After the banks eased the lending standards of the population for loans for the purchase of housing or land in the fall, the easing should be maintained in the next 3 months, the National Bank said in a message.

The main factor contributing to the softening of lending standards in this segment was the increase in competition in the banking sector, the quoted report says.

In the case of companies, credit risk has increased for 8 out of 10 assessed economic sectors, the most risky, moreover, being the energy sector. Banks reported an increase in demand for loans from the public, both for the main categories of loans, mortgages, and for consumption, with the expectation of further growth in demand for loans in the coming months.

This winter, banks are forecasting continued maintenance of lending standards for mortgage loans and easing of consumer standards, although lending institutions in the eurozone reported tightening lending standards for loans granted to households, the degree of tightening is much higher than previous expectations.

The main drivers of the increase in both housing and consumer loans were increased risk perception and lower risk tolerance of banks. The decline in loan demand was stronger than expected for both housing and consumer loans.

In the fourth quarter of 2023, eurozone banks expect credit standards for home loans to remain largely unchanged, while standards for consumer loans are expected to tighten further.

The household debt ratio (DSTI) declined modestly to 34 percent (-7 percentage points) for new loans in 3Q2023, and remained unchanged at 42 percent for total loans.

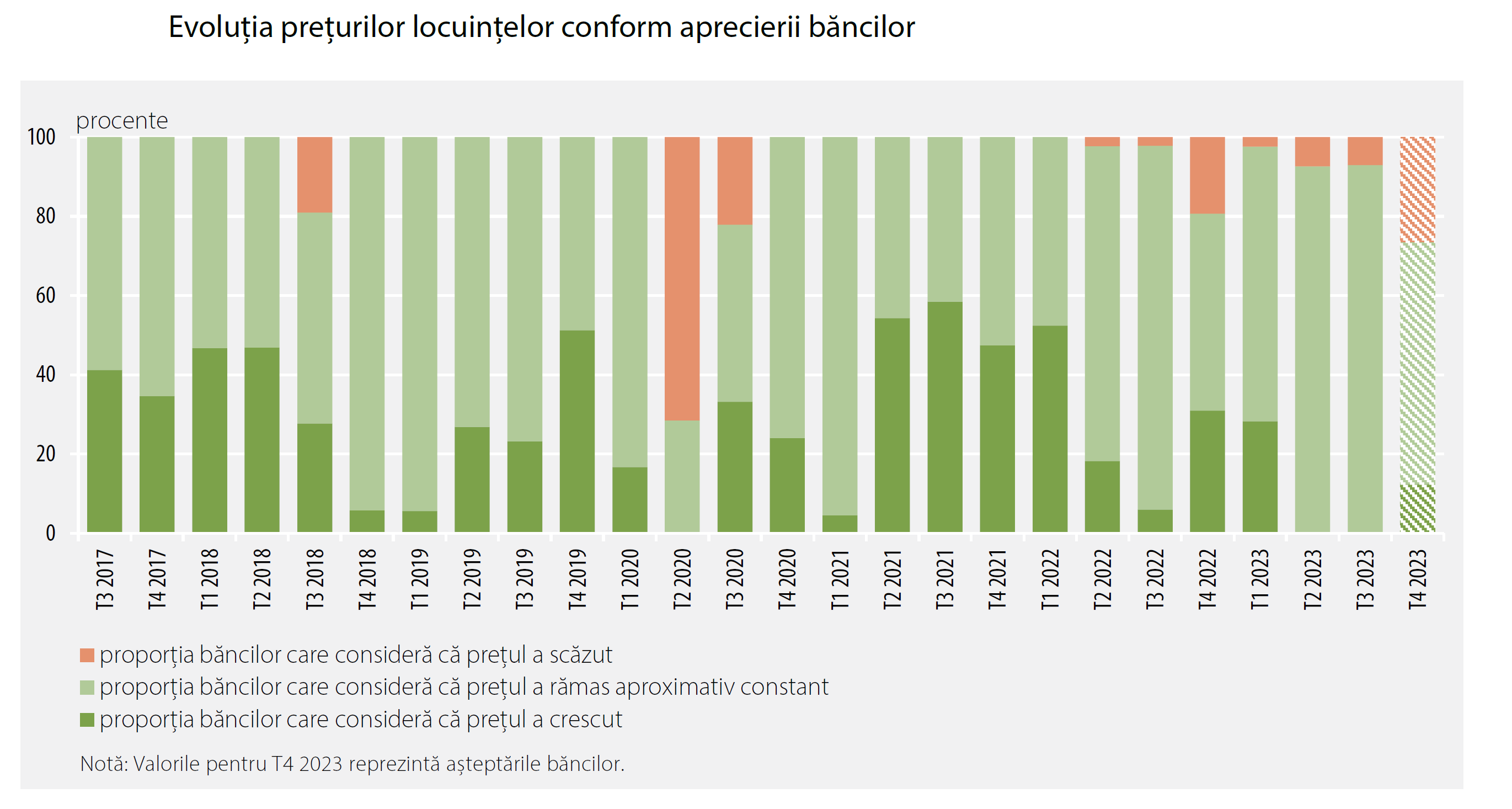

Evolution of mortgage demand and housing prices

According to the majority of banks (93 percent), the price per square meter of housing remained roughly unchanged in the 3rd quarter of 2023, while 7 percent reported a slight decrease, as in the previous quarter. In the 4th quarter of 2023, 61.2 percent of respondents predict almost unchanged prices, 26.5 percent predict some decline, and 12.3 percent predict a relatively moderate increase

Demand for housing and land loans increased significantly (35 percent net), and responding banks expect this trend to continue next quarter, but to a lesser extent.

The share of loans requested and rejected by banking institutions decreased moderately for loans intended for the purchase of housing (-6.4 percent net).

According to the respondent institutions, demand for consumer loans increased significantly (27 percent net) against the background of significant growth in demand in the segments of consumer loans with and without mortgages. Credit cards were requested to a lesser extent. In the fourth quarter of 2023, banks expect an increase in demand for all categories of consumer loans, in particular for the non-mortgage component and credit cards.

