“Hey, did you get PAD landslide and flood insurance this quarter? That the bank is putting me on my neck to do this in addition to optional insurance.” This is what a friend complained about the other day, and he was not the only one. ASF confirmed to HotNews.ro that it has received such complaints from policyholders who live in areas without floods, landslides or earthquakes and claim that PAD insurance would be a hidden fee.

I explained to my friend that according to Law 260/2008 on compulsory home insurance, no insurer can take optional insurance for a house that does not have mandatory PAD insurance.

In the case of Romanians with real estate loans, the bank also requires additional home insurance, so the mandatory PAD insurance against the three risks of natural disasters: earthquake, flood and landslides should also be done automatically.

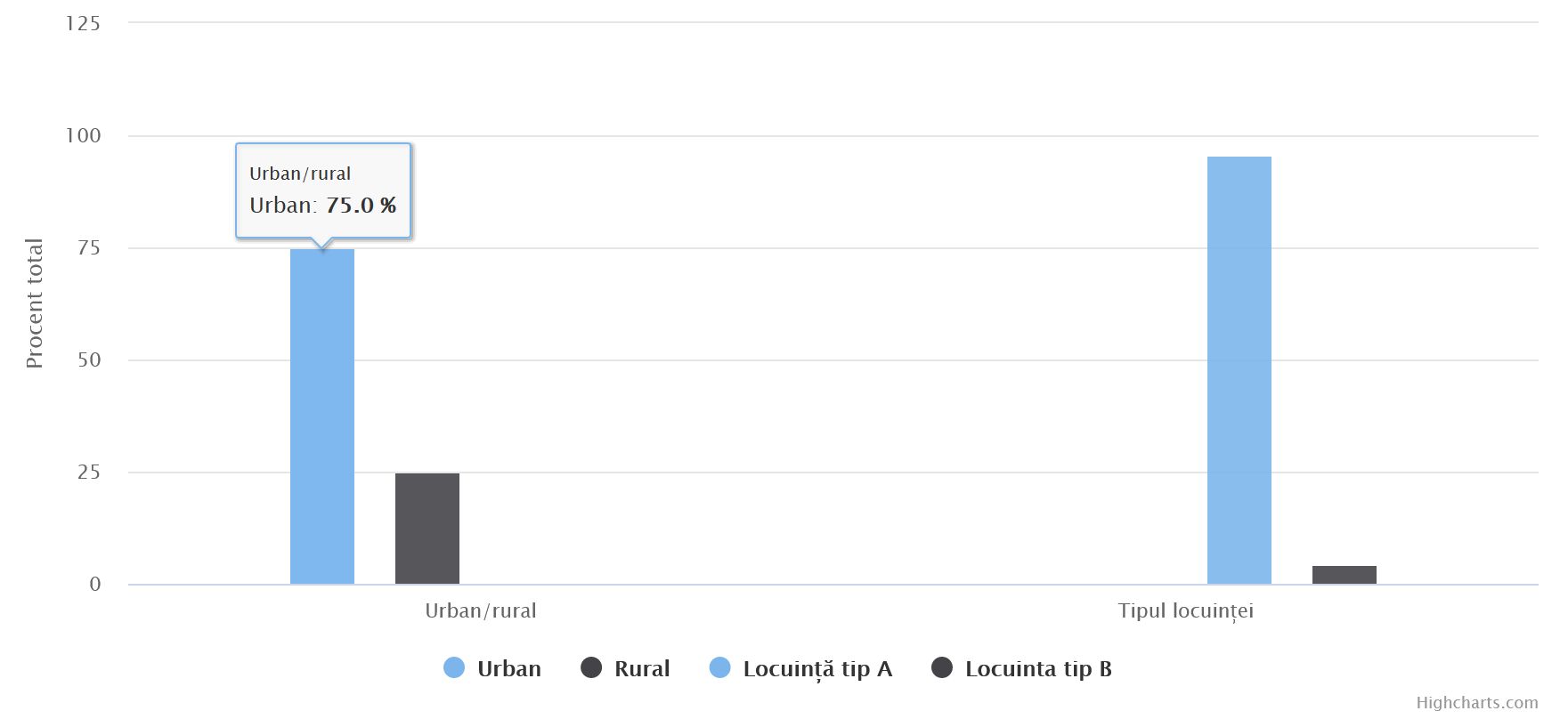

Less than 20% of houses in Romania are insured by PAD. Most of them are apartments in cities

