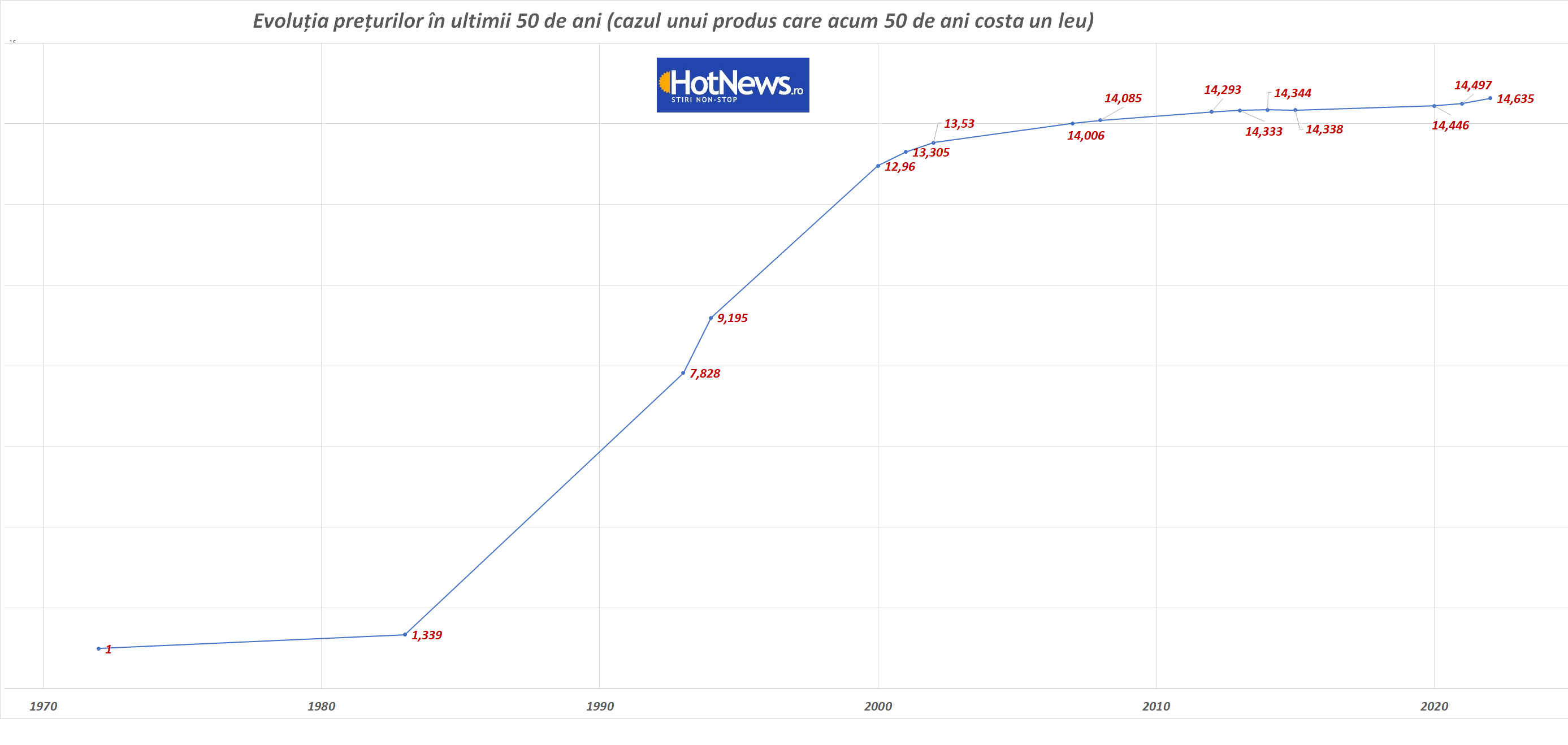

This year, inflation has fallen from over 15% in February to 6.7% in November 2023, which is great news, if a bit misleading. Because a decrease in inflation does not mean a decrease in prices, but only a slowdown in their growth. A product that cost one lei 50 years ago would cost around 15 lei in November 2023.

Prices are still rising. Whether it’s food, clothing, or phone service, everything continues to rise in price, which means the lei on your card or in your pockets are buying fewer and fewer things. Practically in the last 50 years, only two years have Romania had a period of deflation (negative inflation associated with falling prices – this was in 2015 and 2016).

No matter how you measure it, inflation is ubiquitous in the economy. Sometimes you feel it directly, sometimes it comes subtly, but it always erodes your purchasing power, reducing the value of money.

And the future does not necessarily bring good news. Costs associated with the transition to clean energy, climate change, rising military spending and labor shortages may keep prices high for some time.

Inflation – “the most insidious tax” or “hidden tax”

Both definitions are correct. Inflation is often called “the most insidious tax” because most people don’t notice its effects. Hypothetically, paying 4% interest on a bank deposit at a time when inflation is 7% makes many people feel 4% richer. In fact, they are 3% poorer.

What we do know for sure is that inflation is not going away anytime soon. What you can do is simply protect yourself so that price increases affect you as little as possible.

It’s hard to say what to invest in to protect against rising prices. Some recommend gold, others real estate, and still others investments in the capital market.

It may sound interesting, but the best way to protect yourself from inflation is to invest in yourself

By far the best investment you can make is investing in yourself. One that will help you through the tough times that may come your way.

This investment starts with quality education and continues with keeping skills up-to-date and acquiring new skills needed in the near future. Being able to stay abreast of the changing needs of society can help you not only protect your salary, but also protect your career in the event of a crisis.

The bad thing is that in Romania, less than 15% of the population aged 18-69 searched for information during the last 12 months about the possibility of attending courses in an educational institution in the education system or participating in informal shows. INS research.

You can protect yourself from inflation either by carefully monitoring your expenses or by trying to increase your income.

Review your expenses

Cut back on discretionary spending, those that aren’t really necessary, even if they make you think they are. Cut your entertainment budgets by just 5% and see if it’s still as good.

If it’s a big purchase you’re targeting (a car or equipment like PV panels), you should make a purchase decision as prices are likely to increase. In housing, a little patience will not hurt.

If possible, rearrange your subscriptions: cable, telephone. I know people who call phone companies year after year to ask what is the best plan they can get. And he moves from one company to another without emotions, if he saves even 20 lei per month.

Reduce the number of your subscriptions if you are not using them all to their full potential. Do an “audit” of these subscriptions from time to time, at least to see if sometimes they go up in price and the price increase just shows up on your card, without notification

In terms of returns, look for banks that offer higher interest rates than you currently have. Invest in government programs like Fidelis or the Junior Centenary account.

Inflation is not the same for everyone. And three out of 10 Romanians do not even believe that inflation will ever return to normal

According to the latest data, inflation decreased to an average of 6.72%. But the country’s inflation rate is unlikely to be your personal inflation rate. If you are a foodie, you experience it differently than a vegetarian. Inflation also affects people with low incomes more than the rich. Someone living on minimum wage has to make an important choice when standing in front of a store shelf.

It is important to protect yourself from inflation and know that prices will not fall anytime soon. In fact, three out of 10 Romanians do not even believe that inflation will ever return to normal

Source: Hot News

Ashley Bailey is a talented author and journalist known for her writing on trending topics. Currently working at 247 news reel, she brings readers fresh perspectives on current issues. With her well-researched and thought-provoking articles, she captures the zeitgeist and stays ahead of the latest trends. Ashley’s writing is a must-read for anyone interested in staying up-to-date with the latest developments.