The NBR survey is conducted quarterly in January, April, July and October. It is based on a questionnaire (published as part of the analysis in May 2008) which is sent to the top 10 banks, selected according to the market share of lending to companies and households. These institutions account for approximately 80 percent of lending to these sectors.

The questionnaire consists of two sections, clearly following the characteristics of credit (A) to non-financial companies and (B) to the population. The questions relate to banks’ views on evolution:

- lending standards (internal norms or lending criteria that govern the credit policy of credit institutions);

- lending conditions (specific obligations agreed by the creditor and the debtor in the concluded credit agreement, for example: interest rate, collateral, repayment period, etc.);

- risks associated with lending;

- credit application;

- other details specific to lending (expectations regarding the average price per square meter of housing, the share of debt service in household income, the share of the loan in the value of the mortgage guarantee, etc.).

The answers to the questions are analyzed in terms of net interest (current balance). For questions about lending standards, the net percentage is the difference between the percentage of banks that reported tightening standards and the percentage of banks that reported loosening.

A positive net interest rate indicates that a greater proportion of banks have tightened lending standards, while a negative net interest rate means that a greater proportion of banks have relaxed lending standards.

In the case of questions related to credit demand, the net percentage is the difference between the percentage of banks that reported an increase in credit demand and the percentage of banks that reported a decrease.

A positive net percentage indicates that a greater proportion of banks reported an increase in loan demand, while a negative net percentage means that a greater proportion of banks reported a decrease in loan demand.

The net percentage is calculated taking into account the market share of the respondent banks. Thoughts refer to the development of the last three months, and expectations refer to the next three months.

Source: Hot News

Ashley Bailey is a talented author and journalist known for her writing on trending topics. Currently working at 247 news reel, she brings readers fresh perspectives on current issues. With her well-researched and thought-provoking articles, she captures the zeitgeist and stays ahead of the latest trends. Ashley’s writing is a must-read for anyone interested in staying up-to-date with the latest developments.