cash holdings.

The three main findings of the OeNB’s Euro Review on euro cash:

- First, the proportion of respondents holding cash in a currency other than their national currency is significant in some countries in the region and varies considerably between countries.

- Second, the euro appears to be more reliable than local currencies in some cases.

- Third, especially in the countries of South-Eastern Europe, the share of those who preferred the euro was higher 20 years ago, then a period of mistrust passed, after which this share began to grow again.

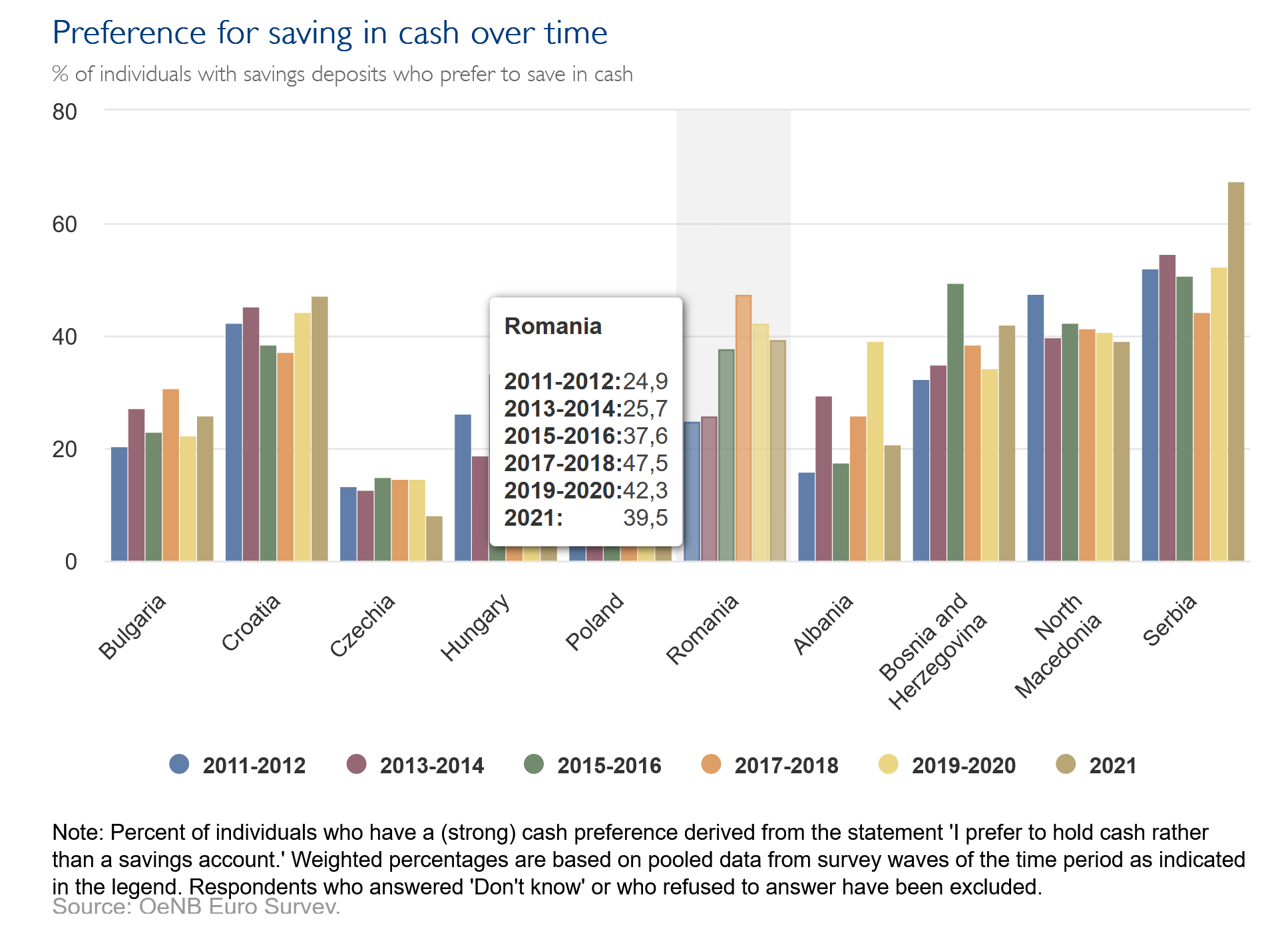

Cash preferred

Over the past 20 years, the proportion of Romanians who prefer to keep cash rather than put money in banks has changed in different ways. In the period 2011-2018, it grew steadily, after which it began to decrease somewhat.

Looking deeper into the cash preference phenomenon, the Austrians show that a lack of trust in the banking system is a key factor that explains people’s preference for keeping cash rather than depositing it in banks. Remembering past banking crises reinforces this effect.