The latest data about PAID (Catastrophe Insurance Pool)the private insurance company that issues compulsory PAD home insurance policies and pays out compensation in the event of disasters shows that they were in force at the end of January this year 1,850,373 PAD policies which is 19.30% of the national housing stock.

75% of houses insured by PAD are located in cities.

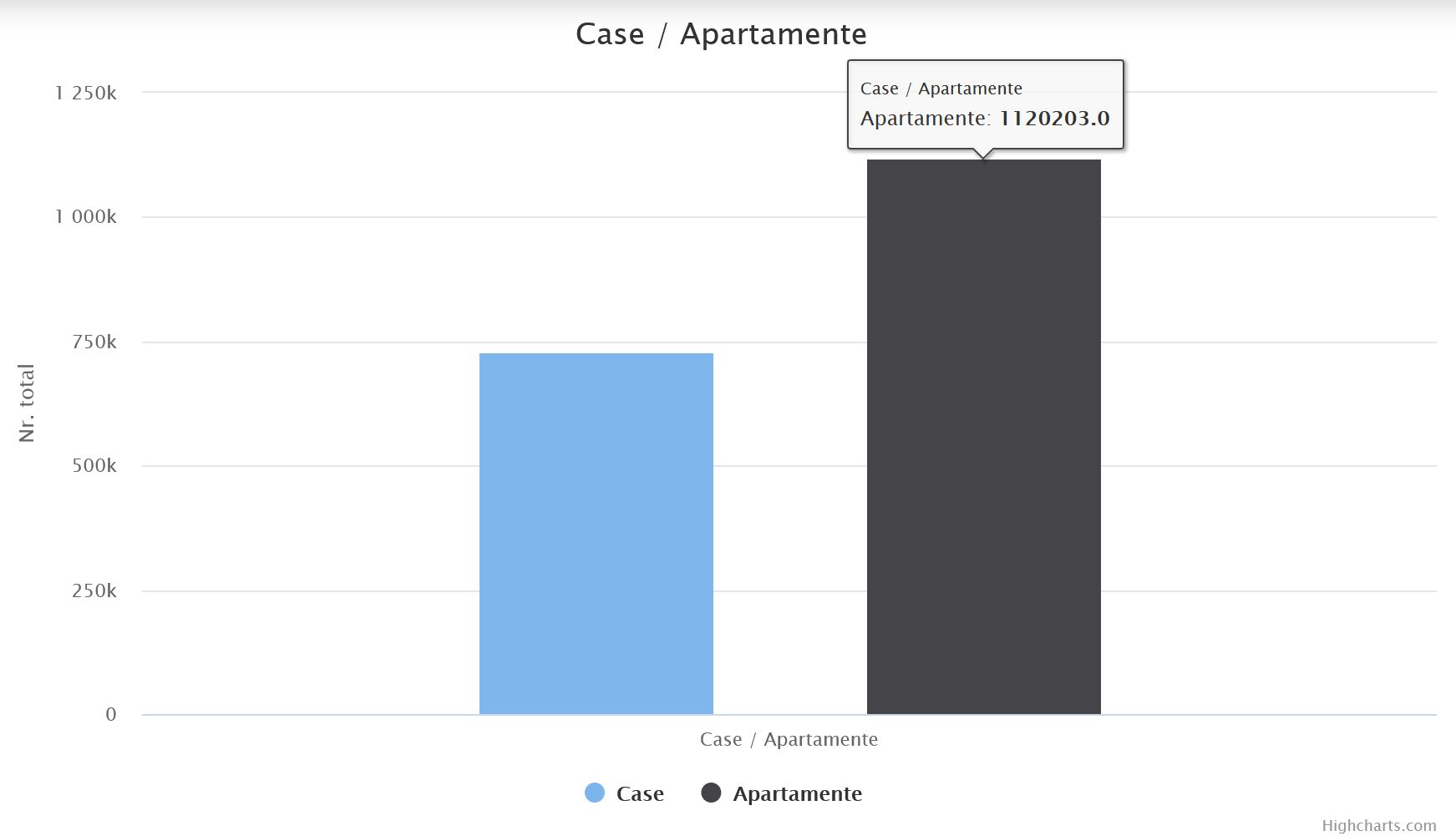

The apartments are insured for more than 1.1 million PAD

PAID does not have data on voluntary home insurance, but the latest figures from the Financial Conduct Authority (FSA) show that over 1.6 million voluntary home insurances were in place in the first 9 months of 2022.

There are Romanians who accuse PAD insurance as a hidden tax. What does ASF correspond to?

In these circumstances, HotNews.ro asked the ASF to clarify whether there are Romanians who own houses and claim that PAD insurance would be a hidden tax, given that they live in areas where floods and landslides or earthquakes cannot occur.

The Financial Supervision Authority (ASF) told HotNews.ro that it “received the following reports.”

What does the ASF correspond to them?

Below we provide the explanation of the Authorized Body:

- “In these cases, the authors of the petition are informed that Romania is not immune to the serious consequences of climate change, which are occurring all over the world and cause an increase in the frequency and amplitude of natural disasters, resulting in significant damage both material and human, the only viable system there is an insurance system to combat such attempts.

- Law No. 260/2008 on compulsory insurance of buildings against earthquakes, landslides and floods (hereinafter – Law No. 260/2008) is the result a project developed jointly with the World Bankrespectively, the Romanian Catastrophe Insurance Program (PRAC), which aimed to financially protect Romanians against the risks of earthquakes, landslides and floods, understood as natural phenomena.

- It should be noted that the three risks covered by the PAD policy were not chosen arbitrarily, as they were identified as part of a comprehensive study of natural disaster risk management in Romania conducted by one of the world leaders in the field of disaster insurance consulting, Willis Re.

