According to official statistics, global remittances will reach a record of around $650 billion in 2022, and that’s just the amounts sent through official channels, not counting money sent through rogue bus drivers. Egypt’s revenue exceeds that of the Suez Canal; in Sri Lanka they exceed tea exports; and in Morocco remittances are higher than tourism income.

India is the largest recipient in the world. In 2022, it became the first country to receive more than $100 billion in annual remittances. Mexico, China and the Philippines are also big beneficiaries. For small or conflict-ridden countries, these transfers are vital.

In times of crisis, remittances are a financial lifeline. Migrant workers typically increase the amount they send home after a natural disaster, say to help affected relatives buy food or pay for shelter.

The United States is the largest source of remittances, especially for Latin America and the Caribbean. The Gulf countries are the second largest source of remittances in US dollar terms, but by far the largest when remittances are measured as a share of their GDP. The share of foreign workers in the Persian Gulf often exceeds 70 percent of the population. Saudi Arabia and the United Arab Emirates are large sources of remittances for South Asia, North Africa and Southeast Asia.

Sending money is often expensive. According to the World Bank, customers must pay an average of $12.50 when they send $200 to a low- or middle-income country. This represents 6.3% of the deal and is more than double the target set by the UN Sustainable Development Goals.

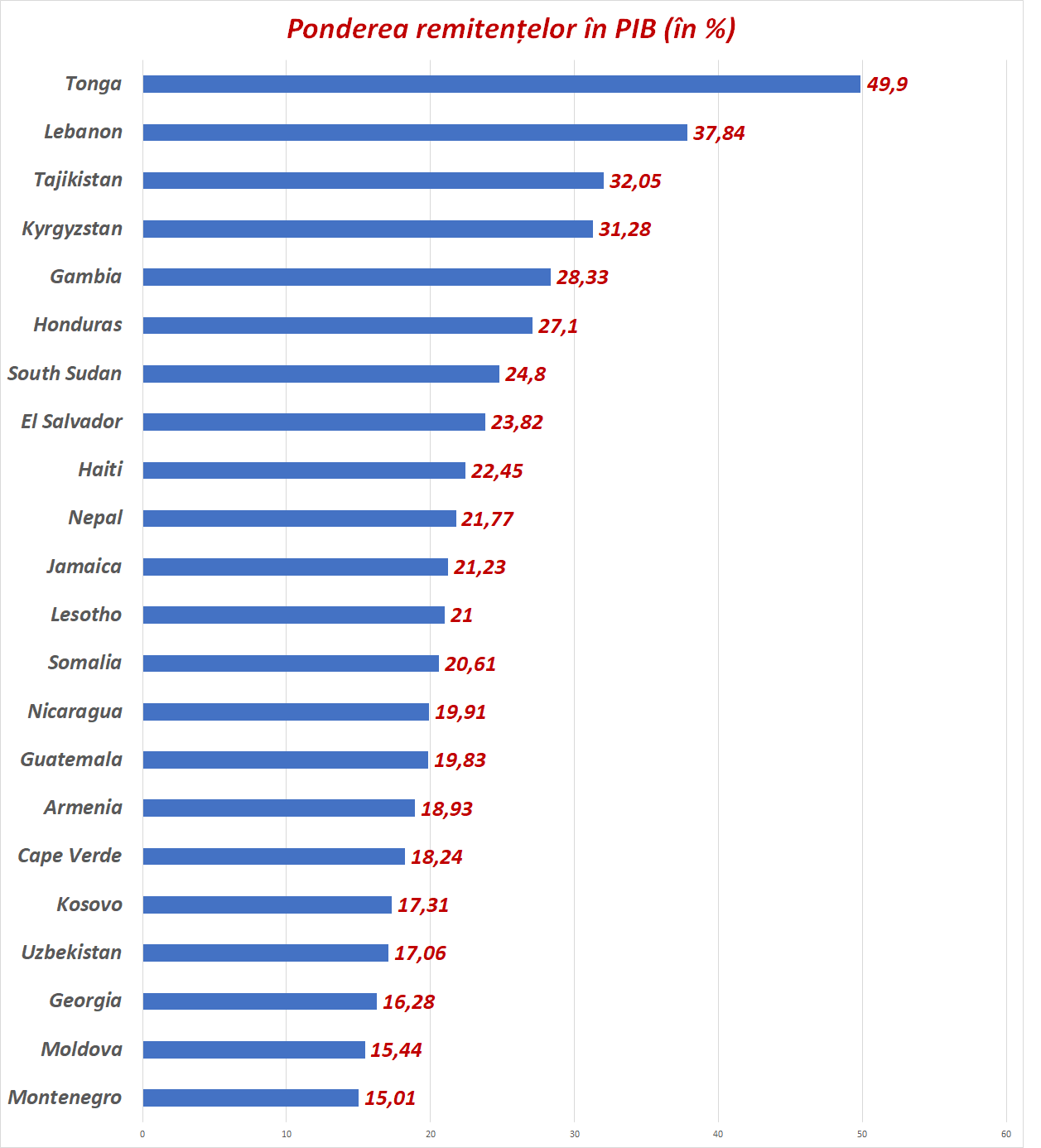

There are also countries where a drop in remittances could mean economic collapse or, in any case, serious problems in the economy

Tonga – Who receives remittances and from whom?

Tonga (official name – Kingdom of Tonga) is an island state in the Pacific Ocean, known as the “Friendly Islands” or “Pearl of the South Pacific”.

In 2022, inward remittances to Tonga are estimated at US$220 million, equivalent to approximately 44% of Tonga’s gross domestic product. Most households in Tonga receive remittances. Out of 1160 analyzed households, 959 receive cash transfers. It is interesting and tangible that about half of families in Tonga receive remittances from someone who is not a family member.

The average amount of remittances sent home in the last six months of 2021 was 5,892 Tongan paanga (TOP), which is equivalent to €2,000, or about €333 every month.

Lebanon

Remittances have long played an important role in Lebanon’s economy, bringing in an average of US$7.15 billion annually over the past 10 years.

The collapse of the Lebanese economy caused by the economic crisis in late 2019; an explosion at the port of Beirut in August 2020; and rising global food prices due to the war in Ukraine and the Covid-19 pandemic have made remittances even more important.

In 2021, Lebanon was the most remittance-dependent country on the planet, with remittances then accounting for 53.8% of GDP. Last year, their share fell below 40%. An estimated 25-30% of Lebanese families rely on remittances as a source of income, up from 10% in 2018.

Tajikistan

In Tajikistan, one of the poorest countries in the Asian region, most rural families have at least one or two members who emigrate abroad in search of work.

Tajikistan has been highly dependent on remittances that migrants send back to their countries of origin. In 2017, individual cross-border money transfers from Russia amounted to $6.5 billion.

While these transfers can be a huge source of investment, most of them are spent on basic needs such as food, housing and education.

Directing these revenues to agriculture, which is the second largest sector of the country’s economy.

The Gambia

Official remittance flows to The Gambia have grown steadily, nearly tripling over the past four years, from $278 billion in 2018 to $773 billion in 2021.

The sheer volume of remittances makes The Gambia one of the most remittance-dependent countries in the world, and the cost of sending money to the country is among the highest in the world.

Source: Hot News

Ashley Bailey is a talented author and journalist known for her writing on trending topics. Currently working at 247 news reel, she brings readers fresh perspectives on current issues. With her well-researched and thought-provoking articles, she captures the zeitgeist and stays ahead of the latest trends. Ashley’s writing is a must-read for anyone interested in staying up-to-date with the latest developments.