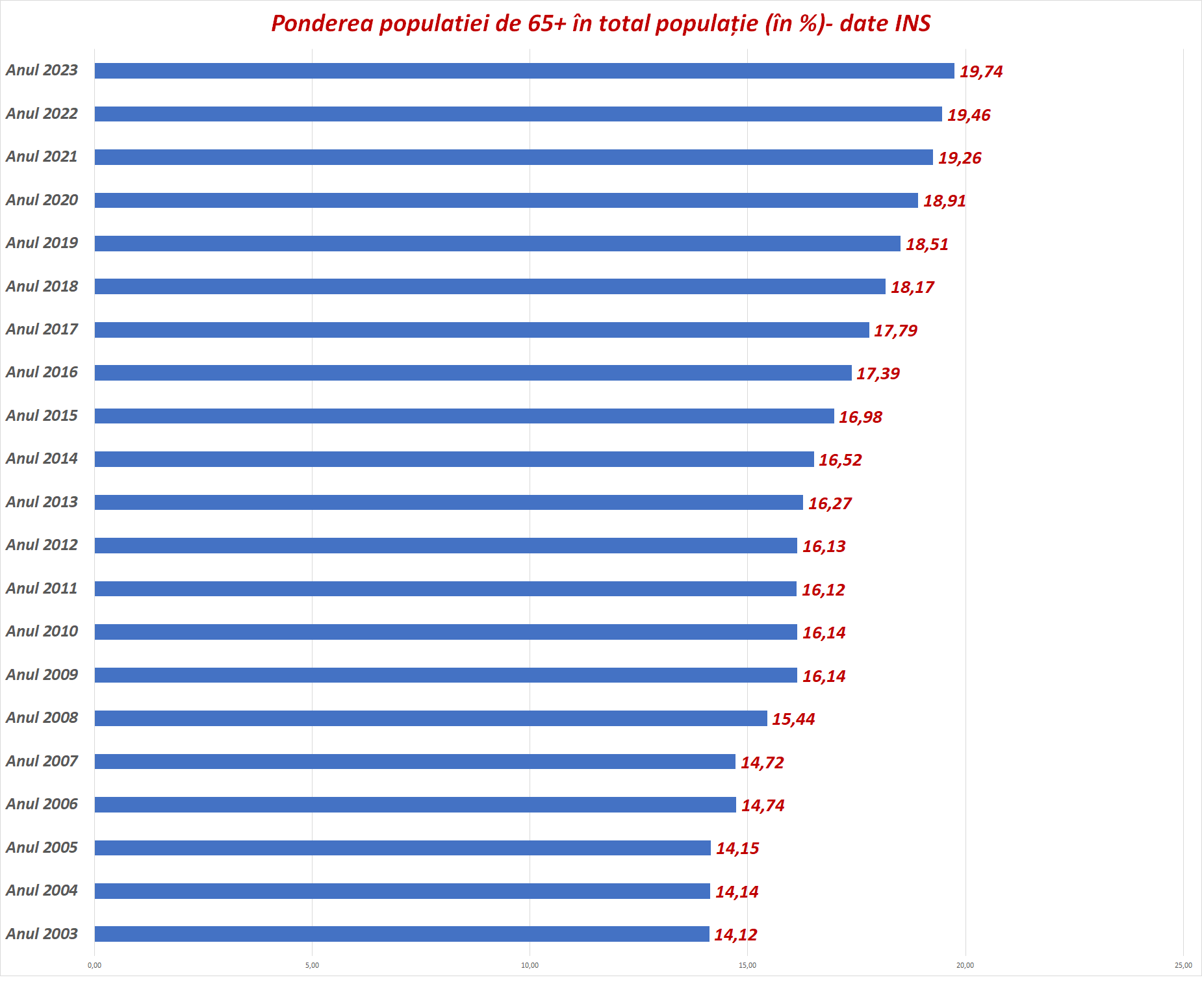

In 1950, the share of Romanians over 65 in the total population was 7.16%. After the revolution, it rose to just over 10%, and since 2003 has crossed the 14% threshold often used to define an aging society. We got close to 20% last year, and INS estimates for the next 25 years put us closer to a 30% share of seniors.