In addition, the perception of weak public institutions, such as low quality law enforcement or even tax collection, as well as low bank penetration are significant factors that explain the strong preference for cash. Another interesting conclusion of the OeNB is that the preference for cash is stronger in countries with euroized economies.

Confidence in the lei, in banks and the government

Romania has the worst level of trust in the national currency of all the countries participating in the survey of the Bank of Austria. We also have the least trust in the government, as well as local banks. As for the security of bank deposits, the Bulgarians are inferior to us in terms of trust. Despite the fact that bank deposits in Romania are not safe, there is no doubt that, against the background of the unstable level of financial knowledge of the respondents, our country is in the last places in terms of financial education.

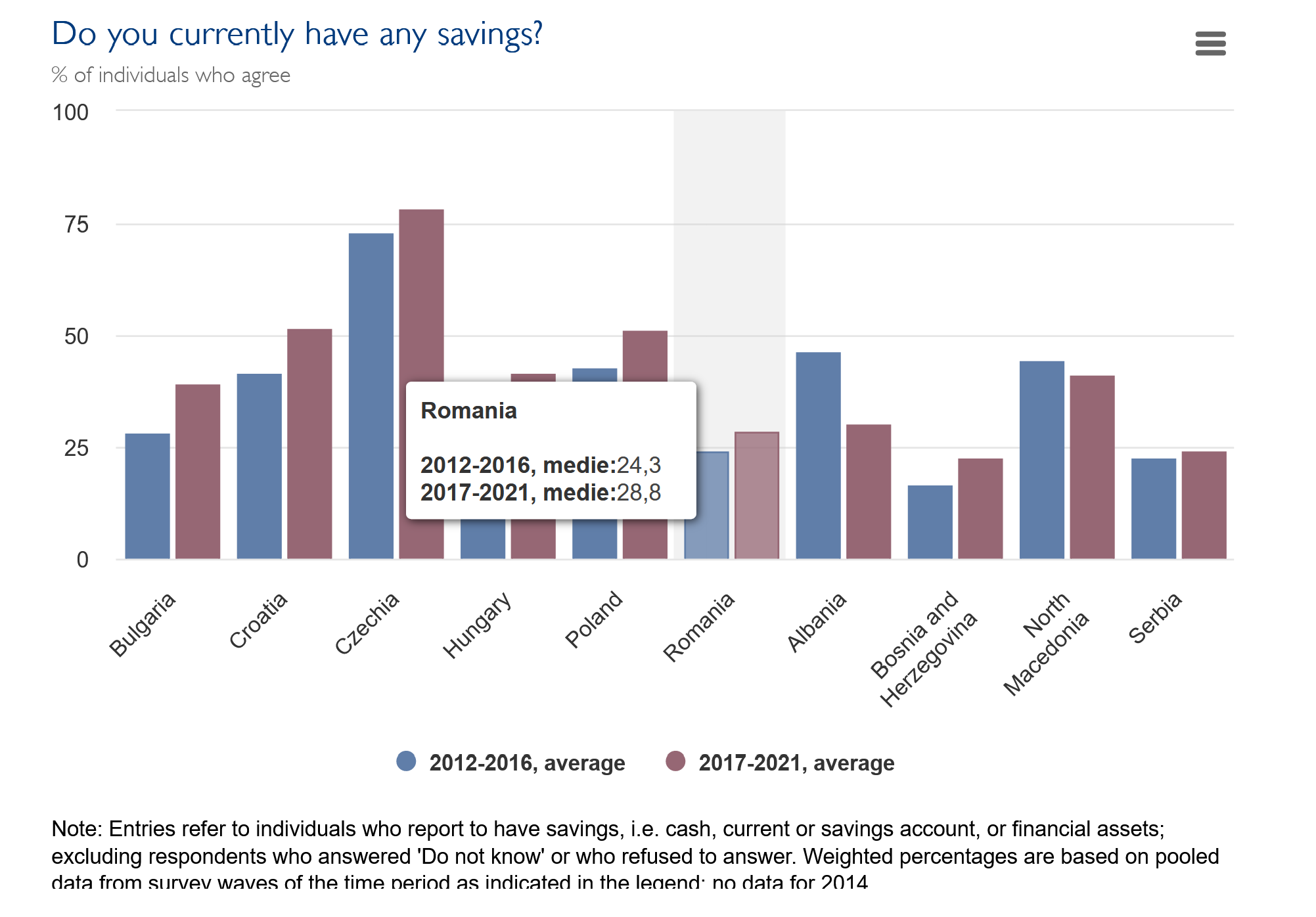

Below is the answer to the question: do you currently have savings (in cash or in banks).

