Mr. Ionescu will not go on vacation this summer either, although he promised Mrs. Ionescu that he would serve breakfast on the terrace by the sea.

“Leave it, my dear, I promise you that next year I will take you to Thassos, where the Romanians full of money go,” he told Mrs. Ionescu, relying more on hope than calculation. In any case, Mrs. Ionescu has not seen the sea for about 5 years.

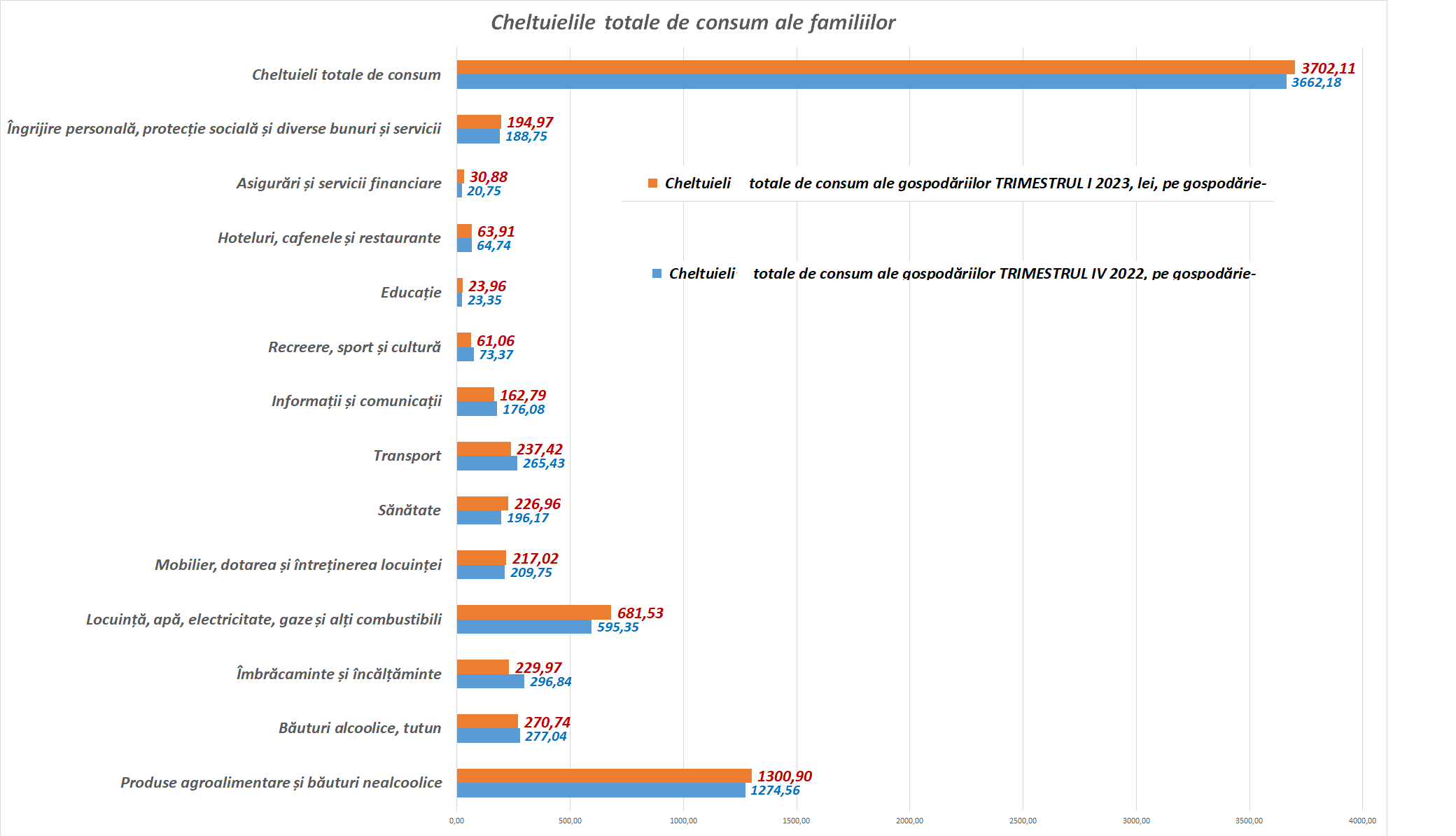

And the data published on Monday morning by Statistics confirmed it: the majority of Romanians are experiencing a cost of living crisis that has led to impoverishment compared to last year. And in the first quarter of this year, bank rates, utilities and health care costs created the biggest holes in the family budget.

Insurance costs and bank rates rose by 40%, and health and utility costs by 15%, the INS said in a release on the income and expenses of Romanian families in the first quarter. At the same time, revenues increased by 5% compared to the previous quarter.