- According to the principle of social solidarity which was the basis of Law no. 260/2008, when creating an insurance fund for mandatory insurance, all homeowners must participate, taking into account that when performing actuarial calculations to establish the insurance premium, not only the social nature of insurance was taken into account, but also the dispersion of risks for the total number of 8 million houses, which belong to Romania.”, ASF representatives informed HotNews.ro about this.

How claims are paid if the owner has both PAD and optional insurance

Compulsory PAD insurance is issued exclusively by the insurance company POOL de Asigurare Against Natural Disasters (PAID).

Compulsory PAD policies are sold through PAID member companies or through insurance companies that have signed cooperation protocols with PAID.

The form and provisions included in the insurance contract for mandatory home insurance are regulated by ASF Norm No. 7/2013 on mandatory home insurance against earthquakes, landslides or floods:

- Covered risks through the PAD compulsory insurance policy, earthquakes, landslides and floods, manifested as natural phenomena. Compensation is provided only for those losses that are a consequence of the manifestation of one/some of the three risks, and not as a result of other phenomena (natural or man-made).

- Guaranteed amount through a mandatory PAD policy (i.e. the maximum amount of compensation) is 10,000 euros (with an insurance premium of 10 euros/year) or 20,000 euros (with an insurance premium of 20 euros/year), depending on the type of housing;

- Payment of compensation at the request of the policyholder/beneficiary, PAD will be carried out by PAID, who will pay only the equivalent of the repair/replacement costs associated with the loss caused by the occurrence of the insured risk, within the total sum insured through PAD.

Homeowners can protect themselves additionally and for other risks by concluding additional insurance, a contract that can cover compulsorily insured risks, but only for amounts exceeding the maximum amount of EUR 10,000 or EUR 20,000, or other risks for buildings in accordance with the insurance products offered by the insurers “. This was reported by ASF representatives.

