Bulgarians from Euroins Insurance Group (EIG), who own Euroins Romania, the former bankrupt leader of RCA, started selling general insurance on the local market (except RCA) through another company, based on the Freedom of Services (FOS) or the so-called “European passport”. ASF sources warn that the supervision of these companies is in Sofia and that in the event of bankruptcy in Bulgaria there is no guarantee scheme for the optional insurances sold.

How Bulgarians from EIG can sell insurance in Romania, despite the bankruptcy of Euroins

Bulgarians from Euroins Insurance Group (EIG) control two more companies besides Euroins Romania through which they can sell general insurance and life insurance on the Romanian market on the basis of Freedom of Services (FOS).

With this mechanism provided by EU law, an insurance company can sell its insurance products directly over the Internet in another remote Member State (without having a registered office or an open branch in the Member State).

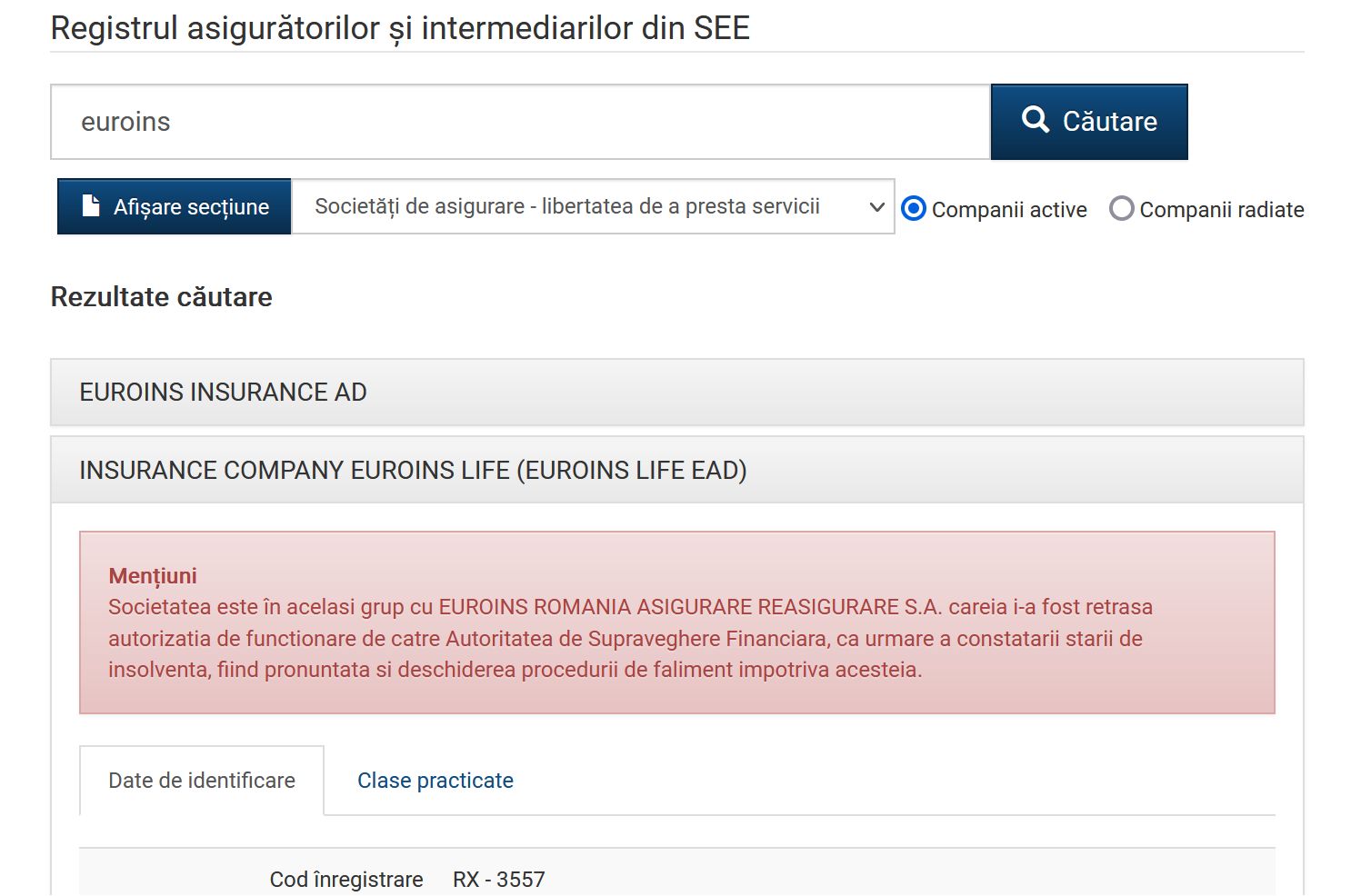

Two companies belonging to the Bulgarian EIG group are Euroins Insurance AD and Euroins Life Insurance Company (Euroins Life EAD), according to the Register of Insurers and Intermediaries in the EEA, managed by the Financial Supervisory Authority (ASF).

