The Financial Conduct Authority (ASF) claims that RCA insurers do not take gender or religion into account when selling car insurance, which is discriminatory and in breach of national and European law. The clarifications come after the Ministry of Defense demanded that auto insurance auctions for thousands of cars do not vary in price based on location, age, gender or religion.

Insurers do not take gender and religion into account when determining the RCA price. Why would it be illegal?

- “In insurance practice, companies do not use segmentation criteria in pricing that lead to discrimination based on gender or criteria related to the policyholder’s membership in a certain social group, this practice violates national and European legislation on discrimination and equal opportunities. “, This was reported to HotNews.ro by ASF representatives on Monday.

The authorities’ clarification comes after HotNews.ro reported that the Ministry of Defense, through military unit 02574, wants to provide RCA with more than 2,800 vehicles that it has registered in several countries, demanding in the specifications that the prices do not vary depending on the criteria. such as the location, age, gender or religion of the driver.

Insurers are free to calculate their RCA rates. Age or place of residence matters

When asked what criteria Romanian insurers use when determining RCA prices, the Financial Supervisory Authority (ASF) reminds that, according to EU rules, they calculate their premiums freely.

- “According to the provisions of European legislation (Articles 21 and 181 of Directive 2009/138/EU (Solvency II), companies freely calculate their premiums.

- In their calculations, RCA insurers may use risk criteria, load indices, adjustment factors or other tools to adjust premium rates in accordance with generally accepted actuarial principles.

- The criteria chosen by the insurers are established by them based on the statistical data available to them both at the market level and at the level of their own portfolio, and they are related to risk.

- The most often used are the criteria to which the insured vehicle falls (category, power, cylinder volume, number of seats, weight, etc.), as well as for the insured (Physical/Legal person, mode of use, number of users, age group to which the user belongs) , place of residence, etc.)”. ASF representatives informed HotNews.ro about this.

ASF also emphasizes that according to Art. 21 of the same EU Directive, “Member States do not require prior approval or systematic notifications regarding general and special insurance conditions, the level of premiums, technical bases used, in particular, for calculating the level of premiums and technical reserves or forms and other printed documents, on which the company intends to use in its dealings with policyholders or transferring or retroceding companies”.

What conditions does MApN impose on RCA thousands of car insurance: Prices should not vary according to location, age, gender or religion

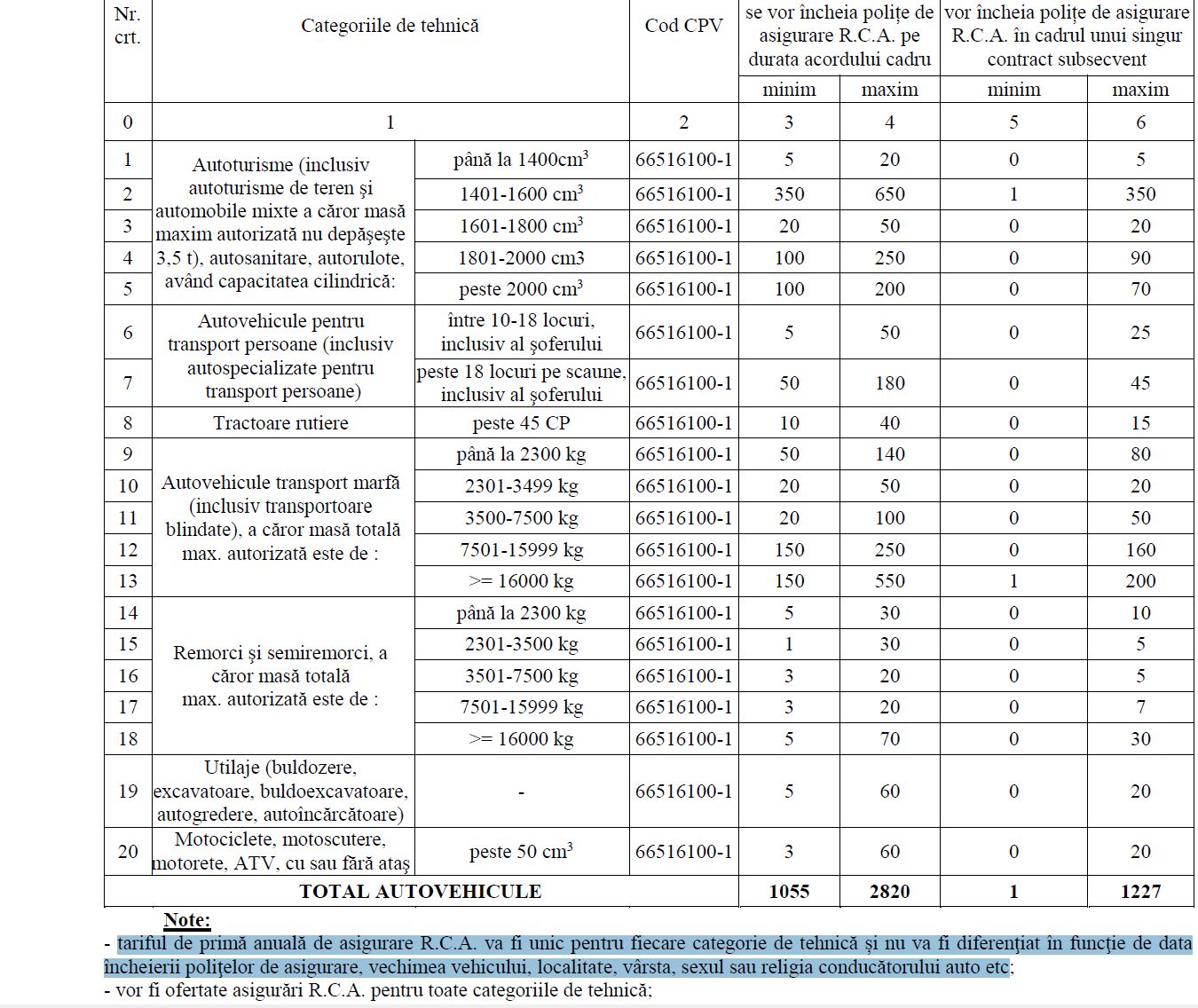

The Ministry of Defense wants to provide the RCA with more than 2,800 vehicles (vans, SUVs and city cars, motorcycles, trailers, etc.) from several countries.

Since we are talking about many cars whose RCA insurance is valued at more than 13.7 million lei (excluding VAT), MApN sets the price conditions:

- “RCA’s annual insurance premium rate will be unique for each equipment category and will not vary based on policy date, vehicle age, city, age, gender or religion. driver, etc.;”, it is shown in the specifications.

In other words, MApN asks insurers not to set RCA prices that differ based on criteria such as the age of the vehicle, location, age, gender or religion of the driver, etc.

Source: Hot News

Ashley Bailey is a talented author and journalist known for her writing on trending topics. Currently working at 247 news reel, she brings readers fresh perspectives on current issues. With her well-researched and thought-provoking articles, she captures the zeitgeist and stays ahead of the latest trends. Ashley’s writing is a must-read for anyone interested in staying up-to-date with the latest developments.