In 2007-2008, cash savings were common in the countries analyzed by the OeNB. Half of the population did not have a bank account or a savings account at that time. Although financial availability has increased since 2007-2008, at the 2020-2021 level, less than half of respondents confirmed that they have savings, i.e. cash, deposits or other financial assets.

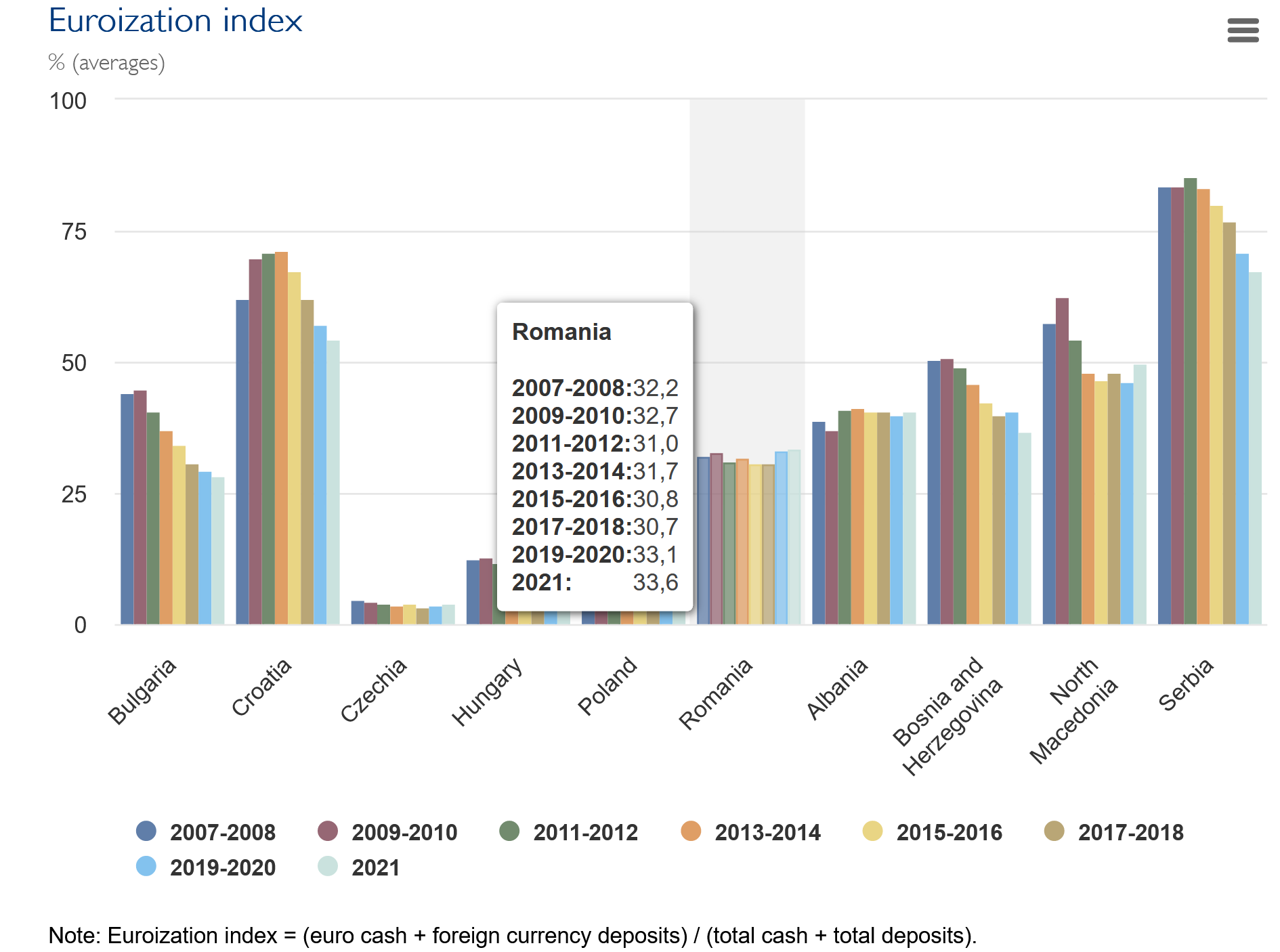

Euroization index (ratio between cash plus deposits in euros and total cash plus deposits in banks – average annual values)

Combining micro-data from the OeNB’s Euro Survey on cash in euros and macro-data on household deposits in foreign currency allows researchers to get an overall picture of the degree of euroization in the economies under study.

This indicator is calculated as the sum of euro cash per capita and foreign currency deposits per capita compared to the total sum of cash per capita and bank deposits. The euroization index turned out to be quite stable, which indicates that the stability of individual saving behavior is high.