In order to carry out their insurance activities in Romania, these two companies do not need authorization from the Financial Supervisory Authority (ASF), but it is sufficient to have authorization in their countries of origin, in this case Bulgaria.

ASF has no supervisory or control authority over such companies.

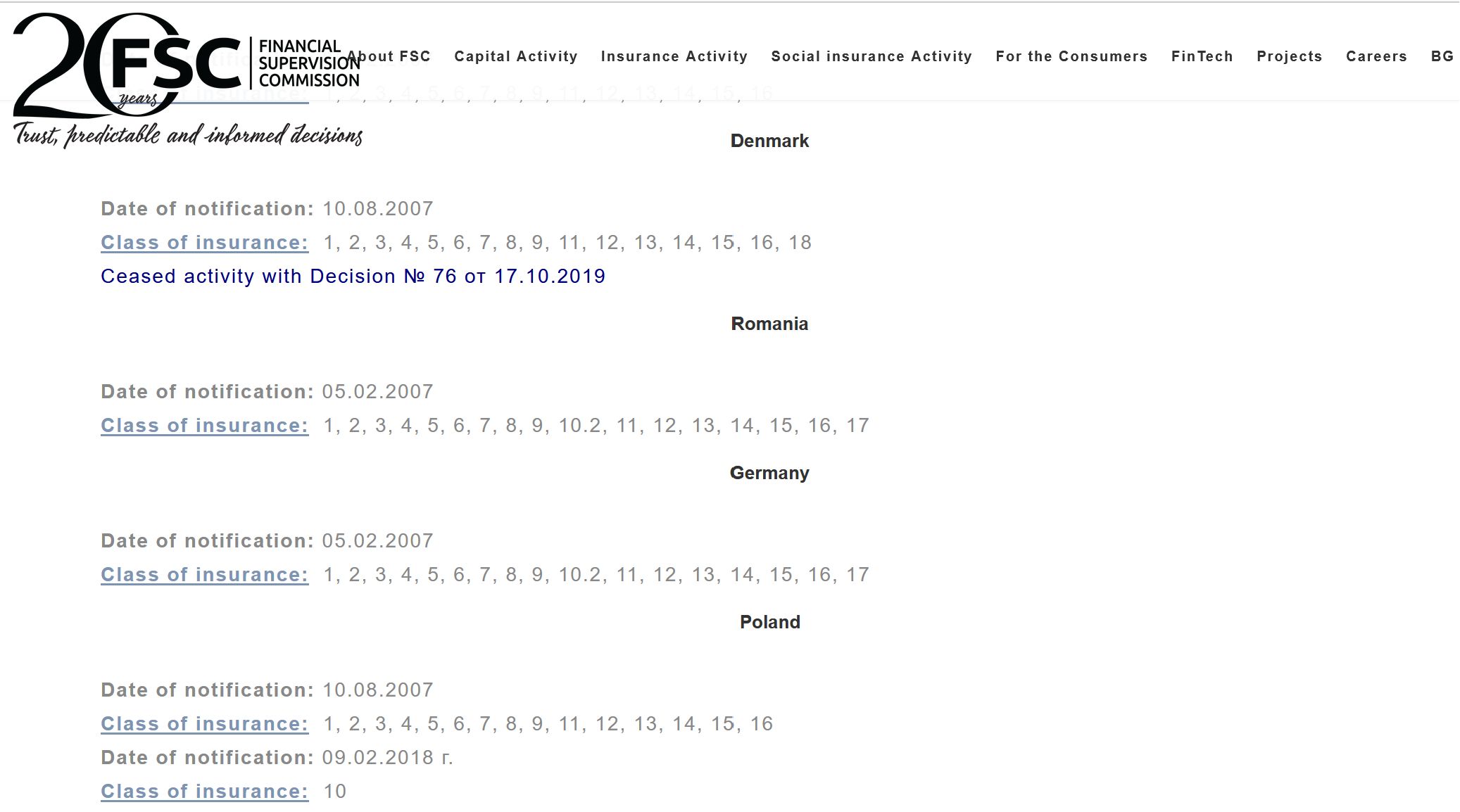

The insurance arbitrator in Bulgaria, the Financial Supervisory Commission (FSC), which authorized an insurer intending to carry out insurance activities in the territory of Romania, on the basis of the freedom to provide services, has notified the ASF of this intention.

- “This notification about the two companies existed since 2007, but recently the supervisory authority in Bulgaria returned with updated information about the general insurance company – Euroins Insurance AD, and the ASF made changes to the Register of Insurers and Intermediaries in the EEA,” ASF sources clarified to HotNews.ro .