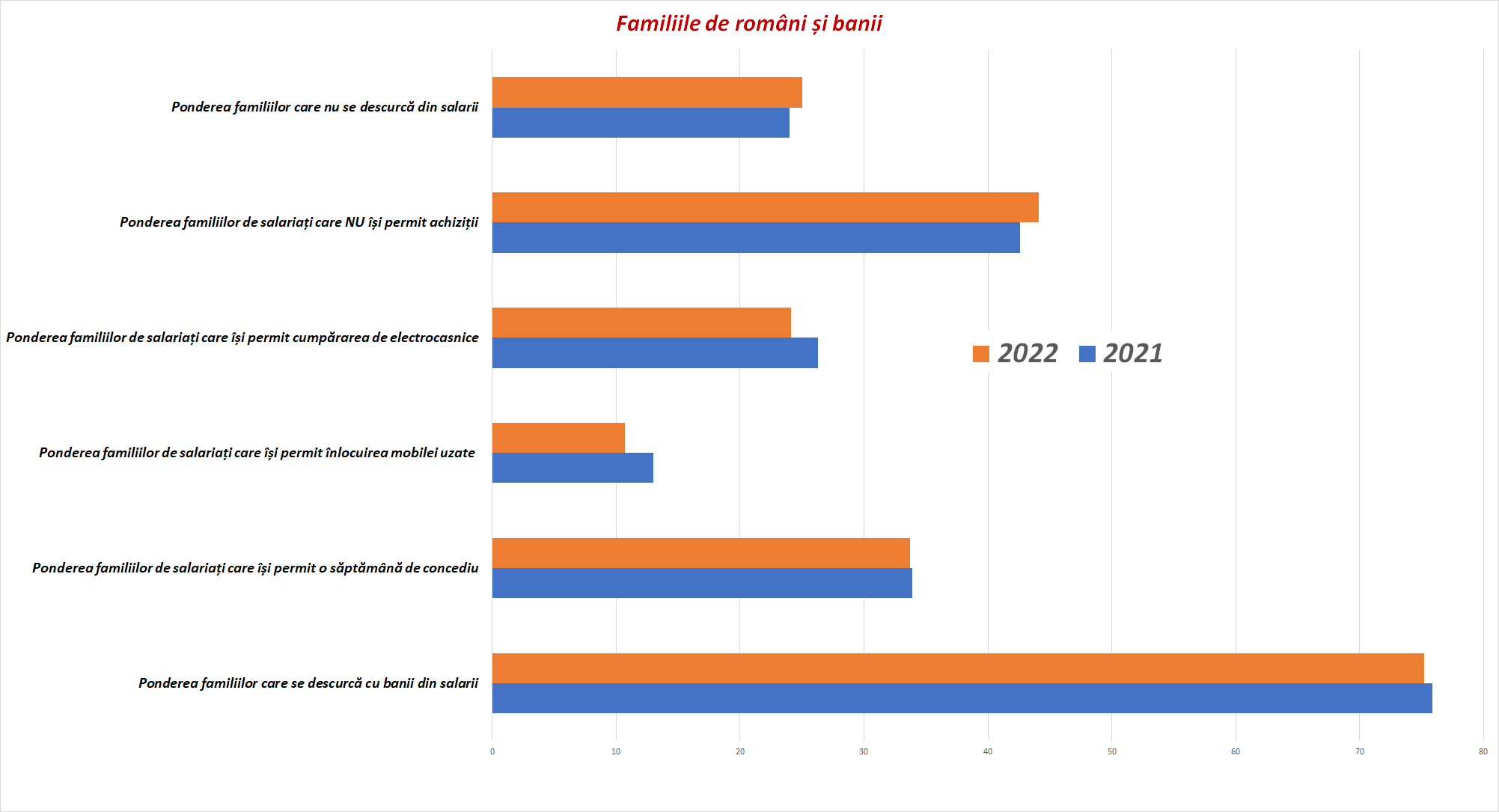

In relation to 2022, the number of those who cannot afford vacations or cannot afford shopping has increased.

The polarization in Romania is huge

But Romania holds both the richest and the poorest together, even if the inequality between the two categories is huge.

According to INS data, the ratio between the incomes of two families – one from the first decile and the other from the last decile by income (the first decile includes families with the lowest income per person, and the last decile consists of families with the highest income) in 2022 from 1 to 4.8. In the case of individuals (that is, not the entire family), the ratio was 1 to 8.4.

The difference between the top decile and other deciles is noticeable due to the existence of significantly higher incomes, statistics also show.

Also, the National Bank showed the day before that high polarization in our country is fueling mistrust of state institutions and social tension.

Those on low incomes set aside a much more stable portion of their paychecks to pay for essential expenses

According to HotNews calculations based on data provided by the INS, the increase in the cost of living is greater for the poorest families, who have also been hit hardest by inflation. Those on low incomes allocate a much more consistent portion of their salary to pay for essential expenses (maintenance, food, bank deposits, etc.).

0.5% of compatriots own more than a quarter of all bank deposits in Romania

If we look at the distribution of deposits in Romanian banks, we can see that 0.4% of depositors (59,500 people) accumulated 26% (64.6 billion lei) of the total amount of deposits in 2022, with an average of 1.08 million lei . per person, corresponding to the equivalent of 220,000 euros.

At the opposite pole are 99.6% of depositors (14.1 million people), who own 74% of deposits, the average amount of savings of these people is 11,000 lei, which is equivalent to only 2,200 euros.

Returning to the Ionescu family…

With two small children and “almost” owning a three-bedroom apartment bought on credit, the Ionesti’s now have other priorities than holiday entertainment: expenses with the children, bank payments, and food and living expenses leave them with next to nothing. pocket

According to the INS, the monthly expenses of the population in the first quarter of 2023 amounted to 5,971 lei per family (2,393 lei per person). Compared to the first quarter of last year, the total average monthly expenses per household increased by 12.2%, and per person – by 13.1%, Statistica reports.

Salaries were 4,526 lei per household per month, say the statisticians, who also calculated where most of our money goes:

Source: Hot News

Ashley Bailey is a talented author and journalist known for her writing on trending topics. Currently working at 247 news reel, she brings readers fresh perspectives on current issues. With her well-researched and thought-provoking articles, she captures the zeitgeist and stays ahead of the latest trends. Ashley’s writing is a must-read for anyone interested in staying up-to-date with the latest developments.