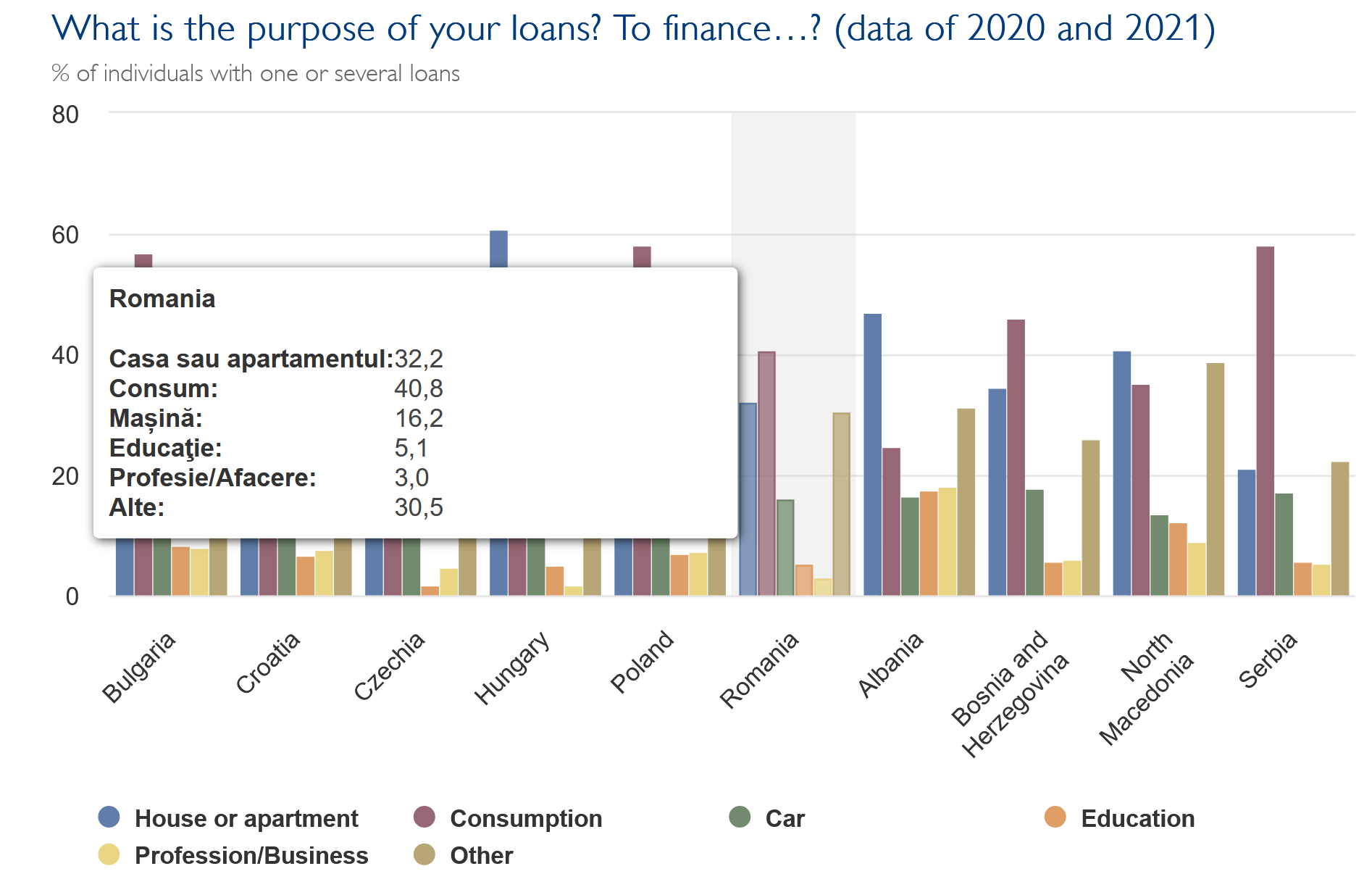

Why do we borrow in euros? Most Romanians do it for consumption, then for home

In Central, Eastern and South-Eastern Europe (CESEE) the use of foreign currencies in general and the euro in particular is widespread.

In Romania, the majority takes loans in euros for consumption (40%). Only then come those who buy housing, and the car takes the third place in terms of the preference for loans in euros.

Photo source: © Vlad Ispas | Dreamstime.com

Source: Hot News

Ashley Bailey is a talented author and journalist known for her writing on trending topics. Currently working at 247 news reel, she brings readers fresh perspectives on current issues. With her well-researched and thought-provoking articles, she captures the zeitgeist and stays ahead of the latest trends. Ashley’s writing is a must-read for anyone interested in staying up-to-date with the latest developments.