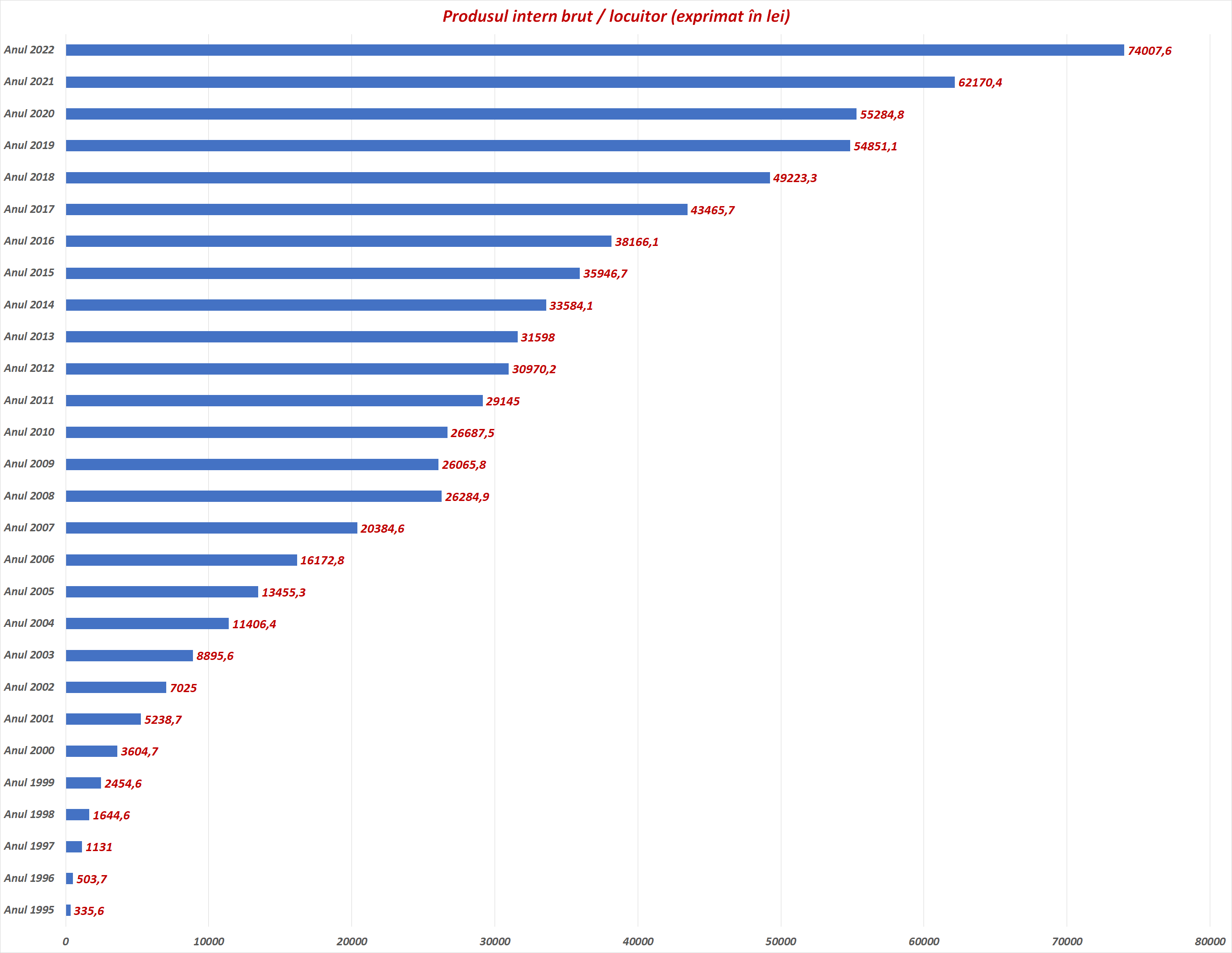

In 2003, when we crossed the threshold of an aging society, Romania’s GDP per capita was about $2,680. In 1994, when Japan passed the 14% seniority mark, it was almost 15 times richer with a GDP per capita of US$39,953.

This is one of the biggest obstacles for the future development of Romania. To protect its elderly citizens, many of whom are poor, the government will have to spend more on their health care and pensions. The problem becomes even more serious after 2030, when an important cohort will retire – the decrees.

Rapid aging and slowing economic growth are combined in emerging economies such as Romania.

Another equation that needs to be solved is that in poor countries, you need to think about when the pension level will be, and start saving money at an early age.

We believe that the world will change. From a deflationary world to a hyperinflationary one, say the authors of one of the best-selling books on demography: The Great Demographic Reversal, Charles Goodhart and Manoj Pradhan (published in 2020).

Simply put, an increase in the dependent ratio is usually deflationary because workers produce more than they consume, while dependents consume but do not produce.

A sharp deterioration in dependents means that dependents who consume but do not produce will outnumber wage earners who generate income. The inevitable result will be inflation, say the two authors.

More and more of us will live longer, but it is currently unclear where the resources will come from to allow older people to consume after retirement.

“Elderly people are a powerful electoral machine, appearing at polling stations in greater numbers than young people”

There are three alternatives, say two economists: the first is to raise the retirement age. A second alternative is for workers to self-fund their retirement by saving more. Although at the age of 25 it is very difficult to think how you will cope at 85 and what you will need then. And the third channel is for the state to tax employees more and transfer this money to the elderly – both for health care and for pensions.

Two authors bet on the latter scenario and explain why: “First, pensions for the elderly are generally protected by governments. In addition, the elderly represent a powerful electoral machine that appears at the polling stations in greater numbers than young people. The growing share of older voters among the electorate is a strong argument for increasing pensions. Note that promises to preserve or increase pensions have often been a large part of the manifestos of populist political parties, e.g. in Italy in 2018″

Inequality and poverty are huge and something like this is the ultimate political speculation, especially in election years

If you exclude the millionaires in lei (about 60,000 Romanians have bank deposits of at least 1 million lei), the rest of the population barely has 2,000 euros put on the mattress, says Florian Nyagu, director of the BNR Financial Stability Office. Polarization is one to 100, Neagu says.

