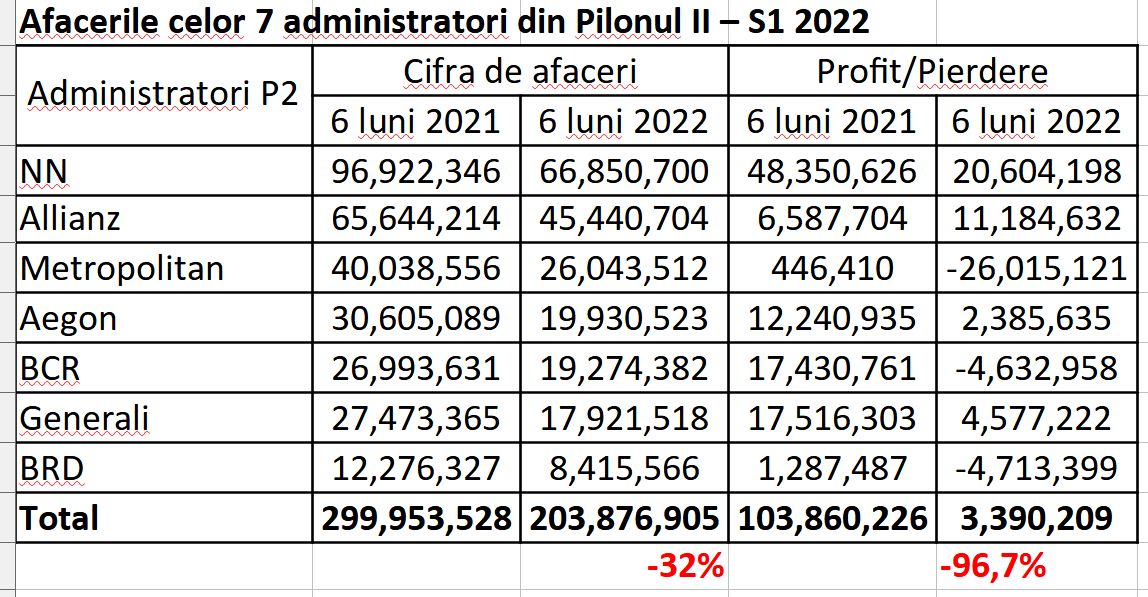

Only one in seven Tier II pension administrators increased net income in the first six months of this year, while the rest faced sharp declines and even suffered losses. To summarize, the Tier II industry remained in surplus, but cumulative profits fell by almost 97%, first semester data analyzed by HotNews.ro shows.

HotNews.ro has analyzed the latest financial statements of 7 pension level II administrators in the context that the government is preparing to cut their incomes on the grounds that they will be unjustified.

Consolidated net profit fell by almost 97% in the first half of the year.

Financial results for the first six months of this year show that 7 Level II pension fund administrators recorded a total turnover of more than 203.8 million lei, which is 32% less compared to the same period last year.

The industry remained in surplus, but the cumulative net profit of the 7 administrators decreased by almost 97% to 3.3 million lei.

Most administrators recorded a decrease in profits, and some even suffered significant losses, such as the case of Metropolitan Life Pensii, which had a net loss of more than 26 million lei in the mentioned period from a profit of more than 400,000 lei last year.

Despite the decline in business, Allianz-Țiriac Pensii managed to make a profit of more than 11.1 million lei, compared to more than 6.6 million lei for the same period in 2021.

We continue to reproduce the situation of the seven companies, including their financial statements.

1. NN Pensions: Decline of business and profit. There is a significant discrepancy in the number of employees

NN Pensii’s business fell by 31% in the first six months of this year to more than 66.8 million lei, compared to 96.9 million lei in the same period of 2021.

In the same reporting period, net profit decreased by 57.3% to over 20.6 million lei compared to over 48.3 million lei last year.

Personnel expenses increased to 8.05 million lei in the first six months of this year compared to 7.54 million lei in the same period of 2021. Personnel costs accounted for 16% of NN’s total costs in the first six months of this year.

The NN report shows that the average number of employees as of June 30, 2022 was 72 employees (similar to the situation in 2021), while the actual number of employees on the same date was 240 employees (compared to 248 employees in 2021).

HotNews.ro has asked NN Pensii’s point of view on the situation with the number of employees, and we will be back as soon as we get answers.

- SEE PENSION REPORT NN HERE

2. Allianz-țiriac Pensii: Profits up 70%, although business has fallen

Allianz-Țiriac Pensii Private reported a net turnover in the first half of this year of more than 45.4 million lei, which is 30.7% less compared to the same period last year, when the business exceeded 65.6 million lei.

On the other hand, net profit increased by almost 70% to more than 11.1 million lei in the first half of this year, compared to 6.5 million lei for the same period in 2021.

In the first half of this year, personnel costs increased to 4.76 million lei, compared to 4.49 million lei for the same period in 2021. Compared to the total expenses of more than 38.1 million lei for the first six months of this year, personnel expenses are 12.4%.

Data from the administrator shows that as of June 30, 2022, the average number of employees at Allianz-Țiriac Pensii Private was 48 employees, while the actual number of employees on that date was 52 employees. The dates are close to 2021.

- SEE THE AZT REPORT HERE

3. Capital life pensions: Net loss of more than 26 million lei compared to profit in the previous year

In the first six months of this year, Metropolitan Life Pensii Private recorded a net turnover of more than 26 million lei, which is almost 35% less compared to the same period last year, when the business exceeded 40 million lei.

In addition, the company went from a profit of more than 446,000 lei in the first six months of 2021 to a net loss of more than 26 million lei in the first half of this year.

Personnel expenses increased to more than 2.32 million lei in the first half of 2022, compared to expenses of 2.01 million lei in the same period last year.