Note that in February 2017, the ASF reported that it “gave an affirmative response to the notification received from the Financial Supervisory Commission (FSC) of Bulgaria regarding DallBogg’s request to operate on the Romanian insurance market, based on Freedom of Services (FOS).” .

- HotNews.ro has also asked the point of view of representatives of EIG / Euroins and we will return with the answers as soon as we receive them.

Euroins Insurance AD can sell 16 types of insurance in Romania / Some brokers have started selling CMR and ROT insurance

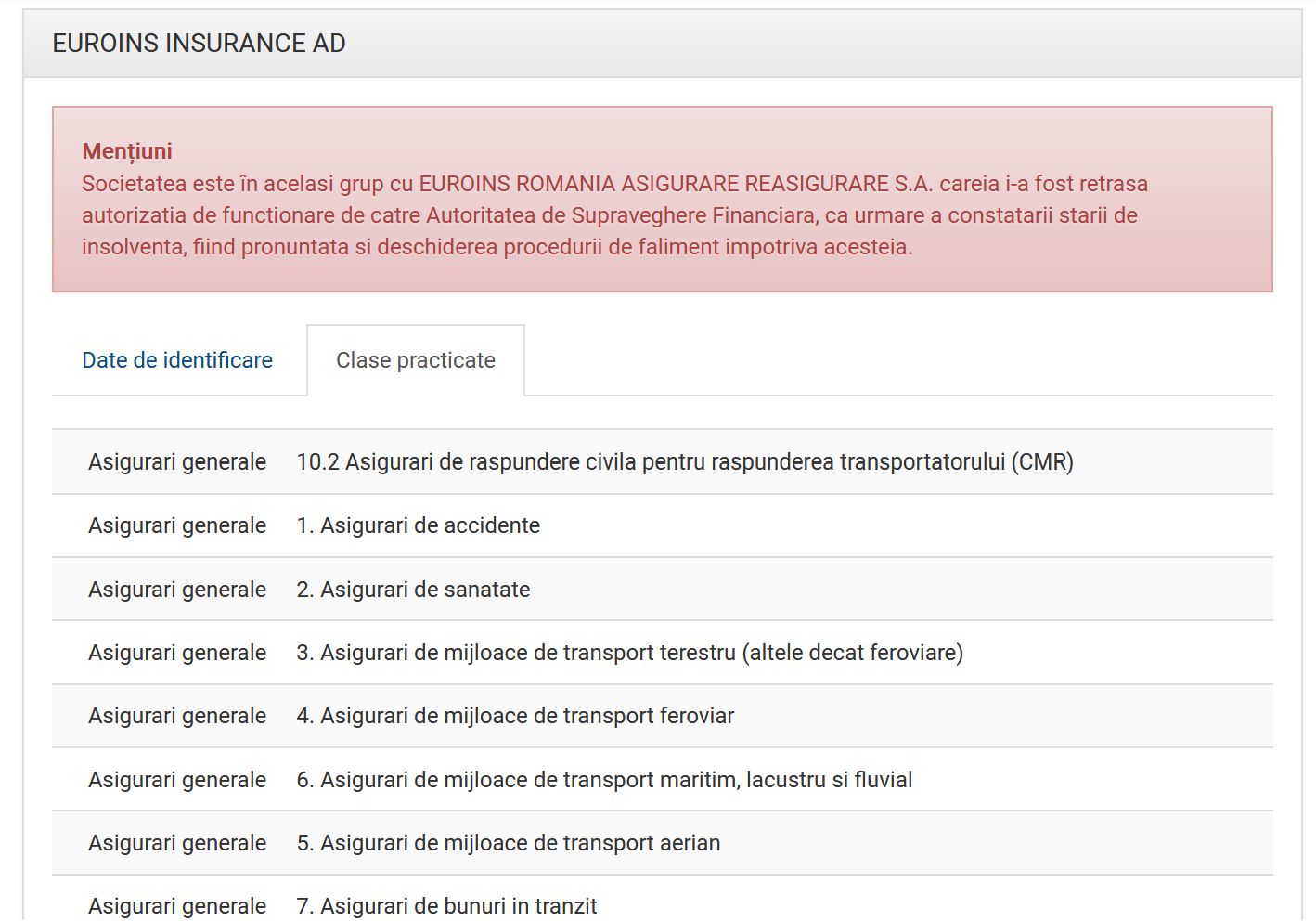

Euroins Insurance AD is authorized by Bulgaria to sell 16 types of general insurance (except RCA), including carrier liability (CMR), guarantee, credit or financial loss insurance, according to information published in the Register of Insurers and intermediaries in the EEA.

The website of the Bulgarian Financial Supervisory Commission states that Euroins Insurance AD is authorized to sell several classes of general insurance except RCA (class 10). The company is authorized only to sell insurance of class 10.2 – insurance of the CMR type.