The office notes that according to the law, “insurance and reinsurance companies authorized to deal with catastrophe risks cannot conclude optional home insurance that did not previously issue mandatory PAD insurance. “

- “exception o these are houses not covered by PAD insurance, i.e. houses located in buildings that have been legally examined by certified technical experts and classified in risk class 1, to the extent that insurers who take out optional insurance establish through own policies and procedures that these homes can be insured at will.

- Summing upwith the exception of non-insurable buildings, which we also specified in the answers to the first set of questions, there are no situations where an optional home insurance policy can be taken out without first taking out a PAD policy.

- PAD also covers the three statutory risks (earthquake, flood as a natural phenomenon and landslides) up to the maximum limit (€10,000 or €20,000).

- In conditions where the sum insured specified in the additional insurance contract exceeds the PAD limits, the optional policy covers the difference.

- exampleif a house of category A is insured for the amount of 60,000 euros, up to the level of 20,000 euros, three risks are covered by PAD, and the difference between 20,000 euros and 60,000 euros is covered by an additional policy,” the message says. ASF

The payment of compensation for the three risks covered by the PAD policy will be made directly to PAID on the basis of the centralizer sent by the insurer who carried out the establishment and assessment of losses.

For amounts exceeding the mandatory insurance sums, if the insured also has an optional home insurance contract, compensation is paid on the terms stipulated in the relevant contract by the insurer who concluded this optional insurance contract.

Why does the principle of solidarity not apply to insurance companies that are not required to insure houses with a red dot?

In the context of homeowners who believe that PAD insurance has imposed a hidden tax on them if they live in non-dangerous zones, and the authorities respond that Law 260/2008 arose from the principle of social solidarity, HotNews.ro asked why insurance companies were exempt from this principle.

As a reminder, by law red dot buildings classified as Seismic Risk Class 1 cannot be insured against any of the risks included in a PAD policy, probably because the risk of catastrophe is much higher.

Officially PAID: There is no zero risk in the PAD policy / Evidence: floods in the city of Craiova

The answer to this problem was given by Cosmin Tudor, Director of PAID Development.

- “The principle of solidarity that you are talking about was the basis for determining the social value of the policy, not for analyzing the presence or absence of risk. The insurance contribution is not set actuarially (as is practiced in insurance), but socially, so that vulnerable categories of the population can afford it.

- As a reminder, since 2010, when the first policy was issued, the PAD (insurance premiums) of the policy has not changed and the company has been well capitalized, managing to absorb over 55% of general inflation during that time. This is the meaning of solidarity when we talk about PAD politics.

- The proof that this policy is zero is that, for example, in July 2022 in the center of the municipality of Craiova there was a flood that hit apartment buildings, cars were parked on people’s balconies, we opened and paid 48 files for a total of almost 600,000 lei .”, Cosmin Tudor, Director of Development of PAID, told HotNews.ro.

Why do Romanians not get PAD insurance, even though it is mandatory by law?

- “In our opinion, the main reasons that our insurance coverage level is only 20% are the lack of information at the population level and the lack of financial education. Hence the lack of trust in the insurance system, the lack of trust that the insurance will really help them recover and repair.

- The impression that insurance is unnecessary is also the result of a misunderstanding of probabilities, the principle of mutualization of risks and the method of capitalization of insurance companies.” claims the PAID official.

How much PAID can compensate in case of disasters. Income vs Paid Losses

Regarding the financial capacity to pay compensation, PAID said it has equity capital of approximately €50 million, a catastrophe reserve of €32.50 million and reinsurance program worth 1 billion euros.

As for income and claims paid, preliminary results, not yet verified, show that last year PAID had a gross premium income of more than 176.29 million lei, while claims costs exceeded 3.53 million lei.

- For more on paid claims see: Compulsory home insurance ‘traps’: why some people are being denied compensation

Source: Hot News

Ashley Bailey is a talented author and journalist known for her writing on trending topics. Currently working at 247 news reel, she brings readers fresh perspectives on current issues. With her well-researched and thought-provoking articles, she captures the zeitgeist and stays ahead of the latest trends. Ashley’s writing is a must-read for anyone interested in staying up-to-date with the latest developments.