- We have certain problems with human capital. Thirdly, more precisely: firstly, we are getting smaller and smaller – between two censuses (2011-2021), the population decreased by about a million people. Second, we are getting older. The demographic aging index dropped significantly, by 20 percentage points, from 101% to 121%, where it is today. And the third is education, where although the level has significantly improved over the last decade, we are still in last place in the European hierarchy. In short, we are getting smaller, older and have relatively modest levels of education, which is the vulnerability of this country’s human capital. This vulnerability will have implications for financial stability. Not today, not tomorrow, but in 10-20 years we will settle it

When Romanians are asked why they don’t have current bank accounts, here are the answers: the majority – 42% – say they don’t have enough money, Nyagu explains.

Populist parties – left or right, depending on the circumstances – speculate about the growth of social inequality. Examples are easy to cite: Trump in America, Brexit in Great Britain, the Northern League in Italy, the National Union in France, AFD in Germany, Orban in Hungary, Law and Justice in Poland, etc.

How other countries solve the issue of pensioners and pensions

As the world’s population ages, countries are preparing for radical change.

According to the United Nations, due to declining birth rates and increased life expectancy in recent decades, the number of people aged 65 and over will exceed the number of those under 5 years of age, and in 2065 it will exceed those , who is under 15 years old.

Some call demographic change a “silver tsunami,” a term that equates the aging population with a natural disaster. But as longevity puts pressure on institutions, from pensions to the family, countries that take a closer look at what lies ahead are likely to find better solutions.

“We need new models, new policies, and new creative institutions to integrate older people into society,” says Mark Friedman, founder of CoGenerate, a nonprofit that seeks to bridge the generation gap.

Some countries, such as Finland, employ elderly people as “surrogate” grandparents. In Finland, there are approximately 830 “surrogate” grandparents – elderly people who voluntarily spend their time with children in libraries, kindergartens and schools. This practice has two purposes. It helps alleviate the loneliness epidemic among the elderly and helps children who live far away from grandparents (or don’t have them at all) to form meaningful multi-generational connections with older people.

Other government programs encourage or require workers to save more for the future.

One of the most ambitious programs is in Singapore, which is redeveloping a densely populated area to encourage intergenerational integration and problem solving.

Pension Savings Dashboard (Denmark)

Denmark has a simple solution.

In 1999, he launched a website called PensionsInfo, which allows workers to see what their pension will be like in one place. The website allows users to model the impact of retirement as they age, and users who believe their retirement is below target can save more or retire later.

Hybrid pension plans (Netherlands)

The Dutch pension system is a combination of a pay-as-you-go system and individual investments and is built on three pillars:

State Pension (AOW) – The General Old Age Pensions Act or Algemene Ouderdomswet (AOW) ensures that all people who have lived in the Netherlands between the ages of 15 and the pensionable age are entitled to a state pension when they reach retirement age. From 2022, this age will depend on average life expectancy. All residents of the Netherlands receive AOW every year – it is not necessary to be in paid work. The amount you receive depends on, among other things, whether you live alone or with a partner, and is calculated on the basis of the minimum wage. It is offered by the Social Insurance Bank (SVB). SVB will show you approximately how much AOW is, or you can request a more detailed calculation. This information is available through My SVB. You will need a DigiD to access. For every year you live in the Netherlands, you get 2% of your full AOW pension. If you are insured for 50 years, you will receive the full amount.

Collective pension schemes – collective pension schemes are linked to a specific company or industry. These schemes are managed by pension funds or insurance companies. Employers pay monthly contributions to these funds on behalf of their employees, with investment returns paying benefits to both current and future retirees.

Individual pension products – Individual pension products in the Netherlands are mainly used by those who are self-employed or work in a sector without a collective pension fund. Individuals independently purchase and manage their own pension products or investments. Anyone can purchase a product under this third pillar.

Intergenerational relations (Finland)

As the number of people living far away from family increases, a non-profit organization in Finland is promoting a new way to bring generations together.

Launched in 2006, the surrogate grandparent program places elderly people in schools, libraries and family clubs organized by the Mannerheim Children’s League, which runs the program throughout Finland. Volunteers receive training on topics such as the importance of creative play and typically work a few hours a week helping teachers and staff with everything from arts and crafts to teaching reading.

But the real goal is to develop the relationships that so many lack today. The program “reimagines the family” and offers a way to “combat isolation and loneliness on both sides of the age spectrum.”

Source: Hot News

Ashley Bailey is a talented author and journalist known for her writing on trending topics. Currently working at 247 news reel, she brings readers fresh perspectives on current issues. With her well-researched and thought-provoking articles, she captures the zeitgeist and stays ahead of the latest trends. Ashley’s writing is a must-read for anyone interested in staying up-to-date with the latest developments.