Compared to total expenses of more than 56.3 million lei in the first six months of this year, personnel expenses are 4.1%.

The company does not have headcount figures for the first half of this year, but the financial report for 2021 shows that Metropolitan Life pensions had 58 employees last year, of which 17 were in management positions, a situation almost similar to that. of 2020.

- SEE REPORT ON METROPOLITAN PENSIONS HERE

4. Aegon Pensii: Net profit fell 80.5%

In the first six months of this year, Aegon Pensii recorded a net turnover of more than 19.9 million lei, which is almost 35% less compared to the same period last year, when the business exceeded 30.6 million lei.

In the same reporting period, net profit fell by 80.5% to 2.38 million lei, compared to net profit of 12.2 million lei last year.

Personnel expenses amounted to 3.93 million lei in the first half of this year, which is equivalent to 19.4% of the total expenses, which exceeded 20.2 million lei this year.

The average number of employees of the company was 43 people, and the actual number of available employees as of June 30, 2022 was 44 people, which is a slight decrease compared to last year, when there were 51 people working.

- VIEW THE AEGON PENSION REPORT HERE

5. BCR Pensii: Net loss of 4.6 million lei from profit for the previous year

In the first six months of this year, BCR Pensii recorded a net turnover of more than 19.2 million lei, which is 28.5% less compared to the same period last year, when the turnover exceeded 26.9 million lei.

In the first half of this year, the company reported a net loss of more than 4.6 million lei, while in the same period last year, the net profit was more than 17.4 million lei.

Personnel expenses amounted to 4.66 million lei in the first half of this year, which is equivalent to 17.7% of total expenses, which exceeded 26.2 million lei in the period ending June 30, 2022.

BCR Pensii’s average number of employees was 50, and the actual number of employees available as of June 30, 2022 was 62, up from last year’s actual number of employees of 48.

- VIEW THE BCR PENSIONS REPORT HERE

6. Generali Pensions: net profit decreased by 74%

In the first six months of this year, Generali Pensii recorded a net turnover of more than 17.9 million lei, which is 34.7% less compared to the same period last year, when the turnover exceeded 27.4 million lei.

The net profit achieved in the first half of this year amounted to more than 4.5 million lei, a decrease of almost 74% compared to the same period last year, when the profit exceeded 17.5 million lei.

Personnel expenses increased to 2.04 million lei in the first half of this year, equivalent to 12% of total expenses, which exceeded 16.9 million lei in the period ending June 30, 2022.

The average number of employees was 26 on June 30, 2022, but the actual number of employees on that date was 32, up slightly from 28 for the same period in 2021.

- VIEW THE GENERAL PENSION REPORT HERE

7. BRD Pensii: Net loss over 4.7 million lei compared to profit in the previous year

In the first six months of this year, BRD Pensii recorded a net turnover of more than 8.41 million lei, which is 31.4% less compared to the same period last year, when the turnover exceeded 12.2 million lei.

In the first half of this year, the company recorded a net loss of more than 4.71 million lei, compared to a net profit of more than 1.2 million lei in the same period last year.

Personnel expenses increased to 2.5 million lei in the first half of this year, equivalent to 16% of total expenses, which exceeded 15.6 million lei in the period ending June 30, 2022.

The company does not present data on employees in the first half of this year, but the financial report for 2021 shows that BRD Pensii had an average number of 35 employees, for whom wage costs exceeded 4.14 million lei. The average registered number of employees was the same in 2020.

- VIEW BRD’S PENSION REPORT HERE

Reduction of commissions in the second level: the government postponed the decision for the second time

On Wednesday, the government postponed for the second time a decision on the draft emergency resolution, which provides for the reduction of the commission of administrators in the second and third levels of pensions. why Experts who participated in the development of this law have not yet found the optimal formula, says government spokesman Dan Karbunaru.

It is essentially a GEO project initiated by the ASF, with which the executive wants to eliminate one of the two sources of income for pension fund administrators: commissions paid by 7.8 million Romanians in the second level of pensions (mandatory private pensions). ) and level III (optional private pensions), on the grounds that this would lead to an unjustified reduction of the private pension.

Administrators believe that this measure will have “disruptive potential for Part Two.”

SEE DRAFT GEO AND KEYNOTE HERE

The new GEO draft retains the provision that it will be installed single administrative feewhich is charged by the administrator for the performance of the main and secondary/ancillary activities, without justifying this change in any way.

What 7 second-level administrators fear: the government will force them to operate at a loss, with revenues lower than expenses

Administrators of private pension schemes have warned the authorities that the abolition of contributions will further exacerbate this year’s sharp decline in income, which may affect the stability of operations in Romania.

They say that this year, against the backdrop of financial market volatility and an implicit decline in the performance of pension funds, they expect commission income to fall by 43% compared to last year, meaning income of around 330 million lei compared to income of more than 577 million lei in 2021 .

In addition, the abolition of contribution fees, currently proposed by the ASF and the Government, will further reduce these revenues by 15-20%, respectively by approximately 55-60 million lei, according to APAPR estimates.

Public data analyzed by HotNews.ro shows that if commissions were abolished, the 7 pension fund administrators would next year have revenues from Tier II commissions of around 220 million lei, given that annual expenses reach approximately 400 million lei.

- Read more: The government postponed the reduction of commissions from II and III levels of pensions / Sources: Discussion with Ciucă on the “destructive potential” of the new GEO was canceled

Photo source: Dreamstime.com

Source: Hot News RO

Robert is an experienced journalist who has been covering the automobile industry for over a decade. He has a deep understanding of the latest technologies and trends in the industry and is known for his thorough and in-depth reporting.