Sources from the insurance industry told HotNews.ro that several insurance brokers have already signed brokerage contracts with Phoenix MGA Services SRL as a representative of Euroins Insurance AD from Bulgaria, and have sold some road transport (ROT) and carrier liability insurance ( CMR).

Phoenix MGA Services SRL was founded this summer, located in Bucharest, has a capital of 100,000 lei and is fully controlled by Euroins Insurance Group AD (Bulgaria), and the administrator is Krasteva Stela (authorized individual), according to information from Termene.ro.

The company was to be headed by Daniela Nicolae-Pora, director of underwriting at Euroins Romania, Profit.ro reports.

- HotNews.ro also asked for the point of view of representatives of Phoenix MGA Services, and we will contact you as soon as we receive a response.

ASF sources: There is no voluntary insurance guarantee scheme in Bulgaria. Exactly what Euroins AD Bulgaria sells

ASF sources, who spoke on the condition of anonymity, warned of possible problems for those who took out insurance from Euroins Insurance AD if the insurer went bankrupt.

- “We do not give any opinion. This is a European procedure, the only person responsible for the activity in the FoS is the supervisor from the country of origin, in this case from Bulgaria. There is a pan-European register/database managed by EIOPA. We, ASF, are only taking note of the message, full responsibility rests with the supervision in Bulgaria.

- ASF is not responsible for companies selling on FOS. Also, companies selling on FoS are not covered by the warranty scheme in Romania.

- There is no guarantee scheme of optional insurance in Bulgaria. Exactly what Euroins AD Bulgaria sells.

- If the ASF is informed about certain aspects related to the company’s activities on the FoS, it can contact the authorities in the country of origin. This body is directly responsible for the company’s activities.” Sources from the ASF informed HotNews.ro about this.

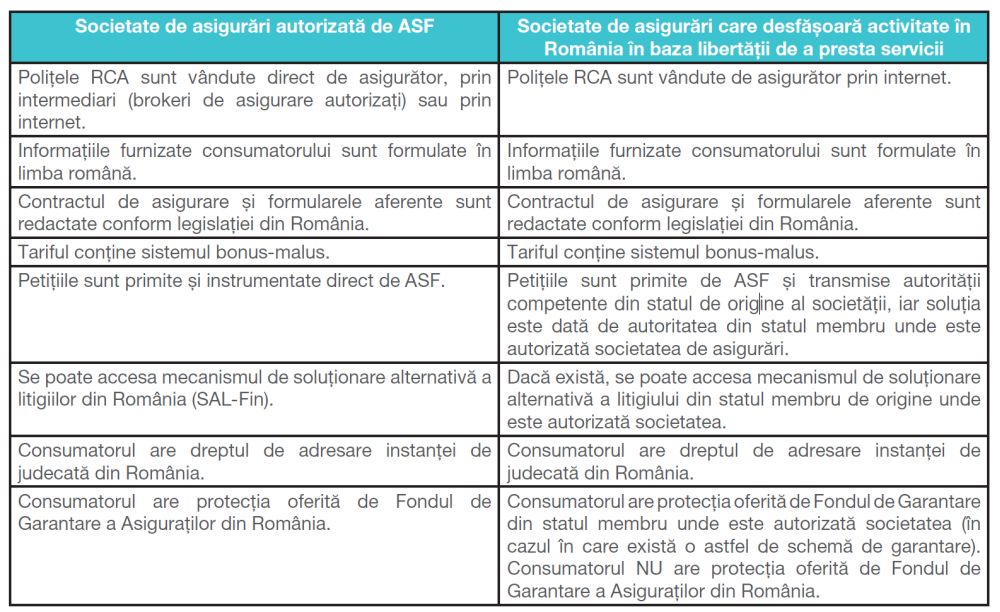

Even if in this case it is not, at least until now, the sale of an RCA, the Financial Supervisory Authority (ASF) has a guide for concluding an RCA with such an insurer, a document that may also be useful in the case of other types of insurance.

In short, the injured party must contact the claims representative appointed by the insurer in Romania and does not benefit from the protection offered by the Guarantee Fund for Insureds in Romania.

The injured party is protected by the Guarantee Fund of the Member State where the company is authorized (if such a guarantee scheme exists).

However, in Bulgaria, according to an ASF representative, there is no guarantee scheme for optional insurance sold by Euroins.

- SEE – ASF GUIDE TO FREEDOM OF SERVICES

Source: Hot News

Ashley Bailey is a talented author and journalist known for her writing on trending topics. Currently working at 247 news reel, she brings readers fresh perspectives on current issues. With her well-researched and thought-provoking articles, she captures the zeitgeist and stays ahead of the latest trends. Ashley’s writing is a must-read for anyone interested in staying up-to-date with the latest developments.